Sundry Photography

December 1 was quite painful for Salesforce (NYSE:CRM) shareholders as shares fell by more than 8% during the trading session. Usually, quarterly figures contain a large amount of noise, and such an event would make the share price of any company far more attractive for long-term investors. Unfortunately, this was not the case for Salesforce.

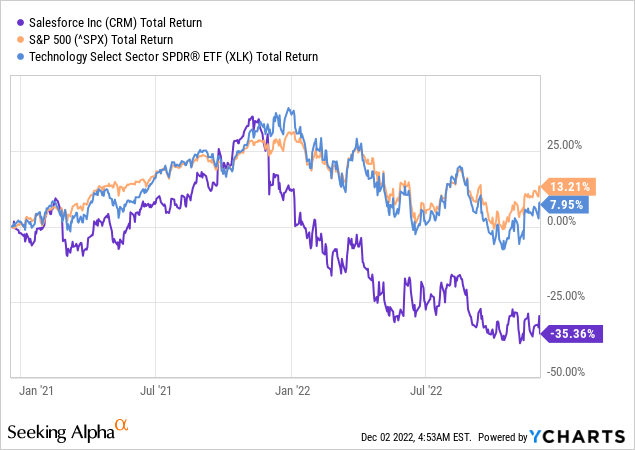

Salesforce’s share price has already been in a freefall due to its exceptionally high momentum exposure. However, the more important issue with the company has been its strategy and the major red flags I highlighted back in 2020. All these combined resulted in the company losing more than 35% of its value, during a period when the broader market and the technology sector returned roughly 13% and 8%, respectively.

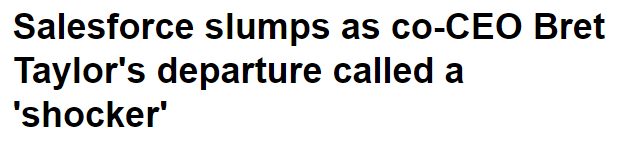

For anyone who has been aware of these red flags, the recent announcement that the co-CEO Bret Taylor will leave the company after only a bit more than a year on the job should not come as a surprise to Wall Street analysts.

Seeking Alpha

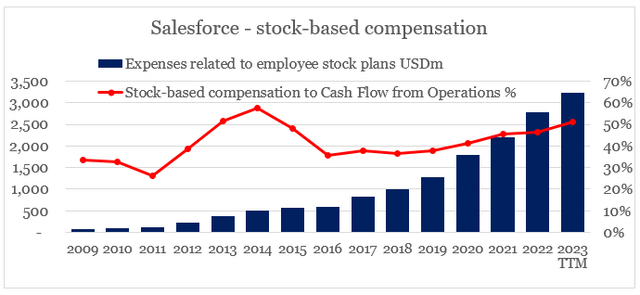

One major pillar of attracting and retaining talent for tech companies has been the amount of share-based compensation. As we will see below, CRM’s management has taken this to extreme levels and as I previously warned, it poses significant risks for one of the company’s key assets – its workforce.

Although it was largely left unnoticed, on the December 1 conference call the management spent a significant amount of time talking about the challenging economic environment and the ‘tectonic shifts’ happening within it.

And we’re not assuming that this economy gets any better anytime soon. We’re just reporting what we see with our customers, the kind of changes they make, when they start to feel these headwinds. We’re following our playbook to make sure we’re well positioned to gain market share, to increase our profitability, to focus on our operating margin, to focus on the growth of our revenue and be able to continue to invest, especially when the economy recovers.

Marc Benioff – Chair & Co-Chief Executive Officer

Source: Salesforce Q3 2023 Earnings Transcript

It was a rather unusual experience for anyone following CRM as the management usually focuses on the strategy itself as opposed to outside factors related to the broader economy. In combination with the sudden departure of the co-CEO and all other issues that I will highlight below, I believe this change of language is a bad omen.

Pressure Is Rising

The recent downturn in both equity and fixed income markets has the potential to make Salesforce’s growth strategy obsolete. The reason why I am saying that is because CRM relies heavily on growing through ever-larger acquisitions, and it needs this topline growth to support its sky-high valuation, which in turn is key for the company’s stock-based compensation.

This has created a circular relationship between these processes that has worked well during periods of extreme liquidity being provided. However, the risk of a more permanent shift in the monetary policy has now made Salesforce vulnerable.

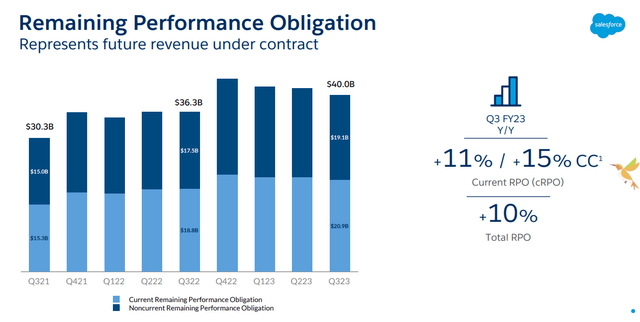

Although topline growth remains high, without the boost of a new large acquisition, CRM’s growth story begins to fade.

