Kateryna Onyshchuk/iStock via Getty Images

Investment Thesis

In my last note on AbbVie (NYSE:ABBV) for Seeking Alpha – in early July – I reviewed the Big Pharma’s Q1’22 earnings and looked ahead to the release of Q2’22 figures. I also considered the long-term outlook for a company that is still only 10 years old and is about to feel the impact of a loss of patent protection for its mega-blockbuster auto-immune drug Humira, which made $20.7bn of sales for the company in FY21, representing 37% of total revenues generated.

AbbVie has fought off patent challenges against Humira for years longer than expected, and despite losing exclusivity in Europe in 2020, a series of price hikes and market dominance in the US in indications such as Rheumatoid Arthritis (“RA”), Psoriatic Arthritis (“PsA”), Crohn’s Disease (“CD”), and Ulcerative Colitis (“UC”) – have enabled the drug’s sales revenues to keep growing.

It is generally accepted however that 2023 will see the entrants into the US market of several generic versions of Humira – which works by inhibiting Tumor Necrosis Factor (“TNF”), an inflammation causing protein – from the likes of Viatris (VTRS), Organon (OGN), Pfizer (PFE), Amgen (AMGN), and several more companies involved in the development and sale of generic or biosimilar drugs.

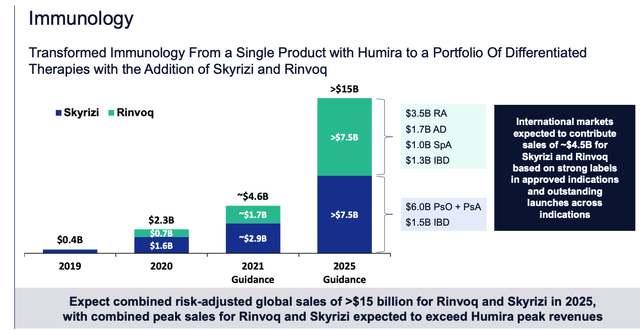

AbbVie has been working hard to ensure the 2 drugs it has developed to replace Humira – Skyrizi, which inhibits the pro-inflammatory cytokine IL23, and Rinvoq, a Janus Kinase (enzymes involved in immune cell function) inhibitor – are winning approvals and growing sales in Humira’s markets. Management believes these 2 drugs could one day generate $15bn in peak sales, going a long way to solving the Humira loss of exclusivity (“LOE”) problem.

Management has previously stated that it expects total revenues to decline in 2023 following the Humira LOE, followed by a return to growth in 2024, and a “high single digit CAGR” maintained through the remainder of the decade. In other words, management believes the LOE of Humira – despite it being the world’s best-selling drug – will not hinder growth at the company.

Outside of Humira, management does not have to worry about LOEs for any of its other portfolio products before the end of the decade, which is encouraging, however, based on my own projections of how AbbVie will generate its revenues between 2023 and 2030, if management wants to drive a CAGR in the high single digits after 2025, it will need some help from its pipeline – not an area of particular strength for AbbVie.

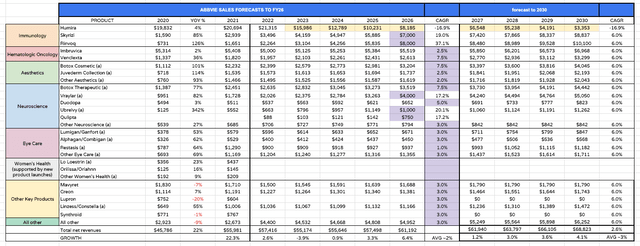

AbbVie product revenue forecasts to 2030. (my tables and forecasting)

I have been maintaining a revenue forecasting table for AbbVie’s products which I have amended based on Q2’22 and H1’22 results, and the slightly downgraded guidance issued for 2022 – management now expects adjusted earnings per share (“EPS”) of $13.78 – $13.98, representing growth of 17% at the midpoint.

That figure suggests a forward Price to Earnings (“P/E”) ratio of ~10x, which is well below the US Big Pharma sector average of ~23x, although it should be noted that the GAAP/non-adjusted EPS may be only significantly lower than the adjusted figure, based on adjusted EPS of $6.52 across H1’22, and GAAP EPS of $3.03 over the same period.

