DNY59

**As I’ve done over the last several months, this subscriber exclusive end-of-month market analysis and Equity CEF Performance Update is being made available to all of my followers**

Note: You will need Microsoft Office or Excel to open the spreadsheet

Let me make this perfectly clear. If the Federal Reserve raises interest rates 75 bps on Wednesday and in its statement and Q&A with Jerome Powell afterwards, maintains it ultra-hawkish position going forward, the markets will not like that at all.

On the other hand, if the Fed raises only 50 bps and says something to the effect that they will be patient to see what impact their policies are having on bringing down inflation, then we have a new bull market on our hands. But even if the Fed does raise 75 bps and then hedges on its tough talk, that would probably still be market friendly as it would be an acknowledgement by the Fed that stresses in the global markets also have to be taken into account.

But after last week’s rally which took the S&P 500 (SPY), $389.02 current market price, up +3.9% and knocking on the door of the $395 level again, there seems to be high expectations that the Fed is going to be more market friendly going forward. And that may be a mistake.

Because after a positive early GDP report last week that showed the economy actually grew +2.3% in the third quarter after two negative quarters, and then a Personal Price Expenditure (PCE) reading on Friday that showed inflation was still rising, albeit more slowly, there’s not really enough evidence to give the Fed the leeway to be less hawkish.

The PCE is important because it’s the inflation gauge the Fed prefers over the Consumer Price Index. Also hurting the odds that the Fed will be less hawkish next week is the fact that gasoline prices have moved back up in October after three months of declines.

All of this leads up to next week’s Fed meetings on Tuesday and Wednesday. Though obviously we have no idea what the Fed and Jerome Powell will do or say after a quiet period over the last few weeks, there’s a good probability that the markets will be disappointed by what they hear and the current market advance will probably not be sustainable.

Then there’s the fact that Federal Reserve board and committee members will, once again, be able to speak their collective minds at meetings and events over the next few weeks until the next quiet period ahead of the Dec/=. 14 rate decision. And if the past is any guide, we can expect that the tough talk on inflation and how the Fed has to stay vigilant, will just continue.

That’s sort of what happened in 2018 too until the Fed raised rates one too many times in December and the S&P 500 fell -15% between Dec. 1 and Dec. 24 before Jerome Powell was forced to pivot and take any future rate hikes off the table.

Though history may not repeat itself, it can certainly rhyme, and when you also take into consideration the Fed’s balance sheet reduction of $90 billion per month, there’s also the liquidity factor working against the markets as well. That’s a lot of headwind, and even back in 2018 when a much less aggressive rate rise and balance sheet tapering program was in place, the Fed was still forced to start cutting rates again though the first wasn’t until August of 2019.

On a positive note, any gains by Republican candidates the following week during the mid-term elections will probably be taken as market friendly. So in summary, probably a negative week next week from over-bought levels, and don’t forget the October period jobs report next Friday, but perhaps some relief after the Tuesday, Nov 8 elections.

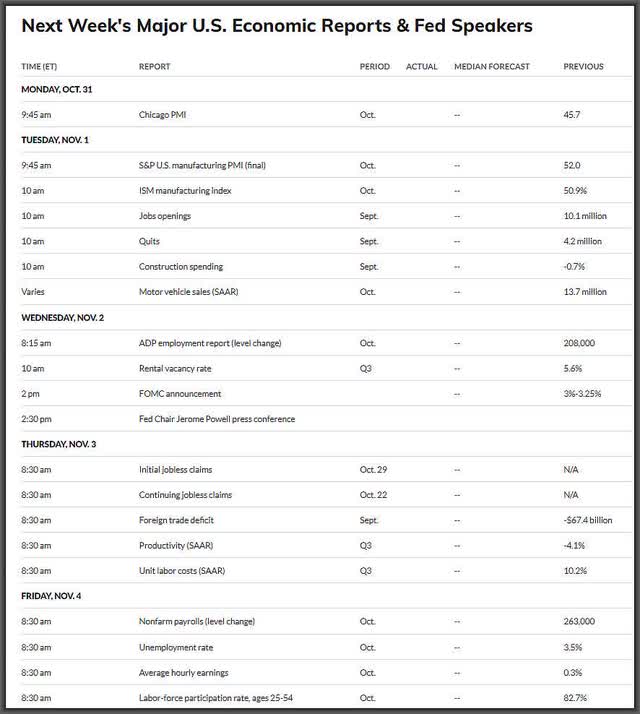

But who knows, even the elections could be locked in turmoil for some time too. Here’s next week’s economic calendar:

MarketWatch

Equity CEFs/ETFs

A very good week for most CEFs even as the major market indices gyrated up and down. What has worked? Utility focused funds have come storming back and my recommendation to add or initiate the Allspring Utility & High Income fund (ERH), $11.22 current market price, at $10.20 from Oct. 20, has certainly worked well, up 10%. But truth be told, you could have bought just about anything in the utility/infrastructure space and done well.

