ablokhin

Introduction

During this year’s stock market weakness, I added two new holdings to my long-term dividend portfolio (94% of my total net worth). These investments are CME Group (CME) and Danaher Corporation (DHR). While I am consistently adding to my existing holdings, I’m looking to add another stock to my portfolio. I decided that this company is going to be Old Dominion Freight Line (NASDAQ:ODFL) after weeks of considering the pros and cons of every investment on my watchlist. I have accumulated more dividends and put more money aside for a large (relatively speaking) investment in this less-than-truckload carrier from North Carolina. In this article, I will walk you through my thoughts and explain why I have so much faith in Old Dominion to generate outperforming long-term total returns. Moreover, the company perfectly goes with my existing holdings, given my high railroad exposure. I will also incorporate a wild card, which I believe could be autonomous trucking. This solution could propel the company’s already high margins into another dimension.

So, let’s dive into the details!

Why I decided To Buy Trucking Exposure

In June of this year, I wrote the following:

If I didn’t have so much industrial and transportation exposure, I would have added the stock by now.

While I do have tremendous industrial and transportation exposure, I’m buying more. That does harm diversification as I will be more dependent on cyclical industrials, yet it’s great for the long-term durability of my portfolio as buying ODFL will add trucking to my portfolio.

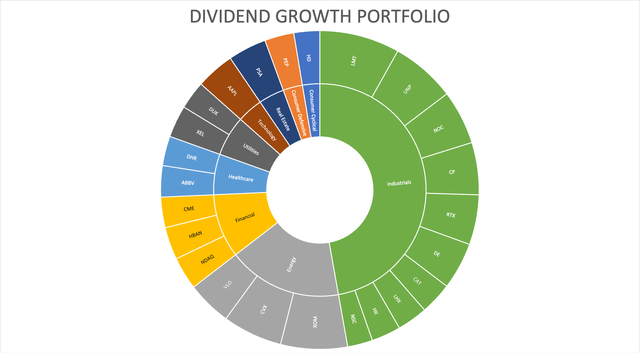

This is what my portfolio looks like right now:

Author

Prior to the pandemic, I avoided companies in competitive industries at all costs as I wanted companies in industries with very high entry barriers. I still want that, yet I changed my mind a bit. I have come across too many companies in various industries that did extremely well in highly-fragmented industries. Companies that had “figured it out” quickly gained market share, allowing them to accelerate free cash flow, resulting in even faster gains.

Old Dominion is such a company. While I do like its peer XPO Logistics (XPO) as well, Old Dominion is simply on a different level.

Before I dove into ODFL, I decided that trucking is right for me as it competes with rail transportation. Adding the best trucking company I can find lowers that competition risk a bit and it adds yet another industry leader to my portfolio. As readers may have figured out by now, I try to buy companies that dominate certain industries and supply chains. While ODFL is replaceable by competitors, it adds highly sought-after trucking capabilities to my portfolio.

With that said, let’s look into ODFL.

Why Old Dominion Is Right For Me

With a market cap of $31.9 billion, Old Dominion is North America’s largest less-than-truckload (“LTL”) carrier. The company provides regional, inter-regional, and national LTL services through its single integrated, union-free organization.

According to the company:

Our service offerings, which include expedited transportation, are provided through an expansive network of service centers located throughout the continental United States. Through strategic alliances, we also provide LTL services throughout North America. In addition to our core LTL services, we offer a range of value-added services including container drayage, truckload brokerage, and supply chain consulting. More than 98% of our revenue has historically been derived from transporting LTL shipments […].

Bear in mind that the numbers I’m about to show you in this article are mainly based on organic growth, meaning internal growth without (major) acquisitions.

What ODFL benefits from is that its infrastructure allows for next-day and second-day services through each of its regions covering the continental United States. As of December 31, 2021, the company had 251 service centers.

Public carriers represent roughly 65% of the LTL market. While I don’t have a handy table to show you, I know that most of these companies operate on very low margins as trucking is an extremely competitive market. Trucking is capital intensive and high investments in technologies and supply chain optimization measures are needed to get ahead. Hence, it’s a competitive industry with high entry barriers, if that makes sense. Or to put it differently, it’s a fantastic environment for companies who have figured out how to get an edge over competitors.

