FotografieLink

Investment Thesis

Generac Holdings (NYSE:GNRC) has its hands full, with the reduced FY2022 guidance further impacting its already tragic valuations from the Pink Energy lawsuit. For the uninitiated, the latter claims that GNRC’s SnapRS component has caused thousands of solar system failures, with the parts melting and causing at least two fires at customer homes. Supposedly, GNRC has also admitted an alarmingly high failure rate of over 40% in its SnapRS component with no viable solution in sight until a replacement third-generation part, SnapRS802, is manufactured and delivered, according to Pink Energy’s lawsuit.

However, there is also conflicting news, at which the fault lies in the substandard installation from Pink Energy’s installers, on top of other service complaints. Naturally, there is no way of finding out the truth about the messy situation until the lawsuit is concluded, potentially over the next few years. Nonetheless, the damage is already to the latter, which already sought bankruptcy claim given the enormity of complaints and malfunctioning parts.

Unfortunately, despite the tragic correction the GNRC stock has suffered thus far, we are uncertain if there is a floor here as well. As a result of the notoriety, there has been a significant decline in orders thus far ( likely attributed to reduced consumer confidence ), affecting its FQ3’22 and FY2022 guidance. In addition, we posit that GNRC may be in hot waters next, assuming the massive lawsuits it might face from consumers (on top of the one from Pink Energy). Otherwise, why would the company set aside a $37M sum for the latter’s warranty-related matters and another $18M in bad debt expenses? Well, no one knows for sure indeed until the outcome of the lawsuit is revealed. We shall see, since our crystal ball is murky as well.

Mr. Market Has Overcorrected Its Valuations, Given GNRC’s Stellar Forward Profitability

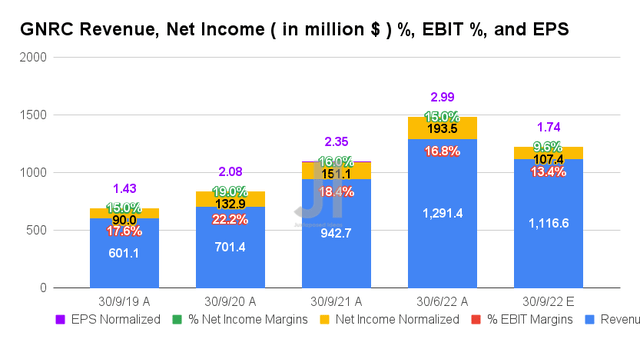

In its upcoming FQ3’22 earnings call, GNRC is expected to report revenues of $1.11B and EBIT margins of 13.4%, indicating a massive deceleration in growth by -13.95% and -3.4 percentage points QoQ, respectively. Otherwise, an excellent YoY growth of 18.08% though a decline of -5 percentage points, respectively, attributed to rising inflationary costs and elevated operating expenses thus far.

Therefore, it is natural that GNRC will report impacted profitability, with net incomes of $107.4M and net income margins of 9.6% for the next quarter. It will represent another decline of -44.49% QoQ and -28.92% YoY. As a result, analysts are projecting FQ3’22 EPS of $1.74, indicating a tremendous fall of -41.80% QoQ and -25.95% YoY. It is no wonder then, that the stock had suffered a drastic correction with a -68.53% plunge YTD, given the massive deceleration in projected growth ahead, exacerbated by the management’s lowered guidance ahead from Pink Energy’s bankruptcy and the notoriety of its “faulty equipment.”

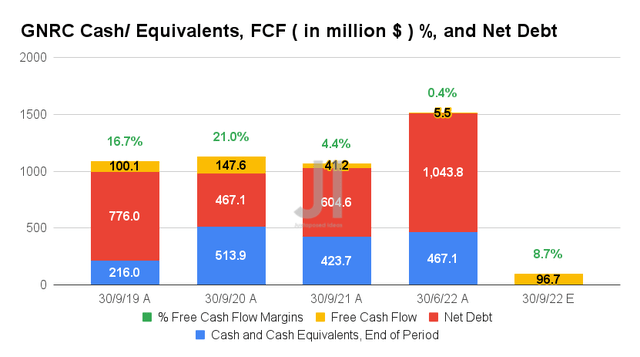

Nonetheless, analysts are expecting improved Free Cash Flow ((or FCF)) generation of $96.7M and an FCF margin of 8.7% for FQ3’22, indicating massive improvements from FQ2’22 levels of $5.53M/0.4%, FQ1’22 levels of -$38.34M/-3.4%, and FQ3’21 levels of $41.2M/4.4%. This is mostly attributed to GNRC’s reduced working capital investments in H2’22, as per management’s guidance of 90% conversion from its adj. net income in FQ2’22. Let’s see by 02 November.

