Editor’s note: Seeking Alpha is proud to welcome Creative Capital Ideas as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

blackdovfx

Investment thesis

I recommend buying Credo Technology Group (NASDAQ:CRDO) as it is one of the leading businesses in the data infrastructure market. The reliable, cost-efficient, and secure innovations that CRDO offers are highly recommendable for hyperscalers, OEMs, ODMs, and optical module manufacturers, as well as for the enterprise and high-performance computing markets. CRDO has also become a major player in the market thanks to its strong SerDes IP portfolio, which is what drives the company’s high-performance, cost-effective, and power-efficient connectivity solutions.

Business overview

Credo Technology Group is an innovator in providing secure and high-speed connectivity solutions. The company delivers power and cost-efficient solutions. Its innovations are focused on easing system bandwidth bottlenecks while improving power, security, and reliability. The technologies offered are based on Serializer/Deserializer (SerDes) and Digital Signal Processor (DSP). The offered solutions are optimized for optical and electrical ethernet applications. CRDO’s clients include the enterprise and high-performance computing markets, hyper scalers, original equipment manufacturers; original design manufacturers; and optical module manufacturers.

Huge increase in data network traffic and demand for digital infrastructure

The massive and growing cloud workloads, streaming video proliferation, 5G wireless deployments, the ever-expanding internet of things, and the growing adoption of artificial intelligence are all contributing to the explosion of online data. This is straining existing data infrastructure and forcing paradigm shifts from transistors to systems. According to a Statista report, the current trends of globally created, captured, copied, and consumed data show that in 2025 it is expected to increase to about 181ZB. Similarly, the ever-growing data and network traffic is resulting in consistent bandwidth barriers and bottlenecks. These problems need to be fixed so that people can connect faster and power and security needs can be met.

Because of the ever-growing data traffic on different networks, there is a consistent requirement for increased data bandwidth. Similarly, participants involved across the data ecosystem need higher-performing connectivity solutions. This demand is driven by hyperscalers, which are at the center of data infrastructure and add up small increases at the edge of the networks. There is also a higher chance that these dynamics will continue to grow, leading to more adoption in enterprises, HPCs, and consumer applications because the industry is growing and it needs more bandwidth.

The development of server connectivity standards and consumer device connectivity standards presents long-term prospects as well. The development of connectivity standards will increase the need for cutting-edge connectivity solutions. As these standards change to support higher data rates and higher order modulation, competitive solutions will need to be more efficient with power and money.

Increased trend towards DDC

As technologies are evolving, everyone is trying to cater to more speed than their predecessors. For instance, hyperscalers and 5G network operators are putting significant light on different network topologies that are deployed. Customers are increasingly looking for Distributed, Disaggregated Chassis (DDCs) which provide efficient scalability as they separate the traditional, proprietary chassis used for switching and routing into their building blocks (according to the company’s S-1).

DDCs offer choices in the hardware utilized, software deployed, and vendor lock-in. Also, the erstwhile legacy connectivity options are not suitable to address the evolution of the internet. All these factors give way to Active Electrical Cable (AEC) technology as a key enabling technology for DDC architectures, as they are capable power consumption moderators and more reliable as well. On the other hand, optical transceivers and active optical cables (AOCs) use a lot of power, are more expensive, and don’t last as long, and passive digital-to-analog converters (DACs) are too thick and short-ranged to route at the required densities and cost more up front.

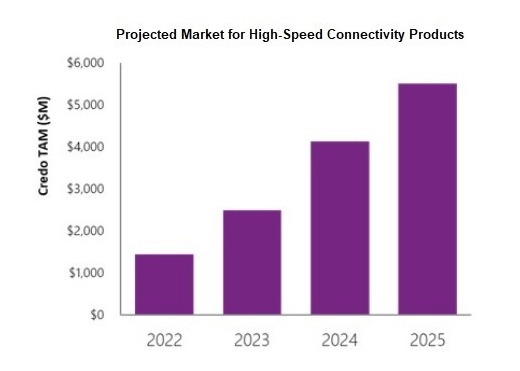

By 2025, CRDO projects that the demand for high-speed connectivity products will have increased TAM from ~$1.5 billion in 2022 to $5+ billion, fueled by data-dependent secular tailwinds.

S-1

Leading technology and proven product

CRDO’s leadership in technology is based on its strong SerDes IP portfolio. Cost-effectiveness, high performance, power, and cost efficiency are the driving forces behind CRDO’s purpose-built mixed signal and DSP architectures. Furthermore, CRDO’s architectural approach enables them to design in mature fabrication processes, yet they deliver leading-edge performance and low-cost power. In the same way, CRDO’s optimized SerDes architectures used mature, low-cost processes to achieve the best power efficiency in the industry on small die areas.

Moreover, CRDO products are tested by top-tier customers. They work with top hyperscalers and have more than 20 blue-chip clients, including more than 10 OEMs and ODMs, 10 optical module manufacturers, and other top technology companies.

Competition

Based on my research, CRDO appears to be the only provider of such comprehensive high-performance network connectivity services. There are no direct rivals to the CRDO solution (companies that offer the same thing), but there are firms that sell products that compete with various aspects of it. Some examples include Broadcom (AVGO), Marvell (MRVL), Synopsys (SNPS), and Cadence (CDNS).

What this means is that CRDO is the only company offering this service, and that are a few key implications:

- One major advantage is that it can help make CRDO’s sales pitch more persuasive and stand out from the competition as CRDO is the only one that can offer this.

- CRDO is able to provide a unique value proposition to customers.

