gilaxia/E+ via Getty Images

Full House Resorts, Inc. (NASDAQ:FLL) offers impressive expertise in the casino industry as well as hotel management. The company is currently undergoing an expansionary phase with the addition of a new building in Colorado, and is investing in sports betting. I am very optimistic about FLL’s future free cash flow generation. My discounted cash flow (“DCF”) model implied a valuation of $13 per share. I obviously see risks from lower slot win, table win, and inflationary pressures. However, in my view, Full House Resorts remains an undervalued stock.

Full House Resorts Has Outstanding Expertise In The Casino Industry

Based in Las Vegas and operating in different regions of the United States, Full House Resorts runs casinos, hotels, sports betting, and several related businesses.

In my view, management has outstanding expertise in the casino industry. The company owns, manages, and develops its facilities in the states of Mississippi, Colorado, Indiana, and Nevada. Each of its casinos is designed according to the cultural and symbolic interests of the region, in which they are located, thus generating a particular atmosphere exclusive to each site.

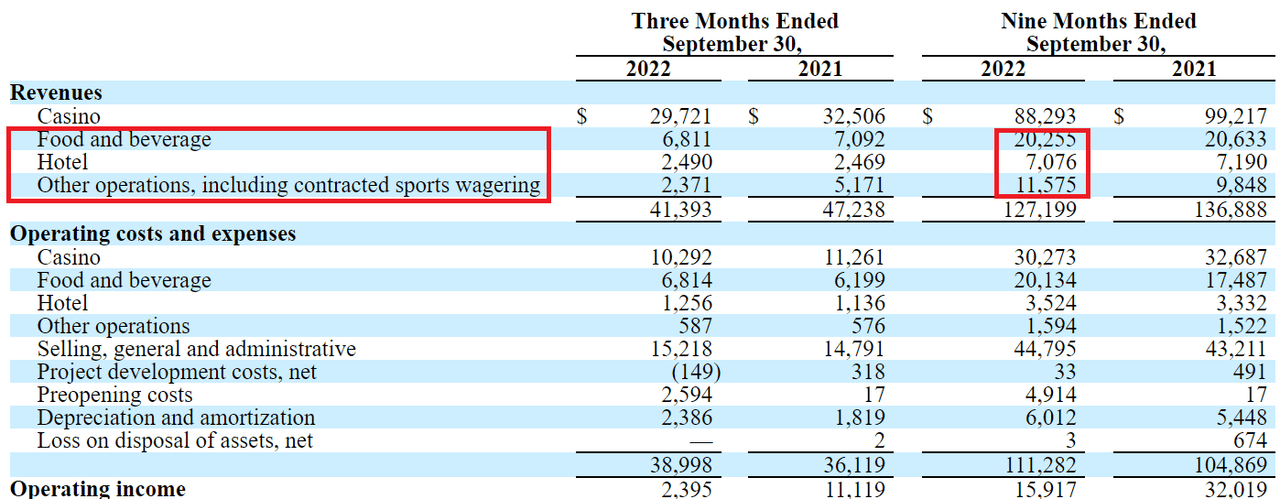

The company currently has five casinos under its control, and the construction of a sixth casino is in progress in a building located in Cripple Creek, Colorado, which is also home to Bronco’s Billy’s Casino and Hotel owned by the company. In this way, clients can enjoy not only the entertainment area in the casino, but also have a complete package that includes a stay in a nearby hotel with facilities such as swimming pools, relaxation rooms, a spa, restaurants, and bars within them. As seen in the last quarterly report, Full House Resorts reports a significant amount of revenue from the sale of food, the hotel business, sports wagering, and other operations.

Source: 10-Q

Although its foundation dates back to the last century, it was not until 2014 that the administration and management team became a central part of the company’s work, thus allowing it to expand market horizons along with the facilities for its clients.

