miniseries

Thesis highlight

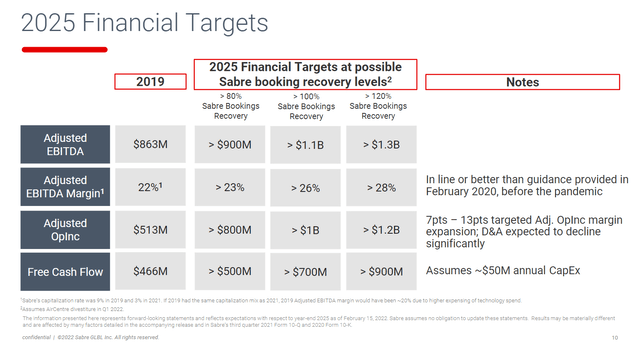

I recommend going long on Sabre Corp. (NASDAQ:SABR) ($5.48 as of this writing). It has one of the best risk-to-reward ratios in the current market environment with a near-term catalyst (post-COVID travel recovery). At this valuation, we simply need SABR to hit management’s FY25 guidance—recover bookings to >80% of 2019 levels—and we can make 3 times our money based on a 25x FCF multiple.

Company overview

Travel Solutions and Hospitality Solutions are SABR’s two business units.

The Travel Solutions division connects wholesale travel suppliers and wholesale travel buyers via a B2B travel marketplace that includes a global distribution system [GDS] and a suite of value-added solutions that can be integrated with SABR GDS. The SABR GDS makes booking easier by connecting a wide range of travel providers, such as airlines, hotels, and car rental companies, with a wide range of travel buyers, such as online travel agencies, traditional travel agencies, travel management companies, and so on.

The Hospitality Solutions team creates and distributes software and solutions for the hospitality industry in the form of SaaS and hosted software. This solution helps hotels and hotel chains manage prices, reservations, and retail offerings across thousands of distribution channels.

Investments merits

Strong network effect

GDS is a straightforward system. It acts as a go-between for travel suppliers such as airlines and travel buyers such as travel agencies. SABR is a GDS that distributes travel content (air tickets, hotel rooms, tours, rails, car rentals, cruises, and so on) from travel suppliers to online and offline travel buyers. Three companies dominate the GDS market: Amadeus, Sabre, and Travelport. SABR accounts for roughly one-third of all travel agency holdings but has a stronger presence in the United States. GDSs generate revenue by charging a fee per booking and allowing airlines to manage and distribute inventory more cost-effectively. The booking fee is negotiated with each inventory supplier, which is typically 2%-4% of the airline ticket price and around 20% of the cost of a hotel reservation.

To be competitive, a GDS must have a variety of supply (air tickets, hotels, etc.) and a large amount of demand flowing from various channels (offline travel agencies, OTAs, etc.). If this sounds familiar, it is because GDS is similar to any other two-sided network business that has solved the chicken and egg problem. SABR has a strong network and a flywheel effect, which means that more demand attracts more supply, which in turn attracts more demand, creating a virtuous cycle. As it takes a lot of work and money to get thousands of airlines, hotels, and demand channels to use a new GDS that hasn’t been tried before, it is very hard for a new player to come in and replace SABR or any other GDS.

Extremely sticky product

We’ve established that GDS has a sizable network effect, making them hard to replace. Learning about the value and importance of GDS is the next step. GDS is gated community (GDS charges a fee at the gate) where large businesses and associations can buy and sell travel-related services. Hotels and airlines can reach their most loyal and frequent guests at a low cost by advertising there (i.e., marketing or creating a GDS-replica network themselves). Furthermore, the huge fixed costs associated with installing and maintaining the system’s necessary hardware are eliminated as the company migrates a large portion of its software capabilities to the cloud. Overall, the importance of GDS makes it an extremely sticky product that cannot be easily ripped out.