- By providing this suite of solutions, CRDO will gain far more commercial experience than any new entrant, allowing them to repeat and improve at a much faster rate.

All in all, CRDO’s patented SerDes IP is the backbone of the company’s product architectures, determining not only how to efficiently transform and transmit data at high speeds across a wired connection, but also how to translate and convert the signal back into its original form so that the data can be used when the transmission is received.

CRDO’s purpose-built offerings outperform the competition despite the fact that rivals use their own SerDes architectures. This is made possible by the company’s use of smaller chip sizes and a cheaper manufacturing process that is one generation older. As hyperscalers place a premium on power efficiency, and as data center quotes are often expressed in terms of power budgets, a structurally lower cost will aid the company in expanding its market share in promising new areas like Optical DSP.

Sales and marketing strategy

CRDO works with a two-pronged sales strategy of targeting both the end users as well as the suppliers of end users. The direct engagement with the customers enables the company to better communicate and understand their problems and provide top-notch solutions for their connectivity requirements.

Such a strategy has enabled CRDO to become the most prominent player and preferred vendor across the global market. This loyal customer base of the company requires their suppliers, OEMs, ODMs, and optical module manufacturers to utilize CRDO’s solutions. I.e., with CRDO’s 200G Optical DSPs, five optical suppliers are currently designing their products; and also, due to performance, power, and cost efficiency, multiple suppliers are designing products for unrelated platforms.

Similarly, CRDO sells solutions globally through its direct sales force, which is located in North America, Asia, and Europe. The sales force is complemented by teams of marketing, business development, and field application engineers across the regions. All these are aligned with CRDO’s product verticals.

Financials

P&L

CRDO has proven to be a fast growing business, with revenue increasing threefold over the last three years (2020 to LTM1Q23), and is expected to continue growing rapidly. This is a clear indication and proof to me that adoption is high and the CRDO sales and marketing strategy is effective. As I mentioned in my thesis, the industry trend is strong, and the TAM is massive. According to LTM figures, CRDO revenue represents only 3% of the potential TAM in 2025. More importantly, in two years, CRDO is expected to be profitable and cash flow positive.

Balance sheet

As a fast-growing company, the fact that CRDO has very little debt on its balance sheet and is rather cash rich is music to my ears. This has two major implications.

- CRDO is not under pressure to sacrifice growth for profits as there are no near-term liquidity issues.

- CRDO has sufficient debt capacity to fund any potential value-adding M&A that could increase their technological lead or give them access to specific markets.

1Q23 earnings review

CRDO’s revenue for 1Q23 was 2% over estimates, and their projection for 2Q23 was 3% above market expectations (before earnings was announced). CRDO’s strategic role in serving next-generation bandwidth needs in a cost- and power-effective setting will enable a robust growth trajectory and, by extension, a fair degree of operating leverage, which I believe will be increasingly acknowledged by investors as customer concentration dynamics increase, despite a more uncertain macroeconomic backdrop.

Valuation

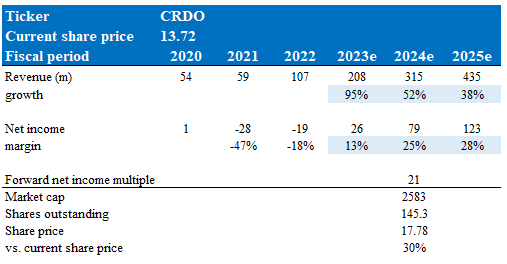

Based on current consensus estimates, which are achievable based on my thesis above, I believe there is a 30% upside over 2 years from the current share price. In the short term (FY23), management expects at least $200 million in revenue and a double-digit margin. This gives me confidence that momentum is still strong with CRRO. and I think it should trade at a similar forward earnings level in FY24. This would give us an implied market cap of $2.5 billion.

Model walkthrough:

- Revenue is expected to continue growing at a high pace as CRDO captures market share, from $107 million in FY22 to $435 million in FY25

- Net margin to expand as CRDO benefits from fixed cost leverage

- CRDO to trade at a mature-earnings multiple of 21x. This is based on CRDO current 21x earnings valuation multiple for FY24, which has more normalized earnings because margins are expected to rise to 20% or more.

Own estimates

Risks

Fast growing market attracts competitors like bees to honey

CRDO operates in a highly competitive market for global semiconductors in general and data infrastructure in particular. Keeping in mind several principal competitive factors, CRDO competes in different target markets to various degrees. Competition growth intensification is inevitable with the involvement of more competitive companies in the data infrastructure market. Such competition in the market means reduced profitability, loss of market share, and price pressures for companies like CRDO, which could lead to negative effects for the business.

ASP tends to decrease overtime for semiconductor products

Historically, the semiconductor products’ average selling prices in the market are on a decline, and CRDO expects a decline in its own products’ prices over time. CRDO may also have to lower the average unit price of its products because of things like price pressure from competitors and the launch of new products on the market.

Revenue concentration risk

In FY2021, CRDO had three major clients who accounted for 32%, 12%, and 10% of the total company revenue. In this way, the loss of a key customer or a drop in sales from any important customer could cause a big drop in sales.

Conclusion

Credo Technology Group is an up-and-coming company in the data infrastructure market, offering efficient and high-performing connectivity solutions. Being a leading innovator, the company is making a name for itself in a highly competitive data infrastructure market as the company deals with top-tier clients. Similarly, its two-pronged sales strategy to deal directly with both customers and suppliers is a unique one in the market. This direct engagement enables the company to enhance its customer base and offer better solutions for its connectivity-related issues. These factors, combined with my valuation assessment above, make me believe CRDO is undervalued.

Be the first to comment