Vittorio Zunino Celotto/Getty Images Entertainment

Great brands don’t always produce great growth. When companies are being valued, of course, brand equity is factored into a company’s valuation, but even the strongest brands usually mature eventually.

There are few companies with stronger brands in the apparel and shoe industries than V.F. Corporation (NYSE:VFC). VFC’s core brands are the North Face Brand, Timberland, Vans, and Dickies. The company also has brand names such as Smartwool, Icebreaker, and Altra. VFC recently acquired the streetwear company Supremes at for nearly $2 billion, with that acquisition completed at the end of 2020.

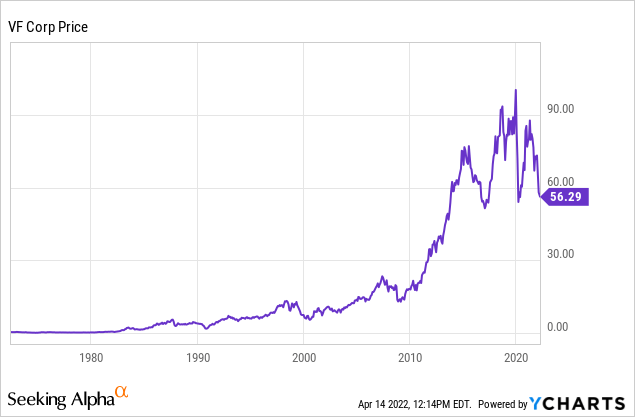

VFC’s stock went on a huge run over the 15 years before 2017.

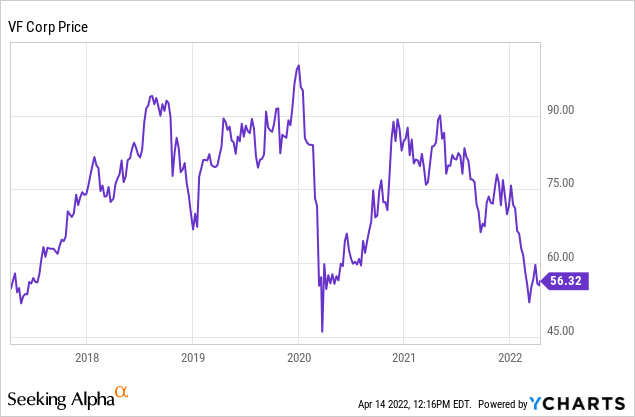

Still, the stock has gone nowhere over the last 5 years.

I wrote six months ago about the problems VFC was having growing their core brands, and specifically, about the likely coming slowdown in growth of the Vans brand.

VFC was trading at $76 a share when I wrote that article, and since then the stock has sold off 26% while the S&P 500 (SPY) has sold off just 6%.

Given the hard recent sell-off in the stock to the current share price of $56 dollars a share, I wanted to review the company’s current fundamentals. I still see no value in the stock at the current price.

VFC gets nearly 42% of its revenues from Vans, 30% from the North Face Brand, 19% from Timberland, and 9% from Dickies. VFC depends very heavily on the Vans brand, because this is the only core brand that has still consistently grown at a double-digit rate. But even the growth of Vans has been slowing, and most Vans’ recent growth has come in China, where the growth rate of this brand has also been slowing. Vans is the only major brand the VFC corporation has that has consistently grown at a double-digit rate over the last 5 years.

From 2010 to 2019, before the pandemic, the Vans brand grew at an average of around 15% per year, with most of that growth coming in Asia. The company saw the Vans brand’s growth fall dramatically from 17% in 2014 to 7% in 2015, but this brand grew at 19% in 2017 and 24% in 2019. 37% of Vans’ growth has been in Asia, and 30% of this brand’s growth was in the United States.

A Vans Logo (Vans)

The problem for VFC is that most of the recent growth in the Vans brand has been in direct-to-consumer and digital sales. In 2019 alone, direct-to-consumer sales increased by 24%, and digital sales increased by 50%. New product rollouts often produce significant short-term spikes in sales, but these growth numbers are usually unsustainable, as has been the case here. VFC recently admitted that Vans’ sales were disappointing again in the third quarter of last year, with sales growth coming in at just 8%. The company also lowered forecasts for overall sales growth in China to the high single digits this year.

China has been slow to open their economy with the country’s zero-tolerance policy, and VFC was seeing a slowdown in growth in the Vans brand in China as well as globally, even before the pandemic. This is particularly important because the company’s second and third-biggest brands, the North Face brand and Timberland, continue to see slowing growth rates as well. Even before the pandemic first hit in 2019, the North Face brand was seeing a single-digit growth in every market except Asia, and North Face’s growth rate continues to slow. The North Face brand grew at 8% in the Americas in 2019, 2% in the Americas 2020, and this brand saw sales drop by 20% in the U.S. and North America 2021. China is the only major market where the North Face brand was seeing double-digit sales growth prior to the pandemic, and that growth rate was 13%. The North Face and Vans brands make up a combined 72% of VFC’s revenues.

VFC’s Timberland brand is also struggling to grow as well. This brand saw negatives sales growth across all major markets from 2019 to 2021. Timberland sales predictably bounced back slightly in the third quarter of 2021, with sales growth of 11%, but Timberland sales growth is still negative on a 3-year average since 2019, and the company has not been happy with this brand for some time. The Timberland brand also makes up nearly 20% of the VFC corporation’s overall revenues.

VFC’s stock, sporting a 3.5% dividend yield, is not currently cheap despite the recent sell-off, either. The company trades at 17.5x forward earnings estimates, 15x forward cash flow, 2.2x sales, and 14.3x forward EBITDA. These numbers are lower than the VFC’s 5-year average, but these numbers show the stock still trades at a significant premium to peers. The average apparel company trades at 13x forward earnings growth and 10x cash flow. VFC has struggled to consistently grow revenues over the last 4 years, and consensus estimates for revenue growth in 2023 are just 7.5%.

VFC is proving that the company can build and grow brands, and there is a possibility that sales and revenue growth will accelerate in China as the country begins to open their economy later in the year. If VFC were to see revenue growth accelerate in China the company could make up for slowing growth in Europe and the Americas, but the Vans and North Face brands were already seeing growth in Asia slow before the pandemic, and even VFC’s management team didn’t see the direct-to-consumer and digital sales growth as sustainable.

VFC is a well-run company that faces the challenge of having strong but mature brands. Well, this company has shown the ability to grow brands and make successful acquisitions, management doesn’t seem likely to make any major acquisitions anytime soon, and the core brands are unlikely to see consistent double-digit growth moving forward.

VFC is a growth stock, not a value stock, and buying this stock if you don’t believe in the growth story does not make sense. Despite the recent sell-off, this company trades at nearly 18x forward earnings estimates, and the company’s core brands are likely to continue to see growth rates slow moving forward.

Be the first to comment