Leestat

“Invincibility lies in the defence; the possibility of victory in the attack” – Sun Tzu

Looking at the European anguish in relation to NordStream 1 gas flows and conjunction with the alleviations of some of the sanctions taken against Russia, when it came to choosing our title analogy, us being history buffs, we reminded ourselves of the famous quote from Gallic leader Brennus, chieftain of the Senones who captured Rome in 390 BC. Brennus besieged the hill, and after subjugating the Romans finally asked to ransom their city. Brennus demanded 1,000 pounds (329 kg) of gold, and the Romans agreed to his terms. According to Plutarch’s life of Camillus and Livy’s Ab Urbe Condita (Book 5 Sections 34-49), the Senones provided steelyard balances and weights, which were used to measure the amount of gold provided by the Romans. The Romans brought the gold but claimed that the provided weights were rigged in the Senones favor. The Romans complained to Brennus, their leader, who took his sword, threw it onto the weights, and exclaimed, “Vae victis!” meaning “woe to the vanquished”, or “woe to the conquered”. It means that those defeated in battle are entirely at the mercy of their conquerors and should not expect-or request-leniency. The Romans thus needed to bring even more gold, as they now had to counterbalance the sword as well.

Given Russia’s foreign minister Sergey Lavrov has said that the “geographical objectives” of the special military operation in Ukraine are no longer limited to the eastern Donbass region but include a number of other territories, we reminded ourselves of the forgotten concept of “realpolitik” and the wise words of Otto von Bismarck:

“I know a hundred ways to pull Russian bear from its den, but no one – to pull him back. Do not tease the Russian bear!” – Otto von Bismarck.

Also, as we indicated in our June conversation “The Myopic Loss Aversion Theory“

“When it comes to the Ukrainian “tragedy” we expect a “Carthaginian peace” deal between Russian and Ukraine. It refers to any brutal peace treaty demanding total subjugation of the defeated side. This is what Russia we think, will ask from Ukraine yet there are some risks of serious escalation with a potential blockade of Kaliningrad.” – Macronomics June 2022

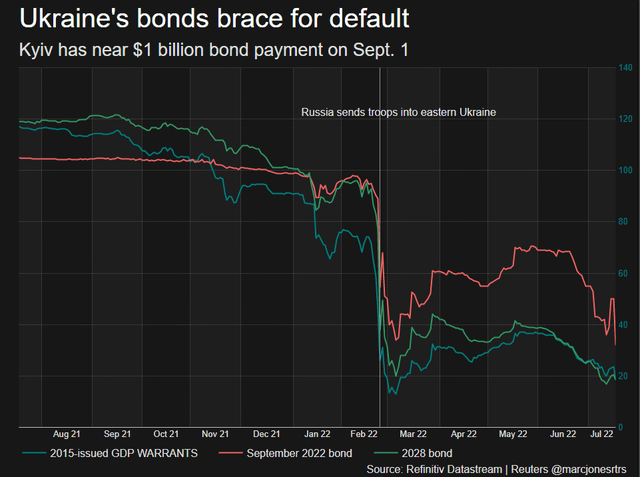

One could add that should Ukraine be defeated in battle it will be entirely at the mercy of their Russian conquerors and should not expect-or request-leniency hence our chosen title. As well given the maturity profile of Ukraine’s debt schedule and the most recent devaluation of 25% of its currency relative to the US dollar, one could certainly opine that a default of Ukraine is in the cards.

In this conversation, we would like to look at the rising probability of a Ukraine default, as well as the ongoing tussle in European politics in general and with the ECB, in particular, given its most recent 50 bps interest rate raise in conjunction of the set-up of a new acronym/tool in order to fight of rising fragmentation risk with Italy.

What is the sovereign CDS of Ukraine telling us?

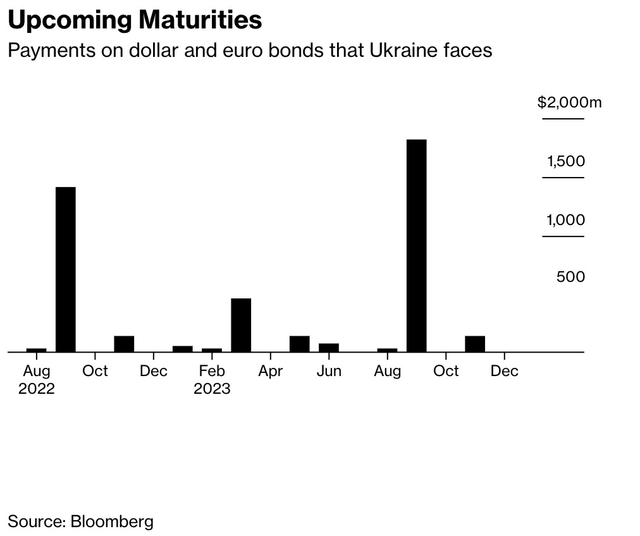

As of late Ukraine has asked its international creditors, including Western powers and the world’s largest investment firms, to “freeze” its debt payments for two years, so it can focus its dwindling financial resources on repelling Russia as reported by Reuters:

“Facing an estimated 35% to 45% crash in GDP this year following Moscow’s invasion in February, Ukraine’s finance ministry said on Wednesday it was hoping to finalise the deferral on its roughly $20 billion of debt by Aug. 9.