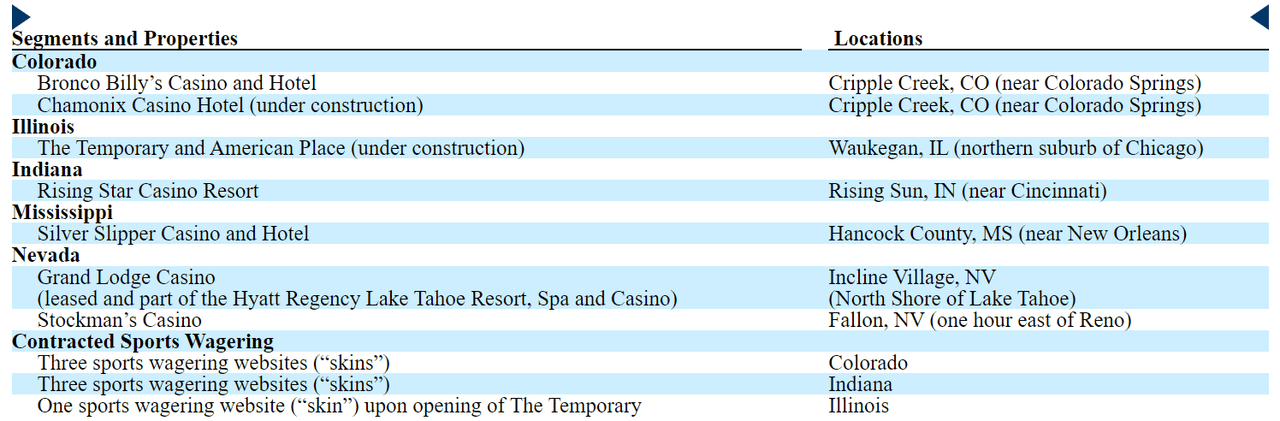

In addition to Bronco Billy’s Casino and Hotel in Colorado, the company has the Silver Slipper Casino and Hotel in Mississippi, the Rising Star Casino Resort in Indiana, and Stockman’s Casino and the Grand Lodge Casino, both in the state of Nevada. The table below offers further information about Full House’s properties and business segments.

Source: 10-Q

Currently, Full House Resorts has a permanent staff of 893 employees along with other 265 individuals performing part-time tasks. This statistic covers workers inside the casino as well as hotel facilities, gastronomic areas, and parking areas.