That is a significant difference because at a forward P/E of 10x AbbVie stock looks like a solid buy opportunity, but at a P/E of 20x, when we consider the risk/challenge of Humira’s LOE, prospective investors may prefer to maintain a watching brief as opposed to opening a position. Between September 2021 and April 2022, AbbVie stock went on a sensational bull run, gaining 62% and hitting an all-time peak of $174. Since then, however, the stock price has fallen 18% to its current price of $142.6.

That reflects uncertainty about what the future holds for AbbVie. In this post, I will discuss Q2’22 results, as well as the long-term outlook for AbbVie based on the latest information, goals, risks, and financial modeling analysis, to try to establish a target price for AbbVie stock.

In my opinion, based on the current portfolio, AbbVie shares look undervalued below $160, but the upside above that price is limited, unless management is able to commercialize more products between now and the end of the decade, in order to achieve what looks like a very ambitious goal in driving high-single-digit revenue growth in the second half of this decade.

AbbVie Q2’22 Earnings In A Nutshell

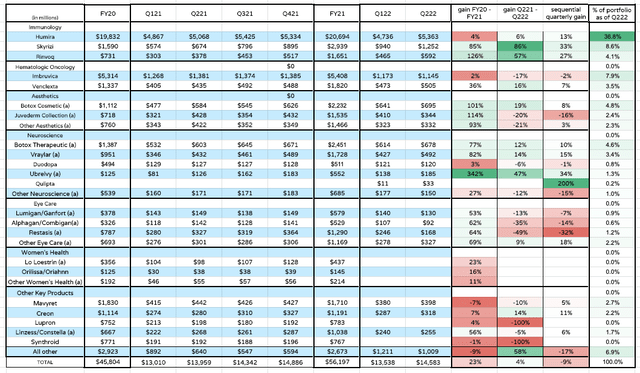

AbbVie product revenues by quarter and year since FY20. (AbbVie data)

The above table shows quarterly and annual product revenues going back to FY20, whilst the last 4 columns show revenue growth percentage between FY20 and FY21, then revenue growth between Q2’21 and Q2’22, the sequential (quarter on quarter) growth, followed by product sales as a percentage of revenues.

As we can see, sales of Humira are still climbing, with losses in Europe – where revenues fell by 14% to $699m – offset by growth in the US, to $4.7bn, up 10% year-on-year. That led to an overall 6% year-on-year gain of 6%, and a 13% sequential gain. As I have mentioned in previous notes, however, the gains owe more to price hikes than sales volumes, and come 2023 and the LOE, even AbbVie admits the blow to revenues will be substantial. In my modeling table above, I estimate Humira sales will decline by 25% between 2022 and 2023, to ~$16bn, although some of that lost revenue will be gobbled up by Skyrizi/Rinvoq.

Both of these assets appear to be doing the job they were intended for – protecting AbbVie’s dominance in various auto-immune markets – and now represent ~13% of AbbVie’s total revenue generation. At their peak, according to a slide from AbbVie’s presentation at the JPMorgan (JPM), these 2 drugs are expected to generate more revenues than Humira at its peak.

Slide from JPM Conference 2022 presentation. (JPM Healthcare conference presentation)

Skyrizi’s performance has been particularly eye-catching. According to AbbVie CEO Rick Gonzalez, speaking on the Q2’22 earnings call, “Skyrizi’s total prescription share of the U.S. biological market (in psoriasis) has increased to approximately 26%”, and”

Psoriatic arthritis is also adding significantly to Skyrizi’s momentum, where we are now approved in 54 countries. In the U.S. dermatology segment, where approximately 30% of patients exhibit both skin and joint involvement, Skyrizi is already achieving an in-play patient share of nearly 20%. We have also launched Skyrizi for PSA in rheumatology, where we’re seeing strong utilization, which is driving accelerated share growth.

Skyrizi has also been approved to treat Crohn’s Disease, an added bonus and another multi-billion dollar market. Rinvoq’s progress has been a little more circumspect, but almost as impressive. The drug is now approved in severe Rheumatoid Arthritis, active Psoriatic Arthritis, moderate to severe Atopic Dermatitis, Ulcerative Colitis, active Ankylosing Spondylitis, with Crohn’s Disease the next approval on the list.

In the past I have written about the high level of competition between major Pharma in the auto-immune space – for example, for Psoriatic Arthritis the list of approved drugs includes Humira, UCB Pharma’s Cimzia, Amgen’s Enbrel, Johnson & Johnson’s (JNJ) Stelara, Eli Lilly’s (LLY) Talzt, Novartis’ (NVS) Cosentyx and Bristol-Myers Squibb’s (BMY) Orencia. All generate blockbuster <$1bn per annum sales – in Stelara’s case >$9bn per annum, and in Enbrel’s case, >$4.5bn.

