Godji10/iStock via Getty Images

A Quick Take On HilleVax

HilleVax (HLVX) has filed to raise $100 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is a clinical-stage biopharma developing a vaccine for the prevention of acute gastroenteritis [AGE] caused by norovirus infection.

HLVX is a promising mid-stage company with top-tier investment backing, so the IPO could be interesting for patient life science investors.

I’ll provide an update when we learn the IPO’s pricing and valuation assumptions from management.

Company & Technology

Boston, Massachusetts-based HilleVax was founded to advance a pipeline of vaccine candidates to prevent acute gastroenteritis in infants, children, adults and older adults.

Management is headed by Chairman, President and CEO Rob Hershberg, M.D., Ph.D., who has been a venture partner at Frazier Healthcare Partners and prior to that was Executive Vice President of Business Development and Global Alliances of Celgene Corporation.

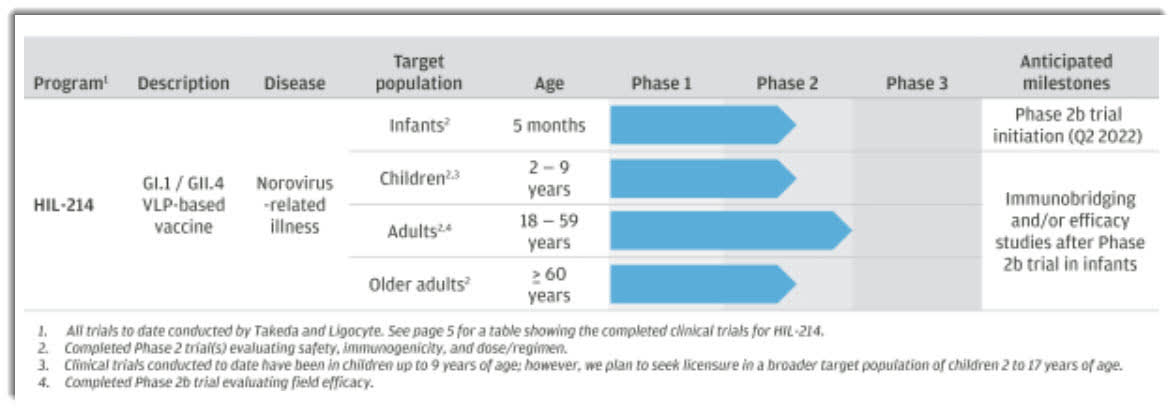

The firm’s lead candidate, HIL-214, is in Phase 2 trials across all four age ranges and is preparing to enter Phase 3 trials for adults between 18 and 59 years old.

Below is the current status of the company’s drug development pipeline:

Drug Candidate Pipeline (SEC EDGAR)

HilleVax has booked fair market value investment of $158 million in convertible promissory notes from investors including Frazier Life Sciences and Takeda Vaccines.

HilleVax’ Market & Competition

According to a 2021 market research report by Mordor Intelligence, the global market for treating infectious enteritis is forecast to grow at a CAGR of almost 4.9% through 2025.

Key elements driving this expected growth are a growing population with irritable bowel syndrome and diarrhea through a variety of means, including foodborne sources.

Also, it is estimated that 15% of the U.S. population in 2017 was affected in some way by a foodborne illness.

Major competitive vendors that provide or are developing related treatments include BioNTech (BNTX), CSL Behring, GlaxoSmithKline (GSK), Merck (MRK), Moderna (MRNA), Pfizer (PFE), Sanofi (SNY), and Takeda (TAK).

