Wolterk/iStock Editorial via Getty Images

Ameriprise Financial (NYSE:AMP) is a very successful financial investment that I picked up prior to, and after the COVID-19 crash. The company since then appreciated massively, and I turned neutral/”HOLD” on the company some time ago.

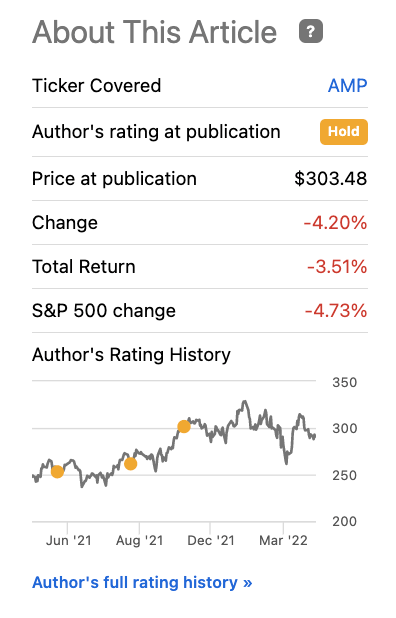

Since my last neutral article, the company has performed thusly, making my thesis at the time the right one.

AMP Performance (Seeking Alpha Article)

There have been a lot better investments than AMP since that time.

Let’s revisit the company and see what we have here.

Looking at Ameriprise Financial

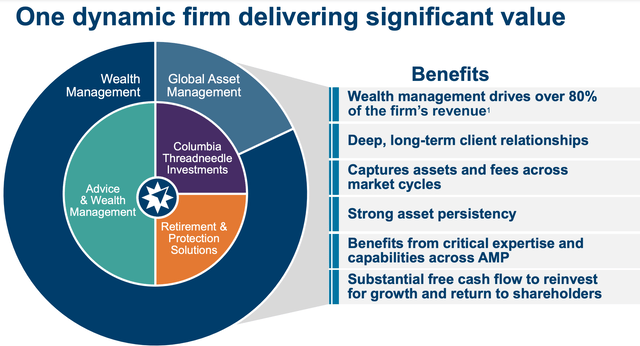

Ameriprise Financial is a great business. The company is an impressively integrated set of operations in asset management, retirement solutions, and similar services.

If something concerns wealth management, retirement, or asset solutions, Ameriprise tends to offer it. As you can see above, wealth management is now over 80% of the company’s sales revenue. Part of the company’s strength is its long-term relationship-building with its clients as well as its overall expertise.

The company has superb FCF generation, it has more than quadrupled its 10-year EPS, has returned over $18B to its shareholders during the past 10 years, and currently has $2B in excess capital. As of 2022 and YTD, the company also has more than 1.4 trillion USD in assets under management, making them one of the more significant asset managers on the planet.

The company’s performance and positives are confirmed by the company’s average return ratios, including a more than 50% operating RoE. Wealth management drives 80% of this profitability, with around 20% currently from retirement and protection solutions. This is a completely different mix than it was years ago when the segment was more than double the size of its current size.

The company now employs over 10,000 top-rated financial advisors with nearly $800k in TTM operating net revenue on a per-advisor basis. These revenues are not performance-based as such but are 90% fee-based.

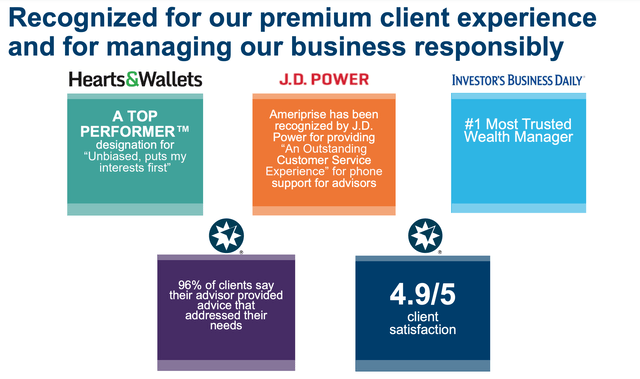

I don’t usually mention things like this, but I believe AMP’s client satisfaction ratings deserve at least a cursory mention here.

AMP Client Satisfaction (AMP IR)

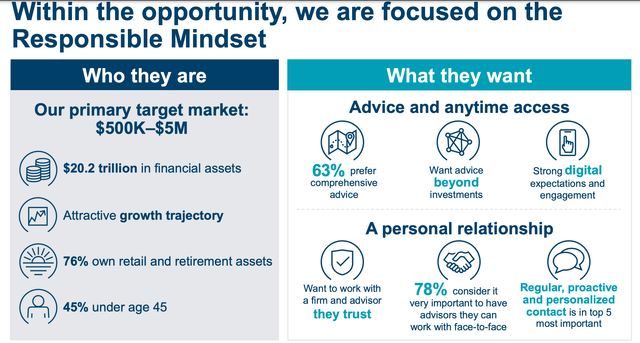

The company targets households as customers with annual incomes of upward of $500k up to $5M, and above $5M, which comes to around 17M households in the USA. The company knows its clients and knows what they typically want.