I had felt this could be an issue for Skyrizi and Rinvoq, given it is rare for a drug to be as dominant as Humira was, but although the level of competition is fierce, both drugs are more than meeting expectations, and with the entire auto-immune market worth as much as $45 – $50bn, it does seem possible that Skyrizi and Rinvoq could one day generate >$20bn revenues between them, as management hopes.

The other major plus is probably the performance of the neuroscience divisions, where as we can see, Botox (indicated for migraine treatment), atypical antipsychotic Vraylar, migraine therapy Ubrelvy and newly launched Qulipta, an oral CGRP inhibitor indicated for chronic migraine all delivered good sales growth. The division delivered >$1.65bn in sales in Q2’22, up >15% year-on-year, and with Vraylar, Ubrelvy and possibly Qulipta all earmarked for blockbuster sales – $4bn in the case of Vraylar – my forecasting suggests this division could double in size by 2030, from ~$6.6bn revenues generated in FY22, to >$13.5bn by 2030.

On the negative side of things, we can see that AbbVie is no longer breaking out sales within its Women’s Health division, with revenues lumped into the “all other section, presumably. There is no mention of Women’s Health in the Q2’22 earnings call or in the 10-Q submission to the SEC, or any of the drugs within it, yet the divisions have not (to the best of my knowledge) been sold, despite rumors it was put up for sale at ~$5bn.

Furthermore, it seems sales of Lupron and Synthroid have joined the “All Other” section, which has generated $2.2bn of revenues in the first half of 2022, versus $1.5bn in the first half of 2021.

Within the oncology division sales of Imbruvica fell 17% year-on-year. Management puts this down to “delayed market recovery for new patients starting therapy in Chronic Lymphocytic Leukemia (“CLL”) and increasing competition” and has downgraded its FY22 guidance as a result.

Although management reminded analysts that “Imbruvica continues to be the total market share leader across all lines of therapy in CLL”, the outlook does not look especially promising. As such I have downgraded my own growth expectations in the forecasting table above, reducing annual growth from 7.5%, to just 2.5%, after forecasting for $5bn revenues in FY22 – down 7.5% year-on-year. Venclexta continues to pick up momentum with sales up 16% to >$500m in Q2’22, and I forecast the drug to exceed $3.2bn in revenues by the end of the decade.

Within eye care, Restasis was a major disappointment, and the entire division seems to be struggling, with total revenues falling from ~$920m in Q2’21, to ~$720m in Q2’22. As such, I have decreased my own expectations for 2022 based on simply doubling H1’22 revenues to get a FY22 figure, and downgrading growth expectations to 3% per annum until 2026.

Aesthetics was propped up by growing sales of Botox – up 12% year-on-year to $678m, but let down by sales of Juvederm, which management put down to lockdown regulations in China, and the “suspension” of operations in Russia. Sales are expected to recover in H2’22, however, and forecast year-on-year growth. I have downgraded my forecasts to 2016 accordingly however to 2% annual growth.

In summary, the total revenue increase of just 4% year-on-year in Q2’22 might disappoint a few investors, as might the downgraded guidance, although it is hard to argue that AbbVie is a bad investment when we consider that the Pharma also pays a dividend of $1.41 per quarter, yielding 4% per annum, drove operating earnings of $3.925bn on a GAAP basis, and trades at a >10% discount to my calculated target price.

Calculating A Target Price For AbbVie Shares

How do I arrive at my share price target?

First of all, as shown in the table above I forecast product sales out to 2030. With no LOEs on the horizon, it is relatively plain sailing for the company ex-Humira, and the performance of Skyrizi and Rinvoq – to date at least – suggests management does have this massive patent cliff covered. Neuroscience looks highly promising too, and aesthetics capable of driving some respectable growth driven by old stager Botox.

I suspect Eye Care is a division AbbVie can turn around given time, and I feel that with regards to oncology, where AbbVie has the strongest pipeline assets – lymphoma bispecific Epcoritamab may be approved to treat large B-cell lymphoma, and peak sales estimates range from $1.5 – $3bn, although AbbVie will not earn all of that since the product is co-developed with Genmab.

