TriggerPhoto

I’ve been warning subscribers of my marketplace service of a low in stocks and a potential short squeeze. This week looks to be the start of that and the bearish sentiment indicators are a dream for contrarian investors.

Stocks line up for a big short squeeze

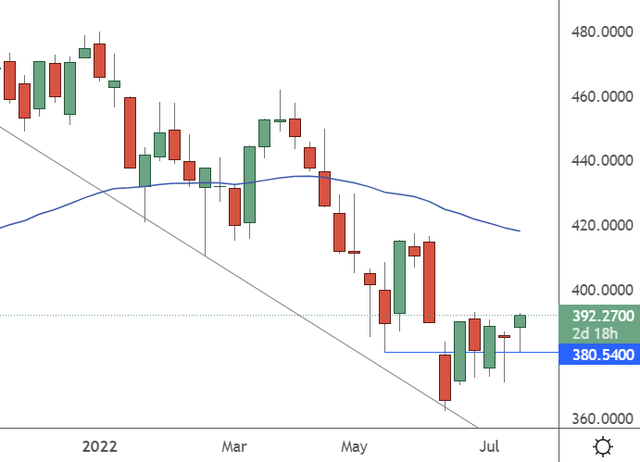

The S&P 500 (NYSEARCA:SPY) rallied 2.76% on Tuesday as stocks got up from the canvas after a recent pummelling. The recent move upward is no surprise as the market was positioning for this over the last two-to-three weeks.

The markets never make it easy for investors, so those who thought they could sell on every inflation print higher will be disappointed. Last week’s Federal Reserve trial balloon seems to have taken a 1% interest rate hike off the table and inflationary expectations are very much priced-in. Investors should react to that very quickly because the sentiment indicators are looking very good for bulls.

The bearish sentiment is off the charts

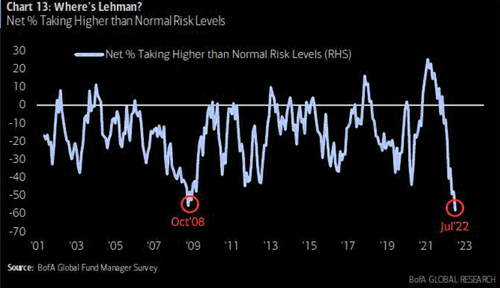

The first chart comes from a Bank of America fund manager’s survey and the bank asks: “Where’s Lehman?”

Fund Manager Survey (BofA)

The last time that fund managers were this bearish was back in October 2008 at the height of the post-Lehman, financial crisis panic. We have actually breached that level in July 2022 and we should see this indicator move higher again. This week could be the catalyst for fund managers to dip their toe in the water once again.

Retail investors buy the top and sell the bottom (again)

Retail investors have been back doing what they do best – buying the top and selling the bottom.

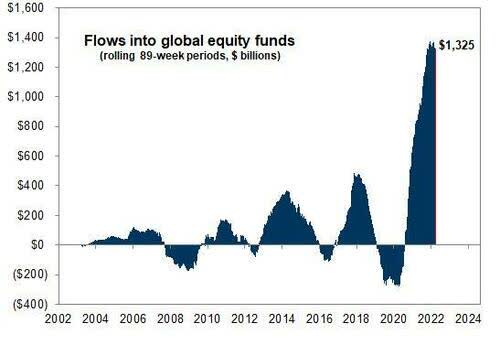

A new stock craze emerged in 2020 where people from all walks of life were locked down at home with stimulus checks and decided that their real calling was to be a stock market trader. That has led to a HUGE amount of retail money into retail funds which peaked in late 2021 and early 2022 – just in time for the top of the tech wreck.

Global Equity Fund Flows (Goldman Sachs)

Those investors have held on to the positions and have not yet liquidated, but a short squeeze rally in stocks could be the ideal time for many to bail out and go back to their day jobs.

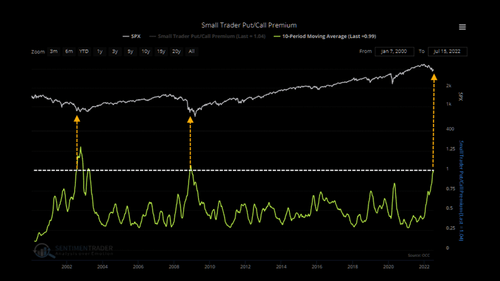

While retail stock investors have been holding onto their longs at the top, that new breed of equity investor also brought swash-buckling options traders, who dream every night of GameStop (GME) short squeeze riches and share their P&Ls on the Reddit WallStreetBets forum.

Sadly, for those traders, they have flipped from big bullish bets on names like Tesla, to big short positions, according to Sentiment Trader. That strategy also looks to be in danger as bearish options bets are at their highest since 2002 – the bottom of the 1990s tech bubble crash; and again, at the 2008 financial crisis lows.

Sentiment Trader

Over the past ten weeks, ‘small traders’ have spent $39.7 billion on put options and $39.6 billion on call options. It’s extremely rare for them to spend more on leveraged, expiring bets that stocks will fall than they spend on bets that stocks will rise. It takes a devastating decline to change mass psychology this much, so the only two precedents were the two worst bear markets in recent memory. This flip in psychology also coincided with the bear markets’ end games. After a relief rally each time, there was another leg lower, but the bulk of the losses was already past.