AMP is a method contrary to the now-emerging robot/purely digital advisor model. Instead, the company focuses on traditional with a new mix, where focus is on a strong client-advisor relationship. The company’s research shows that comprehensive relationships generate far greater net flows (almost 7.5X) in addition to other advantages. Therefore, the company’s model is entirely focused on the best version of this service mix, which includes regular follow-up meetings.

I’ve said it before and I will say it again. I’m not one to use services such as these, but if I were to do this and live in the US, I might be an AMP customer – I very much like what I see, read, and find out about AMP.

The company also now has bank capabilities using the Ameriprise bank, including credit cards with over 65,000 card clients, $11B in deposits, and strong recent growth in lending and home loans. Wealth managers generate a substantial portion of their profits from banking operations.

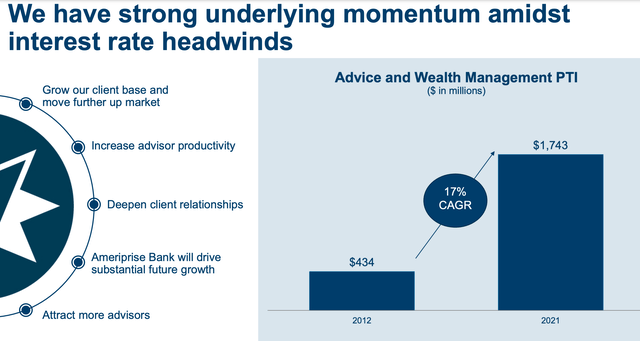

It goes without saying at this point that AMP is a superior performer to most of its peers. Compared to others, AMP has a better rate of margin expansion and higher rates of operating margin. Wealth management has an impressive rate of organic growth over time, with an over 100% growth in fund flows in less than 3 years and a 33% CAGR in total client funds in the same time frame. The company also continually improves its advisor-specific metric, the revenue on an advisor basis. In short, to work at AMP, you need to be one of the best of the best. Despite interest rate pressure over the last 10 years, the company has had a massively positive track record during those years.

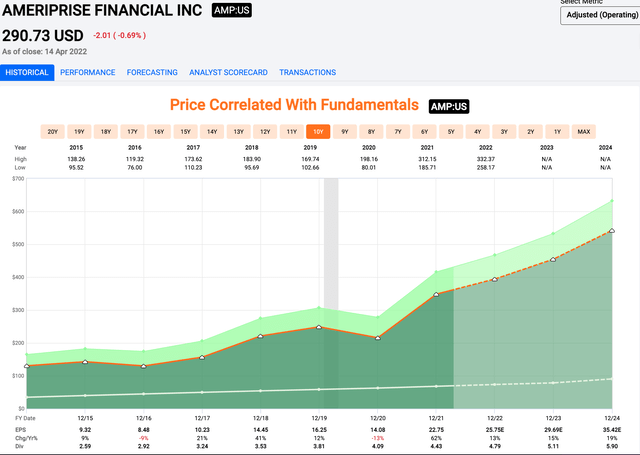

The company’s EPS track record speaks for itself. You’re hard-pressed to find a more positive trend in the same sector – and by that, I mean in the entire market.

Yes, 2020 with COVID-19 wasn’t the best year – a real dip – but otherwise, the company has almost always been growing, and growing, and growing. This seems likely to continue going forward. The latest earnings calls have specified growing client relationships, fund flows, and continued positive results. The company has also been adding to its already-impressive operations by adding other operators’ asset management segments, including banks like the Bank of Montreal (BMO). The only company on the market performing better than AMP in terms of margins is T. Rowe Price (TROW). AMP beats out companies like BlackRock (BLK), Invesco (IVZ), and Franklin Resources (BEN).

Investors in AMP have been able to generate outsized returns for the past 20 years, at above 14% compared to 7% of the S&P500, almost doubling the performance here.

This isn’t to say that AMP is entirely without risk – but I would argue that the primary risk here is valuation-related. Due to the company’s success and operations, yields are very low. Currently, the company yields less than 1.6%. My YoC is above 3%. If you buy the company at a too expensive valuation, you might end up at a sub-par RoR over long periods of time.