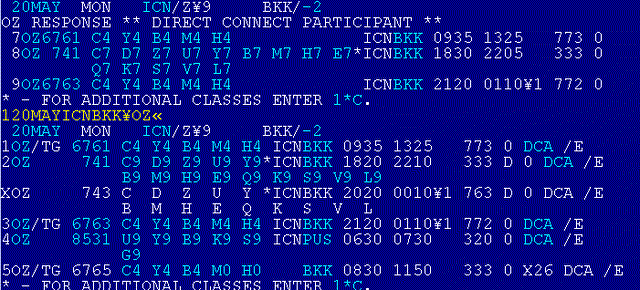

Another point that is less important but good to point out is the operating system of a GDS – the operating system at airport ticket counters where employees enter data into a programming-like screen (see below). As you can imagine, it is incredibly hard to learn and master. Long-term users have a hard time switching to a new system. This also adds to the stickiness as a GDS.

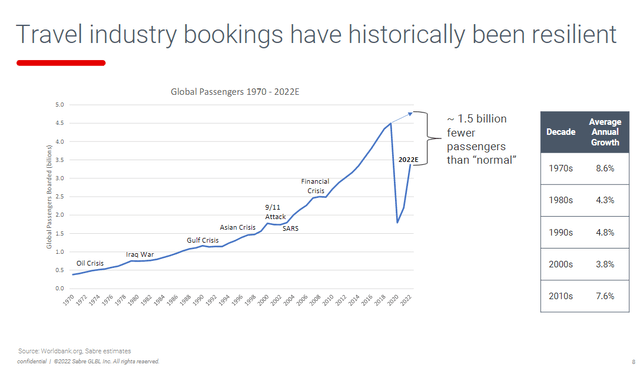

Stable long-term industry growth

SABR benefits from the rising demand for vacations over the long term. There were about 3.3 billion airline passengers in 2014, and this is expected to increase to 4 billion by 2024 (3% CAGR over a decade), as reported by the International Air Transport Association (IATA). A rise to 8.2 billion by 2037 is predicted, up 8% CAGR from the predicted 4 billion in 2024. Even though SABR still has a long way to go due to the situation in China, the long-term tailwind is bolstered by the short-term recovery following COVID.

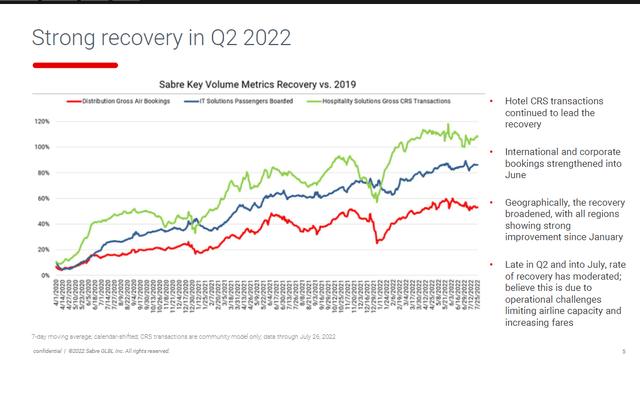

SABR’s 2Q22 earnings presentation SABR’s 2Q22 earnings presentation

Proliferation of LCC and hybrid flights beneficial for GDS

The growth of low-cost carriers and hybrids into a significant segment of the air travel market has helped to stimulate demand through competitively priced flights. Direct distribution has traditionally been the source of the vast majority of bookings for low-cost carriers and hybrids. But as these LCCs and hybrids continue to grow, many of them are expanding their reach through indirect channels such as GDS to reach higher-yield markets and customers, like those who travel for business or internationally.

