Drazen_

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on August 5th.

Real Estate Weekly Outlook

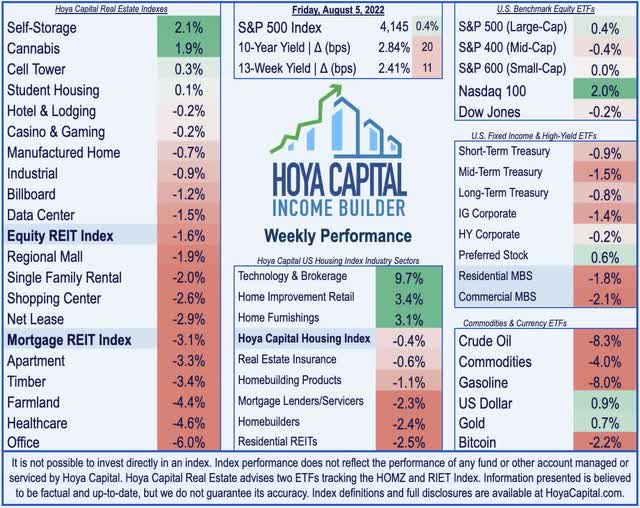

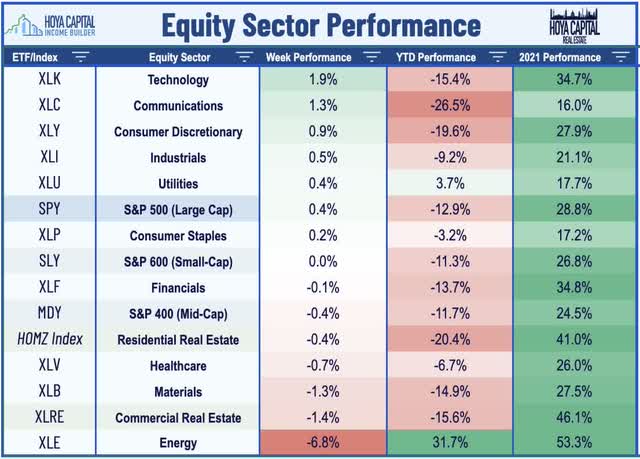

U.S. equity markets were mixed this past week after a surprisingly strong payrolls report cast doubt on the likelihood of a “Fed pivot” towards less aggressive tightening, sending benchmark interest rates sharply higher. An outlier amid a two-month stretch of disappointing economic data – including the weaker trends seen in the Household Survey of the same report – the strong nonfarm payrolls report came alongside hotter-than-expected wage data and hawkish Fed commentary. Absent significant signs of cooling in the critical inflation data in the week ahead, investors now expect the central bank to keep the pedal to the metal in its aggressive rate hiking cycle.