Salesforce Investor Presentation

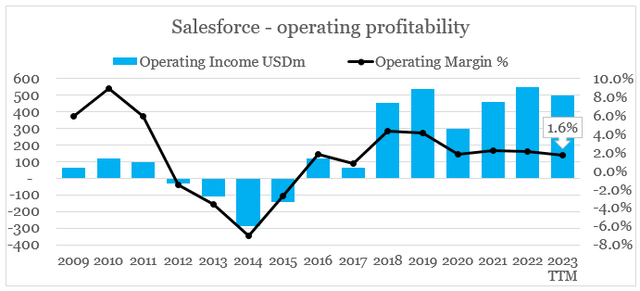

Even more worrisome is the pressure for the company to finally achieve acceptable levels of profitability. Unfortunately for shareholders, though, Salesforce remains barely profitable on a GAAP basis and there are solid reasons to not fully rely on non-GAAP figures as a measure of long-term profitability (more on that here).

Prepared by the author, using data from SEC Filings

The management seems to be focused on achieving that, however, the currently provided guidance for non-GAAP margins was not enough to appease investors.

We’re raising our fiscal year 2023 non-GAAP operating margin guidance from 20.4% to 20.7%, an expansion of 200 basis points year-over-year, and I expect a lot more, especially with this increased focus we have on expanding our operating margin.

Marc Benioff – Chair & Co-Chief Executive Officer

Source: Salesforce Q3 2023 Earnings Transcript

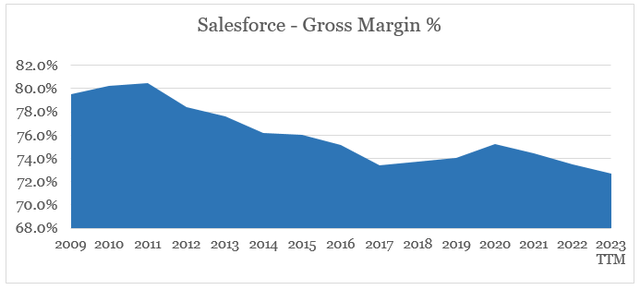

The strategy to improve profitability also seems rather generic, with most of the talk gravitating around achieving efficiencies through higher growth. At the same time, gross margin has been declining consistently, which will put enormous pressure on cutting fixed costs over the coming years.

Prepared by the author, using data from SEC Filings

The Unhealthy Cash Flow Statement

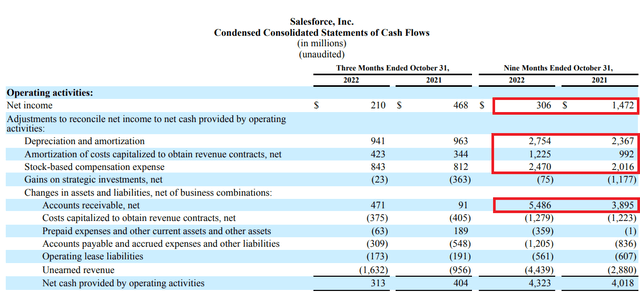

The cash flow statement of Salesforce is also full of red flags for such a large enterprise that is currently a leader in the highly attractive software space.

To begin with, the already low operating profitability results in a razor-thin net income figure due to fading gains on strategic investments. The cash flow from operations figure then relies on the accounting treatment of depreciation and amortization as well as stock-based compensation expenses.

Needless to say that this development is unsustainable over the long term and the pressure on it changing is already high, Salesforce’s management has also been focused on improving its receivables turnover in order to improve its cash flow position.

The bigger issue, however, is the skyrocketing amount of stock-based compensation, which is already more than half of the company’s cash flow from operations for the past 12 months.

Prepared by the author, using data from SEC Filings

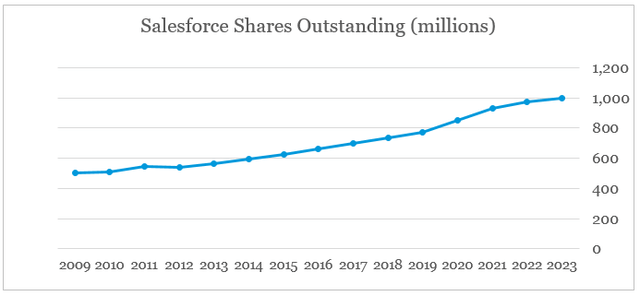

This in combination with the aggressive M&A strategy resulted in a massive shareholder dilution over the past decade and even the $1,677m spend on share repurchases over the past fiscal year was not enough to fully offset dilution.

Prepared by the author, using data from SEC Filings

Conclusion

Even though Salesforce has created a very strong ecosystem of services, the means to achieve that are flawed. Too aggressive M&A approach and a sole focus on topline growth have now put the company in a tough spot to improve profitability at a time when the outside environment is turning into a headwind and competitive pressures are rising. The heavy reliance on stock-based compensation also puts Salesforce’s ability to attract and retain talent at risk. Investors looking for a low entry point should be careful of further downside, even as valuation has already cooled off in 2022.

Be the first to comment