July Alcantara/E+ via Getty Images

2022 has been the year for unprecedented renewable energy growth, providing a source of security amidst market turmoil and uncertainty. Strong government policies in the European Union, China and Latin America have incentivized the switch to sustainable energy solutions to become increasingly attractive. The United States lags well behind in its adoption of renewable energy and tax incentive policies. However, earlier this week, contrary to his previous stance, senator Joe Manchin reached an agreement with Democrats to reduce US carbon emissions by 40% before 2030. Spending $369 billion on climate and energy initiatives is part of the arrangement.

The announcement has been a catalyst for stock price increases across renewable energy companies, including Sunnova Energy International Inc. (NYSE:NOVA), a residential energy service provider. Although NOVA is far from profitable, it is a significant player in the solar energy industry, servicing 225,000 customers throughout the United States. These customers are typically in solar service agreements for 10 to 25 years, in which the initial cost is taken on by NOVA, but long-term cashflow is contracted in. Off the back of the beneficial legislation, a noteworthy Q2 2022 financial performance, and a 1-year target price almost 50% above the current stock price, this company appears to have a lot more upside. For this reason, I believe investors may want to take a bullish stance on this company.

Introduction

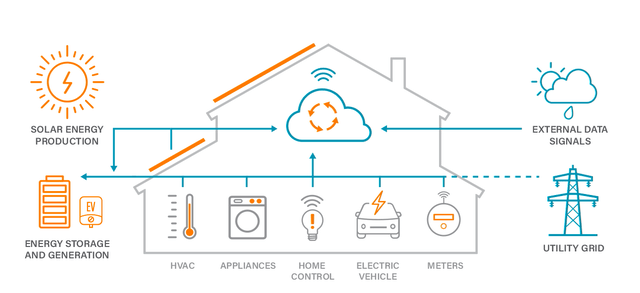

NOVA is a residential service energy company founded by startup and power industry expert and CEO John Berger in Houston in 2012 and has been publicly trading since 2019. It designs, installs, monitors, and maintains solar panels for residential homes. The company aims to be more than a solar panel provider. It can offer 29 various and value-adding services to new and existing consumers through advanced technologies. Sunnova Adaptive Home is an integrated full-scope solution for customers, including everything from solar, to the battery, storage and services, as seen below in the image.

Sunnova Adaptive Home (Sunnova.com)

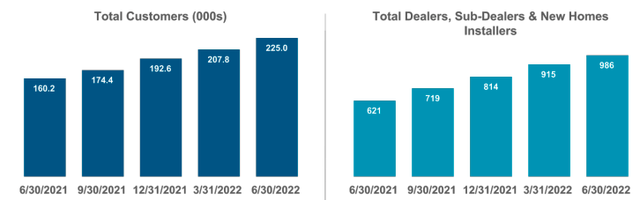

The solar service agreements with customers are typically in the form of a lease or loan, with little upfront cost for the new customer. Its differentiated dealership network model drives the number of consumers and the company’s sales growth. As of June 2022, NOVA has 986 dealers across the globe. These dealers are responsible for initiating, designing, implementing, monitoring and maintaining solutions for local customers with the products, guidance and expertise of NOVA. The business model significantly reduces employment costs and location logistics expenses faced by many competitors.

Total Customer and Dealer Growth per Quarter (Sunnova Investor Presentation 2022)

Although the renewable energy industry has been volatile, stock prices rise and fall depending on geo-political factors such as government regulations, media coverage swaying public opinion on green energy and global environmental disasters. This year, in the States, natural gas and coal pricing have increased so much that investing in a rooftop solar panel is becoming a more secure energy solution in terms of its predictability and a more economically viable choice.

Choosing to Invest in an Unprofitable Company

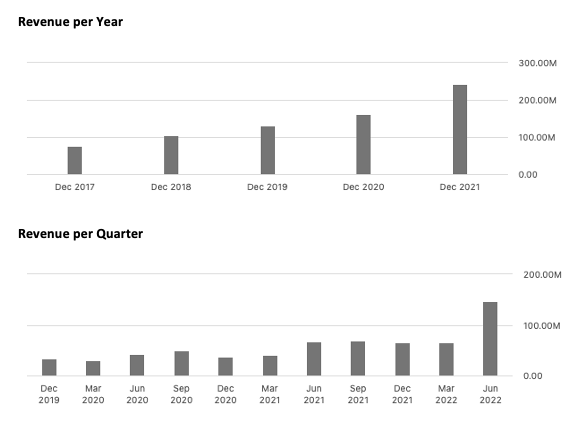

Profits are critical for the growth of any company. If we look at unprofitable companies, it is essential to look into why these companies are making a loss and what the future growth potential could be. NOVA is in the growth phase of the business life cycle. We can see in the financials that revenue has grown yearly; however, start-up costs and debt remain very high. Financials show a downward trend in net income between 2017 and 2021 by 52%.

History of Revenue per Year and per Quarter (SeekingAlpha.com)

So why look further at this unprofitable company? For one, it is an industry that is gaining importance with governments putting in place pro-use legislation. Furthermore, there is strong consumer demand for energy services. NOVA is simultaneously maturing its capabilities, growing its market share, geographic expansion and extending its service offering to new and existing consumers. Although costs remain high, the company will reduce the cost per customer in the long term. The duration of a customer contract is 10 to 25 years.

