ktsimage

Although current market conditions have caused a lot of pain for investors, there is an upside to consider. And this is the fact that when the market is volatile to the degree it has been, it can also result in shares of quality companies trading at a nice discount. A great example of this can be seen by looking at Energizer Holdings (NYSE:NYSE:ENR), an enterprise made famous for the production and sale of batteries. The company also produces automotive care products like fragrance, performance, and air conditioning recharging devices. Recently, shares have taken something of a beating, driven in part by mixed financial performance provided by management. But even with this mixed performance, shares are trading on the cheap. Given how affordable the stock is right now, I do still believe that the company presents investors with an attractive opportunity for strong upside, especially once the market starts to recover. Due to this, I cannot help but to retain my ‘buy’ rating on the business for now.

Bad energy

Back in November of 2021, I wrote an article about Energizer Holdings that took a rather bullish stance on the company. I did acknowledge in that article that the company had something of a mixed operating history. But even with that factored in, I said that the overall trajectory of the firm was positive and that its long-term potential was promising. This was even in spite of the fact that leverage for the firm was rather lofty. Ultimately, I ended up rating the company a ‘buy’, reflecting my belief that it would outperform the broader market for the foreseeable future. However, the market has had different plans in store for the firm. While the S&P 500 is down by 23.1%, shares of Energizer Holdings have generated a loss for investors of 33%.

To be clear, much of this decline in price seems to be related to general market pessimism about the business. But this is not to say that some decline was not warranted considering how much the market has fallen. After all, when I rate a company a ‘buy’, I’m often focusing on that company’s potential to outperform the market, not the potential for it to increase or decrease on its own. Even so, the performance of the firm from a share price perspective since the publication of that article cannot be explained solely by market fluctuations. To understand the cause, we need to dig a bit deeper.

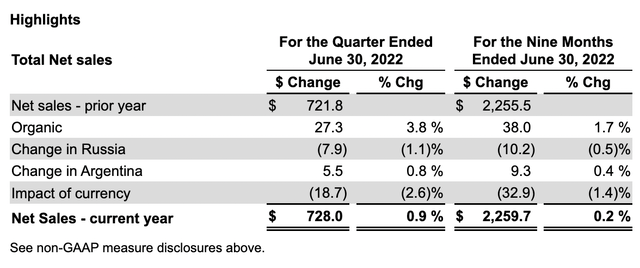

From a revenue perspective, Energizer Holdings is performing fairly well. Sales in the first nine months of its 2022 fiscal year came in at $2.26 billion. That’s roughly flat compared to the same time one year earlier. For the third quarter alone, sales have performed fairly well, coming in at $728 million. That’s 0.9% above the $721.8 million the firm generated the same time one year earlier. Although these changes may seem modest, we should discuss the figures a bit deeper because there’s a lot going into each of these numbers. For instance, for the first nine months of the company’s 2022 fiscal year, organic revenue actually rose by 1.7%, or $38 million. However, the business was impacted to the tune of $10.2 million because of Russia and to the tune of $32.9 million because of foreign currency fluctuations. Fortunately, some of this was also offset by a $9.3 million increase in sales associated with its operations in Argentina. The company keeps these figures separate because of a high inflation environment in that country. Similar changes affected sales for the latest quarter alone, with organic revenue growing a robust 3.8%, driven by pricing in battery and auto care products pushing sales up by 10%. The company also benefited in this quarter to the tune of 1% from new distribution across both segments. However, this all was offset by a 7.5% decline caused by decreased volume.