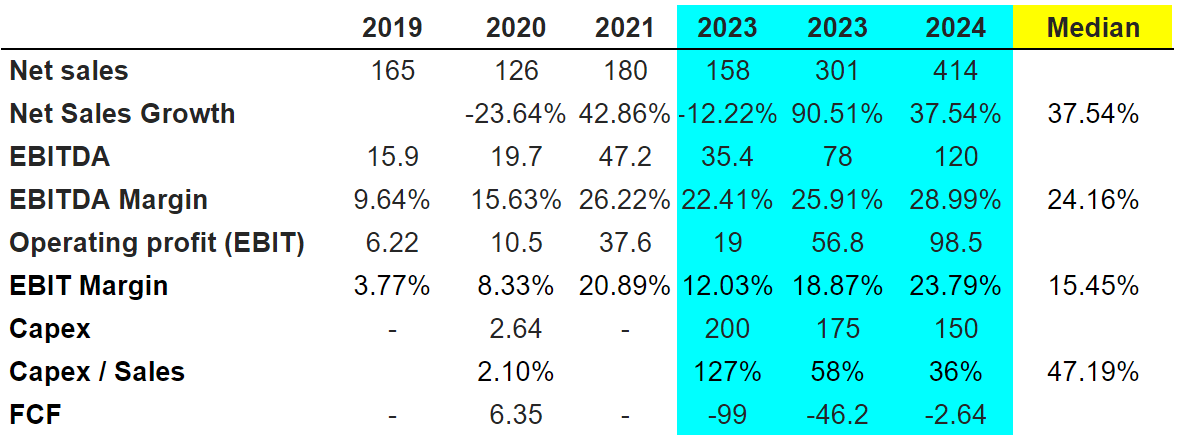

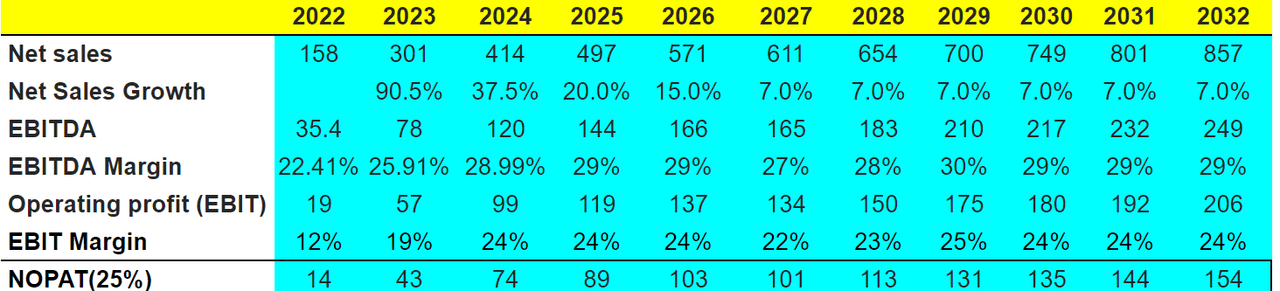

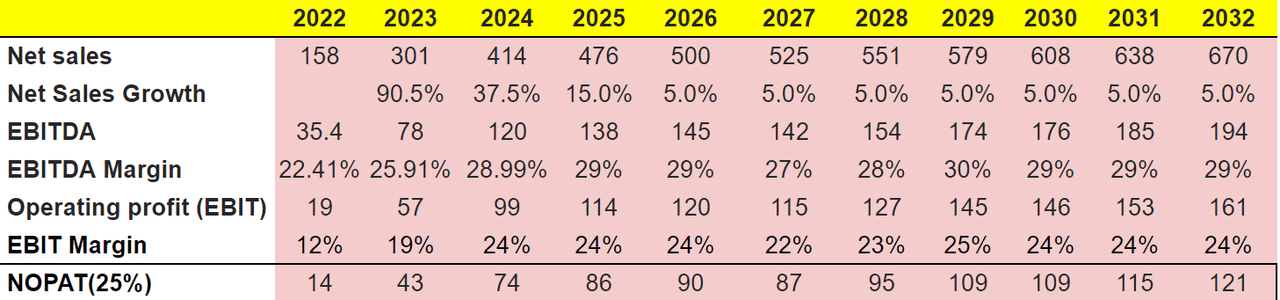

2024 Expected Net Sales Growth Of 37.54%

Analysts expect 2024 net sales of $414 million with a net sales growth of 37.54%. 2024 EBITDA would stand at $120 million with an operating profit of $98 million, in addition to the EBIT margin of 23.79%. Analysts are also expecting a 2024 capex of $150 million with a capex/sales of 36%.

Let’s note that the free cash flow (“FCF”) is expected to grow from -$99 million in 2022 to -$2 million in 2024. 2022 FCF was equal to $6 million. I believe that with further increase in revenue from 2025 and less capital expenditures, FCF could be positive around 2025.

Source: wallstreetzen.com

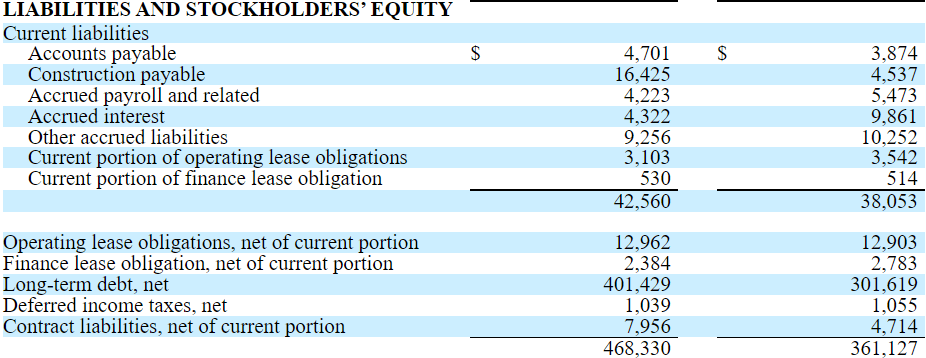

Full House Resorts Finances Its Activities With Some Financial Debt, But The Balance Sheet Appears In Good Shape

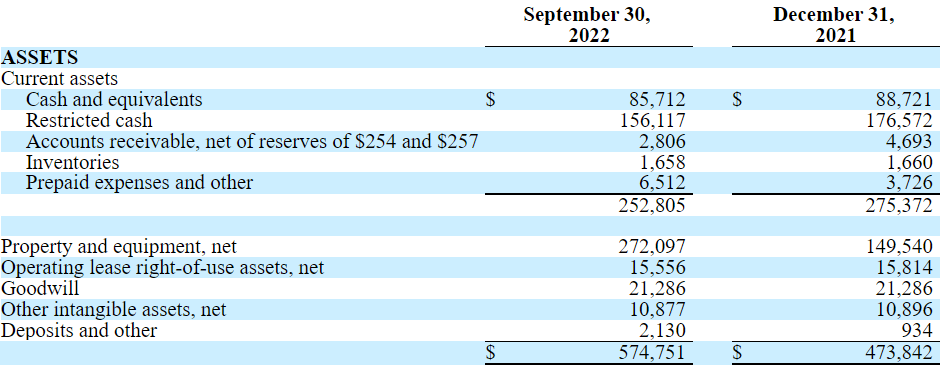

As of September 30, 2022, cash stood at $85.712 million with restricted cash worth $156.117 million. Prepaid expenses and other expenses were equal to $6.512 million, which implied total current assets of $252.805 million. Current assets stand at more than 4x the total current liabilities. Liquidity does not seem to be an issue here.