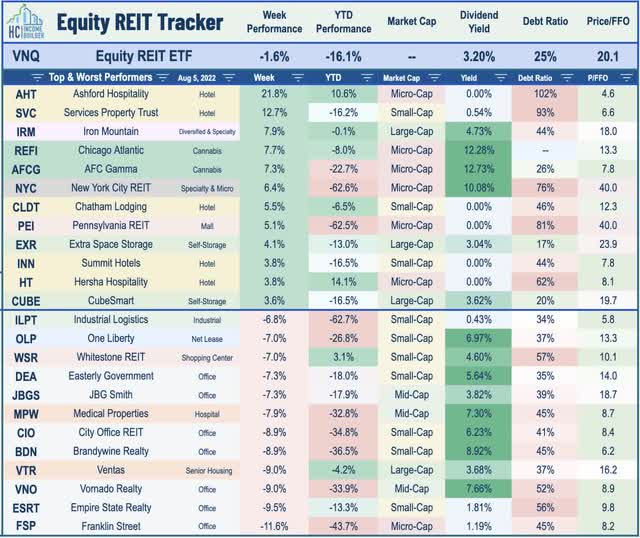

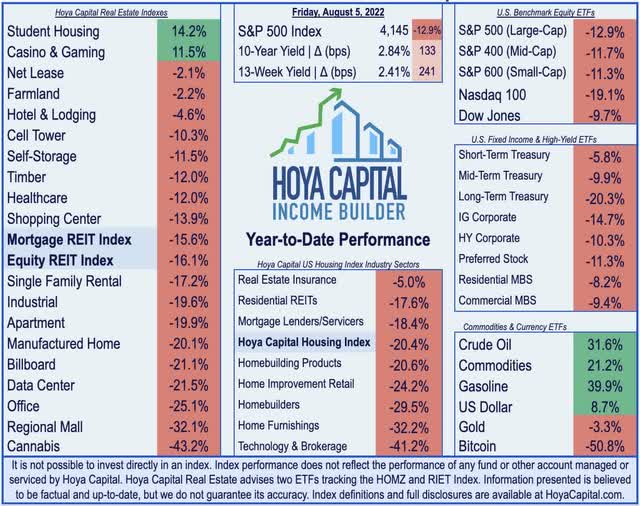

On the heels of its best month since November 2020, the S&P 500 advanced another 0.4% on the week – extending its gains to a third-straight week which follows a brutal stretch of 11-of-15 weekly declines. The tech-heavy Nasdaq 100 advanced 2.0% on the week but the Mid-Cap 400 slipped 0.4%. Real estate equities and other yield-sensitive sectors were under pressure by rebounding benchmark interest rates despite a strong slate of REIT earnings results and another wave of dividend hikes. The Equity REIT Index slipped 1.6% on the week with 14 of 18 property sectors in negative territory as gains from storage REITs were offset by declines from office and healthcare REITs while the Mortgage REIT Index retreated by 3.1%.

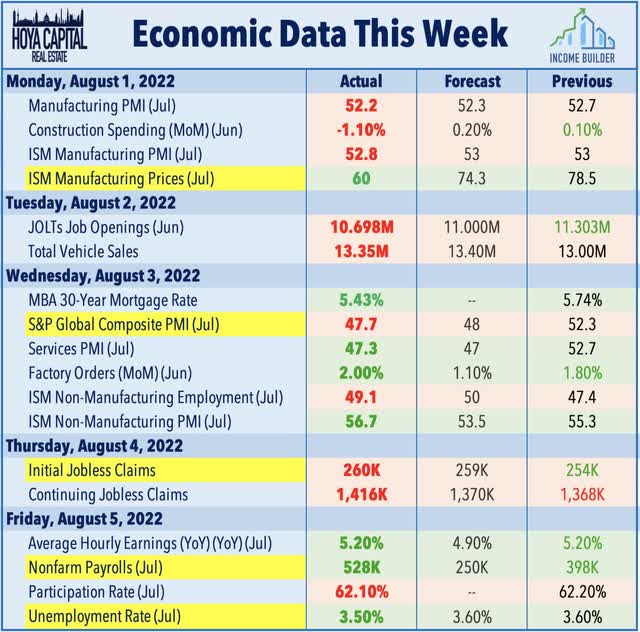

Following a notable rebound in July, bonds across the credit and maturity curve were once again under significant pressure this week as the 10-Year Treasury Yield surged 20 basis points back up to 2.84% after briefly dipping to its lowest closing level since April earlier in the week following weak PMI data which showed that global economic activity slumped to a two-year low in July while a separate ISM manufacturing survey showed that prices paid – a proxy for inflationary pressures – plunged 18.5 points to the lowest level in almost two years. While the U.S. may indeed be able to pull-off the “soft landing,” it’s harder to find reasons for optimism for struggling European and Asian economies, underscored by the stark forecast by the Bank of England this week, projecting a prolonged recession dragging into 2024. Weakening global demand may have silver linings for U.S. consumers, however, as Crude Oil dipped another 8% on the week to the lowest-level since February.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

