FatCamera/E+ via Getty Images

We are long Merrimack Pharmaceuticals (NASDAQ:MACK) as we see it as a very unique opportunity in the biopharma space. It does not develop or market any drugs or have any meaningful operations to speak of. Rather, it is a holding company that with rights associated with the drug Onivyde. They are due a large milestone if the drug works in first-line pancreatic cancer, and we believe that this has a high probability of success based on a long history of the active molecule in the drug being used in that setting with success.

Company background

Onivyde is a pancreatic cancer treatment that was initially developed by Merrimack when it was still developing drugs and was subsequently licensed to Ipsen for commercialization. Following this Merrimack wound down operations for reasons unassociated with this drug. However, before when it was licensed, the agreement had milestone payments associated with its approval for additional indications. The biggest of these catalysts is the approval of the drug for first-line pancreatic cancer (it is already approved for the second line of treatment), and this program has a very near-term clinical readout. The majority of the investment thesis for MACK is tied up in this readout, and I argue that there is a high probability of success for the following reasons:

- It is well understood: The active molecule in Onivyde, irinotecan, is already used extensively in the first-line setting and is considered the most aggressive treatment.

- The comparisons have been made before: In multiple contexts irinotecan regimens have been compared to the same drugs in the control arm in this study and outperformed them.

- Despite this, it need not actually be better: The product need not demonstrate superiority to the control arm as it is approvable on the basis of non-inferiority if needed.

- The commercial economics are not part of the thesis: The value to MACK is entirely associated with approval and the associated milestone.

Ipsen acquired Onivyde in 2017 and the deal included $575m upfront and $450m in putative milestones associated with approval for additional indications. These milestones are payable as follows:

- $225.0 million upon approval by the FDA of ONIVYDE for the first-line treatment of metastatic adenocarcinoma of the pancreas, subject to certain conditions;

- $150.0 million upon approval by the FDA of ONIVYDE for the treatment of small cell lung cancer after failure of first-line chemotherapy; and

- $75.0 million upon approval by the FDA of ONIVYDE for an additional indication unrelated to those described above.

Onivyde for first-line pancreatic cancer

Ipsen is currently in a Phase III clinical study of the drug in first-line pancreatic cancer that is expected to read out around the end of 2022. This will be the biggest value inflection point for the stock. I believe that there are a series of misconceptions around this study that have contributed to the stock being mispriced.

The biggest misconception that I have seen in sell-side reports and elsewhere has been that Onivyde should be compared to other failed drugs in pancreatic cancer. Pancreatic cancer is a famously hard indication do develop drugs for and it has often been referred to a “graveyard.” Despite some recent progress, the number of targeted therapies for pancreatic cancer are limited and doctors have had to rely in large part on chemotherapy. And therein lies the misunderstanding about Onivyde’s potential in pancreatic cancer: it is not a targeted drug; it is a chemotherapy. We know it works in the setting where its being tested. In fact, the active molecule is what patients get when these targeted drugs fail.

Onivyde is a liposomal formulation of the chemotherapy drug irinotecan. Irinotecan has been used extensively for a wide range cancers and is part of multiple common treatment regimens. Despite this, irinotecan is an old drug that has been “grandfathered” in, and it isn’t actually approved for any particular indication. Onivyde was developed to improve on the drug using liposomal technology, which can provide a more tolerable pharmacokinetic profile. Liposomes are essentially droplets of oil which carry the drug and they fundamentally do not change the activity of the drug. And additional, and perhaps motivating consequence of the new formulation is that it allowed for new intellectual property. These liposomes may or may not improve the properties Onivyde in the diseases it is being tested in, but this is immaterial to the clinical readouts because the drug is not being compared to non-liposomal irinotecan. But at the very least we can expect Onivyde to perform similarly to “naked” irinotecan.

Onivyde is currently approved as a second line treatment for pancreatic cancer as part of a multidrug regimen, and it is marketed worldwide for this indication. Naked irinotecan has a long history of use in this disease and is used in the first line and later settings. It is a component of the FOLFIRINOX treatment regimen (FOLinic acid, Fluorouracil, IRINotecan, and Oxaliplatin) the standard of care for first line treatment, recommended in the ASCO guidelines. Over the years irinotecan has been used in a large number of other similar regimens with slightly different combinations of drugs (and other long acronyms eg. FOLFIRI), but irinotecan is a cornerstone of almost all of them.

