Justin Sullivan/Getty Images News

Dear Readers,

In this article, we’ll look at Harley-Davidson Motorcycles (NYSE:HOG) – the company that sells the arguably, most iconic motorcycles in the entire world. As a European, I’m partial to both Ducati and BMW (OTCPK:BMWYY), but in the end, a Harley is still a Harley – so in this article, we’ll look at if you should be considering the company as an investment – either long-term or short-term.

I also hope I can present a reasonable thesis for this business for the reader who asked my opinion.

Looking At Harley-Davidson

My days of driving a motorcycle are past – I haven’t been on one in years, and when I did ride, I rode BMW, and specifically an R1150GS in black/silver – a great off-roader. However, I’d be lying if I didn’t say that a Harley was often on my mind as a very solid alternative, and an attractive one.

So – Harley-Davidson. Some basic facts.

The company currently has a market cap of just below $6B, has a BBB- credit rating, and recently reduced its yield to $0.6, which comes to around 1.58% at the current share price. It has a decent debt/cap below 50%, and it trades at one of the highest discounts we’ve seen since the COVID-19 crisis (more on that later).

HOG is a survivor. It’s one of the very few American motorcycle companies (and there are a lot of them) that has survived every single recession for over 115 years. The only other company that can claim this feat is Indian Motorcycle (no Symbol). The company was founded in 1903, incorporated in 1981 at which point it bought the motorcycle company from AMF Incorporated. The company IPO’ed back in 1986.

I don’t think I need to make a whole host of arguments as to why the company’s products are loved. I can certainly make arguments for BMWs, but there are masses out there that swear by Harleys – and that wouldn’t be caught driving anything else. The company builds “adventure machines” for life.

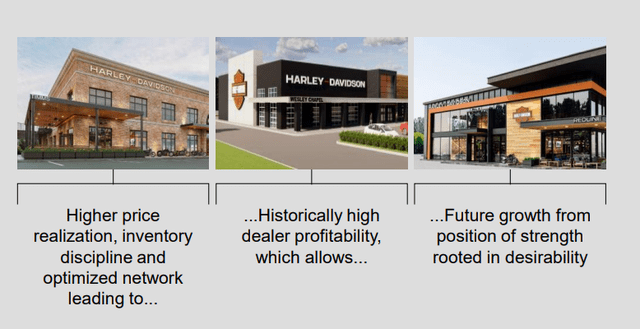

HOG can be compared to Mercedes Benz (DDAIF) or BMW in terms of brand appeal. When it comes to Motorcycles, this is the most desirable brand – and this comes from someone with my background. The company’s profitability hinges on its ability to retain this basic investment appeal, its product appeal and qualities rooted in the desirability of its near-timeless motorcycle products. Much like car companies like Ferrari (RACE), HOG creates desire and demand for its products through quality, reliability, and innovation.

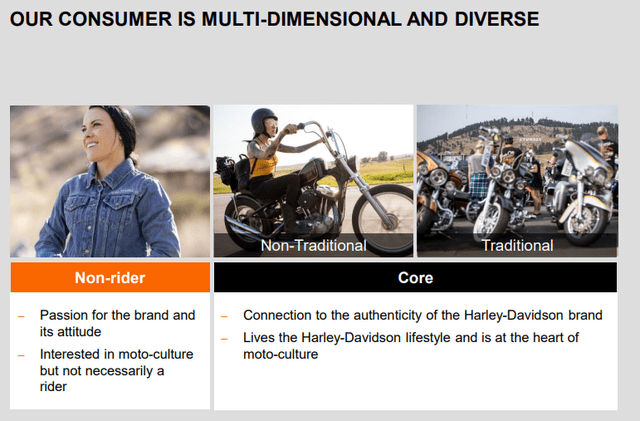

HOG knows its customer – and divides them into two groups.

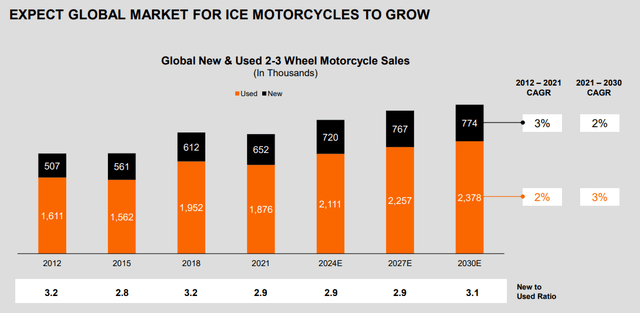

The company’s objective is to encourage Non-riders to engage with HOG and become either aspirational riders or riders, inspired by the company’s values of freedom and adventure. The company also seeks to attract new riders through its riding academy, new market introduction, and improved sales trends. This means that more people are riding Harleys than ever before, and the company’s products are selling more profitably than before. The company expects the global motorcycle market to grow, and I would say this trend is realistic.