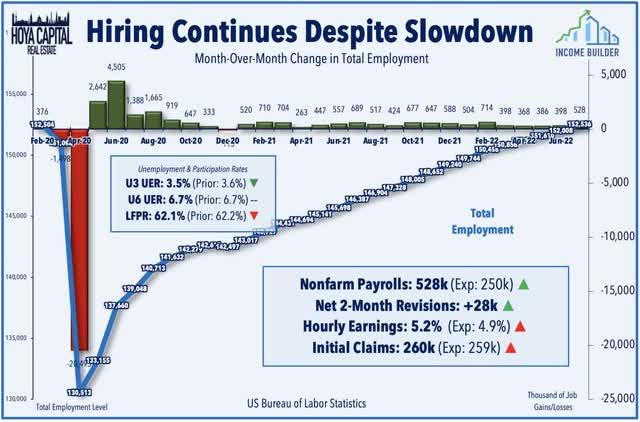

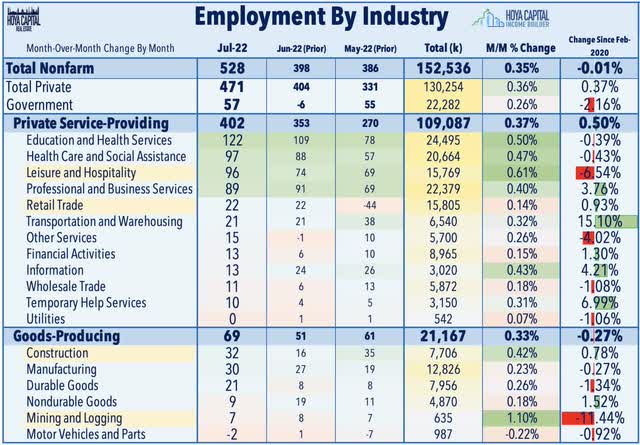

The Bureau of Labor Statistics reported this week that the U.S. economy added 528k jobs in August – nearly double the expectations of roughly 250k – a surprisingly strong report seemingly at odds with the GDP report in the prior week showing that the U.S. economy has been in a technical recession since early this year. Notably, the strong job gains seen in the establishment survey seen over the last four months have been at odds with the household survey in the same report – which is used to calculate the unemployment and labor force participation figures – which has shown net job losses of 136k since March while the establishment survey has recorded 1.68M job gains over that period. Both employment surveys show that total employment has now fully recovered to their pre-pandemic employment levels from February 2020.

Employment gains were relatively broad-based in July with essentially every category seeing net job growth, led by gains in leisure and hospitality, professional and business services, and health care. Notably, despite the recent strength in leisure and hospitality hiring, employment in the industry is still down by 1.2 million, or 6.5%, since February 2020. Also of note, the category with the strongest relative increase in hiring in July was in mining and logging, consistent with rig count data showing a much-needed increase in activity, but U.S. oil production still remains nearly 10% below pre-pandemic levels. There were some soft-spots under the hood, however, as the labor force participation rate declined to 62.1% in July – still quite a bit below its February 2020 level of 63.4% – while the number of persons employed part time for economic reasons accounted for the majority of the employment gains – 303,000 to 3.9 million in July – reflecting an increase in the number of persons whose hours were cut due to slack work or business conditions.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

