gk-6mt

Intro

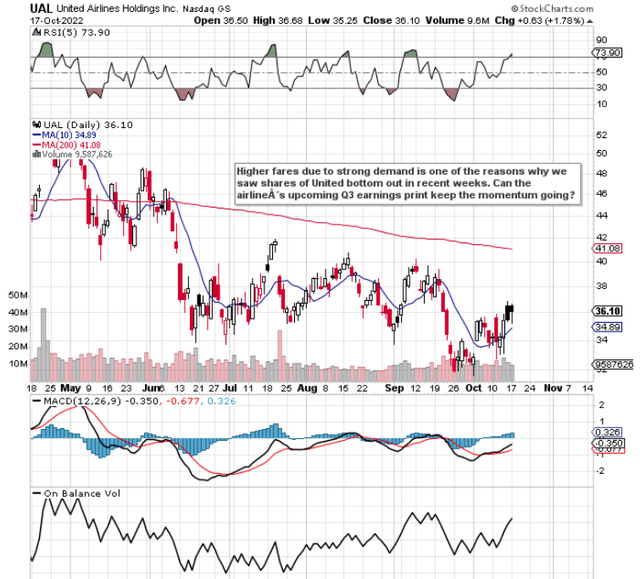

Shareholders of United Airlines Holdings, Inc. (NASDAQ:UAL) will be hoping that the company’s upcoming Q3 earnings report can add to the stock’s momentum we have seen over the past three weeks or so. The consensus bottom-line number comes in at $2.29 per share for United’s third quarter while revenues of approximately $12.74 billion are expected to be reported. As we can see from the technical chart below, although United has been printing lower lows for quite some time now, buying volume has been strong in recent sessions and we have seen a strong upturn in the 10-day moving average. Despite the enthusiasm we have seen in recent weeks in this industry with respect to rising fares still not affecting demand, for the most part, the market will need to see these much higher fares being reflected in sustained profitability for United.

United Airlines Recent Momentum (Stockcharts.com)

Worrying Fundamentals

We state this because of the company’s second-quarter earnings report (When the airline reported a net profit of $329 million) which definitely had an underlying cautious tone. The reasons for this are self-explanatory in many ways when one looks at this industry. For one, United cannot get their hands on enough aircraft fast enough, then you have rising fuel prices and finally, you have the risk of a global recession.

Then you have the US dollar which has been very strong in recent months and puts more purchasing power in the pockets of Americans compared to the world at large all things remaining equal. We maintain the US dollar remains heavily overbought from a technical standpoint, and any blink by Jerome Powell with respect to becoming more dovish (Which Britain incidentally has done already) could easily register a multi-year top in the greenback which means future dollars would not go as far.

From United’s point of view, however, all four areas above (Visibility with respect to aircraft delivery, fuel prices, a potential global recession, and how the greenback will fare) are all outside of the company’s control. This is why it is extremely dangerous for management at present to pull out all the stops so to speak and invest aggressively through this present cycle.

This paradigm gives United less scope with respect to lifting that share price over the near term. By using fewer planes than usual but by keeping staffing levels high, management believes it will have the operational leverage to take advantage of any bullish change in forward-looking trading conditions. For the market to be “content” with this over the near-term, top-line sales and consequently customer demand simply have to remain strong to protect the income statement and cash flows at large.

The reason being is that due to lower capacity, we already know that the income statement & margins will be under pressure due to rising fuel prices as well as higher costs. Nevertheless, management was pretty adamant on the recent Q2 earnings call that United’s pretax margin will come in at approximately 9% next year. CEO Scott Kirby literally stated that everything will be done to achieve this target next year. Suffice it to say, if demand was to taper from present levels, it will be interesting to see the measures United undergoes in order to hit this target. From a shareholder’s standpoint, United needs to see Asian demand return for example sooner rather than later. Furthermore, profitability as we know does not always mean a growing share price in this industry. Once the market sees spending deteriorate significantly for example, it will begin to price the ramifications of this immediately on the technical chart.

Q3 Earnings Strategy

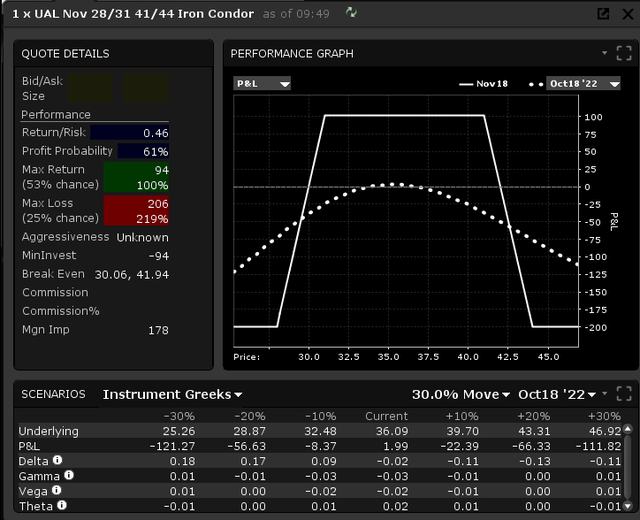

Therefore, given the risks that are prevalent in this play at present and the overhead resistance on the technical chart, we would prefer to stay neutral and use United’s high levels of implied volatility to sell something like an iron condor in the November cycle. The $31/$28 – $41/$44 iron condor which can be sold for approximately $1 per condor in the November cycle has a probability of profit of over 60% (POP is far higher if one does not wait for the maximum profit to be realized) and would take advantage of the volatility crush which will take place post the announcement.

UAL: Iron Condor Earnings Setup (Interactive Brokers)

Conclusion

Although UAL has turned profitable and is trading with a pretty attractive valuation, we believe the stock will remain rangebound for some time until the market believes some of the challenges above have abated. We look forward to continued coverage.

Be the first to comment