DNY59

This is a Z4 Energy Research Pre Call Note. We have written about Civitas (NYSE:CIVI) multiple times over the years and our last note can be found regarding their ability to generate significant free cash flow, something that’s really coming to pass now, can be found here.

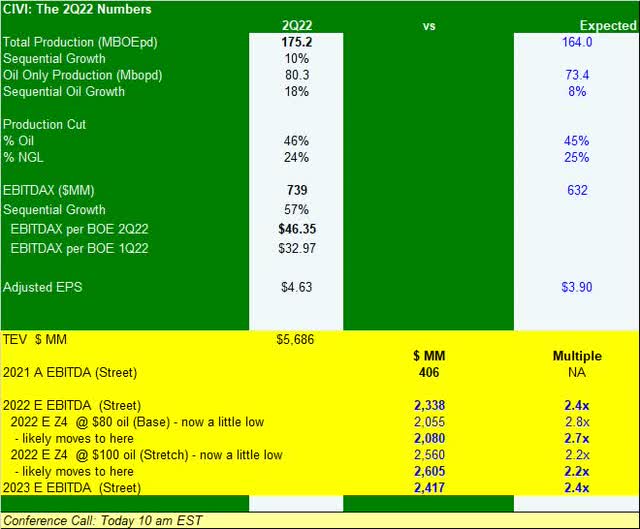

Z4 Energy Research CIVI Quick 2Q22 Table (Z4 Energy Research)

CIVI beat expectations on all front from production to oil cut to EBITDA to free cash flow. Many of the key numbers are covered in our table above. We would also note that operating costs (LOE + cash G&A) were at best in show levels during the quarter coming in at a low $4.21. Low costs combined with a strong liquids cut and high realizations resulted in record free cash flow of $437 mm, equating to a 36% implied FCF yield.

Guidance:

- Production: The company tightened the range higher to 162 to 168 MBOEpd (68 to 70% liquids) vs. prior 156 to 167 MBOEpd (68 to 70% liquids), up 2% on mid. We don’t remark on the year of year growth here given the inorganic nature of the last 18 months as Bonanza gobbled up several peers and bolted on producing acreage early this year. For modeling purposes we have been using 161.5 MBOEpd, 45% oil, and 25% NGLs. Street consensus has recently migrated above us and as of yesterday was at 162.1 MBOEpd and 45% oil, the new low end of the guidance range.

- The company also improved on prior oil differential guidance moving to a range of $4 to $5 off WTI. We have been using -$6.50 which had been our legacy read on Bonanza Creek.

- Estimates will rise modestly in the wake of the release as we and analysts adjust for higher production, better differentials and modestly higher cost guidance.

- D&C Capex: They also tightened drilling and completion capex higher to a new range of $890 to $940 mm vs prior $825 to $950 mm, up 3% on mid. Most names in the upstream space have boosted capex with mid points travelling anywhere from 5 to 18% higher on our closely watched names so they’re on the lower end of increases here as they may have taken a more conservative approach to spending guidance early than many others.

- Interestingly we note that management moved the wells drilled, completed, and brought on line guidance all to the lower end of the range. Without a change in working interest or lateral length this suggests well productivity is better than expected or some other systemic improvement vs. the combined results of the acquired firms is at play. Good fodder for the Q&A.

Balance Sheet: In great shape. The balance sheet was already fortress quality and is now fortress plus. Net debt to annualized EBITDAX is now negative vs. 0.2x last quarter. They have $400 mm in 5% 2026 notes. They have $439 mm in cash and the revolver is undrawn giving them more than ample liquidity as they look at the remaining private players nearby.

Return of Capital: Combined Dividend Increased 30%. The Base Dividend of $0.4625 per quarter was maintained. We would expect them to only grow this slowly over time in a sustainable manner, likely with greater production scale. The Variable Dividend was increased to $1.30 declared vs. the prior quarter’s $0.90. Their Variable is highly formulaic with 50% of FCF after the Base to be paid on a trailing twelve months average quarterly basis. As Free Cash Flow has risen this has resulted in the growth in the Variable we’re now seeing but it’s not fully reflective of this most recent quarter’s FCF. We note this quarter’s Variable is utilizing average quarterly FCF of $260 mm on a trailing twelve months basis (far below the $437 mm FCF noted above. As such, the variable portion is set to be get dragged higher as the quarters roll by. At present, the combined dividend implies one of the higher implied yields in the group of 12.5%. We note that at this time, they’re content to pay big dividends and not engage in a large share repurchase. Given the cheapness of the stock we would expect questions during the Q&A on this as well.

Nutshell: Much stronger than expected quarter. Strong guidance relative to most analysts’ expectations for volumes and the capex boost is likely small enough not to raise any negative eyebrows. The 12.5% implied yield is impressive but we get much higher figures for the full year if the stock remains near current levels as we see a rising variable portion in the coming several quarter. We note, however, that due to oil price weak, the shares are down 12% since the 1Q22 call while Street 2022 and 2023 EBITDAX estimates are up 16% and 26%, respectively. Those estimates should rise modestly in the wake of the call. The name continues to trade at exceedingly cheap multiples to our Base and Stretch cases as noted in the table above despite strong margins, the fortress balance sheet, and upper quartile implied yield. We do want to hear more about Permit granting certainty and timing on the call, specifically the timing of approvals for the OGDP and CAP locations (195 permits in total) but our sense has been that management has the situation well in hand and will have permits in time to complete the 2022 drilling program fairly soon. CIVI remains the #1 position in the ZLT and we recently added a little more on recent group weakness and now have an average cost of $25.80.

Be the first to comment