With property and equipment of $272.097 million and operating lease rights of use assets worth $15.556 million, goodwill stands at $21.286 million. Total assets are equal to $574.751 million, more than 1x the total amount of liabilities. I believe that the balance sheet is in good shape.

Source: 10-Q

The list of liabilities include construction payables worth $16.425 million, in addition to other accrued liabilities of $9.256 million and total current liabilities of $42.560 million. With operating lease obligations of $12.962 million and long-term debt of $401.429 million, the total amount of debt may be worrying for certain investors. Net debt is close to $160 million, which is close to 1x 2024 EBITDA, which does not appear that large. The total amount of assets’ liabilities is equal to $468.330 million.

Source: 10-Q

More Sports Wagering And The New Building In Colorado Could Imply A Valuation Of $13 Per Share

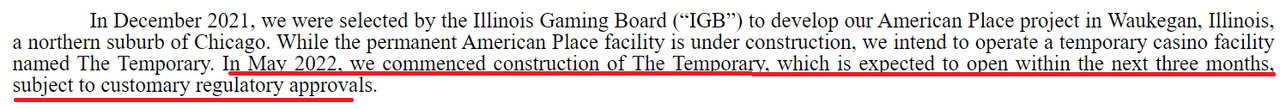

In addition to building a new building in Colorado, the company is also developing a new entertainment center in the Waukegan area north of Chicago, under the name of American Place, under the direction of the Illinois Gaming Board. I believe that investors will likely see sales growth derived from the new entertainment center.

Source: 10-Q

Under this case scenario, I am optimistic about the company’s agreements with Circa Sports and the company’s on-site sportsbooks. In my view, considering the expected growth of internet sports wagering, Full House’s revenue growth may be larger than expected.

Sports Betting Market to Rise at a CAGR of 9.8% during Forecast Period 2022-2031, notes TMR Study. Source: Sports Betting Market to Rise at a CAGR of 9.8%.

In May 2022, we entered into an agreement with an affiliate of Circa Sports to jointly develop and manage on-site sportsbooks at both The Temporary and American Place. Circa Sports currently operates at Circa Resort & Casino in Las Vegas, and offers online sports wagering in several states. Source: 10-Q

Under the previous conditions, I included 2032 net sales of $857 million together with a net sales growth of 7%. I also included an EBITDA of $249 million with an EBITDA margin of 29%, operating profit of $206 million, and EBIT margin of 24%. 2032 NOPAT would be $154 million.

Source: Chatool’s DCF Model

My expectations include 2032 D&A of $43 million, changes in working capital of $17 million, and capex close to $129 million with capex/sales of 15%. 2032 FCF would be $86 million with FCF/sales of 10%.

If we also use a WACC of 11% and an exit multiple of 6x EBITDA, the enterprise value would be close to $596 million. The equity valuation would stand at $436 million, and the implied price would be $13 per share.

Source: Chatool’s DCF Model

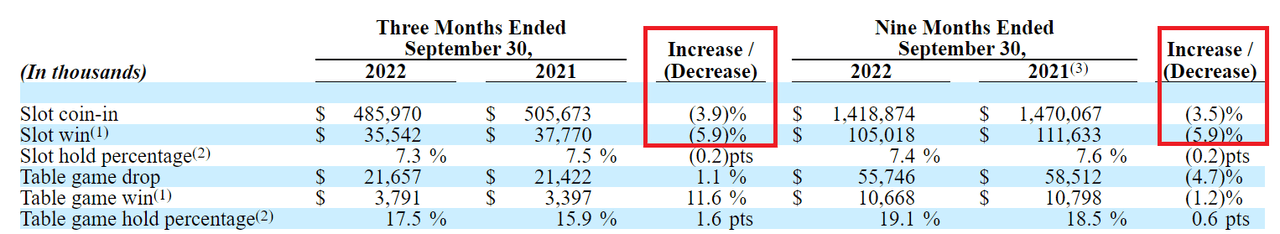

Risks: Lower Slot Win, Table Win, and Further Decrease in Consumer spending Due To Inflation Could Bring The Stock Price Down To $4.265 Per Share

Under very detrimental conditions, I expect a continuous decrease in the slot win reported by management. Keep in mind that in the nine months ended September 30, 2022, the decrease in slow win was close to -5.9%. The company’s table game win also decreased by close to -1.2% in the same period. Lower key performance indicators would most likely bring lower FCF, and the company’s fair valuation could diminish.

