Solskin/DigitalVision via Getty Images

For those who don’t know, FIGS (NYSE:FIGS) is a healthcare apparel brand that focuses on scrubs and other apparel products that are more fashionable than generic alternatives. The focus on fashion and comfort gives the company a unique niche in a recession-resistant industry. Thus far, the strategy seems to be working as revenues have grown about 400% in the last three years alone. In the balance of the article, we will look at why I think this fast-growing company is still a little overpriced.

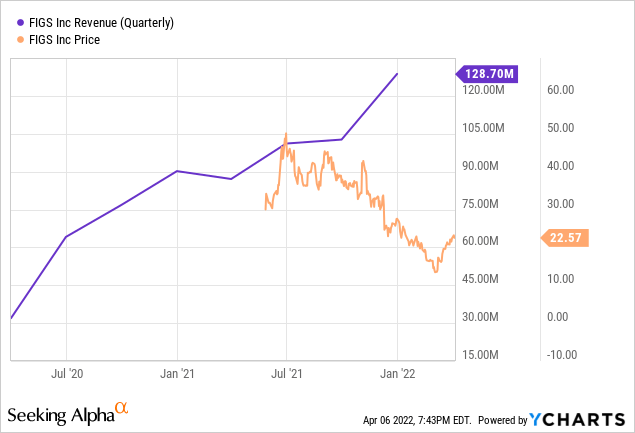

Three-Year Graph of FIGS Stock Price and Revenue Trends

The Bull Case-Management, Growth, and Industry Trends

Management matters. We do have to give a tip of the cap here to co-founders Heather Hasson and Trina Spear. These ladies serve as co-CEOs. Hasson has received a ridiculous number of industry distinctions for a 39-year-old executive. Spear, also very young for an executive, fostered her business acumen at Harvard Business School, Citibank, and Blackstone Group. Together, the two have created a fast-growing company with a loyal customer following. The pair has assembled an impressive slate of directors including a former Amazon executive and a former P&G CEO.

The industry trends are favorable as well. First off, medical careers consistently dominate the “fastest-growing occupations” projections. Secondly, scrubs are mandated for most medical positions, including CNA positions needed to fill needs at nursing homes, facilities and hospitals. These positions are subject to very high turnover. In addition, relatively new data show that burnout rates in health care are at an all-time high in the nursing field, with 34% of nurses reporting they will very likely leave their current jobs by the end of 2022.

Obviously, with a huge need for health care workers and a high level of turnover in the field, more and more new workers will be in the market for medical apparel. The model is replenishment driven and backed up by data from Frost & Sullivan, who estimate the global market for medical apparel to be $79 billion.

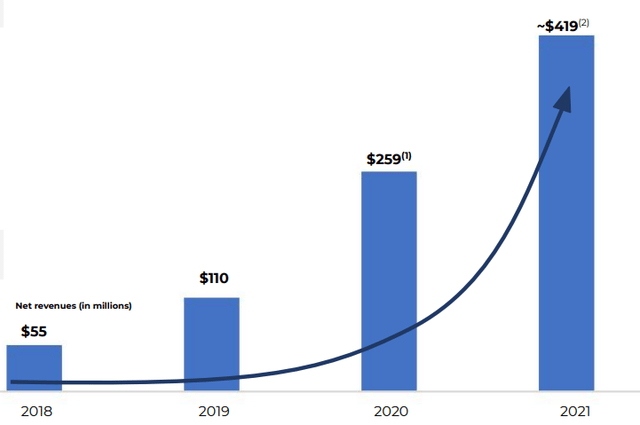

Growth is Undeniable

It is hard to argue that growth thus far has been very impressive. The past three years have shown revenue growth of 100%, 135%, and 62%, respectively. Frost & Sullivan model for 6.2 CAGR in the health care apparel niche in coming years and the FIGS management team is forecasting company revenue to grow 30% over the next five years. While that is not quite what it has been, 30% growth is pretty impressive.

FIGS Revenue Growth (FIGS Corporate Presentation)

However…

I’ll cut right to the chase here. I think Hasson and Spear have done so well so fast that there are not a lot of levers left to pull. They basically created a market that did not exist. Prior to FIGS, all scrubs were generic, ill-fitting, and seemingly uncomfortable pieces of clothing. There was little to no differentiation. With FIGS, we have a better fitting, better looking, and more comfortable apparel line. And, of course, more expensive.