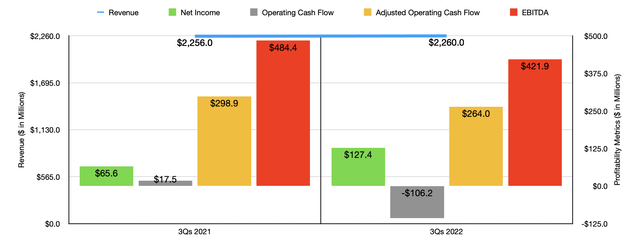

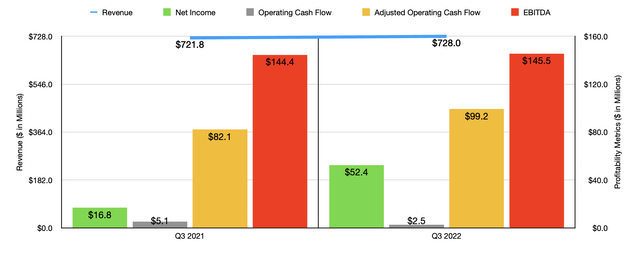

On the bottom line, the picture is also mixed. In the first nine months of the company’s 2022 fiscal year, net income came in strong at $127.4 million. That’s over double the $65.6 million generated the same time one year earlier. Most of that improvement came in the third quarter, with net income of $52.4 million dwarfing the $16.8 million experienced one year earlier. A lot of this pain is actually due to a loss on the extinguishment of debt during the 2021 fiscal year and has been driven by acquisition and integration-related costs. On an adjusted basis, earnings in the latest quarter would have been $55.5 million. That’s up from the $50.6 million reported one year earlier. And for the full nine-month window we are looking at, it would have been $158.6 million, down from the $185.5 million reported the same time of the 2021 fiscal year.

We should also pay attention to other profitability metrics. So far in 2022, operating cash flow has been negative to the tune of $106.2 million. That’s a significant swing compared to the $17.5 million reported one year later. If we adjust for changes in working capital, however, the metric would have fallen more modestly from $298.9 million to $264 million. And over that same window of time, we would have seen EBITDA drop from $484.4 million to $421.9 million. Similarly mixed results can be seen when looking at the latest quarter alone. Operating cash flow fell from $5.1 million to $2.5 million. On an adjusted basis, however, it rose from $82.1 million to $99.2 million, while EBITDA increased from $144.4 million to $145.5 million.

For the 2022 fiscal year in its entirety, management is forecasting net income of between $184 million and $207 million. On an adjusted basis, this should be higher at between $215 million and $238 million. The company also provided guidance for EBITDA to come in at between $560 million and $590 million. No guidance was given when it came to operating cash flow. But if we assume that it will increase at the same rate that EBITDA, at the midpoint, should, then we should anticipate a reading of $323.5 million.

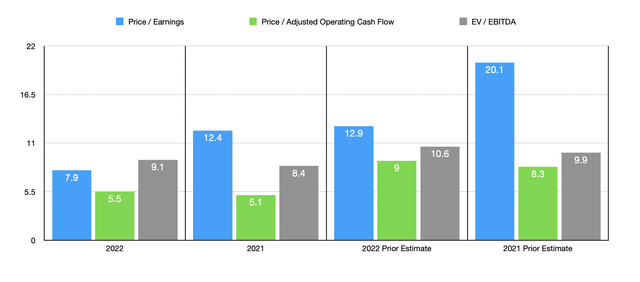

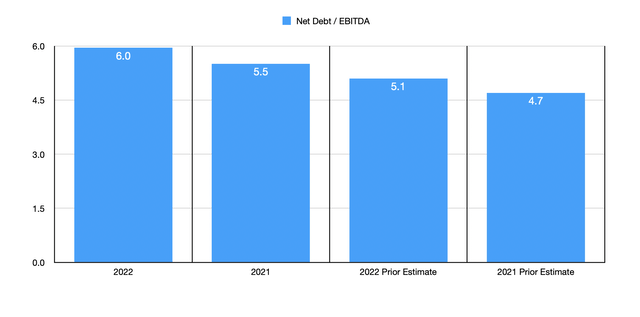

Given these figures, it becomes pretty easy to value the business. On a price-to-earnings basis, the firm is trading at a forward multiple of 7.9. This compares to the 12.4 reading we get using data from 2021. The price to adjusted operating cash flow multiple should increase from 5.1 using data from last year to 5.5 using forward estimates. And the EV to EBITDA multiple should increase from 8.4 to 9.1. As you can see in the chart above, the pricing for both years is lower than what it was when I last wrote about the company. At the same time, however, the net leverage ratio is also forecasted to be higher. Naturally, this is something that investors should keep a close eye on. But considering how much extra cash flow the company is generating, I don’t see this as a significant concern right now.

Takeaway

Normally, I would want to value Energizer Holdings relative to similar firms. But there aren’t any truly good comparable firms that are publicly traded. On an absolute basis, however, I will say that shares of the enterprise look attractively priced right now. They look even better than they did when I last wrote about the business. Given this, I have no problems, even considering the uncertainty that might lie ahead, in rating the company a solid ‘buy’.

Be the first to comment