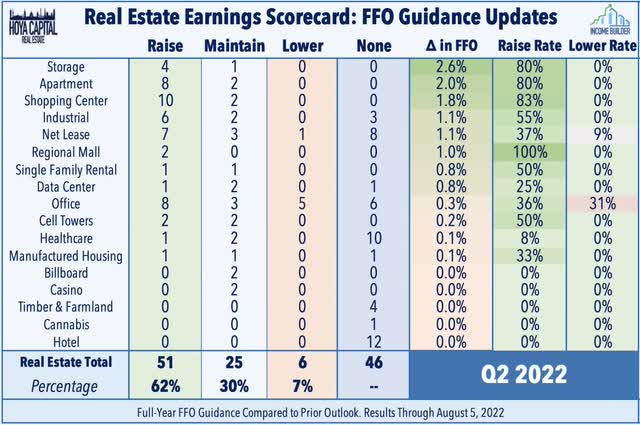

We’re now in the home stretch of real estate earnings season following a jam-packed slate of over 100 earnings reports over the past week, which we covered in our REIT Earnings Halftime Report. The back-half of REIT earnings season was nearly as impressive as the first-half with particularly strong results this week seen from the self-storage, shopping center, and net lease REIT sectors. Among the 82 REITs that have provided full-year Funds From Operations (“FFO”) guidance, 51 REITs (62%) raised their outlook while just 6 REITs (7%) have lowered or withdrawn their outlook. Strong results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 48% of S&P 500 companies boosted their outlook while 52% have lowered their full-year EPS targets. Below, we discuss some of the standouts from the week ahead of our full REIT Earnings Recap published this weekend on Income Builder.

Alongside the busy slate of earnings reports, five REITs hiked their dividends this past week. Shopping center REIT Federal Realty (FRT) raised its quarterly dividend by 1% to $1.08 per share, which marked the 55th consecutive year that FRT has raised its dividend – the longest record of consecutive annual dividend increases in the REIT sector. Elsewhere, industrial REIT Terreno Realty (TRNO) raised its quarterly dividend by 18% to $0.40 per share while hotel REIT Host Hotels (HST) doubled its quarterly dividend to $0.12 per share. Mall REIT Simon Property (SPG) hiked its dividend for the third time this year to $1.75/share while mortgage REIT Great Ajax (AJX) hiked its dividend for the second time this year. We’ve now seen 73 equity REITs raise their dividends this year compared to 2 dividend cuts. On the mortgage REIT side, we’ve seen 12 dividend increases offset by 4 cuts.

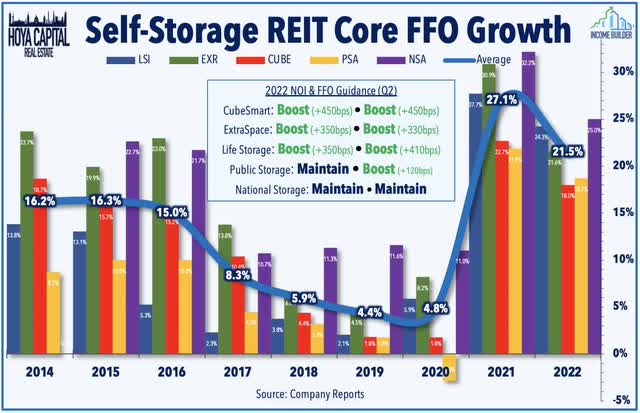

Storage: The most impressive property sector this earnings season was once again the storage REIT sector, which seemingly continues to defy expectations quarter-after-quarter since late 2020. CubeSmart (CUBE) – which we named as one of our three “Best Ideas in Real Estate” last month – rallied nearly 4% this week after reporting stellar earnings results and significantly raising its full-year FFO and NOI outlook. Fueled by strong rent growth in its critical New York metro market, CUBE now projects full-year FFO growth of 18.0% – up 450 basis points from its prior outlook. Extra Space (EXR) was also among the leaders with gains of 4% after raising its full-year outlook for the third time this year and now sees FFO growth of 21.6% – up 330 basis points from its prior target – and NOI growth of 20.0% – up 350 basis points. Public Storage (PSA) also gained after it boosted its full-year FFO growth outlook by 120 basis points to 18.7%. Notably, PSA commented that “new customer demand through the summer leasing season has been exceptional… We have good pricing dynamics on both, move-ins and with existing customer rate increases, leading to the highest rent levels we have seen historically.”

