Klaus Vedfelt

Investment Thesis

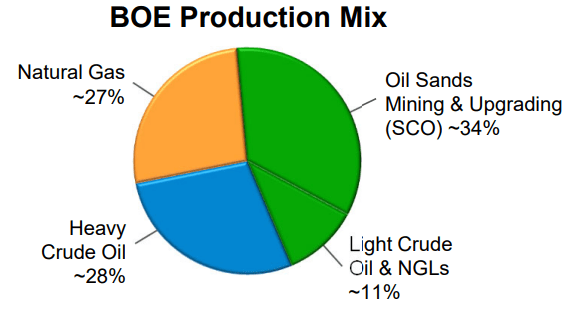

Canadian Natural Resources (NYSE:CNQ) is an oil and natural gas production company.

CNQ October presentation

As you can see above, just under 30% of CNQ’s production is natural gas. So, what happens in the natural gas market has substantial implications for the bull case.

Meanwhile, even though natural gas prices have fallen in price substantially in the past few weeks, I believe that natural gas prices will bounce back in the coming months.

Accordingly, I lay out the near-term headwinds affecting natural gas prices, which are likely to have a fair impact on CNQ’s Q4 results. Although, the impact on its Q3 results will likely be immaterial.

Here’s what to think about and reasons to remain bullish.

What’s Happening Right Now?

US natural gas prices have come down hard in the past several weeks. Sliding more than 40% since my previous bullish article.

Two key drivers have sent natural gas prices tumbling. Unseasonably warm weather plus above-average production in the US. Furthermore, Freeport LNG having to close down for repairs has not aided matters either.

While in the very near term, that’s clearly leading many investors to believe that the natural gas energy trade is over. However, I argue that the setup here is not dramatically different than it was a few weeks ago.

In fact, I believe that we are more likely to see $7 mmbtu before we see $4 mmbtu. And here’s why.

Canadian Natural Resources, Back to Basics

Lest we forget, this is the bull case for CNQ. Prices for natural gas in Europe traded for approximately $28 on Monday, while in the US the price is around $5. Why in the world should there be a 5x difference in price across the Atlantic? There should not. And in time, a significant proportion of that differential will likely be arbitraged away.

I believe that as more LNG facilities are built, such as Cheniere’s (LNG) Corpus Christi and there I say, possibly Tellurian (TELL) Driftwood, there should be the opportunity for these companies to wither away at this price difference.

Another consideration to keep in mind is the lack of pipeline networks. Where certain regions, such as Texas have access to very cheap natural gas prices, while other areas, further afield, and into Canada continue to embrace high energy prices.

Simply put, there are logistics problems that are causing pricing inefficiencies, but I suspect that in the coming twelve months a significant amount of these hurdles will be overcome.

Another pipeline issue is that Kinder Morgan’s (KMI) Gulf Coast Express and El Paso Natural Gas pipeline systems are due for maintenance for two days this week, according to Bloomberg.

Next, let’s turn our attention to CNQ’s stock valuation.

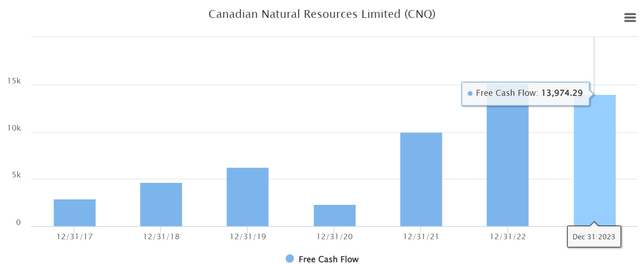

CNQ Stock Valuation – 7x 2023 Free Cash Flow

CNQ continues to split 50% of its free cash flow to pay down debt on its balance sheet. Thus, I believe that in Q1 2023, CNQ’s net debt will reach CAD$8 billion. At this time, CNQ will be better capitalized to increase its capital return program.

That being said, keep in mind that there’s the general expectation that CNQ has over earned in 2022.

While it’s difficult to have any serious visibility into how much free cash flow CNQ’s oil and gas business will bring in next year, there’s a widely shared belief that the cash generated will be lower than in 2022.

For my part, I continue to believe that there’s a significant likelihood that CNQ will make around CAD$12 billion to CAD$13.0 billion.

That implies that looking out to 2023, CNQ is priced at approximately 7x next year’s free cash flows.

The Bottom Line

Presently, there are some headwinds affecting close to 30% of CNQ’s operations, its natural gas operations. However, I explain why I don’t believe that the natural gas energy trade is permanently impaired.

Furthermore, I laid out what investors should think about, in terms of drivers and detractors within the natural gas thesis.

Finally, I explained why I believe paying approximately 7x next year’s free cash flow is an attractive valuation.

Be the first to comment