The initial cost of implementation is taken on largely by NOVA. Throughout the contract servicing, monitoring, upgrades and add-ons will increase the profitability of each customer. Therefore, it is critical to look at the growth of the number of customers, rather than profitability for now. High upfront costs require sufficient funding. NOVA has raised more than $9.8 billion in capital since it was established, more so it has received tax benefits and incentives through local, state and federal government organizations.

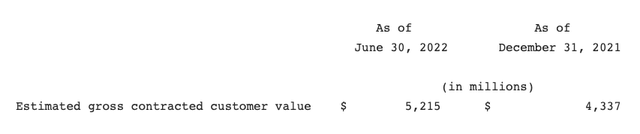

The company calculates the estimated contracted customer value to give an idea of the remaining future cash flow of a customer, given the 25-year long contact period. This gives investors the ability to compare value across different competitors and confidence in future positive cash flow.

Present Value of Long Term Customer Value (Sunnova Q2 2022 Financial Report)

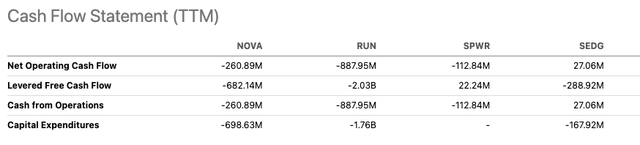

The company has a goal to improve its liquidity by the year 2023. It has $363.9 million in total cash, $208.1 million of this is unrestricted, additionally, there is $277.7 million available for borrowing through different financial agreements. Moreover, the company is up to date and in compliance with its debt obligations. If we compare it to competitors, we can see that across the board, companies have a negative or low positive cash flow as heavy initial investments and acquisitions are taking place across the industry.

Cash Flow Amongst Competing Companies (SeekingAlpha.com)

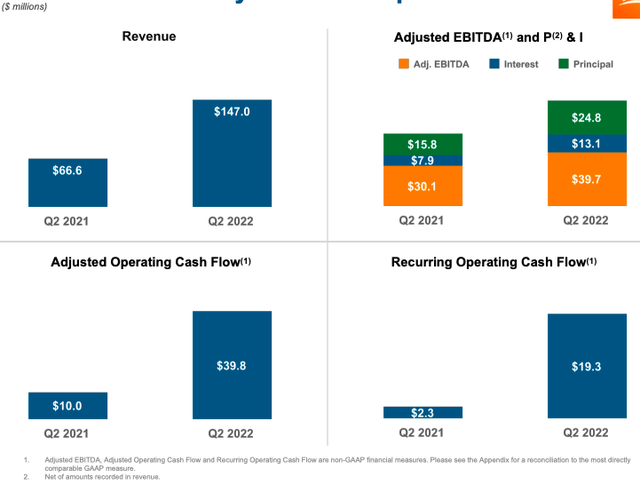

The market reacted well to the release of NOVA’s Q2 2022 financial results with a 29% increase in stock price. However, year to date, the price has decreased by 11.58%. In the Q2 2022 results, revenue grew YoY by 120.87% to $147.01 million. There is still a long uphill climb before the bottom line becomes attractive, but the net loss decreased from $66 million in Q2 2021 to roughly $10 million, or $0.32 loss per share, this quarter.

The company aims to grow revenue by providing more services per customer and upselling to the existing customer base.

Financial Highlights in Q2 2022 (Sunnova Investor Presentation 2022)

The company must attain more customers and its ability to implement, maintain and, of course, bill these customers for its recurring services. Supply chain disruption impacted NOVA in the form of delayed battery deliveries and slower interconnection times within the utility areas. Nonetheless, management expects between 85,0000 and 89,000 customers for the entire period of 2022. The company has a large backlog of contracted customers who have not yet contributed to the revenue growth numbers. Furthermore, although it has a negative EPS of -1.23, NOVA has a 1.9 Strong Buy rating on Yahoo Finance and a Wall Street rating of Buy by a few analysts.

Risks

We cannot ignore that this is and has been a loss-making company for many consecutive years. Although the reason has not been performance related, the company is still loss-making, and profitability is not predicted before 2024. The incurred costs may impact the possibility of making and sustaining profitability in the future. Furthermore, the company’s acquisition, growth and success depend on the ongoing relationships, success and size of its dealership network. If the company cannot establish cooperative and long-term agreements with existing and new dealers, it will be detrimental to the business model of the company. Lastly, although the company is not basing the success of its company on government legislation, these are not guaranteed and have considerable implications on whether or not a customer may or may not be inclined to invest in solar power for their residential homes.

Future and Final Thoughts

It is difficult to ignore what is happening in the world around us with global heatwaves with record-breaking temperatures, wildfires and flooding across continents. Now more than ever, renewable energy is to enter the mainstream market mindset.

For NOVA, this also opens up the opportunity to enter more sectors. The company has already put its foot in the door with EV chargers, accessories, roofing, and consumer load management systems. The goal is to provide an integrated service from supply through to the end user.

Where the current nature of the economy negatively impacts most companies, for NOVA, the increasing inflation and rising utility bill concerns are reinforcing the cost-saving benefits and necessity of the predictability its solar energy provides. With a senator recently announcing his approval, an upward trend in company performance and a large and growing customer base, I believe investors may want to take a bullish stance on this company.

Be the first to comment