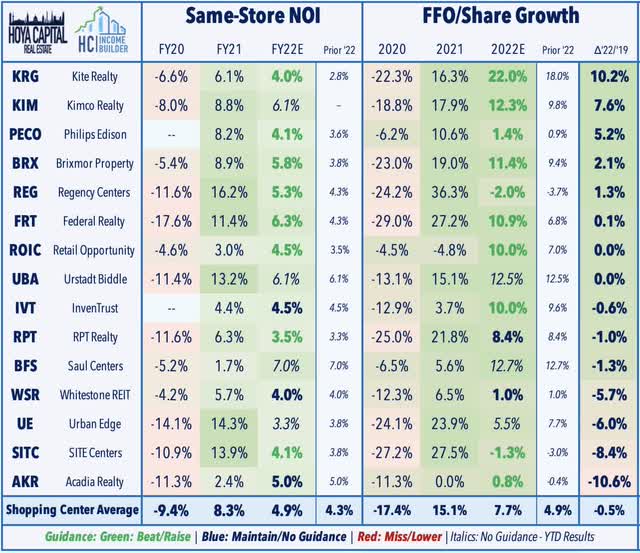

Shopping Center: Results from shopping center REITs were also highly impressive as fundamentals are now as strong – if not stronger – than before the pandemic with occupancy rates climbing to the highest level since early 2015 while rental rates have continued to accelerate despite the broader economic slowdown. Upside standouts included Kite Realty (KRG) – which we own in the REIT Focused Income Portfolio – which reported another strong quarter and raised its full-year outlook. Driven by strong leasing activity with 13% blended cash spread, KRG now projects FFO growth of 22.0% this year – up 400 basis points from last quarter – and 10.2% above its pre-pandemic 2019 rate, the strongest in the shopping center REIT sector. Federal Realty (FRT) was also among the leaders after raising its full-year FFO growth outlook to 10.9% – up 410 basis points from its prior outlook – citing “record levels of leasing.” Regency Centers (REG) also delivered a “beat and raise’ report as its grocery-anchored portfolio saw “robust leasing activity.”

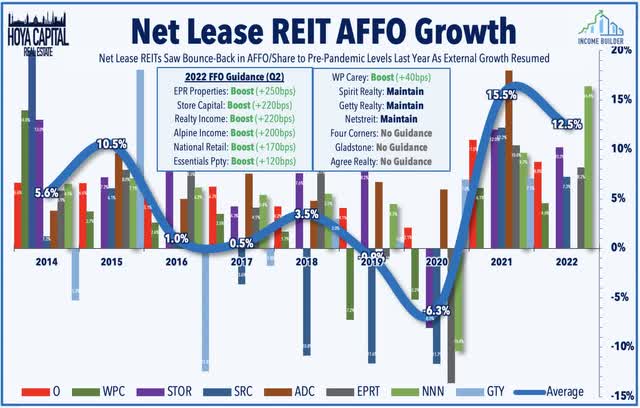

Net Lease: Rising rates overshadowed an otherwise solid week of net lease REIT reports as well. Realty Income (O) was among the upside standouts after raising its full-year normalized FFO guidance by 220 basis points and reporting its highest occupancy rate in over 10 years. STORE Capital (STOR) finished lower by about 4% despite reporting very strong results and raising its full-year FFO growth target to 10.2% – up 220 basis points from last quarter. National Retail (NNN) was also under pressure despite strong beat-and-raise results, boosting its FFO growth target to 8.2% – up 170 basis points from its prior outlook. Also under pressure despite rising its guidance was EPR Properties (EPR), which now sees FFO growth of 39.6% for the year – up 250 basis points from its prior outlook. Spirit Realty (SRC) declined about 4% after maintaining its full-year outlook which calls for FFO growth of 7.3%. Broadstone (BNL) lagged after lowering the midpoint of its FFO range.

