Alfio Manciagli

The price of copper is often viewed as a strong leading economic indicator. Demand for metal is driven by construction and industrial activity, which is generally very cyclical. Today, copper has become highly dependent on trends in the Chinese economy as over half of all global refined copper supplies are consumed there. China’s construction and manufacturing activity has slowed dramatically over the past year due to the nation’s heavy-handed lockdowns and slowing construction activity. Copper is under added pressure due to the substantial energy shortage in Europe and slowing manufacturing growth in the U.S.

Many analysts believe demand for copper may improve soon due to a government-funded increase in renewable energy construction in China. Indeed, among many investors and speculators, copper is attractive due to its necessity in virtually all renewable electricity infrastructures. That said, only 5% of China’s total copper consumption goes to renewable energy, with the rest going to cyclical construction and industrial sources. Given the acceleration in the bursting of China’s bubble, the nation’s vastly overdeveloped infrastructure, and its energy crisis, I expect declines in cyclical copper demand to be considerably more significant than any growth in renewables demand.

The copper shortage threatens the global push for renewable energy. Still, at this point, the size of the renewable energy market does not appear large enough to direct overall copper demand. Production and demand are falling in Europe as energy prices soar, while economic demand and manufacturing activity may be peaking in the United States. Copper production levels are low as most miners have not expanded output in many years, but for now, demand appears to be equally low and trending even lower.

Inventory levels are finally rising in the London Metals Exchange, potentially signaling another lower move for the price of copper. Critical copper miners such as Freeport-McMoRan (NYSE:FCX) have suffered significant losses this year due to the copper price decline. I covered that stock last April in “Freeport-McMoRan: Operational Difficulties And Copper Demand Destruction Threaten Rally.” Since then, the stock has declined by ~46% and has re-touched its yearly support level, signaling another potential wave lower. Of course, its valuation is far lower, and in the long run, a renewal in copper demand may see the mining stock return to new highs. Accordingly, I believe it is an excellent time to take a closer look at Freeport to determine its long-term and short-term value potential better.

A Problem of Low Supply and Lower Demand

Before 2020, copper was stuck in a systemic glut marked by global over-supply. This trend was true for most commodities but quickly changed in 2020 as shutdowns led to rapid declines in output. Weakened balance sheets and the ongoing labor and materials shortages have led to prolonged decreases in most miners’ CapEx spending, keeping production levels low. Demand for copper surged from 2020 to 2021 as industrial and construction activity rebounded with QE and other economic stimulus efforts in western economies; however, as most central banks have reverted to QT, there has been a rapid reversal in industrial demand.

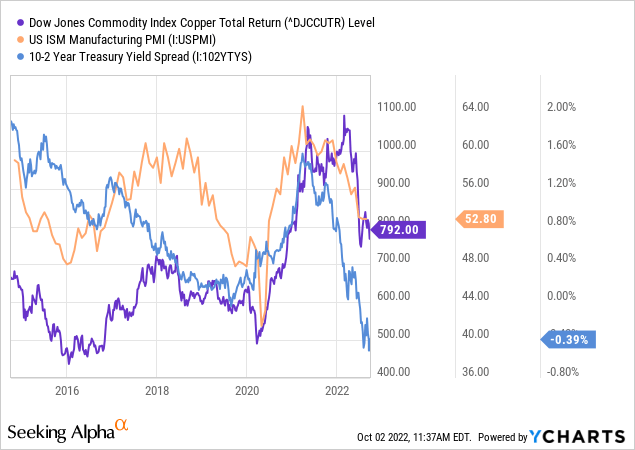

These trends can be seen in the correlation between the U.S manufacturing PMI (a leading economic indicator), the U.S yield curve, and the copper price index. See below:

The relationship between the manufacturing PMI and the price of copper is particularly strong, but both have also been closely correlated to the yield curve since 2020. An inverted yield curve, such as today’s, indicates short-term interest rates are above long-term rates – giving long-term capital investment a poorly discounted return. As such, an inverted yield curve is a firm indication of an impending economic slowdown. Copper is facing clear recessionary dynamics with the manufacturing PMI and the yield curve slipping.

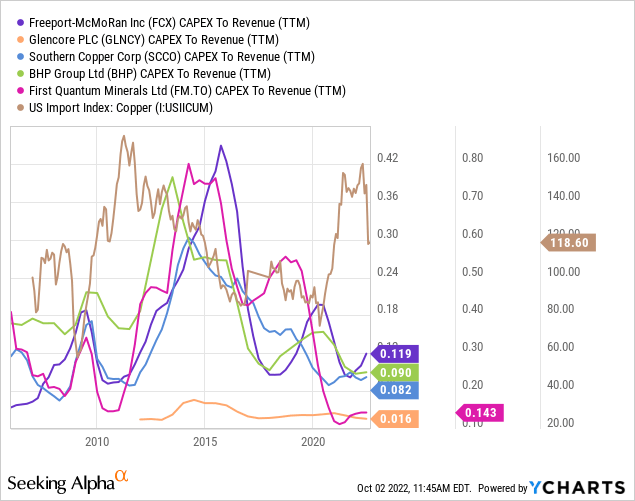

If we were only looking at the demand side, copper’s outlook would be abysmal – particularly considering China and Europe’s quicker economic slowdowns. That said, the supply of copper is also weak due to low CapEx spending on behalf of the largest copper miners. In the late 2000s, copper miner CapEx levels were equally low, leading to shortages that rapidly raised the price of copper by 2011. See below:

By the mid-2010s, high copper prices caused miner profits to soar, leading to immense increases in CapEx spending. Of course, higher capital investments eventually encouraged a glut, leading to a significant reversal by 2014. We’re seeing this cycle repeat today as low supply and higher prices likely press a rebound in investment. Of course, with interest rates rising and the U.S yield curve so inverted, it may be some time before we see a lasting rebound in copper production.

