shaunl

Article Thesis

ZIM Integrated Shipping (NYSE:ZIM) is a battleground stock right now. Its shares are incredibly cheap based on 2022’s earnings, but at the same time, it is pretty clear that profits will fall off a cliff in the next two years. This makes ZIM a high-risk, high-reward pick. Two container shipping companies with a different business model, Global Ship Lease (GSL) and Danaos (DAC), offer a very low valuation as well, could generate strong rewards, and their risk levels are much lower. That’s why I believe ZIM is not the best risk-reward pick among these three.

ZIM: Very Cheap But Risky

ZIM Integrated Shipping screens as one of the cheapest stocks in the world. Based on current estimates for this year’s earnings per share, ZIM is trading for an incredibly low earnings multiple of just 0.6, which translates into an earnings yield of more than 150%. That already makes it pretty clear that the market is anticipating that profits will fall a lot over the next couple of years, otherwise ZIM would not be trading at a 2022 earnings multiple this low.

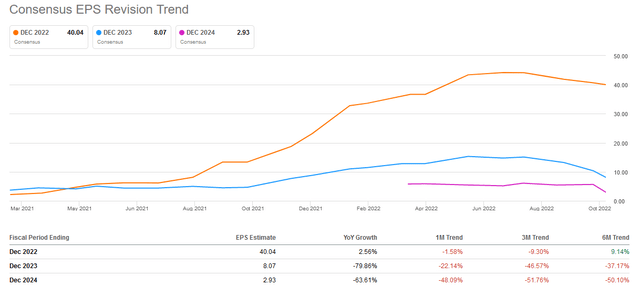

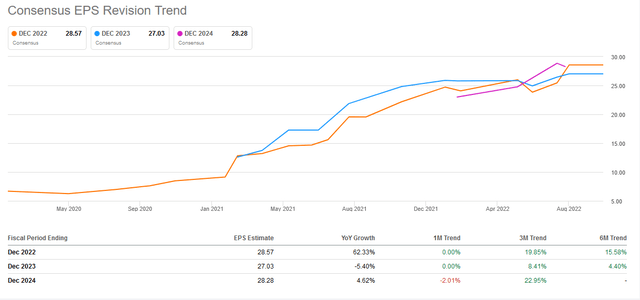

The following chart shows how earnings per share estimates for ZIM Integrated Shipping have changed over time:

Estimates for the current year have come down slightly over the last couple of months, but since a large portion of this year’s profits were already generated in H1, and since ZIM has locked in some contracts for H2 at strong prices, the ongoing freight rate slump has not impacted estimates too much. Looking beyond 2022, we see that profit estimates have fallen a lot in recent months, however. Earnings per share estimates for both 2023 and 2024 have declined by around half over the last three months, and ZIM is now forecasted to earn just around 7% of what the company will earn this year in 2024. In other words, its earnings multiple will expand 13-fold if prices remain at current levels and if the consensus earnings per share for 2024 turn out to be correct.

A 13-fold increase in ZIM’s earnings multiple still only translates into a P/E ratio of 8 or so, meaning that ZIM would still be trading at a lowish absolute valuation. But EPS for 2024 could come in well below current expectations, as estimates continue to get revised downwards, and since the ongoing economic slowdown continues to pressure the outlook for container shippers. With ZIM (likely) experiencing a big profit drop from 2022 to 2023 and from 2023 to 2024, investors also have to consider that profits in 2025 could be even lower than those forecasted for 2024. In that case, paying a high-single-digit earnings multiple based on 2024 estimates is not necessarily attractive, if there is a risk of earnings slumping further in 2025 and beyond. In fact, some commenters and investors believe that ZIM will start to generate net losses a couple of years from now, although that is of course not set in stone at all.