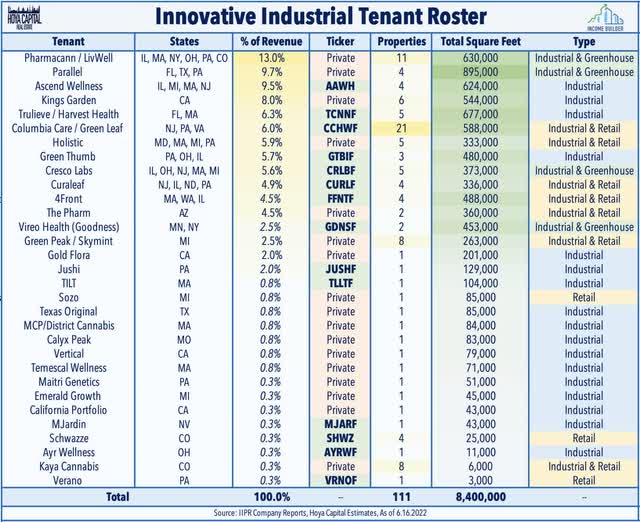

Cannabis: Innovative Industrial (IIPR) – a perennial outperformer that has been slammed this year on concerns over tenant credit issues and coming into the crosshairs of short-sellers – remained under pressure this week as solid second-quarter results were offset by mixed updates on the status of rent payment from two troubled tenants. In early July, IIPR reported that one of its tenants, Kings Garden, defaulted on its rent and property management fees for July while another major tenant, Parallel, is named in a lawsuit from several of its private investors. On its earnings call, IIPR noted that it has commenced legal proceedings against Kings Garden – which represented about 8% of its revenues last year – but noted that Parallel and all of their other tenants have “continued to pay rent in full in July and August. The ten largest publicly-traded cannabis REIT tenant operators have plunged between 50% and 80% over the past year, hurt in part by a slowdown in stimulus-fueled sales growth and a far more-difficult capital raising environment.

Mortgage REIT Week In Review

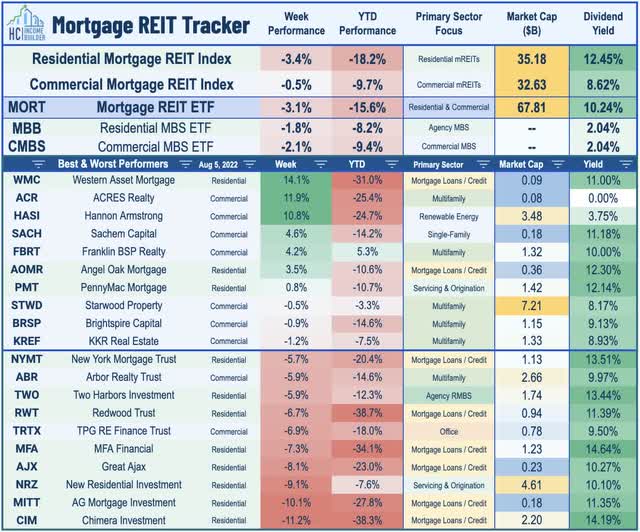

Mortgage REITs pulled-back this week after an impressive rally in July as a generally solid slate of earnings reports were offset by renewed selling pressure across mortgage-backed bond markets. On the upside this week, Western Asset (WMC) – which trades at a 40% discount to book value – surged 14% on the week after announcing a “review of strategic alternatives” which may include a sale. On the commercial mREIT side, Starwood Property Trust (STWD) – which we own in the REIT Focused Income Portfolio – was among the leaders after reporting that its book value rose 1.2% in the second quarter while small-caps Sachem Capital (SACH) and ACRES Commercial Realty (ACR) posted strong gains after reporting a similar increase their book values.