The company recently, back in 2020, did what it called “The Rewire” – this consisted of a massive overhaul of the company’s business in order to execute on the company’s 2025E strategic plan – the “Rewire”. The goals include being the most desirable motorcycle brand in the world, a strong focus on profitability, growing its leadership, expanding in product segments aligned with the profitability focus (Adventure Touring and Middleweight Cruiser segments) and stronger focus on international markets.

HOG has identified 50 global markets that matter to its future growth – with USA obviously being the priority #1 market – but also the so-called DACH markets, meaning Germany, Austria, and Switzerland. However, HOG also intends to push Japan, France, the UK, Italy, Australia, New Zealand, Canada, and China.

Electric Motorcycles? Is this going to be a thing?

Yes, absolutely. HOG is still in the development phase – but it has one electric motorcycle for sale – The Livewire. I would personally be curious how such products are received by Harley drivers – as I prefer my motorcycles to run traditionally. I’m also unsure how the whole EV/charging thing works with the company’s mottos and values of freedom, given the relatively limited range of electric motorcycles.

The company has one product segment – Motorcycles and Related products. This is where HOG does everything. It designs, manufactures, and sells motorcycles. It also sells parts, accessories, and apparel, and works on its trademark licensing.

Sales are global, and the company’s sales model is the agency/dealer model – a network of independent dealers selling the company’s products. Dealers also stock parts and accessories, and other things that the company sells. There are over 600 dealers in the US, 362 in Europe, over 250 in Asia, and a total of ~1350 in the entire world.

The company’s sales spit is simple. Almost 77% of annual sales revenues are motorcycles – 16.3% are parts and accessories, around 5% Apparel, and the rest is licensing and services.

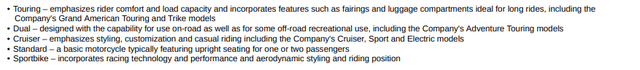

The company’s motorcycles focus on the following segments.

Competition for Harley-Davidson exists, but it’s like saying there are other companies that make cars next to BMW or Mercedes – for some customers, such as myself, it doesn’t matter that there are “other products”. I know what I want, and the “desire” argument is big here. If you ride a motorcycle, chances are you want a Harley – and few other products will in this case be good enough.

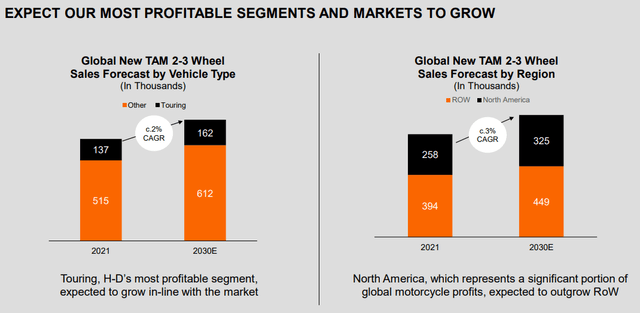

This is confirmed based on the premium commanded by the company’s products. The company expects its most profitable segments to grow.

This combined with a record-high ridership of 3.136 million riders and with new blood coming into the “sport” compared to the number of riders “aging out” of it spells positivity for the company. it’s also to be mentioned that the Harley-Davidson brand, for many people, has positive connotations or associations. It’s a lifestyle – and this also needs to be considered at over 15% of sales.

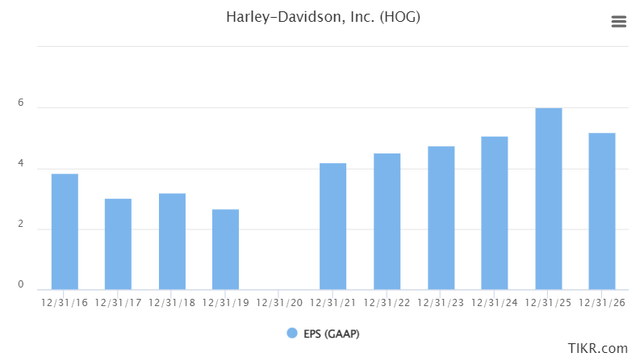

The company had issues during the pandemic. EPS dropped like a stone and 2020A was down 77%, following an 11% decline in 2019. This would spell real problems for some companies, but HOG bounced back up by 447% and is currently on track to deliver single-digit EPS growth for the 2022E Fiscal.

The company is investing across the board, which also goes in line with its current capital allocation priorities – meaning not dividends. HOG is instead investing into its products, its dealerships, and everything around the products.