However, going forward, we have an upside for the company even with a relatively conservative upside.

Ameriprise Financial’s valuation

Ameriprise might look expensive, to begin with, and indeed, it can’t rightly be called “cheap” at this valuation. AMP at around 12.3X P/E is only slightly below its 13.1X normalized, 20-year P/E average. When I bought most of my AMP, it was at multiples of between 5-9X, explaining some of my relative outperformance when looking at what sort of valuation we have today.

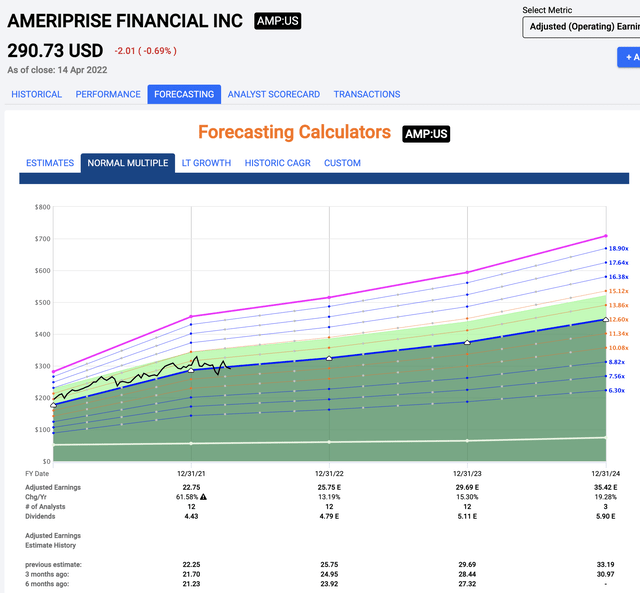

Still, the prospective growth upside based on company forecasts is nothing short of excellent here. The company’s upside has been updated, and compared to a few months or even half a year ago, most analysts have upped their upsides by at least $1-$3 on an EPS basis at this time.

Therefore, even on a 12.6X P/E basis when looking at forward multiples here, the upside is really quite amazing.

Once establishing this potential upside, the next question we ask ourselves is how likely this upside is to materialize. Here comes the good news in terms of forecast accuracy. Looking at this 18.5% annual upside to a 2024E based on a 12.6X forward P/E, analyst accuracy on a historical basis is higher than 80% if you include the positive misses (when the company actually beat estimates). It’s not entirely perfect – there’s a 15% negative miss chance on a 1-year forward basis with a 10% margin of error (Source: FactSet), but this is quite low when considering.

Also, remember that AMP is one of the highest-rated in its sector, coming in at an A-rating with very little historical downside or a record of ever having a really “terrible” year, the meaning of negative EPS or a result that threatened fundamental operations. The company has not had this.

There is if I haven’t made this abundantly clear in the previous section of this article, a lot to like about Ameriprise Financial. That’s what drew me to investing in the business in the first place and that’s why, despite having sold some of my shares at a high valuation, I still have some of my position in the company left and why I, once I have bought most of my other holdings to a decent size, intend to build more on this position and once again increase my stake, even if it’s at a lower comparative yield.

Yields on the market are lower today than they were 1-2 years ago. What once was 8-9% is now 6-7%, and what was 2-3% is now 1-2%. Returns are lower, even though we’re looking at a potential recession in the next 1-2 years, valuations for many companies are still comparatively on the high side compared to what we might want to see.

We’ll simply have to make do with the opportunities that exist – even if they’re not as good – and this is one of them!

S&P Global considers AMP a “BUY” with a decent upside here – and by decent upside, I mean that analysts consider this company 20% undervalued here. I wouldn’t go quite that high personally, but I would give AMP an upside to a 12.6X midpoint 2022E P/E, which would come to a valuation of around $305/share. This is still an upside of around 5-6% based on a current share price of just north of $290.

For the long term, I believe that the company’s expected 16% EPS growth on average will deliver almost 19% annualized RoR, which makes this company a “BUY” here again.

I’m very pleased to change my rating for this superb business, and here is my thesis.

Thesis

My thesis for AMP is the following:

- This is an excellent company at a superb sort of upside of almost 5-6% to a very conservative 12.6X 2022E midpoint P/E and with a potential 19% annualized RoR until 2024E.

- The company’s expected earnings have been adjusted in the positive direction several times over the past few months, and the company is expected to grow significantly on the background of superb fundamentals, a good market, increased interest rates, and a streamlined organization and offerings.

- I consider AMP a “BUY” with a good upside – and I own the stock here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

AMP is a “BUY” with an upside of 19% in the longer term to an annualized 2024E.

Thank you for reading.

Be the first to comment