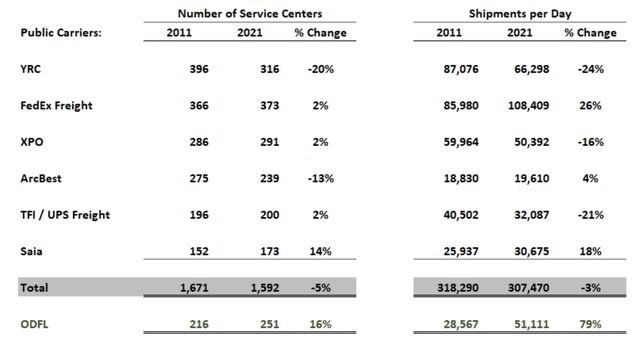

As the table below shows, ODFL is one of the largest players with 251 service centers. Even more important, ODFL is one of the few companies expanding the number of service centers, while effectively leveraging its network to reach outperforming shipments per day growth.

Old Dominion Freight Lines

With a network of close to 25,000 full-time employees, 10,600 trucks, and more than 42,000 trailers, ODFL has the ability to service every single market in a short amount of time. Moreover, and I got this from hours of online research, it seems that most towns that get new ODFL service centers are happy with the way the company manages its business (with regard to an exploding number of trucks on the road and other things that may annoy local residents).

Moreover, the company is very successful in what it does. With enough money, everyone can build new service centers. Operating them efficiently is a whole other kind of deal.

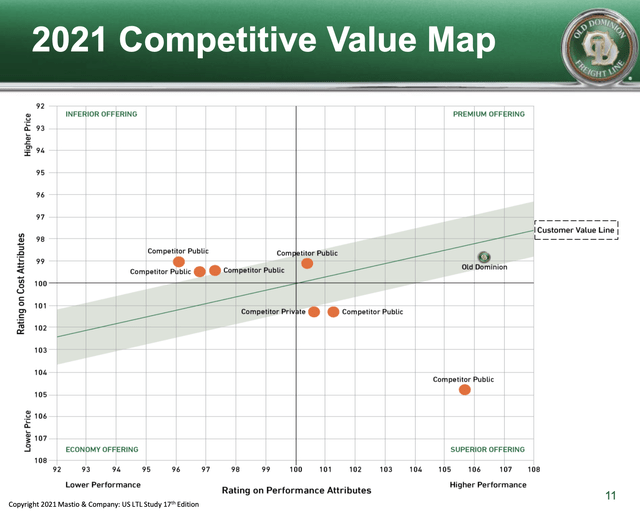

99% of the company’s services were on time in 2022. That’s up from 94% in 2002. The cargo claims ratio fell to a mere 0.1% in 2022. ODFL won the Mastio Quality Award for 12 consecutive years.

Using the company’s own chart, we see that the company scores very favorably when it comes to the comparison of price and performance. The company is operating on a similar price level as most of its public competitors (the only ones providing this kind of info to the public), yet the company scores higher on performance.

Old Dominion Freight Lines

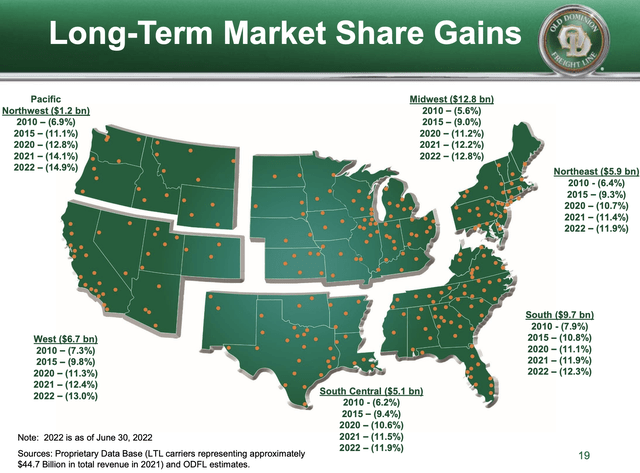

As a result, ODFL has tremendous market share gains. As of 2021, the company has an 11.4% market share. In every single region, the company was able to gain market share on a consistent basis. The overview below includes 2022 numbers (as of June 30):

Old Dominion Freight Lines

With all of this in mind, Old Dominion is turning these opportunities into high profit (growth). Between 2002 and 2021, revenue has grown by 12.4% per year – almost all of it is organic growth.