HilleVax Financial Status

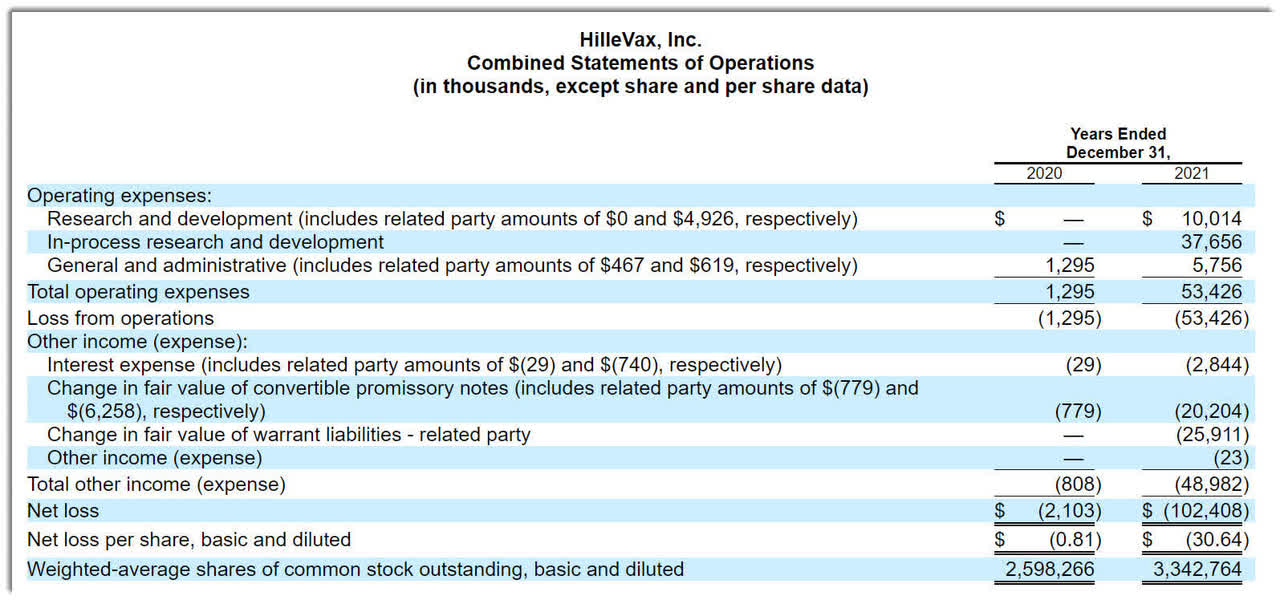

The firm’s recent financial results are typical of a clinical stage biopharma in that they feature no revenue and significant R&D and G&A expenses associated with its development efforts.

Below are the company’s financial results for the past two calendar years:

Statement of Operations (SEC EDGAR)

As of December 31, 2021, the company had $124.6 million in cash and $69.6 million in total liabilities (ex-convertible promissory notes).

HilleVax IPO Details

HilleVax intends to raise $100 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

to fund the clinical development of HIL-214, including certain manufacturing activities, and the remainder for working capital and general corporate purposes.

We may also use a portion of the remaining net proceeds to in-license, acquire or invest in complementary businesses, technologies, products or assets, although we have no current agreements, commitments or understandings to do so.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently a party to any material proceedings.

Listed bookrunners of the IPO are JPMorgan, SVB Leerink, Stifel, and Guggenheim Securities.

Commentary About HilleVax’s IPO

HLVX is seeking public investment capital to fund advancement of its program trials.

The firm’s lead candidate, HIL-214, is in Phase 2 trials across all four age ranges and is preparing to enter Phase 3 trials for adults between 18 and 59 years old.

The market opportunity for treating acute gastroenteritis is expected to grow at a moderate rate of growth in the coming years.

The company has a major pharma firm collaboration with Takeda Pharmaceuticals through its in-licensing relationship.

Management plans to seek commercialization partners for HIL-214 outside the United States.

The company’s investor syndicate includes Takeda and notable healthcare venture investor Frazier Life Sciences.

JPMorgan is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (38.8%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

HLVX is a promising mid-stage firm with top tier investment backing, so the IPO could be interesting for patient life science investors.

But the company relies heavily on its in-license from Takeda, so an important risk factor, above and beyond trial risks, is if that license was terminated.

I’ll provide a final opinion when we learn more information about the IPO from management.

Expected IPO Pricing Date: To be announced.

Be the first to comment