Trial results demonstrated an overall response rate of 63% and a median duration of response of 12 months, where 39% of patients had already tried a CAR-T cell therapy. I haven’t included Epcoritamab sales in my forecasts this time, but I hope to adjust the table before Q3’22 results are announced.

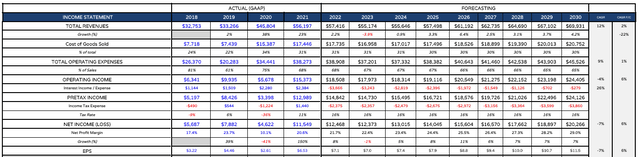

I take the total revenue figure from each year and plug it into an income statement forecast as follows:

AbbVie income statement forecast. (my table and forecasts)

As we can see, as per management’s guidance revenues fall between 2022 and 2023, before recovering and growing in each year after. I have not managed to match management’s ambitious high-single-digit growth figures from 2025 – 2023, despite anticipating 6% growth for nearly all products in that period. That is interesting to me as I think it suggests management will need to commercialize more assets if it wants to hit that target. Epcoritamab alone will not be sufficient to get AbbVie where it wants to be – despite some analysts believing it will be the highest grossing Pharma revenue wise by 2026.

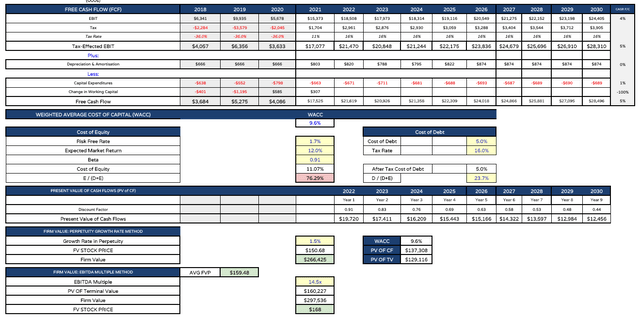

AbbVie discounted cash flow analysis. (my tables)

After creating the income statement I prepare the discounted cash flow/EBITDA multiple analysis. The weighted average cost of capital I estimate to be 9.6% – I tend to use a WACC of 10% for most Big Pharma analysis. As we can see, AbbVie is likely to generate some impressive cash flow based on its operating margins, which begin at 32%.

It should be noted however that, with ~$12bn near-term debt falling due, and long-term debt of ~$61bn – most of it due to the $66bn acquisition of Allergan, completed in 2020, AbbVie has some hefty interest expense payments to make – $15bn between 2022 and 2027, I estimate, and the level of debt makes it tough for the company to invest in M&A deals. Having so much debt in a prevailing inflationary environment is also unattractive.

Nevertheless, after applying the discount factor, I calculate a share price target of $151 based on DCF analysis and a slightly higher figure of $168 based on EBITDA analysis.

Conclusion – It Ought To Be Safe To Keep Buying ABBV Stock

When I began this post it was in my mind to give AbbVie stock a “Hold” rating owing to an underwhelming – on some levels – set of Q2’22 earnings, some concerns around high revenue generating products such as Imbruvica, Juvederm, and Restasis, the disappearance of the Women’s Health division, the imminent LOE for Humira and the high levels of debt.

Having dived into the numbers however and looked ahead to 2030 through the eyes and guidance of management, my conclusion is that investors can probably buy AbbVie stock at current price with reasonably high hopes of making a decent ROI – perhaps 15 – 20% in the next 12 – 18 months, whilst also benefiting from a generous dividend.

The fact that my own forecasts are less ambitious than management’s reflects the fact I have not introduced new products into my forecasts, and it will be interesting to see how management performs on that front as AbbVie has not really had to have a string pipeline while Humira has delivered such dominance in the auto-immune markets.

With Skyrizi and Rinviq – two assets developed in-house – performing so well, however, perhaps we should give management the benefit of the doubt. I look forward to seeing if Epcoritamab is approved this year, and although there is not a lot else in the near-term pipeline at this time, I also look forward to seeing how other projects may progress, e.g., opportunities in Parkinson’s Disease, Alzheimer’s and Cystic Fibrosis.

AbbVie could be the biggest global Pharma by revenue generation in 2028. If signs point to that happening I will likely be revising my target price upwards again, but I am playing it more conservative as nobody truly knows the scale of losses after the Humira LOE.

Be the first to comment