Jack Taylor

Thesis

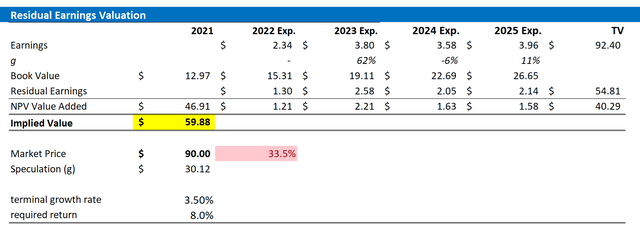

I am bearish on Monster Beverage (NASDAQ:MNST) as I see the company’s stock as overvalued. In my opinion, trading at a P/E of close to x40, the current market environment provides much better opportunities for investors to allocate capital. Notably, Monster Beverage stock did not lose much value YTD and thus outperformed the S&P 500 by about 20 percentage points. I like to view the current share price strength as a selling-opportunity and rotate capital into bargain opportunities, such as Victoria’s Secret (VSCO), Meta Platforms (META), or Volkswagen (OTCPK:VWAGY). I value MNST stock with a residual earnings framework, anchored on analyst consensus EPS estimates, and calculate a fair implied share-price of $59.88.

About Monster Beverage

Monster Beverage is a consumer company that develops, manufactures and markets energy drinks. The company operates three major segments: Monster Energy Drinks, Strategic Brands and Alcoholic Beverages. Notably, Monster Energy Drinks is about 95% of total sales and Strategic Brands accounts for the rest. Alcoholic Beverages, as of 2021 does not account for any noteworthy share of sales for the group. Geographically, more than 60% of sales are generated in the North America Region and slightly less than 20% in EMEA. Asia Pacific and Latin America make up the rest.

Growing revenues significantly above 10% CAGR for the past 5 years, many investors regarded Monster Beverages as an international growth story. The company has quickly grown to claim more than 40% of the global energy drink market, only slightly behind Austrian-based Red Bull. Accordingly, MNST share price jumped from about $6/share in early 2021 to more than $90/share as of 2022. This represents a 1,400% total return and 25% annualized.

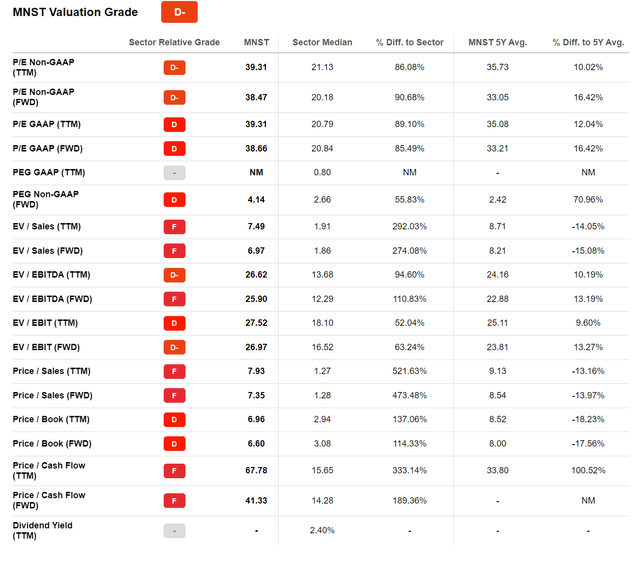

Given these numbers, the company’s stock has been awarded with a rich growth multiple. Accordingly, the company’s current > x39 P/E implies that Monster beverages expansion is expected to continue.

Valuation Ahead Of Fundamentals

However, I would like to point out that Monster Beverage is trading at an expensive price. Especially considering rising real yields and falling asset prices across markets make MNST elevated P/E vulnerable to multiple contraction. Moreover, Monster Beverages’ margins are not immune to rising commodity costs and wage inflation. That said, I see a scenario of 30% multiple contraction in combination with a 15% EPS reduction not as unlikely, which could imply about 40% share-price downside.

But even if there is no EPS and multiple contraction it is easy to show that the market is considerably ahead of analyst consensus. For reference, according to the Bloomberg Terminal as of July 15th, Monster Beverage’s revenues in 2022, 2023 and 2024 are expected at $6.42 billion, $7.08 billion and $7.81 billion. This is a CAGR growth materially below the company’s historical performance. Respectively EPS are estimated at $2.34, $3.08 and $3.53.

From 2018 to 2021, Monster Beverages increased revenues from $3.8 billion to $5.5 billion, reflecting a 3-year CAGR of about 13%. Over the same period, EBITDA jumped from about $1.35 billion to approximately $1.85 billion (11% CAGR).

Monster Beverages is as good as debt-free with only $34 million of financial liabilities and more than $2.7 billion of cash and short term investments. In 2021, cash provided from operations was about $1.2 billion.

Residual Earnings Valuation

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of August 13, 2022. My calculation indicates a fair required return of 8%.

- To derive MNST’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 3.5 percentage points to reflect growth slightly greater (ca. 1%) than estimated nominal GDP growth.

Based on the above assumptions, my calculation returns a base-case target price for MNST of $59.80/share, implying material downside of almost 35%.

Analyst EPS Estimates Author’s Calculation

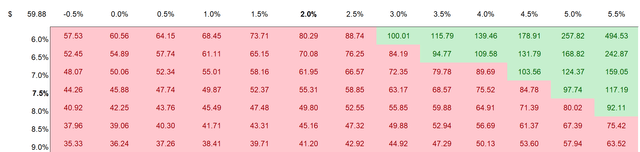

I understand that investors might have different assumptions with regards to MNST’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst EPS Estimates Author’s Calculation

Risks To My Thesis

As a function of valuation, I argue MNST is a Sell. However, I acknowledge that Monster Beverage has proven a steady track-record of topline growth and value accumulation. Accordingly, the company might grow into its stretched valuation within the next 12 – 24 months. If this were to happen, and the valuation becomes “reasonable,” I would turn more neutral on the stock.

Conclusion

Monster Beverages is no doubt a quality business. However, the price is simply too high to justify an above-market return expectation for investors. Especially since many stocks are trading cheaply at the moment, given the recession scare and growth decelerating, I argue investors can find much better buying opportunities than MNST. As a function of valuation, I initiate with a Sell recommendation. My target price is $59.80/share.

Be the first to comment