peshkov/iStock via Getty Images

Company Overview

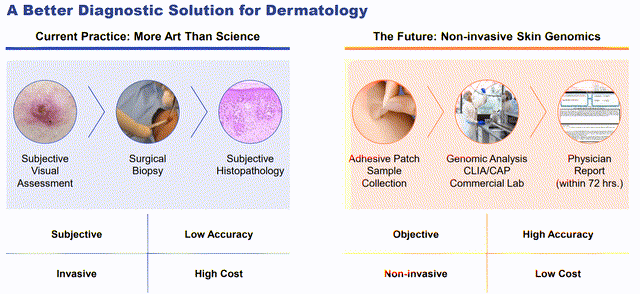

DermTech, Inc. (NASDAQ:DMTK) is a molecular diagnostic company that develops and markets non-invasive tests to diagnose skin conditions and ailments including skin cancer, inflammatory diseases and other conditions. DMTK’s solutions provide an alternative to the surgical biopsy and minimize patient discomfort, scarring and risk of infection. Its primary product is the Pigmented Lesion Assay (PLA) test – a non-invasive, proprietary, adhesive patch (or SmartSticker) that evaluates a tissue sample for melanoma. The slide below highlights the key benefits of DermTech’s PLA approach vs. traditional biopsies.

Company Investor Presentation

Updated Investment Outlook

My prior 2 articles located here and here have provided deep dives on the strategic and financial investment cases. This analysis will focus on whether DMTK is making progress on its growth plans.

On the top line, Q1 revenue grew 16% vs. Q4 2021 to $3.7 million. Unfortunately, Q1 SG&A grew at an even faster 17% pace quarter-over-quarter. This trend is starting to become the norm for DMTK, with SG&A expense growth outpacing revenue growth in 4 out of the last 5 quarters. Management has noted in recent conference calls that the company has focused on scaling its salesforce to sell its solutions at a national level. Quarterly SG&A expenses have tripled from $7.9 million in Dec2020 to $24.0M in Mar2022. Over this period, sales growth has not kept pace, with revenue simply growing $2.1 million to $3.7 million.

Although there are numerous stats around billable sample volumes that could be highlighted to show increased usage of the company’s products, the volumes simply are not growing quickly enough to support the increased SG&A investments. Management has frequently noted it will take time to bring national healthcare insurers on board and get its solutions in play across the US. This dynamic is certainly understandable and is the case for many products/solutions in the healthcare industry. However, the fact is that the company has been going after national payers for 2 years now and progress appears limited at best. Until this dynamic changes, DMTK is largely accumulating non-material financial wins. At the start of 2022, DMTK noted that it had scaled to 72 total sales reps across the US. Based on Q1 sales of $3.7 million, this implies just $51k per sales rep in the first quarter and just over $200k per rep for 2022 if this figure is annualized. Sales per rep will have to pick up substantially in the rest-of-year period if the company is to hit analyst consensus revenue of $25M.

In tandem with the increased SG&A, the company continues to throw money at research and development efforts. Now, it should largely go without saying that all companies should maintain a healthy level of R&D. Looking at DMTK’s recent R&D spend, it’s worth questioning if this level of investment is needed right now given the Company’s lack of commercialization of their SmartStickers. Over the last 2 quarters, DMTK has spent 190% and 170% of revenue respectively on R&D. Similar to SG&A, R&D expense has outpaced revenue growth in 4 of the last 5 quarters. This level of capital investment appears high, especially given the lack of returns to shareholders and stakeholders to date. Although it’s hard to pinpoint for certain which strategic initiatives are tied to this R&D spend, one possibility is that it’s going to DMTK’s DermTech Connect product. This product is a telehealth offering that’s now available in 44 states and is accessible to nearly 95% of the US population. From a strategic standpoint, the question is whether this product is truly needed. Management would note that it was built to help increase awareness of both Skin Cancer diagnostics and the SmartSticker treatment options. DermTech Connect is definitely another avenue to market DMTK’s solutions, however, results remain unclear and thus the benefit from the R&D investment is difficult to quantify.