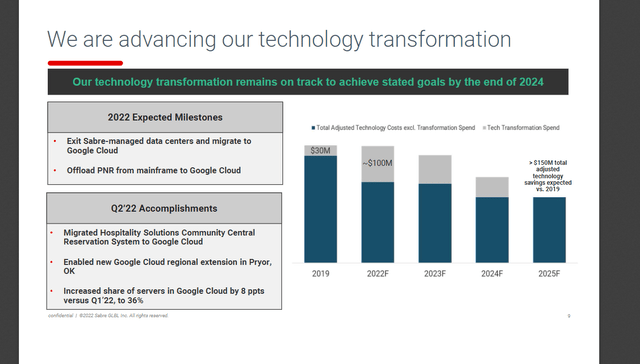

Technology transition should boost profit margins from cost savings

SABR has been hard at work putting in place a number of long-term technological transformations. In preparation for the migration of their entire technology stack to the cloud, they are redesigning it from the ground up. The fact that SABR previously utilized self-managed data centers, which lacked scalability, makes this, in my opinion, a significant development. By the end of the fiscal year in 2025, management anticipated that this will result in a cost savings of $150 million versus 2019. In order to put this into perspective cost savings of $150 million is equivalent to half of SABR’s EBIT for FY19.

SABR’s 2Q22 earnings presentation

Valuation

Price target

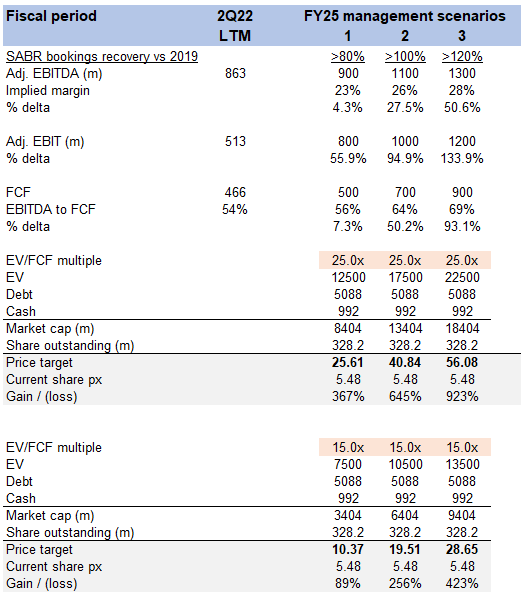

My model suggests a price target range from ~$25 to $56, suggesting an upside of 3.6x to 9x from today’s share price of $5.48. This is based on three different scenarios laid out by the management in the FY21 earnings call. Each scenario represents a different recovery level of bookings vs 2019 (pre-COVID). The fact that management reiterated this FY25 guidance has given me more confidence that it is definitely possible. The market priced SABR as though travel would never recover in our lifetime. I believe that is extremely unlikely given what we see in Southeast Asia (travel is robust!). Even if we assume that it doesn’t get back to 100%, even if it gets back to Scenario 1 (80% to 100% of 2019 levels), we can still get a very high return assuming a range of FCF multiple.

- 25x FCF multiple (4% FCF yield) assuming it trades back to historical average levels would result in significant upside, although I believe it might be hard for this to happen given the rising interest rate environment

- 15x FCF multiple (7% FCF yield) assuming valuation paradigm is permanently impacted by the rising interest rates, where investors seek yield higher than S&P earnings yield. S&P earnings yield is 6% as of date of writing.

Image created by author using data from SABR’s filings and own estimates SABR’s 1Q22 presentation

Risks

Transition to direct bookings

There is a continuing trend among airlines to promote direct bookings because it allows them to save money and collect a large amount of data. This trend is occurring despite the fact that the growth of LCCs and hybrids is increasing the usage of GDS. The network effect starts to work against the network when there are fewer nodes in it, creating a vicious cycle: fewer bookings lead to a lower demand volume, which leads to fewer suppliers joining the network or negotiating for lower prices because the network is no longer as valuable as it once was.

Delay of COVID recovery

The near-term thesis is extremely dependent on the travel industry recovering as a result of countries that previously had travel restrictions being lifted. On the other hand, this thesis has been put into practice for a few months, but it has not yet fully recovered from its effects. Any kind of holdup has the potential to have an effect on SABR’s short-term performance because the company is likely to be categorized as “travel stocks.”

Conclusion

To conclude, I believe the upside for SABR is worth a lot more than it is today if it can hit management’s FY25. The market is pricing this asset as though nobody is going to travel in the future, which I think is absurd. SABR should continue to grow and recover to pre-covid levels. The near-term post-COVID recovery travel boost could be a near-term catalyst to boost the stock price.

Be the first to comment