AscentXmedia/iStock via Getty Images

I stand by my call of last week

Let’s provide some perspective, this sharp dive is not only about bad economic data, this Friday was the end of the worst week of the year for stocks. September in turn is the worst month of the year for stocks. October can be rough too, but this was the worst month’s performance in years, so I will go with the notion that the bottom is near. This is because this was the end of the 3rd quarter and we had a lot of “window dressing” where money managers sell the “losers” to dress up their portfolios. The problem here is that all the volatility downward probably jumbled up a lot of portfolios. I wouldn’t be surprised if many professionals just totally liquidated their positions and went to 3-month T-bills. That could explain a lot of the selling in stalwarts like Apple (AAPL). In fact, as I will show later in the analysis, AAPL is the key to this market. So this isn’t only about the fear that Powell’s “forever war” on inflation will drive the US economy into a ditch. Really the panic selling is more about a reaction to the natural downward pressure that happens every year at this time. Don’t be the ones to sell in a panic now. Though if you see the market soar as it did on Wednesday you should trim shares. This is part of the Cash Management Discipline we advocate at Dual Mind Research.

My big error was to come into this week without hedging. Hindsight is 20-20, but I just couldn’t see the June low NOT holding. I think we are much better off here than where we were in June. So I thought it would hold, though sometimes lemmings jump off a cliff for no reason, that is how I feel about the liquidation of institutional portfolios and panicking individual investors.

Don’t fight the Fed, what I am doing is trading on the Fed’s MO

We hear the constant thrum of “don’t fight the Fed”, yet the Fed has precipitously changed directions under Powell every time. Every time he sets a direction he keeps going until he sees the precipice and then backs off, that is their Modus Operandi (MO). In this case, I am not even modeling that he returns to QE and lowers rates back. All we need is for him and the Fed presidents to be responsible and lower the increments to .50% in November, and .25% in December. They don’t have to lower rates at all once he has the FFR at 4% or there about he can keep it there. The economy will do just fine at stable rates fixed to 4.05% to 4.2% at the 2-Year, out to +4.5% at the 10-Year. Mortgages will top out at 7.5% to 8% and housing prices will moderate and housing supply finally catches up with demand.

The notion that Powell must crash the economy in order to slay the dragon, is beyond reckless and unnecessary. I can’t believe that is what Powell is doing. I have been a supporter of Powell all along but the scales have fallen from my eyes. Why was he still buying mortgage-backed securities as recently as last November when the housing market was already white-hot? In my view, this was a careless mistake. I guess I should admit that accepting Powell’s pronouncement that inflation was transitory was my error as well. In my defense, I think his managing of the pandemic and being a constructive voice then was spot on. That made me a fan and not an unbiased observer. Does he really want to have as his legacy the Fed chief who pushed the economy into recession and then had to lower interest rates that re-ignite inflation?

As far as Friday’s action was concerned the selling intensified during the last 15 minutes, which lines up with the market on close action. Most institutions and money managers use that action, I hesitate to opine on why the sellers overwhelmed any buyers as the sellers have been in charge most of this month. October marks the start of the 4th quarter and while some of the worst trading days have happened in October it is usually part of a coda to the 3rd quarter. If we have seen the power of the seasonal pattern, we can then take guidance from a very reliable 80-year record of stocks notching gains after the midterm elections.