Moreover, in the past few years, the company has made tremendous progress in improving its operating ratio (the % of total revenue it costs to run the business, the lower, the better). In 2Q22, the operating ratio fell below 70% (69.5%), which is absolutely stunning – especially given a high inflationary environment.

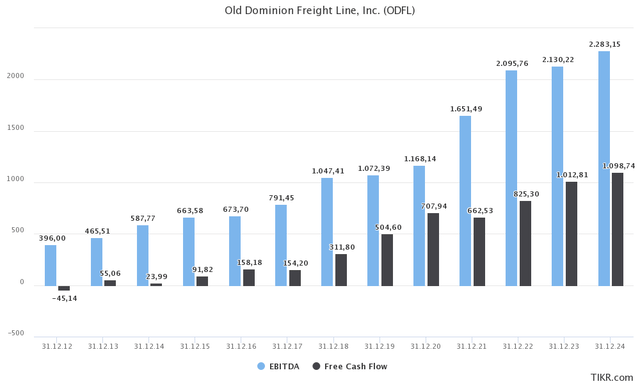

As a result, compounded annual EBITDA growth in the 2013-2024E period is 14.2%. Free cash flow during this period is growing by 28.3%.

TIKR.com

The surge in free cash flow is stunning as the company is generating way more cash (operating cash flow) than it spends on CapEx. Next year, ODFL is expected to do more than $1.0 billion in FCF. That would imply a 3.1% FCF yield, which is impressive.

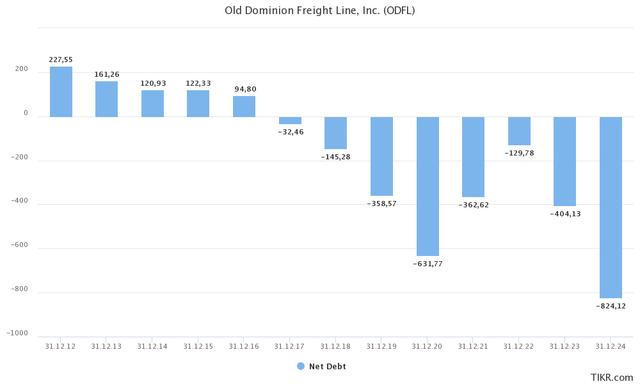

As a result, the company isn’t just efficient and fast-growing, but it has also been sitting on negative net debt (more cash than gross debt) since 2017, which lowers financial risks substantially.

TIKR.com

As of June 30, 2022, the company has $100 million in long-term debt. $20 million of this is maturing within 12 months. All of this debt is due under a Note Agreement with room to borrow up to $350 million. The interest rate is just 3.10%, which is a tremendous deal for a company in the trucking industry.

The Dividend & Outperformance

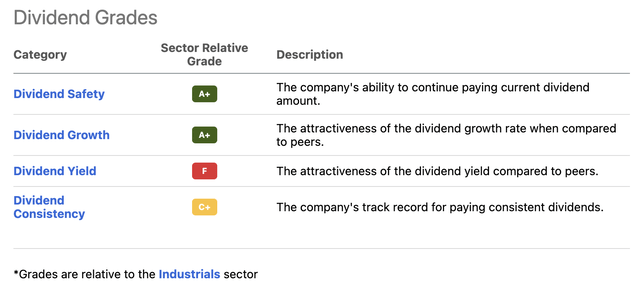

This is the part where some readers will quit reading. At least the ones looking for a decent yield. ODFL is paying a quarterly dividend of $0.30 per quarter per share. That’s $1.20 per year on a share price of $286. That’s a 0.42% yield.

Looking at the Seeking Alpha dividend scorecard, we see that the company is scoring very high on dividend safety and dividend growth. Dividend safety makes sense as net debt is negative and the company has an FCF yield of more than 3%. Hence, it could technically pay a 3% dividend.

Seeking Alpha

The problem is that a $10,000 investment in ODFL gets you $42 in annual dividends. However, my point is that ODFL is a good total return investment that will pay more dividends in the future.