On the residential mREIT side, PennyMac (PMT) was among the leaders after reporting better-than-expected results highlighted by a relatively modest 7.2% decline in its Book Value Per Share (“BVPS”) during the quarter – below the average reported decline of about 10% thus far. Laggards included AG Mortgage (MITT), which dipped 10% after reporting that its BVPS declined 16.1% in Q2 – the second-steepest decline reported thus far in the mREIT sector behind Invesco Mortgage (IVR) which reported a 22% decline. Elsewhere, Great Ajax (AJX) lagged despite hiking its quarterly dividend for the second time this year to $0.27 per share. Rithm Capital (RITM) – formerly New Residential (NRZ) – slumped despite reporting solid results with the most modest decline in BVPS reported thus far.

REIT Capital Raising & REIT Preferreds

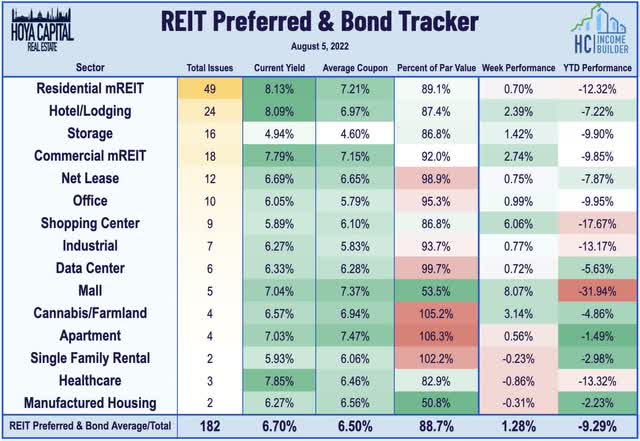

The Hoya Capital REIT Preferred Index finished higher by another 1.28% this week, trimming its year-to-date declines down to roughly 5% on a total return basis. It was a particularly strong week for the preferred series of hotel and commercial mortgage REITs with average gains of over 2% across the sub-sectors, led by the Hersha Hospitality (HT) preferred series and the ACRES Commercial (ACR) series. The preferred series of troubled mall owner Pennsylvania REIT (PEI) also rallied more than 10% after activist firm Cygnus Capital successfully gained two seats on the board of trustees following a long dispute resulting from PEI’s suspension of its distributions. Elsewhere, a pair of industrial REITs received credit rating upgrades. S&P raised Prologis’ (PLD) credit rating to A from A- with a stable outlook and raised Rexford’s (REXR) rating to “BBB+” from “BBB” with a stable outlook.

2022 Performance Check-Up

Through a bit over seven months of 2022, Equity REITs are now lower by 16.1% on a price return basis for the year while Mortgage REITs have slipped 15.6%. This compares with the 12.9% decline on the S&P 500 and the 11.7% decline on the S&P Mid-Cap 400 as well. Within the real estate sector, student housing and casino REITs are the lone property sectors in positive territory this year while the cannabis and regional mall sectors have lagged on the downside. At 2.84%, the 10-Year Treasury Yield has climbed 133 basis points since the start of the year, but has been under pressure since briefly breaking through the prior post-GFC-high rate of 3.25% reached in 2018 and touching an intra-day high in June of 3.50%.

Economic Calendar In The Week Ahead

Inflation data highlight another busy week of economic data in the week ahead. On Wednesday, the BLS will report the Consumer Price Index which investors – and the Fed – are hoping to show that the fastest pace of year-over-year increases is finally behind us. The headline CPI is expected to moderate to an 8.7% annual rate from the four-decade-high set in June as the effects of declining gasoline prices begin to filter into the data. Gas prices have declined about 20% since their peak on June 13th at $5.01 per gallon. The following day we’ll see the Producer Price Index for July which is expected to exhibit similar trends of peaking price pressures. On Friday, we’ll get our first look at Michigan Consumer Sentiment for August. Last month, sentiment fell to the lowest level in more than 10 years as persistent inflation and worries over economic growth have weighed on confidence. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential “wage-price inflation spiral” through elevated consumer wage expectations.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment