Gonzalo Calle Asprilla/iStock via Getty Images

I don’t know about you, but when I think about the word ‘conglomerate’, I often think of a large and diverse operation. I think this is because, generally speaking, the companies that have the opportunity to become operationally diverse are those that, by definition, must be larger. But this is not an accurate portrayal. There are some small firms that could fall under this umbrella. One example is National Presto Industries (NYSE:NPK). With a market capitalization of $483.9 million, National Presto Industries is a fairly small operation. However, it houses three different lines of business, all of which are distinct from one another. These are its Housewares/Small Appliance segment, its Defense segment, and its Safety segment. Operationally, the picture for the company has been a bit painful this year. Having said that, shares have held up well compared to the broader market. Long term, I suspect that the company will fare well. But given the current position of the firm, I do believe that downgrading it from the ‘buy’ rating I had it at previously to a ‘hold’ rating makes sense.

The picture has worsened

Back in February of this year, I wrote an article that took a bullish position on National Presto Industries. In that article, I recognize that the company’s performance had not been all that great over the prior few quarters. This weak performance occurred on both the top and bottom lines. That ultimately led to some pain for its distribution as well. But given the long-term outlook for the company and how shares were priced at that time, I ended up rating it a ‘buy’, reflecting my belief that it should outperform the broader market for the foreseeable future. Using that definition, I would say that my call has been a marginal success. You see, while the S&P 500 is down by 13% since the publication of said article, shares of National Presto Industries have generated a loss for investors of only 7.2%.

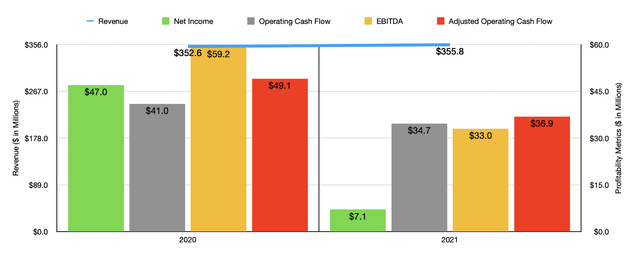

Author – SEC EDGAR Data

To understand why this performance disparity exists, we should probably dig into the financial performance of the company in recent months. To start with, we should touch on how the company ended its 2021 fiscal year. After all, when I last wrote about it, we only had data covering through the third quarter. For 2021 as a whole, management reported revenue of $355.8 million. That was a slight improvement over the $352.6 million in sales achieved during 2020. During that window of time, the company did see a bit of weakness in the Housewares/Small Appliance operations that it owns, with revenue dropping from $117.6 million to $115.9 million. But that was more than made up for by an increase in the Defense segment with sales climbing from $234.6 million to $239.5 million. Unfortunately, management didn’t really provide much detail on why this was. The only thing they said was that the company benefited from an increase in the number of units shipped under this segment.

On the bottom line, the picture was far less appealing. Net income for the firm plunged from nearly $47 million to only $7.1 million. Most of this weakness came from the Housewares/Small Appliance segment, with gross profit plunging from 21% of sales to 9% of sales. Management chalked this up mostly to increased ocean cargo and product costs, as well as to decreased sales from the segment. A less favorable product mix and efficiencies caused by labor shortages and delays in securing materials also impacted the Defense segment’s gross margin, which ultimately fell from 27% of sales to 26%. And the company also suffered from a write-down of inventory and materials for one of its subsidiaries. Other profitability metrics also suffered. Operating cash flow, for instance, dropped from nearly $41 million to $34.7 million. If we adjust for changes in working capital, the pain would have been even greater, with the metric plunging from $49.1 million to $36.9 million. And finally, EBITDA for the company declined from $59.2 million to $33 million.

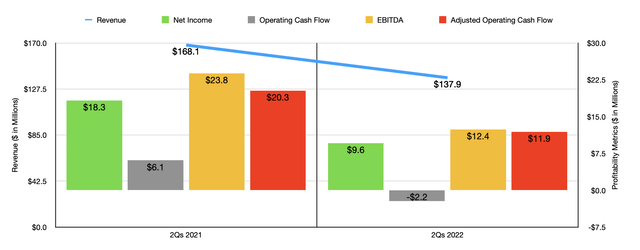

Author – SEC EDGAR Data

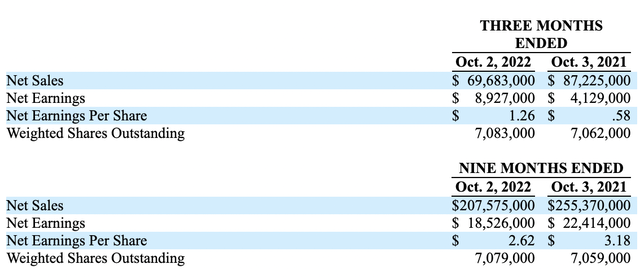

As a fan of National Presto Industries, I would have hoped that things would have improved this year. But sadly, that has not been the case. To be fair, my hopes were bolstered by the fact that backlog under the Defense segment came in at $460.8 million at the end of the 2021 fiscal year. That was up from the $320.2 million reported only one year earlier. Even so, revenue in the first six months of the 2022 fiscal year came in weak, hitting only $137.9 million compared to the $168.1 million reported the same time one year earlier. This 18% decline was painful. But to make matters worse, the situation seems to be worsening. In the third quarter that management just reported, sales were down 20.1% year over year, with revenue plunging from $87.2 million to $69.7 million. For the year-to-date window, revenue for the Housewares/Small Appliance segment fell from $49.7 million to $45.1 million. But at the same time, the Defense segment saw revenue drop from $118.3 million to $92.5 million. In the case of the Housewares/Small Appliance segment, sales dropped in response to a decrease in the number of units shipped. However, the company did offset some of this pain with increased pricing. Under the Defense segment, a reduction in shipments also impacted sales. Management has revealed preliminary data for the third quarter, but that is largely focused on sales and net income. And that data shows much of the same, with revenue falling from $87.2 million in the third quarter of 2021 to $69.7 million the same time this year.

National Presto Industries

Profitability is also proving to be problematic for the enterprise. In the first two quarters of 2022, net income for the company hit only $9.6 million. That’s down from the $18.3 million reported one year earlier. Operating cash flow fell from $6.1 million to negative $2.2 million, while the adjusted figure for this went from $20.3 million to $11.9 million. Even EBITDA took a hit, declining from $23.8 million up to $12.4 million. For the third quarter, only the net income data has been provided. At the very least, the company is showing some signs of improvement there. Profits for the quarter came in at $4.1 million compared to the $8.9 million reported in the third quarter of 2022. This improvement was driven by a mixture of factors, including price increases and a reduction in ocean freight costs for the Housewares/Small Appliance segment.

Author – SEC EDGAR Data

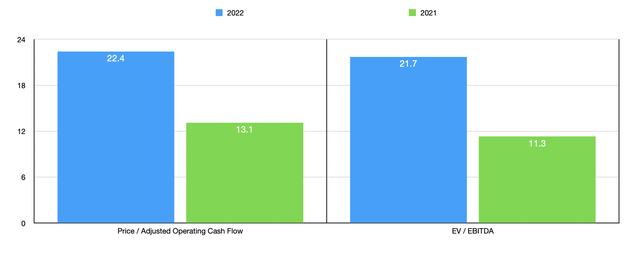

In terms of how to value the company, I decided to annualize results experienced so far this year. So far, that would imply adjusted operating cash flow of $21.6 million and EBITDA of $17.2 million. Based on these figures, the company would be trading at a forward price to adjusted operating cash flow multiple of 22.4 and at a forward EV to EBITDA multiple of 21.7. These are pretty lofty no matter how you look at them. But if the company eventually reverts back to the levels of profitability seen in 2021, these multiples would shrink considerably to 13.1 and 11.3, respectively.

Takeaway

Based on the data provided, I will say that I still do believe that the long-term outlook for National Presto Industries is positive. In the near term though, we could see some additional pain. One bright point to focus on involves the fact that profits under the Housewares/Small Appliance segment are looking up. But a single quarter a trend does not make. And to truly see if the worst for the company is behind it, I do believe at least another quarter or two worth of data will be important. For those with a very long-term investment horizon, I would say that this is still a valid opportunity. But for most of us, I would call this a ‘hold’ instead.

Be the first to comment