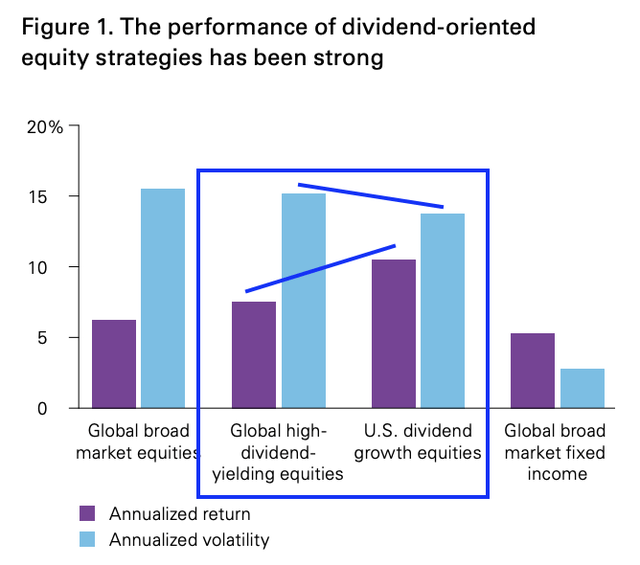

For example, in a recent article (and many others), I highlighted the importance of dividend growth when it comes to outperforming returns.

Essentially, the fact that a company pays a dividend is a stamp of approval. It means a company makes enough money to let shareholders benefit. If companies are able to grow dividends consistently, it means a company has even better “quality” characteristics.

As a result, dividend growth stocks tend to outperform the market on a long-term basis – more often than not with lower volatility.

Vanguard

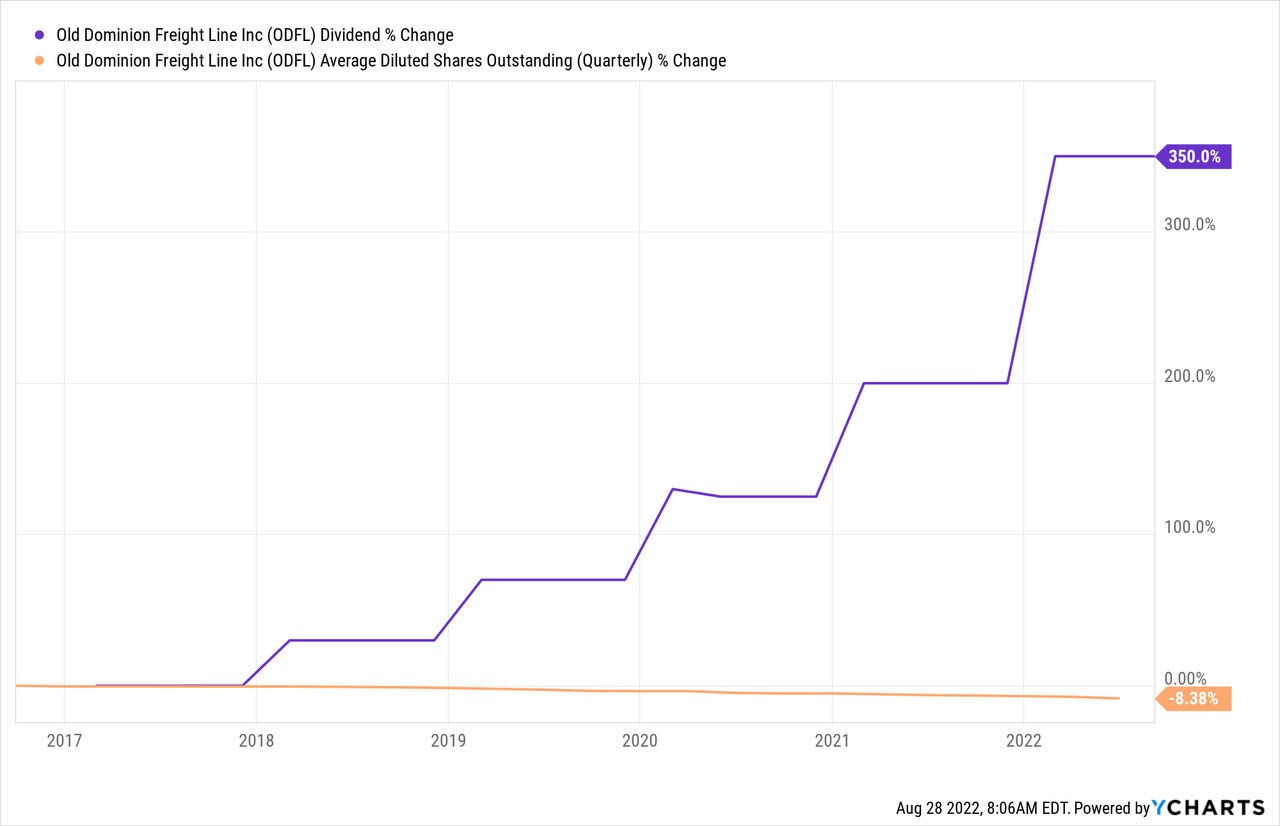

Old Dominion’s dividend growth is impressive.