The bottoming process is messy and certainly not easy

The last phase of a bear market sell-off is that even the stalwart safety stocks are discarded. The prime example is Apple (AAPL) not only did it clearly break down but look at the huge jump in volume from the average of 79 Million to Friday’s volume of nearly 125 Million. Plus AAPL fell 3%, after falling like 6% on Thursday. Yes, some of the extra volume was due to quarter-end adjustments but more than 50% volume? Um no. They were dumping the most beloved, and strongest stock with the best balance sheet on the planet. Perhaps you say AAPL was a consumer cyclical that might underperform in the Christmas selling season? So that’s why it sold off, not that this is part of any bottoming process? Ok, how about utilities? Look at the XLU volume normally 12 Million, Friday’s was over 22 Million, and XLU was down Friday by 2%. Under normal circumstances, it should have been up. What about the day before? On the 28th it closed at 69.59 and on Thursday it closed at 66.80 down nearly 5%! We saw more than 8% of value lost in the utility sector, which is traditionally quite defensive, albeit interest-rate sensitive. The consumer staple stocks represented by the XLP broke under the 52 Week Low. So at the bottom, everything gets thrown out and the money managers just go to cash. Why do I say cash as all this selling happened for most of the last few weeks as interest rates were going up? Think about that for a minute. If interest rates are going up it means that investors are selling out of longer-duration US Bonds. Bondholders were losing principal because everyone believes that Powell will raise rates ever higher. So if equities are losing and even bonds are losing where was the money going? To the very shortest duration T-bills or money market accounts. No sector is immune, consumer staples – look at Procter & Gamble (PG) was down 2% normal volume is 6.5 Million and Friday’s was 9.4 Million. Does that mean we magically start soaring on Monday? Not likely, like I said bottoms are messy. There was really nowhere to hide, that is the key feature of a bottom.

Apple is the key to this market so let’s see if the charts tell us something.

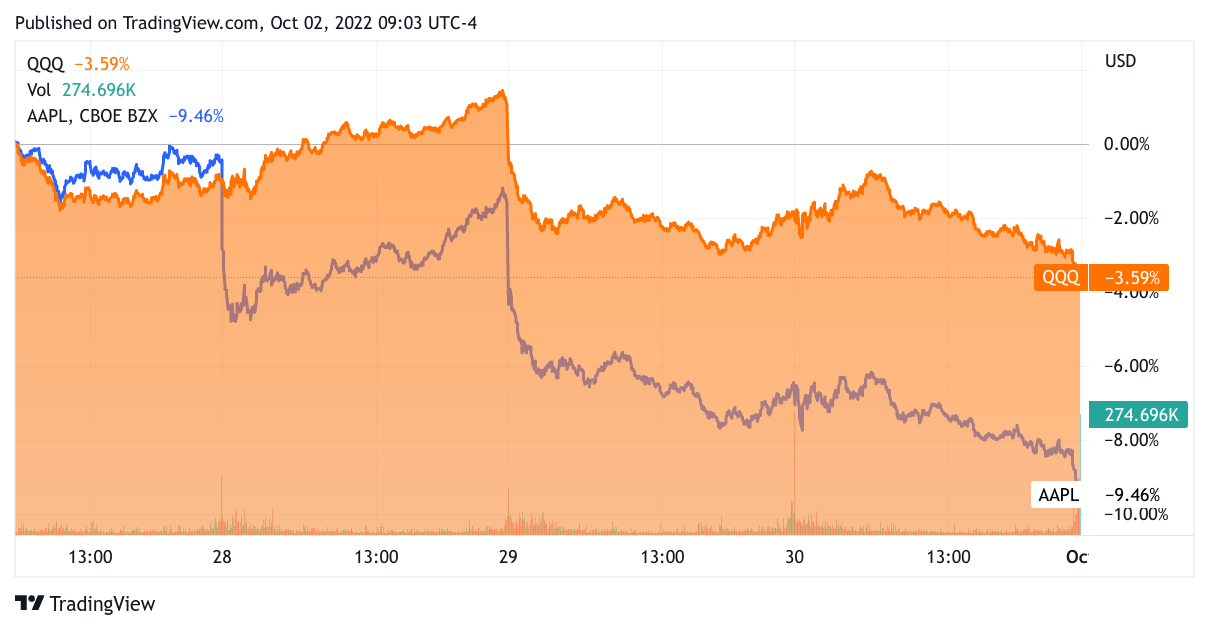

I decided to compare AAPL Nasdaq 100 which is key to this last piece of the sell-off. Here is the 5-Day chart of Nasdaq 100 ETF (QQQ).

TradingView

At the left at the beginning of the 5-day chart, AAPL was above (following the QQQ) in this comparison by Friday it is underperforming by 6%. This very well illustrates that the market is in the process of bottoming. How much lower could AAPL go? I would think that with its massive cash reserve, it will support the stock with buybacks at some point. Either that will tell us when they think AAPL is oversold, or the market will.