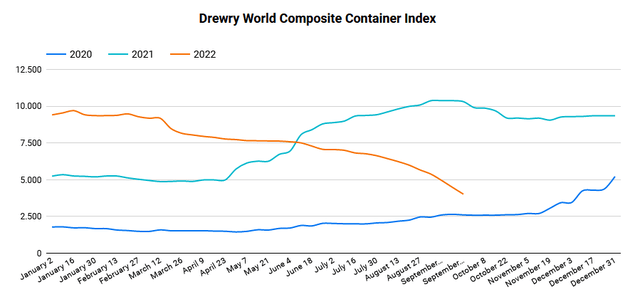

The following chart shows the Drewry World Container index has come down quite a lot in recent months:

While rates had been at a very high plateau for some time in early 2022, they started to decline in spring, accelerating their fall in more recent months. It’s impossible to forecast where exactly container rates will be in the future, but the trend suggests that rates could decline further. That could be caused by a combination of factors. First, order books for container ships are relatively large, which should help with capacity going forward. At the same time, the US and the world as a whole are currently experiencing an economic downturn that sees consumers buy fewer goods as they have to spend more on essentials like heating, electricity, and so on. At the same time, the easing pandemic also makes consumers shift some of their spending from goods to services, or from “things” to “experiences” (e.g. travel), which also eases demand for container capacity.

There are some offsetting factors, such as the coming shipping regulations that will likely lead to a lower average speed for the global container fleet, which will take some capacity (container miles per a specific amount of time) offline. Also, some supply chain risks remain in place, e.g. looming strikes by port workers, railroad workers, and so on. It’s thus not guaranteed that container shipping rates will continue to fall, but it seems unlikely to me that the recent trend of declining rates will reverse drastically. If strikes were to escalate, that could lead to near-term disruptions that cause a rise in container shipping rates, but I do believe that it is reasonable to assume that container shipping rates will be lower than they are today a couple of months ago as a base case assumption.

So while ZIM will report hefty profits for the current year, and while ZIM has a strong balance sheet with billions of dollars of cash, the outlook for 2023 and beyond is very uncertain.

GSL And Danaos: Much Lower Risk, Still Strong Return Potential

Two other container players with a different business model seem more attractive from a risk-reward perspective, I believe. ZIM Integrated Shipping is a container liner company that makes money moving containers from A to B. It also has some smaller business units such as moving vehicles, but the container line business is the core of the company. Global Ship Lease and Danaos are container ship chartering/leasing companies. They don’t make money moving containers, but instead they earn money by leasing ships they own to container liners such as ZIM — ZIM and its peers such as Hapag-Lloyd (OTCPK:HPGLY) and Maersk do not own all of the ships they operate.

GSL and Danaos mostly use multi-year fixed-rate charter contracts, meaning that a large portion of the revenues they will generate over the next couple of years are locked in already. That means that there is way less certainty about their revenue generation for 2023 and beyond, as their revenues are mostly independent from current spot rates — they already know what most of their ships will be earning for years to come, no matter what the market will look like. Most of their expenses are fixed and already known as well, such as future interest expenses. This leads to pretty predictable profits over the next couple of years for both of these container ship players. In fact, as lower-rate charters are rolling off and being replaced by higher-rate charters (some of them already locked in right now), profits will climb for both companies, despite the ongoing economic downturn.

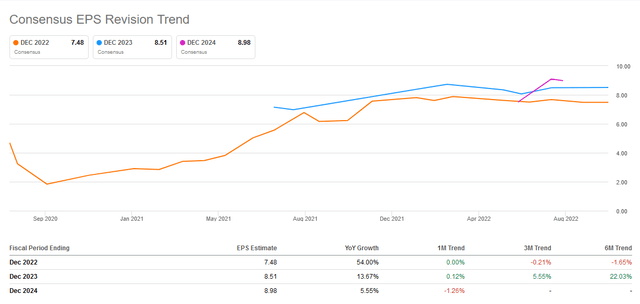

The following charts show the expected earnings per share for GSL and Danaos, respectively:

Earnings per share are forecasted to grow in both 2023 and 2024 for GSL, relative to this year’s levels. We also see that EPS estimates have been very stable over the last couple of months, which is in stark contrast compared to what happened with ZIM’s estimates. Danaos is not forecasted to see the same level of earnings per share growth in 2023 and 2024, but profits are expected to remain very stable at the current level. Again, DAC did not experience deterioration when it comes to EPS estimates for this year or the 2023-2024 time frame over the last couple of months. Quite the contrary — EPS estimates have continued to rise this year despite the ongoing hefty pullback in container shipping rates, showcasing the resilience of GSL’s and DAC’s future profits versus how container shipping rates move.