On the most recent conference call, management highlighted several efforts that are underway to deepen and broaden industry relationships and awareness of its solutions. Similarly, there was also significant discussion about efforts to acquire customers and increase consumer awareness. Although it’s great to see the Company hitting the street and going after customers, this story has been told many times over the last 2 years of conference calls. Management noted that 1 payer was added during Q1, bringing total lives covered to 91 million in the US. This is also a nice win, but it unfortunately doesn’t solve the bigger picture problem for the company which is that adoption of its solutions is still relatively muted.

Perhaps the most disappointing aspect of the Q1 conference call was management’s view on the upcoming outlooks for rest-of-year 2022 and 2023. On the call, it was noted that-

“Much of 2022 will be spent educating consumers and testing key messages, content and digital promotion tactics, and pricing. We don’t expect meaningful 2022 revenue contribution as these educational and testing activities could take place through early 2023.” Source: Q1 Earnings Call

Not expecting meaningful revenue contribution from some of the company’s core operating activities is disappointing, to say the least. Overall, it appears 2022 will be another “business as usual” year for the company, with moderate revenue growth and some additional adoption uptick. On the bottom line, DMTK lost $30 million in Q1 and the cash flow picture is not much better with a cash from operations loss of ($25) million. In the long run, this path is not sustainable and the overall investment thesis is beginning to wash out for DMTK.

To be fair, it’s not all bad news for DMTK. After Omicron subsided, management noted that April was a strong sales month. It will be interesting to see if this momentum carries thru to the rest of Q2. Also in Q1, total billable samples reach a record of 14,370. This is an increase of 22% from the previous record that was set in Q4 of 2021. Also, 2,040 unique ordering clinicians ordered in Q1 2022 compared to approximately 1,200 in Q1 2021 — a 70% increase from the year-ago period and a 13% increase sequentially. Even in the face of some pretty strong COVID headwinds, this is true progress for DMTK and the company deserves credit.

The financial story also has some positives. The company finished Q1 with $199 million of cash and equivalents on the balance should. This should provide enough runway for around 2 years of operating activity. Additionally, DMTK remains debt-free, so the company continues to have some operating flexibility. Lastly, shares outstanding have remained very consistent at almost 30 million over the last 4 quarters so shareholders are not suffering from dilution.

The Future & Recommendation

For DMTK, the future outlook primarily hinges on the company’s ability to make significant progress commercializing its solutions over the next 12-15 months. The addition of 1-2 national healthcare payer organizations could drastically swing DMTK’s future outlook. Unfortunately, it’s hard to be confident in this outcome given the company’s recent performance and lack of conviction from management. Additionally, further commercialization efforts that management has pointed to, including increased sales headcount and the development of the DMTK Connect channel appear to be having moderate impacts. At the moment, a clear catalyst for market cap expansion is not present for DMTK.

The consensus analyst estimate currently calls for DMTK to achieve $25M of revenue in 2022. Given the current macro environment for growth stocks like DMTK, which admittedly has been unkind but is also the world DMTK operates in, it’s becoming difficult to see how the company grows significantly beyond its current $160 million market cap. Sure, maybe market conditions will improve, and the company could achieve an 8.0x price-to-sales multiple, but is that a risk worth taking at the moment? With a history of moderate sales performance, it’s unlikely DMTK will be a to grow into a 10x-12x multiple this year and the opportunity for stock price appreciation appears limited.

The aspect that will benefit DMTK the most is true sales growth. However, this is likely the path that will be hardest to achieve and why the company is really facing an all-or-nothing moment over the next 12 – 15 months. The validity, accuracy, effectiveness and potential of the company’s SmartStickers all remain. DMTK, however, must now prove that it can go from largely being an innovative product/solution to a full operating business. Without this progress, DMTK is likely either winding down operations within a few years’ time or the company will be acquired by a much large healthcare industry player that can effectively commercialize its technology.

Neither scenario is particularly appealing and thus DMTK cannot be assigned a buy rating today. Very risk-tolerant investors might take a flyer on DMTK for the significant upside down the road if the company can find some growth catalysts and increase adoption. This approach is more of a high-risk high-reward speculative play than a true investment play based on fundamentals. In full disclosure, I will continue to hold my shares which have a high average cost basis of $27. However, my view on this stock continues to be neutral, and I expect many investors will choose to sit on the sidelines for the time being.

Be the first to comment