Muenz

Thesis

Freeport-McMoRan Inc. (NYSE:FCX) released its Q2 earnings card amid a steep decline in copper futures (HG1:COM) since March 2022. However, we observed that copper futures staged a dramatic rebound that revalidated its early July bear trap (indicating the market denied further selling downside).

As a result, we believe that copper futures have likely bottomed out in the medium-term. Therefore, it also bodes well for FCX, as we also noticed a bear trap. Notwithstanding, FCX and copper futures are overbought in the near term, given their sharp recovery in July.

However, we remain confident that the medium-term recovery remains intact, even though there could be short-term volatility.

As a result, we rate FCX as a Buy. However, investors can consider a retracement before adding exposure, given its short-term technically overbought levels.

Recession Coming? The Market Is Forward-Looking

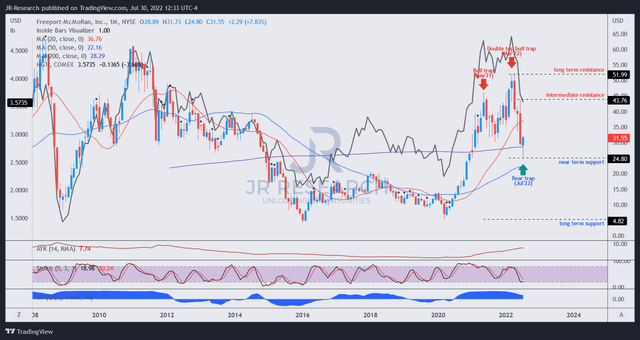

FCX price chart (monthly) (TradingView)

Given the market’s forward-discounting mechanism, we believe it has already priced in a recession since March, as seen in FCX’s long-term chart. The market set up a double top bull trap (indicating the market denied further buying upside decisively) in March 2022, after an initial bull trap in May 2021.

Similar price action is also observed in copper futures (black line overlay), necessitating investors to pay close attention to its underlying price trends.

Therefore, the market used March’s bull trap to stage the final run-up in bullish momentum from buyers before digesting it significantly.

As a result, although the US reported its second consecutive quarter of QoQ annualized quarterly GDP decline (suggesting a technical recession), FCX and copper futures held their July lows and maintained their recoveries.

The recessionary theme was also highlighted by management in its recent earnings call. However, it remains confident that the futures pricing does not reflect the realities in the physical copper market. CEO Richard Adkerson accentuated (edited):

There is a disconnect between today’s physical market and the current copper price. For us, it feels about the same as it did when copper was at $4.50. Our customers continue to report strong business. Copper inventories are at historical lows. There has been, to date, no significant impact on physical demand. But, the outlook is uncertain. Analysts are calling in a range from a near-term major recession to longer-term stagflation. Whatever happens, the long-term outlook for copper is bright. FCX is well positioned to be a major beneficiary. This world is becoming increasingly electrified with the demand for copper growing as the world acts to reduce carbon emissions with electric vehicles and alternative power generation. (Freeport FQ2’22 earnings call)

Therefore, the market reacted differently (based on price action) from what the recent economic data suggested. Why? Because we believe the market has already priced in the weakness in FCX and copper futures.

Note that FCX fell more than 50% from its March 2022 highs to its July lows. We consider the damage significant enough to resolve the potency of its bull trap.

Hence, investors should focus on its most recent price structure, which is FCX’s July bottom.

Can Freeport-McMoRan Sustain Its Current Valuation?

| Stock | FCX |

| Current market cap | $44.61B |

| Hurdle rate [CAGR] | 7% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 13% |

| Assumed TTM FCF margin in CQ4’26 | 26.5% |

| Implied TTM revenue by CQ4’26 | $29.52B |

FCX reverse cash flow valuation model. Data source: S&P Cap IQ, author

To invest in FCX, investors need to believe in the secular long-term underlying fundamentals supporting its growth. CFO Kathleen Quirk emphasized (edited):

The long-term secular demand trends for copper demand associated with electrification and decarbonization will be important demand drivers for copper. We see these trends being less economically sensitive than traditional uses of copper in the economy. S&P Global forecasts above-trend copper demand through 2035 associated with electrification and the energy transition. The report projects long-term structural deficits in copper and highlights copper’s prominent role in the global aspirations of a net-zero economy. (FCX earnings)

Copper futures pricing is also expected to remain stable through 2026, with July 2026 contracts priced at $3.787. Therefore, we believe it also corroborates our observations in FCX and copper’s bottoming price action.

We applied a hurdle rate of 7% in our valuation model and used a free cash flow (FCF) yield of 13%. We believe the yield is appropriate, given the current market dynamics.

In addition, underpinned by Freeport’s robust profitability projections, we require FCX to post a TTM revenue of $29.52B by CQ4’26. We think that level is achievable and justifies our 7% hurdle rate.

Notwithstanding, investors looking for better performance can consider waiting for a retracement first.

Is FCX Stock A Buy, Sell, Or Hold?

We rate FCX as a Buy.

Given its bear trap price action, we are confident that its July lows should hold. However, FCX is near-term overbought. So, investors can consider a retracement first before adding.

Be the first to comment