The delay, which was quickly backed by both the major Western governments and heavyweight funds that have lent to Kyiv, would come just in time to put off around $1.2 billion of debt payments due at the start of September.

The government’s proposal, posted on its website, said all its bond interest payments would be deferred under the plan, although to avoid what would be classed as a hard default it also offered lenders additional interest payments once the freeze ends.” – Source Reuters

A CDS is triggered when a Credit Event occurs. There are three Credit Events that are typically used for Sovereigns such as Ukraine. They are: Failure to Pay; Repudiation/Moratorium and Restructuring.

Right now, the Sovereign CDS 5-year tenor market for Ukraine is pointing towards a credit event YTD:

- Graph source Datagrapple.com

As well, if we look at the one-year chart and 3-year chart, the picture points towards default:

Datagrapple.com Datagrapple.com

- Graph source Datagrapple.com

As well, the redemption profile of Ukraine bonds points towards big pressure before year-end:

A compounding problem for Ukraine is that it has devalued its currency – the hryvnia – by 25 percent against the US dollar making matters worse for upcoming “redemptions“.

The current exchange rate stands at 36.568 to the US dollar “and remains fixed,” the NBU said. When Moscow launched its full-scale invasion of the country on February 24, the rate was 29.25 hryvnia to the US dollar.

Given Russia was judged to have “breached” the terms on a bond after missing a $1.9 million interest payment (which wasn’t due to unwillingness to pay) and triggering an insurance payout on its sovereign CDS, it seems to us reasonable to think in Ukraine’s case, a credit event will be triggered. If it isn’t deemed that the upcoming restructuring of Ukraine debt is not a credit event, then it would mean that the Sovereign CDS market is anything but functioning. Watch this space. Vae victis?

The ECB conundrum

We have long postulated that ECB was in a bind when it came to assessing its current predicament. Given the importance of the energy imports relative to the United States, the more the Euro falls, the more expensive will be its energy bill.

As well the latest rise of 50 bps, the ECB’s first hike since 2011, is in effect “tightening financial conditions” at the time where economic prospects for the European Union are not looking favorable to say the least. On top of this, rising political uncertainties coming from Italy with the resignation of former ECB supremo Mario Draghi (which we fondly nicknamed “Le Chiffre” in a previous musing of ours) are adding to the toxic mix.

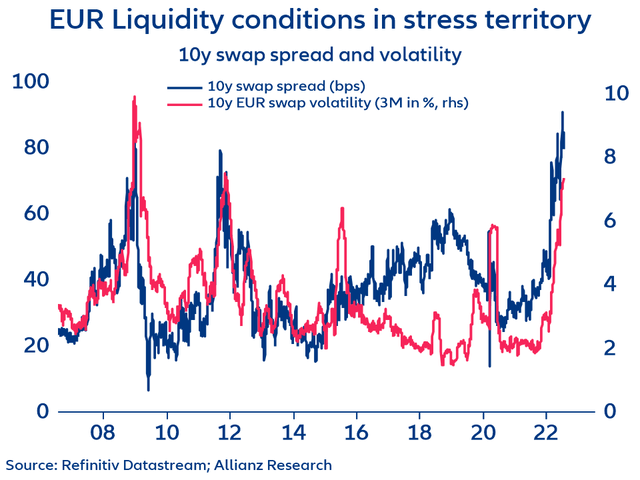

A clear illustration of the ECB’s predicament can be ascertained in the below chart from Patrick Krizan from Allianz Research:

Refinitiv – Allianz Research – Twitter

“ECB meeting will focus on rate hike and anti-fragmentation tool. But there is another risk at least as dangerous. Rates market liquidity is as tight as during GFC. 10y swap spread even at all-time high. Flight to quality, collateral squeeze, counterparty risk – not a pretty mix.” – Source Patrick Krizan – Allianz Research – Twitter

Liquidity issues always lead to Financial crisis in our book. As a reminder here is what Chapter 5 of “Credit Crisis” published in 2008, authored by Dr Jochen Felsenheimer and Philip Gisdakis is telling us about the causes of the bubble:

“A mainstream argument is that the cause of the bubbles is excessive monetary liquidity in the financial system. Central banks flood the market with liquidity to support economic growth, also triggering rising demand for risky assets, causing both good assets and bad assets to appreciate excessively beyond their fundamentally fair valuation. In the long run, this level is not sustainable, while the trigger of the burst of the bubble is again policy shifts of central banks. The bubble will burst when central banks enter a more restrictive monetary policy, removing excess liquidity and consequently causing investors to get rid of risky assets given the rise in borrowing costs on the back of higher interest rates.