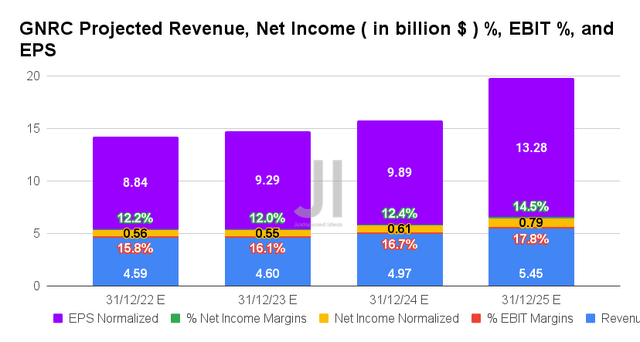

Over the next four years, GNRC is also expected to report a notable deceleration in revenue and net income growth at a CAGR of 9.94% and 9.48%, respectively, compared to pre-pandemic levels of 15.17%/17.03% and pandemic levels of 27.69%/20.74%, respectively. However, we must also highlight the impressive improvement in its profitability, from EBIT/ net income margins of 17%/9.4% in FY2019, to 19.7%/11.6% in FY2021, and finally settling at a stellar 17.8%/ 14.5% by FY2025, despite the lower YoY growth in its top line sales by -16% in FY2022.

In the meantime, GNRC is expected to report revenues of $4.59B, net incomes of $0.56B, and EPS of $8.84 in FY2022, indicating YoY growth of 22.7%, 12.2%, though a decline of -8.2%, respectively. The slower growth is naturally attributed to the tougher YoY comparison and lower-than-expected orders for residential products/ generators. Nonetheless, investors should be encouraged since these numbers already represent massive improvements from FY2019 levels of $2.2B, 0.31B, and $5.06, respectively.

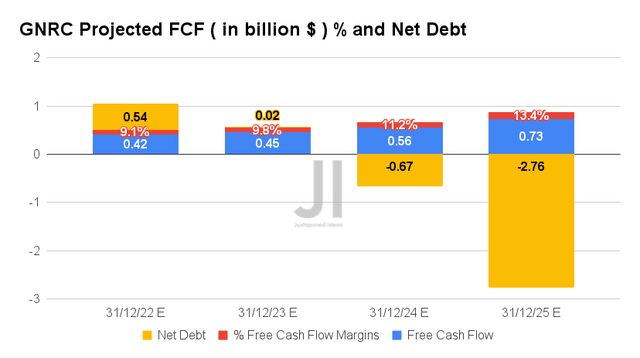

GNRC’s projected growth in FCF is stellar as well, at a CAGR of 24.83% through FY2025, compared to pre-pandemic levels of 4.3% and pandemic levels of 18.72%. Furthermore, its FCF margins are expected to improve from 11.3% in FY2019, to 8.1% in FY2021, and finally to 13.4% by FY2025. Therefore, it is not ambitious that consensus estimates that GNRC’s net debts will be net zero by FY2023, while massively improving to -$2.76B by FY2025. Thereby, indicating its massive liquidity ahead, despite the worsening macroeconomics through 2023, if not longer at 2024.

So, Is GNRC Stock A Buy, Sell, or Hold?

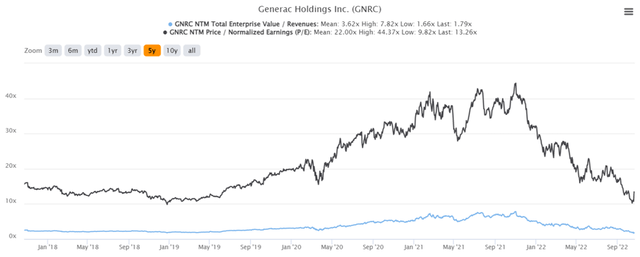

GNRC 5Y EV/Revenue and P/E Valuations

GNRC is currently trading at an EV/NTM Revenue of 1.79x and NTM P/E of 13.26x, lower than its 5Y mean of 3.62x and 22.00x, respectively. The stock is also trading at $109.48, down -79.11% from its 52 weeks high of $524.31, nearing its 52 weeks low of $105.95. Nonetheless, consensus estimates remain bullish about GNRC’s prospects, given their price target of $225.78 and a 106.23% upside from current prices.

GNRC 5Y Stock Price

In the meantime, we are unfortunately in for more pain ahead, due to the worsening macroeconomics as the Fed is aggressively hiking interest rates through 2023, with persistently elevated September CPI/ PPI/ labor market thus far. 91.7% of analysts are already predicting a 75 basis points hike in the Fed’s upcoming November and, likely, December meeting as well. The S&P 500 Index has also tragically plunged below its June lows thrice by now, with recessionary chances upgraded to 100%.

The GNRC stock may, therefore, potentially further retrace to below $100, depending on its FQ3’22 earnings call. However, it is entirely possible that most of the pessimism is already baked in after the release of its lowered guidance, barring another catastrophic event. As a result, due to the massive uncertainty from the Pink Energy lawsuit and “faulty components,” we rate GNRC stock as a Hold for now. Investors who choose to nibble at these levels should also size their portfolios appropriately due to the potential volatility ahead.

Be the first to comment