In the ongoing Phase III NAPOLI-III study (n=750), Onivyde will used in a FOLFIRINOX regimen to replace naked irinotecan. It is going to be compared against a combination of gemcitabine and nab-paclitaxel (GN), another regiment that is already established for the disease. GN is also an established first-line treatment that is typically reserved for those that cannot handle a more aggressive treatment like FOLFIRINOX, or it is provided after FOLFIRINOX fails. It allows patients to avoid some of the long infusion times associated with FOLFIRINOX as well as other tolerability issues, but irinotecan containing regimens are preferred for those that can handle it.

FOLFIRINOX became a first line therapy after a seminal study in 2011 that showed 11.1 months overall survival (OS) compared to 6.8 months with gemcitabine monotherapy. The response rate was 31.6% vs 9.4%. A separate study compared FOLFIRINOX vs GN in these patients and found the same trend: 14 mo. OS compared to 9 mo. A big part the contribution to this increase in survival is that it appears that following up FOLFIRINOX with GN is more effective than the other way around. The FOLFIRINOX patients were generally more fit after treatment. Progression free survival (PFS) was 6 and 5 months respectively and just missed statistical significance (p=0.053).

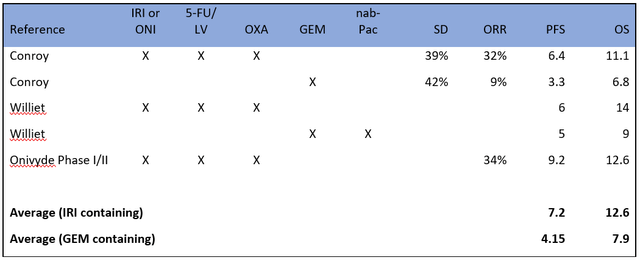

Retrospective studies have been less conclusive: some positive, some negative. An extensive analysis of these studies found OS rates (FOLFIRINOX vs GN) of 10.7 and 9.1 months in retrospective studies and 11.1 and 8.5 in controlled studies. Additionally there are the results from the company’s own Phase I/II study, which showed a PFS of 9.2 mo. OS or 12.6 mo. and an overall response rate (ORR) of 34.4% for the Onivyde regimen. This includes one patient (3%) that had a CR which is rare in this indication.

When we aggregate these data, we find a clear trend favoring regimens that contain irinotecan or Onivyde. Moreover, the results are generally consistent from study to study. Below are some of the most representative results.

Sources listed in image, links above.

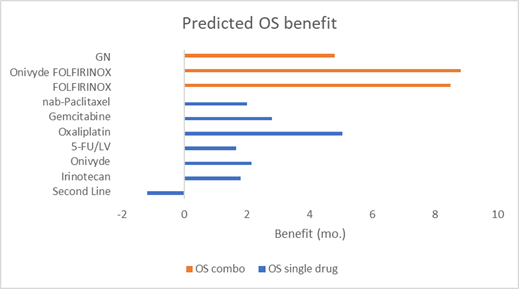

A limitation to this analysis is that because a number of different irinotecan regimens have been tried over the years (as well as various gemcitabine regimens), direct comparisons can be hard. To get around this, I have aggregated all the available pancreatic cancer trials containing irinotecan/Onivyde or gemcitabine in the first and second line and used a linear model to estimate the contributions from each individual component. One of these linear components is the use of these drugs in the second line, which as you might expect, negatively contributes to outcomes. This is a simplification as these drugs likely have synergistic effects that this model ignores, as well as countless variations between individual trials, but this analysis provides a useful estimation of potential benefit given imperfect data and is consistent with our other observations. I consider this illustrative, but I like what it illustrates, and it gives me more confidence in extrapolating from the above results.

Multiple references below

References 1, 2, 3, 4, 5, 6, 7

This analysis is an attempt to encapsulate what is already understood in clinical practice, which is that when patients that can handle it, FOLFIRINOX is preferable to GN. There are however no certainties in clinical research and even if the regimen is superior, there is a chance that an improvement cannot be proven statistically. This is a risk to all clinical programs because certain factors like patient variability can be hard to know beforehand. I do not think this will be the case for NAPOLI-III, but I rest assured that the study need not demonstrate the superiority of Onivyde in this setting. The drug is still approvable on a non-inferiority basis. Non-inferiority comes with its own statistical tests, but it allows an alternative pathway to approval that does require a definitive improvement in patient responses. Given the size and the lack of options in first line pancreatic cancer, there is a strong motivation for Ipsen to seek approval under any criteria for this indication.