This is the theory, but what about the practice? The resurfacing discussion about rate cuts in the United States and in the Euroland in mid-2005 was accompanied by expectations that inflation will remain subdued. Following this discussion, the impact of inflation on credit spreads returned to the spotlight. An additional topic regarding inflation worth mentioning is that if excess liquidity flows into assets rather than into consumer goods, this argues for low consumer price inflation but rising asset price inflation. In late 2000, the Fed and the European Central Banks (ECB) started down a monetary easing path, which was boosted by external shocks (9/11 and the Enron scandal), when central banks flooded the market with additional liquidity to avoid a credit crunch. Financial markets benefited in general from this excess liquidity, as reflected in the positive performance of almost all asset classes in 2004, 2005, and 2006, which argued for overall liquidity inflows but not for allocation shifts. It is not only excess liquidity held by investors and companies that underpins strong performing assets in general, but also the pro-cyclical nature of banking. In a low default rate environment, lending activities accelerate, which might contribute to an overheating of the economy accompanied by rising inflation. From a purely macroeconomic viewpoint, private households have two alternatives to allocate liquidity: consuming or saving. The former leads to rising price inflation, whereas the latter leads to asset price inflation.” – Source Credit Crises, published in 2008, authored by Dr Jochen Felsenheimer and Philip Gisdakis

As well, a flattening trend means that the funding costs for many companies are rising across all maturities.

Back in 2018, in our conversation, we indicated the following in relation to identifying Boom to Bust in credit markets. Simply follow high-yield corporate bond mutual funds flows:

“We would like to point out towards a Wharton paper written by Azi Ben-Rephael, Jaewon Choi and Itay Goldstein published in September and entitled “Mutual Fund Flows and Fluctuations in Credit and Business Cycles” (h/t Tracy Alloway for pointing this very interesting research paper on Twitter).

This paper points to using flows into junk bond mutual funds as a gauge of an overheated credit market to tell where we are in the credit cycle. Could that be finally a reliable “Boom to Bust” indicator?” – Source Macronomics, 2018

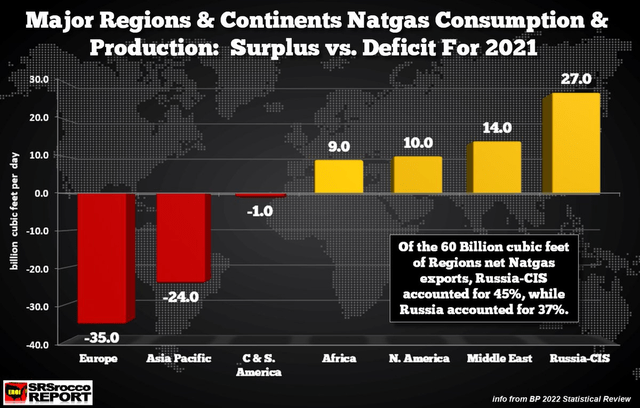

But, returning to the ECB’s conundrum, no matter what the ECB can’t print energy:

- European electricity prices are up 700% from pre-crisis levels.

- Russian gas supply to Germany is down 60%.

- Global oil demand will hit a record high in 2023.

European delusion is that they can live without Russian energy imports:

- Graph source FT – Refinitiv – Twitter

There is nothing much the ECB can do on the energy front:

“With Europe being the most dependent on Net Natgas Imports, they are paying the highest prices, followed by Asia, the second highest net importer of Natgas.” – SRSrocco Report

The ECB will have no other choice to raise rates and continue doing QE given the Italian “elephant” in the room. As well, the more the ECB “prints” the more pressure on the EUR and the more expensive will be its overall energy bill, unless of course, coal can become “green” again but we ramble again.

We would like to point you towards an excellent podcast featuring Louis Gave from Gavekal which was pointed to us entitled “How the West brought economic disaster on itself | UnHerd with Freddie Sayers“.

On a final note, the collapse of the copper price from its peak evidently is not an economic phenomenon driven only by weakening demand. Rather, it is an expression of risk aversion. Heightened risk translates into a greater desire to hold cash balances (and that means a higher dollar, because most people pay bills in dollars and therefore hold cash balances in dollars). To get higher cash balances, market participants sell things like raw materials. Hence, the sell-off we have seen in commodities in recent weeks.

“Believe me, as one who has seen a number of international crises firsthand, they cannot be handled without an understanding of history.” – Pierre Salinger

You can join Macronomics on Twitter profile as well on other means indicated in our Twitter profile.

Be the first to comment