Overall, the economic outlook for copper is admittedly unclear since demand and supply appear weak. From 2020-2021, supply was clearly below demand. Global copper output seems unlikely to grow soon but should not decline further unless there is a rise in labor unrest. Indeed, given the state of the yield curve and rising interest rates, I doubt miners will pursue a large investment binge as they had in the early 2010s. That said, copper demand is also declining due to global energy shortages and strong economic declines.

In my view, the net change is likely to be bearish for copper, and the metal may return to a glut due to its dependence on China’s rapidly slowing economy. Further, I do not believe the renewable energy market is large enough to increase global copper demand materially. Still, while I think copper may fall slightly lower, its downside risk is heavily mitigated by stagnated miner output.

What is FCX Worth Today?

Given my economic assessment of the copper market, I expect copper to maintain a range of $2.7-3.2/lbs over the coming year (6-20% lower than today). This shift will likely hamper Freeport’s EPS, but given its low valuation, that may not dramatically influence its stock price. Further, Freeport may benefit from a rise in the price of gold and likely benefited in Q3 from rising U.S dollar exchange rates (which cause foreign mine costs to decline in U.S dollar terms). Labor and material shortages may cause mining costs to increase further, but FCX may have reached its fair value.

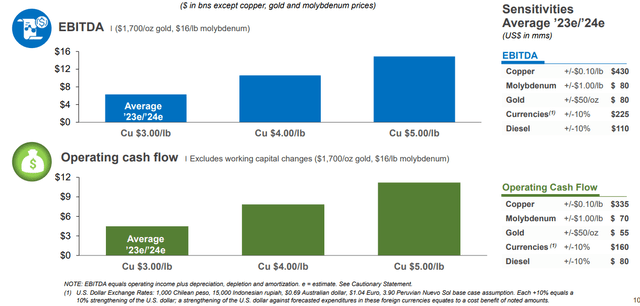

Freeport provides investors with an EBITDA sensitivity analysis of its primary exposures. See below:

Freeport-McMoRan EBITDA Sensitivity (Freeport-McMoRan Investor Presentation Q2 2022)

The company estimates its operating cash flow should be around $4.5B, given a $3.25/lbs price of copper, a $1700/oz price of gold, a $16/lbs price of molybdenum, and flat exchange and energy rates (10-Q pg. 26).

The molybdenum price has slipped slightly but is currently around $18/lbs. That said, the molybdenum market is not very liquid, and prices may vary, so I’ll keep Freeport’s $16 assumption. Gold has declined to $1660/oz as real interest rates have risen, but I would be surprised if gold remained this low long-term, so again, I will keep Freeport’s $1700/oz assumption. While it varies in currencies, the U.S dollar broadly rose by roughly 10% from the end of Q2 to Sep 30th, likely benefiting Freeport’s cash flow by ~$160M. Copper is currently at $3.45/lbs and averaged around $3.5/lbs during Q3, helping FCX’s CFO by ~$840M (given $335M sensitivity to $0.10/lbs movement and assumptions at $3.25/lbs).

Altogether, these Q3 assumptions give us an estimated annualized CFO of $5.5B based on Freeport’s sensitivity data ($4.5B plus $160M from U.S dollar and $840M from copper’s price). This equates to an estimated Q3 CFO of $1.375B, roughly 15% below its Q2 CFO. That said, to value the company, we must consider the outlook price range for copper. If copper declines to around $2.75/lbs-$3.2/lbs as expected, then its annualized CFO estimates decline to $2.98B to $4.48B (given Freeport’s copper sensitivity assumptions and expected benefit of the U.S dollar exchange rate).

Assuming a “fair-value” price-to-CFO of 7X (roughly its long-term median “P/CF” valuation), I estimate the company’s fair market value at ~$21B to ~$31B or a share price of $14.5 to $22. This range is 20-47% below FCX’s current price but is well above its 2014-2019 price range. My choice for a 7X “P/CFO” may seem low. Still, I believe it is fair given the risks of rising operating costs in the mining industry – particularly given chronic labor woes in South America. Further, if the price of copper remains at today’s level and the company’s CFO sustains ~$5.5B (my Q3 annualized estimate), then its estimated fair market capitalization would be ~$38.5B (7 X 5.5B)- almost precisely its current market capitalization. In other words, FCX is fairly valued today if we assume copper holds its price level but may be significantly overvalued if copper declines further.

The Bottom Line

For now, I see a little bullish potential for copper since most demand factors are in decline. Yes, copper is necessary for a renewable energy shift. Still, that market does not yet appear to be large enough that it will offset declines in China’s construction and global industrial output. Further, given the state of European energy (particularly after the Nord Stream sabotage) and overdevelopment in China’s construction market (a key fact the CCP media goes to lengths to suppress), copper demand may remain suppressed for years. Eventually, the chronically low output may lead to a sizeable bullish swing for copper, but I doubt that will occur for numerous years.

Overall, I am slightly bearish on FCX, but not to the point that I would short the stock. The stock faces some additional risk from rising labor cost pressures, but the rising U.S dollar exchange rate may offset this. Given my negative outlook for the price of copper, I expect FCX may decline 20-50% further as its cash flow and earnings are highly sensitive as copper nears $3/lbs.

Be the first to comment