In March of 2017, the company declared a $0.10 quarterly dividend. Moreover, the company has started to repurchase shares, lowering the number of shares outstanding by 9% over the past 10 years – almost all of it happened after 2018.

These are the most “recent” hikes:

- February 2022: 50.0%

- February 2021: 33.3%

- February 2020: 35.3%

As one can see, the company isn’t kidding around. It is quickly boosting its dividend, and I have zero doubt that long-term dividend growth will remain impressive.

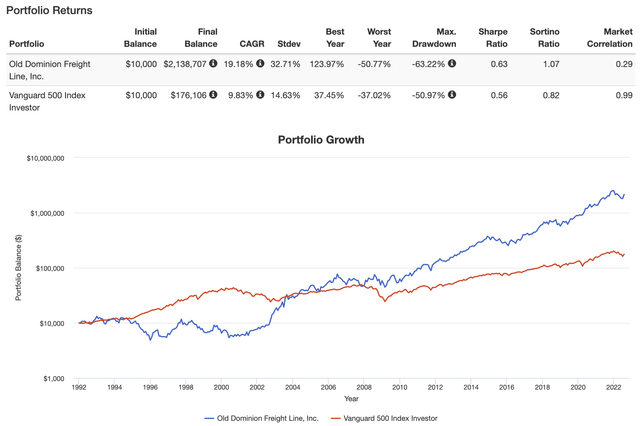

The good news continues as ODFL is an outperformer – even on a volatility-adjusted basis (Sharpe/Sortino ratios). The company has returned 19.2% going back to 1992 with a standard deviation of 32.7%. That’s not a low standard deviation, yet it’s enough to beat the S&P 500 even adjusted for high volatility.

Portfolio Visualizer

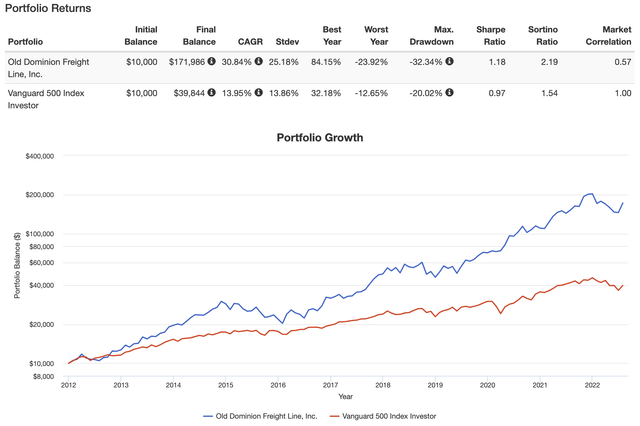

What’s even better is that over the past 10 years, the total return is above 30%. The standard deviation is lower, resulting in a Sharpe ratio of almost 1.2x. That’s truly impressive.

Portfolio Visualizer

With that said, here’s my entry strategy.

Valuation

Whenever investors buy index funds on a long-term basis, it’s best to refrain from timing the market. After all, “time in the market” usually beats “timing the market”.

I’m a bit different. I own 24 different stocks. I bought all of them at a point where I believed it would make sense. Hence, I waited before adding new positions until the market weakened this year.

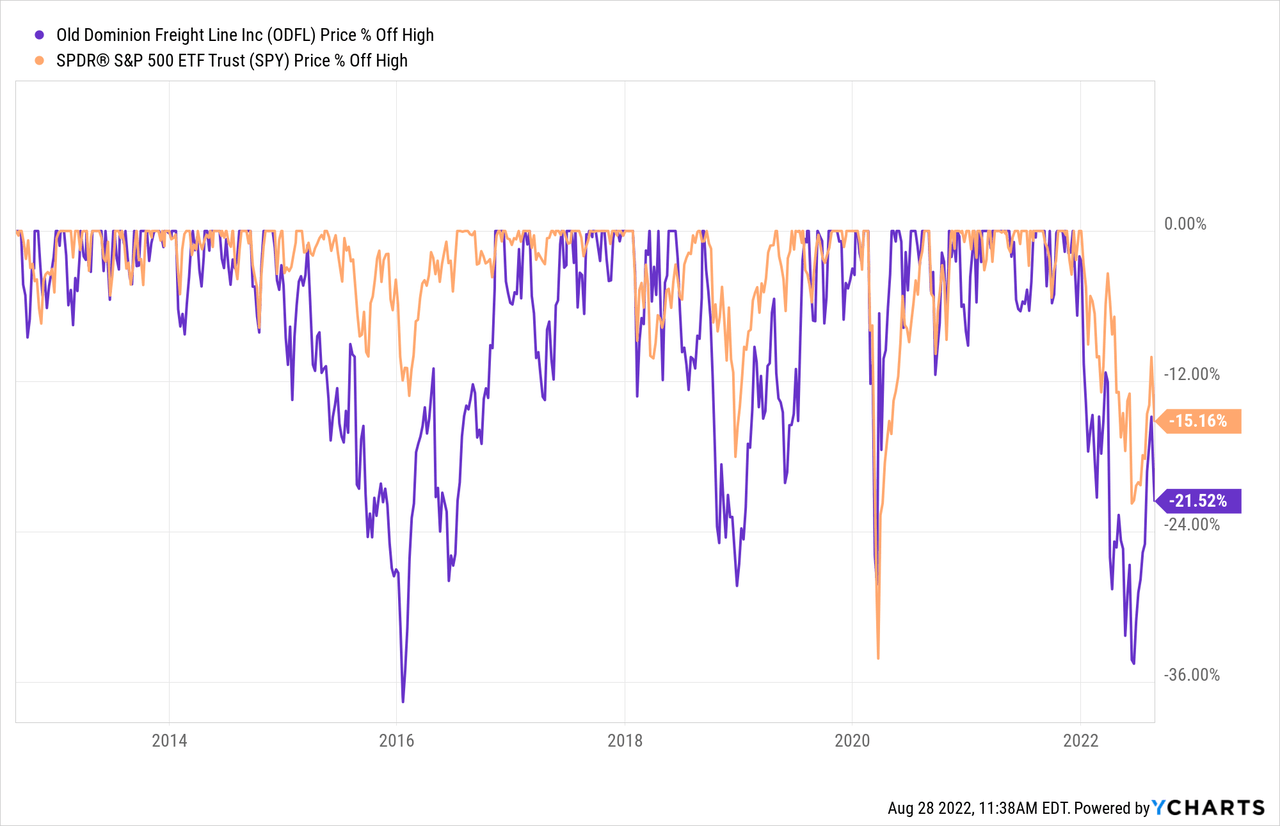

Old Dominion offers regular steep downturns. Over the past 10 years, the stock had four sell-offs of 30% or worse. The first one was in 2016 as a result of the manufacturing recession. The second one followed in 2018 due to slower global growth. The third one happened in 2020 due to the pandemic. The fourth one happened this year.

Right now, ODFL is roughly 22% below its all-time high, which I believe can become a bit worse.

The economy isn’t doing too well. High inflation, supply chain problems, and an aggressive Fed are pressuring consumer confidence and general economic conditions. So far, it looks like growth will be 1.7% in 2022 followed by a GDP decline in 2023 according to Wells Fargo.

Wells Fargo

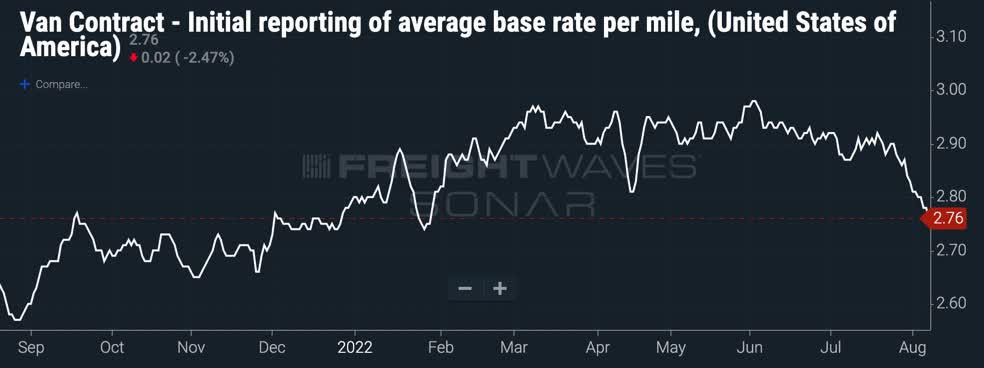

This is hitting trucking, truckload (not LTL) rates have fallen 8% so far since June, and FreightWaves founder Graig Fuller sees another 20% downside.

FreightWaves

According to Fuller on Twitter:

Truckload contract rates have dropped by 8% since early June. Contract rates could fall another 20% by Q2 2023. There will be blood.

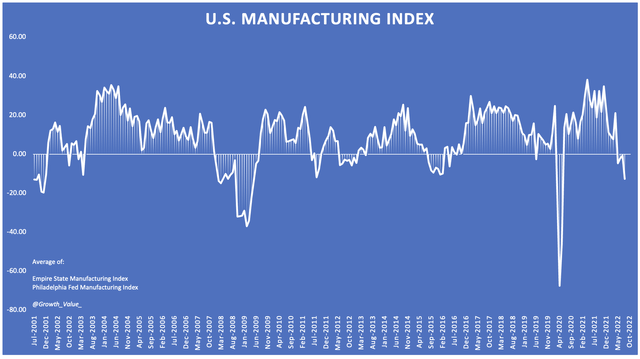

I agree with that statement as we’re seeing a steep decline in economic growth expectations, as displayed by the average of Empire State and Philadelphia Fed manufacturing sentiment.

Author (New York, Philadelphia Fed)

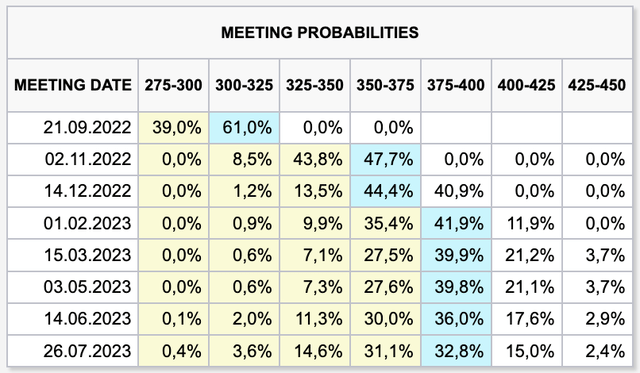

On Friday (August 26), the Fed reiterated its desire and commitment to fight inflation. Expectations are now that the Fed Funds Rate will exceed 375 basis points going into 2023. That’s up 25 basis points from prior expectations.

CME Group

It looks like the Fed will have to raise rates above core inflation, which has worked in the past. That would mean that rates above 400 basis points are likely.

Yet, it’s also likely to slow down economic growth as the Fed is now actively tightening into a slowing cycle.

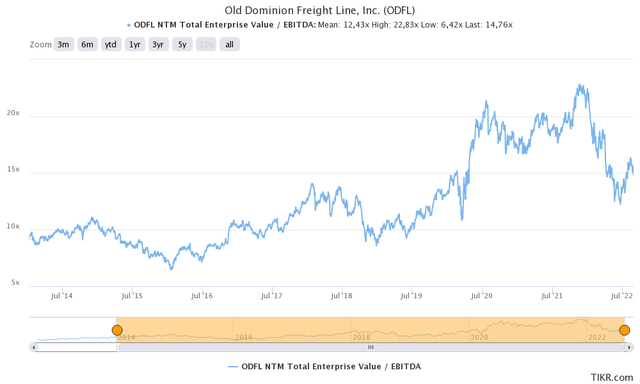

With that said, ODFL is trading at a 14.8x (2023E) EBITDA of $2.13 billion. That’s based on its enterprise value of $31.53 billion consisting of its $31.9 billion market cap and $400 million in expected 2023 net cash (more cash than gross debt).

This valuation is actually very fair given the company’s historic valuation range and the fact that EBITDA growth is expected to remain high.

TIKR.com

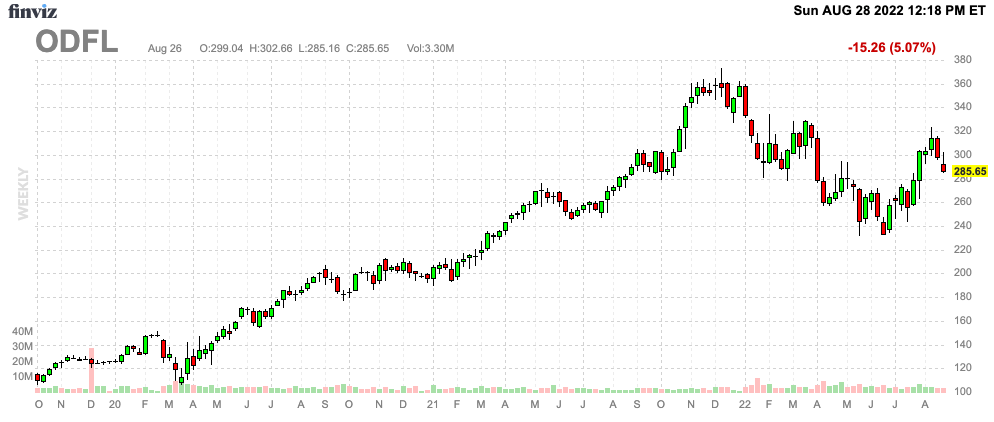

My strategy is to buy ODFL as close to $250 as I can. Given economic developments, I believe that we could see some growth downgrades. Europe has become a tinderbox due to the energy crisis, the Fed is hiking into weakness, and trucking rates are falling.

A decline to $250 would turn the current downtrend into a 30%ish decline from its all-time. That’s a price where I would buy aggressively – meaning investing up to 50-60% more than I would usually do when initiating a new position.

FINVIZ

I would refrain from buying if the stock were to suddenly take off. At that point, I will likely rethink position sizing and focus on assets that are down more than ODFL. Yet, I believe this scenario is unlikely. I want a lot of ODFL and I’m fairly sure that the ongoing market environment will give me another opportunity at $250 per share, or at least close to it.

Even if the stock continues to decline after that, I think buying ODFL at a 30%ish discount is a great deal – especially given that I’m not selling for at least a few decades.

A Wild Card – Autonomous Trucking

I’m not going to spend too much time on this subject as it’s not far developed and prone to a lot of influencing factors.

One of the reasons why I want trucking exposure is because I believe that autonomous trucking can give trucking companies a similar boost that railroads have enjoyed as new technologies allowed them to massively enhance operating efficiencies. I’m going to spend a lot of time focusing on this subject going forward as I’m fairly certain that this could be an incredible money-making opportunity.

Moreover, autonomous trucking increases competition for railroads. As I have a lot of railroad exposure (relatively speaking), buying a competing industry lowers my risks a bit.

So far, it looks like autonomous trucking isn’t going to replace drivers – and that’s a good thing as I don’t like to profit off unemployment.

For now, the most likely scenario will be that trucks take on highway duties where AI software is more reliable. This means that truckers focus on shorter distances. This will mainly benefit truckload companies. Yet, the average trip of ODFL trucks is also more than 900 miles, which means these technologies can help tremendously.

McKinsey estimates that this can lower the total cost of ownership by up to 45% beyond 2027, which would be a huge deal.

McKinsey & Company

Takeaway

While I’ve liked and recommended ODFL to dividend investors for a while, I’m now ready to make it a large position in my portfolio. The company is the perfect fit for my portfolio as it not only complements my railroad holdings but also lowers long-term risks if autonomous trucking shifts demand from rail to the road again. Moreover, ODFL isn’t just another LTL company but the most efficient, fastest-growing company in the industry with excellent management able to lower the operating ratio to levels that were unimaginable just a few years ago.

The company has a very healthy balance sheet, strong and rising free cash flow, and the ability to continue what it has been doing in the past: outperforming the market thanks to organic growth.

The valuation is fine at current prices, yet I’m waiting for a better entry. I believe that economic risks can lower ODFL to $250 or below, which would give it a risk/reward that makes me comfortable investing way more than I would usually invest.

Going forward, I will obviously keep you up-to-date on my investment plans and dive deeper into autonomous trucking, which I believe can be a much bigger game changer than previously assumed – at least in terms of future free cash flow growth.

For now, I’ll closely watch the market and buy if the opportunity presents itself.

(Dis)agree? Let me know in the comments!

Be the first to comment