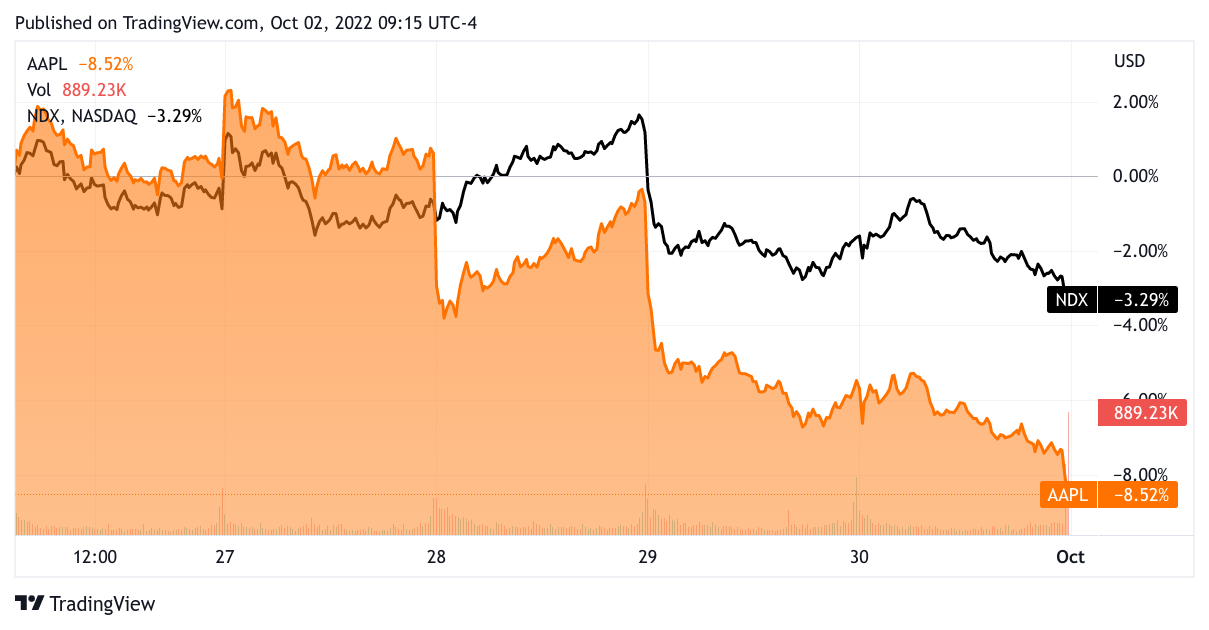

Now that we are in a new quarter, institutions will at some soon point say AAPL is a bargain, and you know what? So is MSFT (along with the rest of the tech titans) even with the possibility of a little recession in the 1st Q of 2023. Here is AAPL against the Nasdaq Composite Index 5-day

TradingView

Here I have the NDX in black and AAPL orange. A fairly similar chart to the QQQ. Again AAPL outperformed until the last few days and now diving because everyone hates ALL equities all of a sudden. Just remember that the stock market is a discounting mechanism it looks out about 6 to eleven months. That means it has been discounting the recession right now along with the rate hikes.