Prepare for the floodgates to open

Investors that are skeptical of the previous charts will want to know where the buyers will come from.

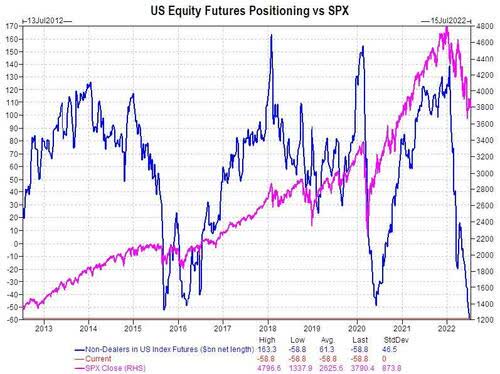

The answer is in hedge funds and corporates as Goldman Sachs reported over the weekend. Goldman’s Scott Rubner said, hedge fund positioning “is so low, it has officially fallen off my chart.”

Rubner added: “I don’t think there is more marginal position left to sell, given large hedges vs. fundamental positions already in play.”

Goldman shared the following chart which sums up the hedge fund positioning in equity futures in comparison to the S&P 500.

Equity Futures vs S&P (Goldman Sachs)

Once again we see that we have breached new lows that occurred at the lows of the 2015 market sell-off and the bottom of the Covid pandemic stock rout.

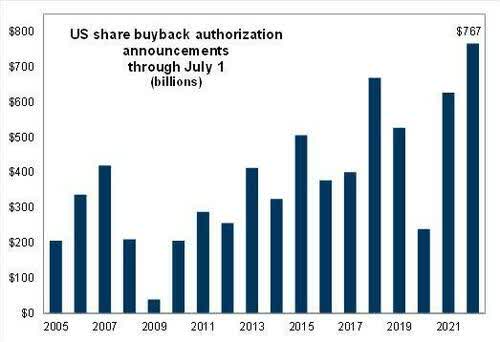

Goldman Sachs analysts also shared their expectations for $300bn in stock buybacks over the third quarter after a recent hiatus.

The first quarter saw $312BN in buybacks and the estimated $300bn for Q3 would mean a daily volume of around $5bn per day. If we add that to a potential rush in hedge fund investors then the move higher could be sharp.

Stock Buyback Plans (Goldman Sachs)

Europe could be another driver for US stock gains

Investors may doubt the potential for stock market gains with a recession looming, but they should consider the potential for a safe haven move from European stocks into the US markets. The European Central Banks are set to raise interest rates this week in an end to their negative rate policy, but they are already bringing a new bailout tool for peripheral banks to avoid ‘fragmentation’ amongst member states. That was in response to the end of the pandemic stimulus measures, which saw yields in indebted nations such as Italy move higher.

However, the immediate risk in Europe is due to gas supplies from Russia. Traders cheered on Tuesday as it seemed likely Gazprom would restart flows into Europe after the ten-day annual maintenance on the Nord Stream pipeline. The Nord Stream pipeline supplies around 40% of Europe’s gas and there were fears that Russia would weaponize it against the EU.

Germany’s economy minister, Robert Habeck, warned this month that the country must “prepare for the worst” while there are fears of a broader economic crisis as the year goes on. Some economists have warned of large-scale bankruptcies in the likes of Germany if the energy crisis is bad and the German government has created legislation to take equity stakes in energy companies if they need a backstop.

“Anything can happen. It could be that the gas flows again, even more than before. It could be that nothing will come at all,” Habeck said.

Despite being in the summer months, utility firms have already tapped winter supplies and Spain’s Enagas said last week that demand for natural gas had reached a new record high as air conditioning units were ramped up for the recent European heatwave.

The reality for investors is that the Ukraine situation is still an unknown for markets and although Gazprom is bringing the pipeline back, they are doing so in the height of summer. This was planned annual summer maintenance, but is it not possible that the company could shut it down again at the onset of winter over an ’emergency’ fault?

The situation is still precarious for Europe and its central bank. As hedge funds look to buy the dip in stocks, it may not be a surprise that they shun the European options and look to the US markets.

Conclusion

The Federal Reserve has actually achieved a long-term goal in flushing speculation out of the market. After being criticized for blowing a stock market bubble for years, the Fed was able to leverage an external boogeyman in the form of inflation and took the steam out of market excesses. The central bank is said to be leaning towards a 75bps rate hike at their next meeting and we may actually see policymakers take their foot off the pedal to limit recession risks. In the sentiment indicators, we are seeing glaring extremes and professional investors are as bearish as they have been since the last market bottoms: 2008, 2016, and 2020. Adding to the contrarian outlook is the fact that retail investors swamped the stock markets into the high and are now the most bearish in options plays since the 2002 tech bubble lows and 2008 financial crisis bottom. The market will not go up in a straight line, but the fuel is clearly evident and we are waiting for the fuse to be lit. As BofA asked: “Where’s Lehman?”

Be the first to comment