Everything written in the prior paragraph is positive. Obviously, there were a lot of medical employees welcoming this new line. The chart above is plenty of proof of that.

Management also pulled levers with cost control out of the chute by using a direct-to-consumer model and word-of-mouth advertising. Even so, management is forecasting a decline in margins as last quarter sported EBITDA margins of 24.8% and the long-term outlook provided by the company is targeting 20%.

My biggest caution flag comes with management’s hope for fostering growth by creating another new market. The company did a great job creating a differentiated niche within the boring and unappealing scrub market. But the foray into becoming a “lifestyle brand” will likely be a much tougher nut to crack. With premium scrubs, FIGS is a first mover with essentially no competition. With their new “layering system” consisting of loungewear, outerwear, undergarments, and performance undergarments, among other things – the competition is limitless.

With all that, I’ll say that FIGS will grow. They will grow profits and revenues. However, the five-year revenue growth estimate put forth by the management and the 24.06 EPS growth estimate put forth by analysts do seem to represent an approximate ceiling.

Let’s accept those numbers and take a look at the valuation going forward. In fact, let’s do one better and apply a 30% growth estimate to both metrics.

Valuation Considerations

The chart below shows the numbers if the company meets estimates and grows by 30% over the next four years. The final price applies a PE Ratio of 22 to those numbers.

| Year | Revenue | Earnings | Price |

| 2022 | $556 M | .30 | |

| 2023 | $722.8 M | .39 | |

| 2024 | $939.64 M | .51 | |

| 2025 | $1221.53 M | .66 | $14.50 |

2022-2026 Revenue and Earnings Projections for FIGS

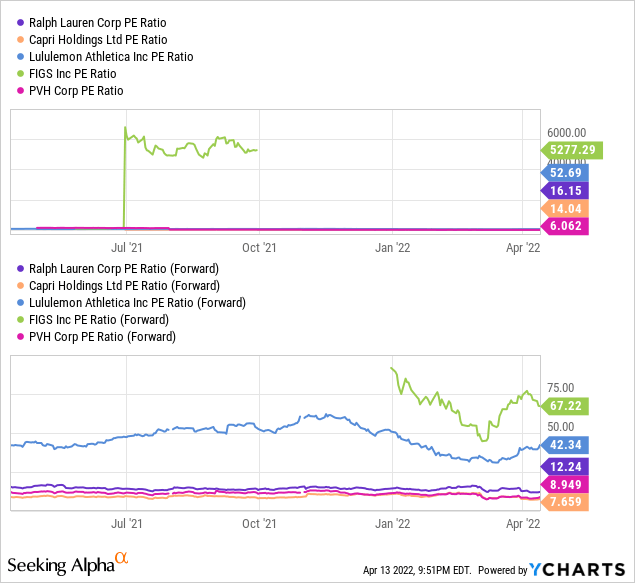

Compared to Peers

Of course, a company that blazed a trail and created its own market has no direct publicly traded peers. A lot of differentiated companies don’t. Therefore, we’ll look at a basket of publicly traded apparel companies and the corresponding valuations. Doing so shows that most apparel companies sport both current and forward PE values in the teens; sometimes lower. The outlier, of course, is Lululemon (LULU) with a premium forward PE of 42. We’ll use this as a framework as we do the final analysis below.

Valuation Metrics of Five Apparel Companies

Final Thoughts

I do appreciate what FIGS has accomplished in its short time as a publicly-traded company. It has successfully disrupted the entire medical apparel industry.

At the same time, operational success alone does not necessarily make for a prudent investment. Price matters. For FIGS to be an attractive investment going forward, essentially two things have to happen. First, FIGS has to meet its growth targets, which I believe is entirely possible. Secondly, FIGS has to maintain a premium valuation in comparison to other companies in the apparel industry. In fact, it would need a PE at the end of 2026 of 32 just to maintain its current share price. While maintaining a PE of 35 or better is possible and Lululemon has done it for years, it is not something I can count on. For that reason, when it comes to my investment dollars, I will take a pass.

Be the first to comment