Another recommendation made last weekend, this time in the financials, was to add or initiate a position in the John Hancock Financial Opportunities fund (BTO), $34.20 current market price. That recommendation from Oct. 23 when BTO was at $31.81, has been good for 7.5% in just a week. And I still think both ERH and BTO are attractive here.

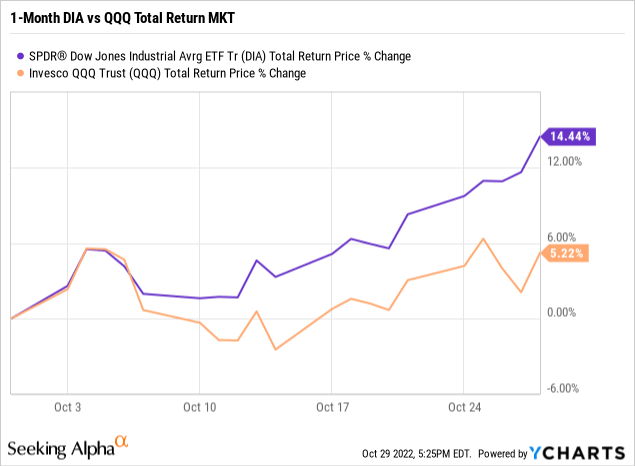

What still seems to be struggling however is technology and that’s not a surprise after last week’s earnings from the mega-cap technology names. But when the Dow Jones Industrial Average (DIA), $328.58 current market price, will probably close its best October ever, barring any unusual collapse in the markets on Monday, it’s clear that investors aren’t waiting around for technology to come back.

YCharts

At this point, it’s probably best to wait until the new year to start looking at the technology space since last week’s earnings from the heavyweights probably means institutional shareholders will not take any meaningful positions in technology for the rest of this year other than as a trade. And then you have the tens of thousands of last-minute tax-loss sellers at year end that could limit any advances too.

So where are the opportunities? Looking at the Equity CEF Performance link from above, Sheet2 offers an unusual look at what’s really working still. I don’t think I’ve ever seen the top seven leaders at total return market price all over +20% YTD while just about everything else is negative on the year.

That just goes to show you the dominance energy and energy MLP CEFs have seen this year. But can this continue? I personally would not be buying in the energy space right now but I probably wouldn’t be selling energy either.

But if you want some more ideas in this short term extended market, I would once again, look to the bottom on Sheet3. There you will still find BTO and ERH but there are a couple others I would like to point out.

First are the Cornerstone funds (CLM) and (CRF). This Monday’s close will mark the last day in October for determining CLM’s and CRF’s new distributions starting in January of 2023.

And based on where the current NAVs are at, it looks there will be a pretty significant cut in the distributions, about -31%. But I doubt there will be much of a negative reaction when it is formally announced by Cornerstone late next week since most everyone knows there will be a significant cut and even with the new reduced distributions, which won’t start until January, the current yield will still be around 18%.

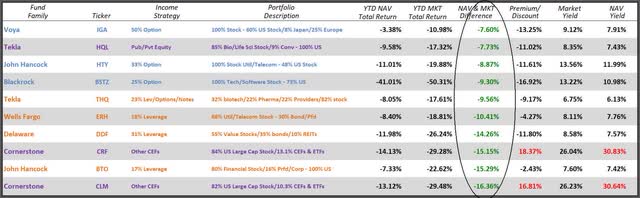

Finally, take a look at a few more funds from the bottom of Sheet3, the John Hancock Tax-Advantaged Global Shareholder fund (HTY), $4.72 current market price, and the Voya Global Advantage & Premium Opportunity fund (IGA), $8.64 current market price and the Tekla Healthcare Opportunities fund (THQ), $20.00 current market price.

Do any of these funds look like they should be performing better at market price considering their outstanding NAV performances? Here are the bottom 10 NAV/MKT Difference funds, shown in green due to the fact that their market prices are severely lagging their NAVs.

In other words, these 10 equity CEFs offer the BEST current opportunity for the fund’s market prices to catch up in performance to their NAVs, all else being equal.

Note: This table sorting changes weekly as the Equity CEF Performance spreadsheet is updated weekly for subscribers of CEFs: Income + Opportunity

Capital Income Management

I would probably wait until Wednesday to see how the markets react to the Fed decision, but if you’re looking for some more ideas in undervalued funds, there are still quite a few equity CEFs that have yet to catch up to the broader market advance.

Be the first to comment