On a perspective of financials, the company has recently confirmed its 2022E guidance. The company expects revenue to grow by 5-10%, and the margin to stay stable at 11-12% (comparable to car premium brands), though the company expects financial services income to be down significantly. The reason for this – increased interest rates, which makes leasing and financing the products less attractive than when money was “free”.

The company has, because of this, already delivered on improved fundamentals. It has proven that it will continue to invest into the company – and the first stage of its Hardwire plan is currently being met.

Unlike cars, the company expects both ICE bikes and EV bikes to grow at 2-20% CAGR until 2030E – and Harley expects to be a major beneficiary of this development, being “the” premium motorcycle player in the world.

These fundamentals and this set of expectations are hard to argue with when you look at trends. The risk for HOG that one usually focuses on is the fact that revenue, as of right now, really hasn’t improved much in 15 years. The company has high margins, but arguments are made against that there is very little actual growth to be had – though I would disagree somewhat with this, pointing to the recent quarterly revenue growth rates.

Investors equating Harley-Davidson to BMW or other brands are, I argue, missing the appeal of Harley-Davidson. While the company does need to prove its EV concept more than we’re seeing today, and while EV motorcycles themselves need to be justified (I would personally never buy an EV bike), Harley-Davidson remains interesting at the right price.

The company is certainly not a “staple” – it’s cyclical, but I will show you why I believe the price to be tendentially worth it here.

Harley-Davidson Valuation

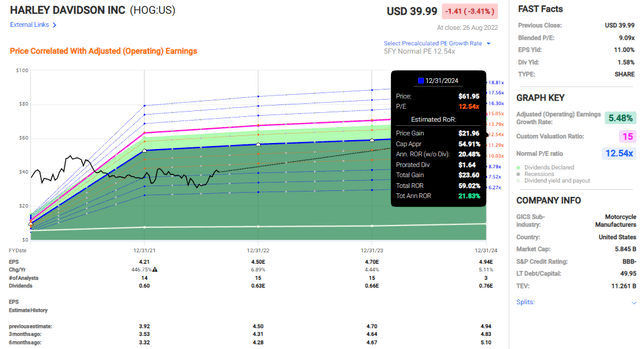

The valuation for this company is very appealing. This is based on the current company yield – which is below the typical average – as well as still trading based on its EPS decline in 2020. We find HOG trading at less than 10x P/E, around 9x P/E, with a 5-year average of around 11.6x. This gives us a conservative upside of between 15-21% annually for the next 3 years.

If you believe in the company’s prospects and stance – that ridership, sales, profitability, and everything points upward, then it makes sense that the company’s results will move in an upward trajectory as well.

A slow upward trajectory – around 4-6% – but upward. Yield isn’t going anywhere soon either. The company’s investment plans mean that it makes more sense for the company to invest its capital in other things than dividends, and the current 15% EPS payout ratio is expected to remain for the coming few years.

Current analyst targets are much more cautious than even just 6 months ago. The expectations are for the company’s EPS to slowly grow, justifying an upside of around 14-16%

The current PT for HOG is around $45.6 from S&P Global, based on a range from $36 low and $60 high. The $36/share low target is interesting, but downright ridiculous for the long term as i see it. $60/share might be realistic in a few years, but not at this particular time. The current upside from analysts is 14.2% and out of 9 analysts, 5 have the company at either a “BUY” or an “Outperform”.

I believe there is a lot to like about HOG here. Even if the company doesn’t offer the highest possible or amazing upside here, it still offers a great valuation in a great company that’s seen some troubled times. It can be said that the company’s product appeal doesn’t exactly disappear with its established user base even in the case of an economic downturn – and the company’s expansion plans are far from unrealistic, as I see it.

Not the greatest upside – but a good prospect. That’s how I’d put a stance on HOG today, and I would make that official, initial stance on HOG a “BUY” with a double-digit long-term upside.

I won’t be buying yet as I favor other companies with higher yields and even better upsides, but I believe HOG offers value here, and you can most assuredly invest in the company at a profit for the long term.

Thesis

My thesis on Harley-Davidson is as follows:

- HOG is the most iconic motorcycle brand in the entire world. It has survived over 115 years without fail, and I believe it will survive the EV revolution as well. It’s already positioned itself for success, and while I believe there are companies with a greater overall upside and yield, HOG still remains a solid investment for what it is – a motorcycle company.

- At a good price, the company offers a double-digit upside with no less than 10-20% annual potential CAGR. HOG is protected by solid financials and a product that’s really going nowhere.

- I view the company as a “BUY” with an attractive upside – and i give the company a $47 PT at this time.

Remember, I’m all about: 1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them:

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment