HJBC

A very good set of numbers reported by AXA (OTCQX:AXAHF) shows its confidence in uncertain times ahead. The company just finished its half-year call with the investor community and the big surprise is the announcement of an additional €1 billion buyback. This new share repurchase plan is a program to further improve shareholders’ remuneration and is a positive sign of AXA’s strong capital requirement and cash flow generation.

Despite a complicated semester with the ongoing war in Ukraine, a financial market that’s very volatile and higher expenses due to natural disasters, the French insurer reported solid results.

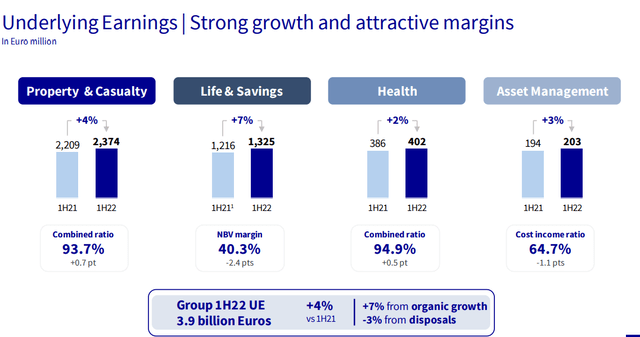

Starting with the numbers, AXA delivered top-line sales of €55 billion, up 1% compared to 2021 first half year. The performance was mixed by organic growth and disposal with +7% and -3% respectively. AXA’s operating profit per share (‘EPS’) stood at €1.65, up 11% in comparison with 2021 accounts. This was also ahead of the company’s target. Looking at the divisional level, EPS growth was achieved in 4 out of 5 divisions. Looking at the good news, we see that there was an improvement in the Property and Casualty division investment income, an increase in fee generation in the Life and Saving segment supported by the Japan region, and moderate growth in the Health division. All the divisions reported higher selling prices.

However, the first half result proved to be complicated for the Group, as the war in Ukraine forced it to pass a provision of €300 million. Moreover, AXA has had to deal with claims declared by Western aircraft rental companies, who have seen their aircraft grounded in Russia, with Moscow refusing to return them. Some policies were also triggered because they contained clauses on crops availability. In addition, traffic recovery due to the end of the health crisis led to an increase in claims for motor insurance. The bad weather which affected France between the end of May and the beginning of July had a cost of €190 million. Indeed, the P&C combined ratio increased by 70 basis points. Here is the link to check AXA’s combined ratio over the previous ten-years. To sum up, the insurer posted a net profit of €4.1 billion, up nearly 3% year on year.

Conclusion and Valuation

Numbers in hand and after having analyzed the half-year results, we can clearly state that:

- AXA is not only a resilient business but also an earnings growth story;

- The company is currently yielding almost 7% and the new buyback plan will further reduce earnings dilution;

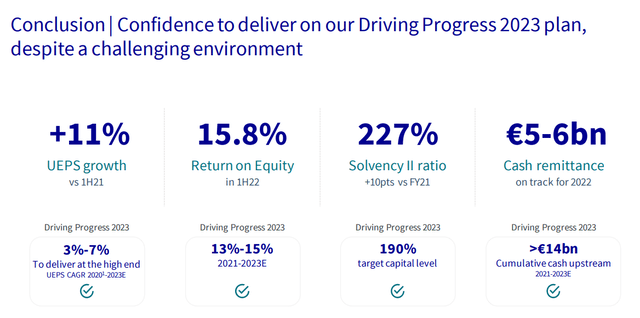

- Despite the ongoing crisis, the Solvency Ratio II stood at 227% and was up by 10 basis points in comparison to last year;

- The company transformation plan is proceeding well and is on track to enhance profitability;

- AXA is proactively managing inflation expectations in the core business and also is benefiting from higher reinvestment yields.

Last but not least, following AXA’s Driving Progress plan, the company is delivering well ahead of its internal 2021-2023 guidance. AXA delivered earnings per share growth of 11% (guidance was between 3% and 8%), return on equity at 15.8% (guidance was between 13% and 15%), and achieved a solvency ratio of 227% (the minimum requirement was at 190%). After the Q1 performance analysis, we moved our rating from Neutral to Buy based on a P/E of 11x at 26 euros per share. Adjusting our model with the new numbers and maintaining the same P/E ratio, we derive a target price of €29 per share.

Be the first to comment