Robert Way

I have written three times about the Chinese tech giant Alibaba (NYSE:BABA). Each time I wrote about the company and some of the more recent developments related to quarterly earnings or news headlines. The company recently reported its Q1 2023 earnings and figured I would pitch in my two cents on where the company is right now.

Investment Thesis

Alibaba is one of China’s largest companies and shares have had a rough couple of years. I was buying on the way down, and I still think shares are undervalued today. Shares trade at 12x earnings and the company bought back a large chunk of shares in the most recent quarter. Alibaba was in the news recently as the SEC added it to the list of companies that could potentially be delisted. I’m still very bullish on the company due to the cheap valuation, large buyback program, and the long-term growth potential of the business.

Earnings

On Thursday, Alibaba reported earnings for Q1 of 2023. While the revenue growth was slightly negative for the largest segment (China commerce), it’s not that surprising to me given the lockdowns that parts of China experienced during the quarter. The other notable segment, the Cloud segment, experienced 10% revenue growth YoY. I’m curious to see what happens in future quarters with the ecommerce segment, but I think the Cloud segment will be able to post sustained revenue growth.

A quick glance at the balance sheet shows that Alibaba still has a huge pile of cash and short-term investments ($67.6B), which is another reason I look at the valuation as so cheap. The other key piece I was looking for in the earnings report was the buyback numbers for the quarter. Alibaba repurchased 38.6M ADRs in the quarter for approximately $3.5B. The $25B repurchase program, which is set to expire in March 2024, has $12B remaining. Compared to Alibaba’s market cap of $253B, the buyback represents a huge return of capital to shareholders, and I wouldn’t be surprised to see another buyback program after the current one is used up.

S.S.D.D.

The recent news headline I saw on Alibaba last week brings me to the title of the article. Alibaba was in the news last week when the SEC put the company on a list for potential delisting. I thought that it was a possibility when I was buying shares, but I don’t think it will come to that. The company has stated that they will try to keep the NYSE listing along with their Hong Kong listing.

Alibaba will continue to monitor market developments, comply with applicable laws and regulations and strive to maintain its listing status on both the NYSE and the Hong Kong Stock Exchange,” the company said in an announcement filed to the Hong Kong stock exchange Monday.

The company said that the fiscal year that ended March 31, 2022, was its first “non-inspection” year under regulations that say a company that goes three years without complying with audit requirements will be forced to delist.

Some have speculated that the potential delisting could be due to the company pursuing a primary listing on the Hong Kong exchange, which is expected to be finalized by the end of the year. While I have mentioned it before, I feel that it would be worth stating again that the Alibaba ADRs can be exchanged for shares on the Hong Kong exchange.

I have also started to hear rumblings the Ant Group IPO might be back on track as Alibaba founder Jack Ma has reportedly given up control of Ant. It’s not anything to change my current stance on the company, but I am curious to see how the next couple of years play out with Ant Group.

Valuation

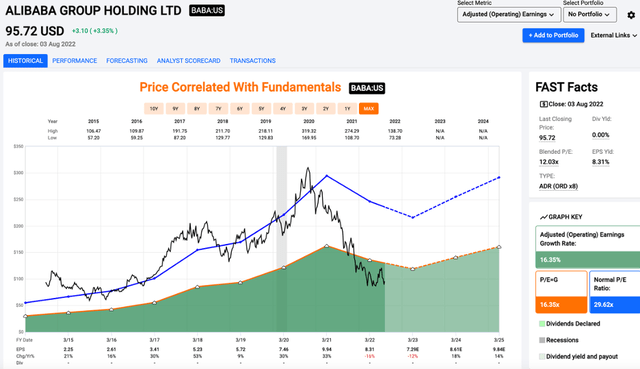

While the balance sheet and Ant subsidiary should be factored into the valuation, Alibaba is still cheap even if you’re just looking at the core businesses. Alibaba currently sits at 12x earnings. I’m not saying we will run straight to the average multiple of 29.6x, but I think some degree of multiple expansion is more likely than not.

Price/Earnings (fastgraphs.com)

While it is hard to project how much a complex business with numerous operating segments will earn in the future, my base case is that Alibaba will earn more in fiscal 2024 and 2025 than it will this year. While it’s hard to measure sentiment, I think that sentiment could be a huge driver of returns moving forward. It led to the massive selloff, and I think it will lead to a rally once it turns.

Conclusion

While the risk profile with Alibaba is complex, I still think the risk/reward is skewed to the upside. The company reported mixed earnings, where revenue was basically flat while profits were lower. The company bought back $3.5B of stock in the quarter and still have $12B on the buyback to use. However, the bad news continued as the SEC added the company to the list of Chinese companies that could be delisted. While I still view that outcome as highly unlikely, it is still a possibility that investors should consider.

While 12x earnings is too cheap in my view, I think sentiment will have to change before shares start to run. If sentiment turns, I think shares of Alibaba could see a massive rally. When you look at the actual business, Alibaba is well positioned with its core business segments of ecommerce and cloud, along with the Ant Group subsidiary and a mountain of cash on its balance sheet. While Alibaba is only suitable for risk tolerant investors, I still think the risk is worth it.

Be the first to comment