Some investors might be worried about the counterparty risk for GSL and DAC — after all, container liners will become less profitable as container shipping rates drop. But container liners, including ZIM, have the strongest balance sheets they have ever had, and ship charter contracts are rock-solid, as there is no way for either party to get out of contracts. I thus believe that counterparty risk is very benign — even as the profits of ZIM and other liners fall, they have enough cash to pay for their contracts, and they can’t get out of them.

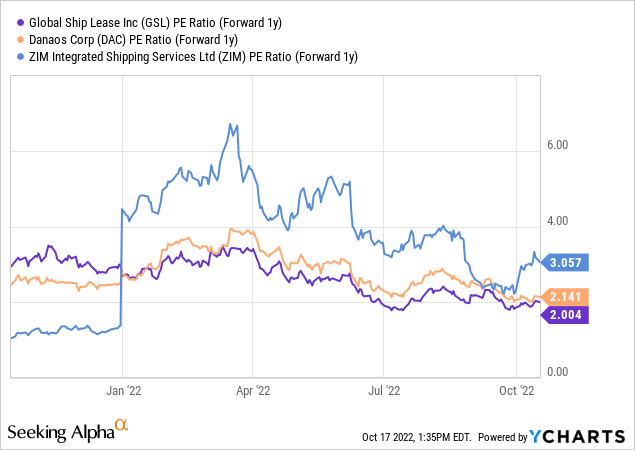

GSL and Danaos are very inexpensive at current prices:

GSL and Danaos trade at 2x next year’s expected net profit, while ZIM trades at 3x next year’s net profit. There is more risk that ZIM will underperform those estimates compared to GSL and Danaos, as the latter two have already locked in the vast majority of these profits via existing contracts. Some have argued that current analyst estimates actually are too low for both GSL and Danaos, based solely on the contracts that are already locked in, meaning actual profits could be even higher, which would make the earnings multiple even lower for these two container ship owners. To me that seems likely, as the Wall Street analyst community has a history of underestimating the profitability of both GSL and Danaos. GSL has beaten EPS estimates in nine out of the last ten quarters (it hit the consensus estimate in the remaining quarter), while DAC has beaten for a perfect 10 out of the last 10 quarters. Danaos has beaten EPS estimates for H1 by a hefty 57%, which shows that there is considerable potential for the company to outperform the above estimates. Notably, ZIM has underperformed the consensus estimate so far this year, missing by a net $1.12, or 4%.

GSL and Danaos offer attractive dividend yields as well. Their trailing dividend yields aren’t as high as that of ZIM, but the dividend yields on GSL and Danaos are sustainable for years — which is not realistic for ZIM. At current prices, GSL trades with a forward dividend yield of 8.7%, while Danaos trades with a forward dividend yield of 5.2%. Considering they both pay out only a smallish portion of their profits via dividends, there is a lot of potential for future dividend increases or buybacks. Even if they continue to spend money on debt reduction, that is not a bad thing, as value is shifted from debt holders to equity holders over time (I personally would favor more buybacks over a debt reduction focus, however).

Takeaway

ZIM looks very cheap at first sight, has a hefty trailing yield, and has billions in cash. Its return potential is far from bad if things go right, especially if there is a major macro issue that disrupts global container rates — e.g. if port worker strikes make container shipping rates spike. But ZIM’s business is also volatile and there are major uncertainties when it comes to profitability in 2023, 2024, and beyond. This makes ZIM a stock with considerable upside potential, but also major uncertainties and risk.

By comparison, GSL and Danaos have much more stable business models, more predictable profits in 2023 and beyond, and yet their shares are very cheap as well. From a risk-reward perspective, I thus see those two as favorable versus ZIM in the current environment. That does not mean that ZIM is a bad pick, but GSL and Danaos are looking more favorable.

Be the first to comment