Small cell lung cancer

Ipsen reported the results from the Phase III RESILIANT trial in small cell lung cancer (SCLC) in August 2022. Importantly, this trial was looking at Onivyde as a monotherapy compared to topotecan, unlike the comparisons between combinations made above in the pancreatic cancer trial. The trial didn’t reach statistical significance for the primary endpoint, which was improvement in overall survival. However, Ipsen did note that the response rate to therapy was doubled in the Onivyde arm. This suggests that the drug trended towards improvement but that the statistics were not reached Otherwise little additional detail on the results was not provided.

It would have been nice to see clear superiority, but similar to the pancreatic cancer program, these data can potentially be submitted for approval based on non-inferiority as well. We can’t evaluate if the study satisfied those criteria, but the above doubling in response rate is encouraging. Based on communication with Ipsen, the company’s biostatisticians are evaluating this pathway now.

Although this program still has a potential pathway to market, it is important to evaluate it for readthroughs to the more relevant pancreatic cancer program. This is virtually impossible because both the disease and the treatments that were administered are substantially different. The two studies are not comparing it against the same drugs, so lack of separation in this trial can’t really be extrapolated. Moreover, there is no question that Onivyde is clinically active in either indication because irinotecan is used in both. This being said, there has been much more research into irinotecan in pancreatic cancer. The SCLC study also didn’t screen out people that received irinotecan in the first line (where it is recommended under ASCO guidelines), so some patients may have already been resistant to treatment.

The most important thing to come out of these results is that it has set up MACK as a highly asymmetric trade. It brought the stock price back to levels not seen since 2020, despite there still being significant potential value for SCLC alone (on non-inferiority) before even considering pancreatic cancer.

Financials

One of the attractive features of this trade is that it is extremely simple from a financial standpoint. Because MACK has no meaningful operations, its burn rate is very low at $2 million for the past 12 months. It has $13.4 million in cash, so many years of runway. Based on communication with management, the main reason for them to retain this cash is to make sure the contract for the milestones is legally enforceable, i.e. they have sufficient capital to bring suit if Ipsen decides not to seek approval for the drug.

Data from the pancreatic cancer study is due this year in 2022, so very soon. Following this Ipsen will need to prepare and file an supplementary new drug application (sNDA) with the FDA to expand the label to the first line setting. The FDA then has two months to accept the application and 10 months to review, putting any likely approval decisions likely in H1 24 at the earliest. The $13.4 million in current cash is more than sufficient to reach that milestone.

Risks

The biggest risk here of course is clinical: in theory the drug could simply not work. We however, are very skeptical of this based on the preponderance of clinical evidence provided above and the fact that the product is already approved for later line pancreatic cancer. We believe that it is likely to be superior to the active control based on this evidence, but the potential of approval on non-inferiority widens the approval window making our assumptions even safer.

This being said, there are always risks to clinical development that cannot be known or eliminated and any investors in biotech and pharma should be aware of these risks. There could be issues with how the trial was performed for instance, or with how the product was manufactured for the study. These could delay or derail the delivery of the milestone payment. There are few strategies to hedge this risk (i.e. a stop loss), because the stock is likely to gap on the announcement of results. However, we think that these risks are also mitigated simply by the highly asymmetric nature of this trade because the payout is so much higher than the current market cap ($51 million).

Another risk that has more to do with this security than the long thesis is that the low volume on the stock increases volatility and liquidity risk. We cannot eliminate this risk, but typically volume increases dramatically upon the announcement of clinical results.

Conclusions

The setup for this trade is very clean. We do not need to speculate about the commercial prospects of Onivyde, or whether it is better than other treatments that are already approved. The only factor that is important is whether the drug is approved for these indications and the only comparison that is important is whether it can do at least as well as the drugs it is compared to.

The approval for pancreatic cancer is worth $225m alone, which is approximately 4x the current market cap. Any probability of success over approximately 20% implies there is value here that the market isn’t recognizing. I would argue that the probability of success is much higher due to the substantial amount of clinical experience looking at this and similar questions. That is why irinotecan is part of the recommended treatment. And I believe that the market has unreasonably disregarded the potential for an approval of Onivyde for SCLC on non-inferiority, which could translate into additional multiples on the current price.

Finally, the timeline for this stock very fast. The clinical results for pancreatic cancer are expected this quarter, Q4 2022, and the vast majority of the value of the future milestones should be apparent following this readout. The milestones are payable on approval, but it should be clear if the product is approvable at that time. The drug is already approved and marketed so there is little chance that there will be any safety or manufacturing issues that could tie up things. All these factors have combined to make a story that is easy to predict, timely, and offers large payouts if successful.

Be the first to comment