Source: 10-Q

I would be concerned if inflationary pressures continue to damage the spending pattern of customers. Besides, higher insurance and food and beverage costs could be quite detrimental for the FCF line. Management already noted some of these risks in the last quarterly report.

These include inflationary pressures, which could affect the spending pattern of customers, as well as labor shortages for us to meet the demands of potential customers.

Consolidated operating expenses increased by $2.9 million and $6.4 million for the respective three and nine months ended September 30, 2022, primarily due to preopening costs for The Temporary (expected to open within the next three months) and for Chamonix (expected to open in mid-2023), as well as higher insurance, food and beverage costs. Source: 10-Q

Full House Resorts maintains a strict corporate philosophy, which includes raising awareness among employees, investors, and customers about the risks of gambling in the casino and the importance of complying with the licenses and regulations of U.S. law. If the company fails to comply with some regulatory framework, I believe that fines or even closure of casinos could damage the company’s revenue line.

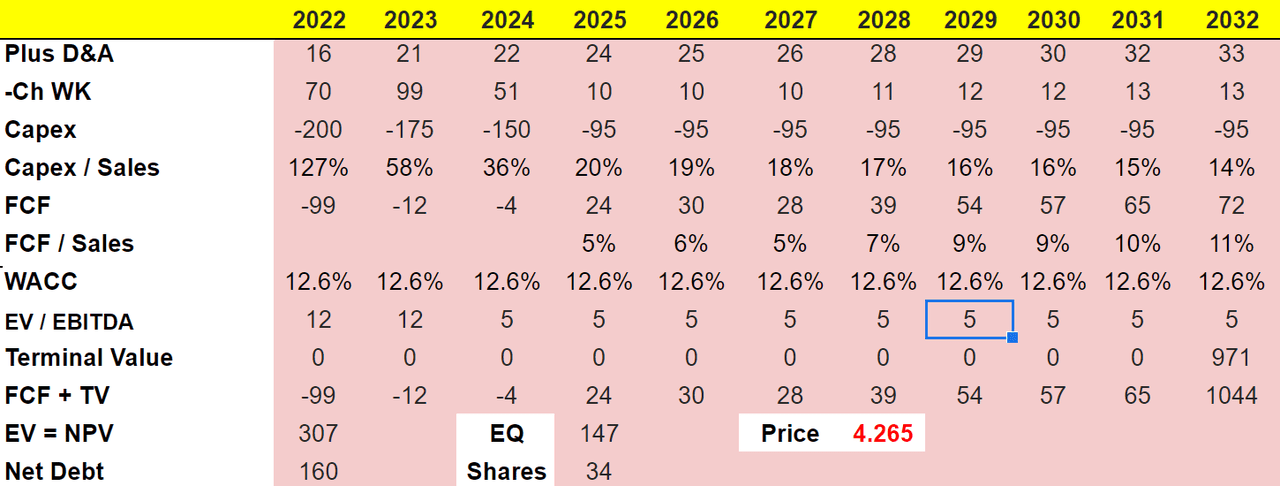

Under my bearish case, I used 2032 net sales of $670 million and net sales growth of 5%. 2032 EBITDA would stand at $194 million with an EBITDA margin of 29%, operating profit of $161 million, and an EBIT margin of 24.5%. Finally, if we assume an effective tax of 25%, 2032 NOPAT would be close to $121.5 million.

Source: Chatool’s DCF Model

I also assumed 2032 D&A of $33 million, with capital expenditures of $95 million and capex/sales of 14%. The results would include FCF of $72 million with FCF/sales of 11%.

If we consider a discount of 12.55%, with an EV/EBITDA multiple of 5x million, the enterprise value would stand at $307 million. Besides, with net debt of $160 million, the equity valuation would be $147.5 million, and the implied price would be $4.265 per share.

Source: Chatool’s DCF Model

Conclusion

Full House Resorts has outstanding expertise in the casino industry, and obtains significant profit from management of hotels and related businesses. The company is also investing in sports betting, which will likely grow at a larger pace than the casino business segment. Considering the new building in Colorado, Full House Resorts could experience significant revenue growth and FCF margin increase in the coming years. Under normal conditions, I obtained a fair valuation for Full House Resorts, Inc. close to $13 per share.

Be the first to comment