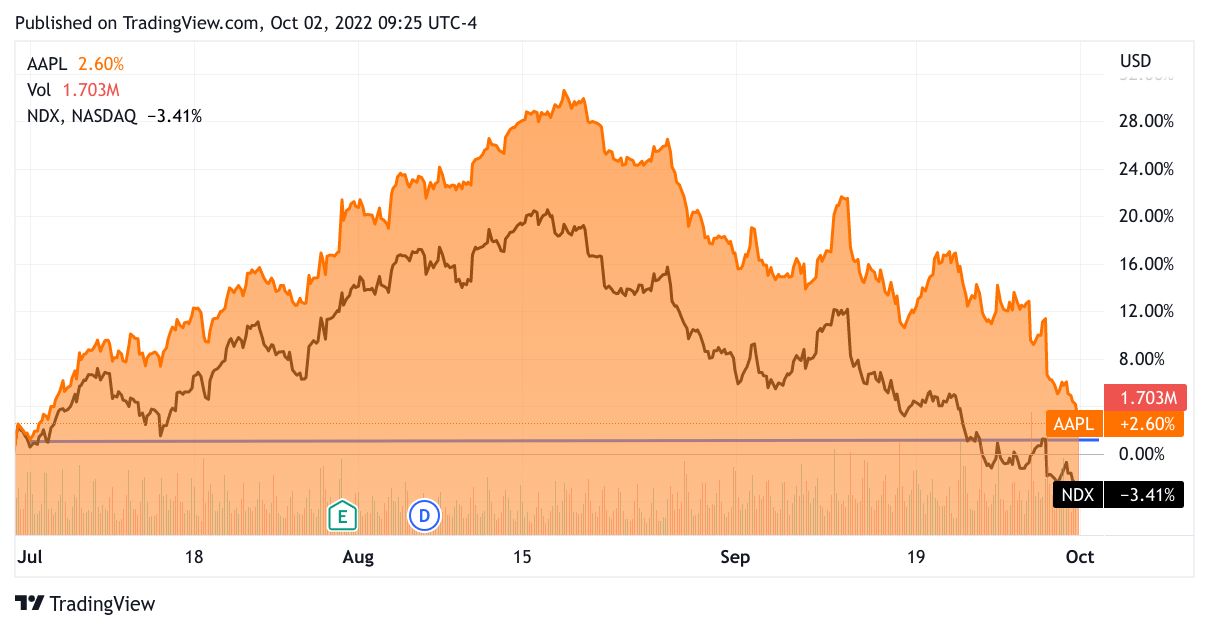

Let’s zoom out to 3 Months.

TradingView

On a percentage basis, AAPL hasn’t broken support. Clearly, the Nasdaq composite has in comparison to AAPL on the 3-M. I take some solace in that, I think AAPL goes up in here, at least this week, maybe 2 weeks, and brings up the rest of the NDX. Perhaps we should be buying AAPL soon.

For once the Fed can moderate the delta of rate raises before something breaks. I think if the Fed would just decelerate to .25% until they reach the longstanding norm of 4.25 to 4.60 for the FFR, the economy can take that level. More importantly, I think the Fed pulling back on rates because they went too far will reanimate inflation expectations.

My Trades

As I said last week, I am adding Boeing (BA) and Eli Lilly (LLY). This week I started building those positions share by share. I want to say there are a lot of high-quality big-cap stocks that could be part of your portfolio. Perhaps Procter & Gamble (P&G), Costco (COST), Home Depot (HD) or McDonald’s (MCD) or Coca-Cola (KO), or maybe PepsiCo (PEP), could be on your list. I am not endorsing any of these names, I haven’t been watching their price action or looking at them from the fundamental side, but if you feel they are at their bottom you could adopt my tactics here. Buy them share by share. Every time they drop significantly buy another share or two. Or if you are more comfortable spreading your risk use ETFs. I prefer stocks but as I have shown by comparing AAPL to the Nasdaq, to a lesser degree there is always 1 or 2 companies that are the leaders of their sector. Now that I mention AAPL I may just have to buy it if it falls any further.

A while back I sold out of my position in PayPal (PYPL) when it looked to me like it would hold the 90s. As it fell into the mid-80s I restarted my position. I sold out of my position in Meta Platforms (META) because it looks META could underperform in the coming rally.

I added a bunch of shares to my NIKE (NKE) position, I think it could fall into the high 70s and I will gladly add again to that position. NKE is indisputably a quality big cap name, I expect it to overcome its current challenges and regain its true value in the future.

I will also keep buying Microsoft (MSFT), and Alphabet (GOOGL) if they fall further. I am holding off on adding to my AMZN position because my average stock price is below where it is right now.

That’s basically what I have been doing for a while now, favoring the large-cap names that everyone knows. Yet market participants are dumping the best-known, best-loved stocks right now. Bottoms are scary, they build panic, but they also offer the chance to build wealth if you have the fortitude to stay in the scrum and acquire great names in a disciplined way.

Be the first to comment