Paul Butterfield/Getty Images Entertainment

At this point in time, consumer discretionary companies may not be viewed as all that appealing. High inflation and supply chain issues, combined with the fear of an oncoming recession, does not generally bode well for firms that sell products that are not technically needed by society. Having said that, there are some players in this category that are trading at extremely low prices and that are exhibiting attractive growth even in this difficult environment. One such example can be seen by looking at Funko (NASDAQ:FNKO). Despite broader economic concerns, the strong fundamental condition of the company and its low share price have led me to rate the enterprise a ‘strong buy’. This is further bolstered by some other recent developments that indicate additional upside for the company might be on the table.

The picture is looking up

As you might know by now, Funko is an extremely popular pop culture lifestyle brand. It’s mainly known for selling its iconic Pop! figurines. However, the company also has a variety of other products, including bags, wallets, board games, plushes, and has even recently moved into the NFT space. The strong growth the company has achieved in prior years, combined with the low share price of the enterprise, ultimately led me, in my last article on the firm published in April of this year, to rate the business a ‘strong buy’. I have also, over time, made Funko the single largest holding in my rather concentrated portfolio. So far, this call has proven to be remarkably successful. Even as the S&P 500 has dropped by 15.1%, shares of Funko have risen by 14.7%.

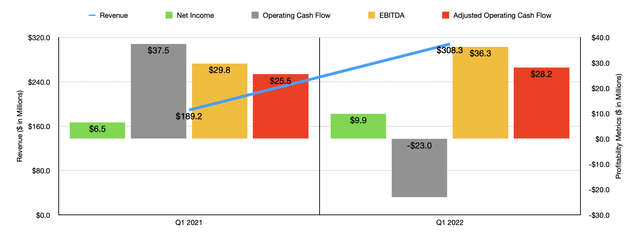

This increase in price during a difficult market can be chalked up to a couple of factors. First and foremost, we have the fact that financial performance of the company remains strong. Since my last article, we have only seen new data covering the first quarter of the company’s 2022 fiscal year. But what a quarter that was! Revenue for the company skyrocketed, coming in at $308.3 million. That’s 62.9% above the $189.2 million generated just one year earlier. The company attributed this to a weak first quarter last year that was a direct product of the COVID-19 pandemic. Growth was particularly strong in the US, with year-over-year expansion totaling 70.1%. In terms of product category, the greatest expansion came from products excluding the company’s iconic figurines. While figuring revenue rose 59.4% year over year, revenue associated with its other products jumped by 77.1%.

On the bottom line, performance was also very strong. Net income of $9.9 million represented a 52.3% rise over the $6.5 million reported just one year earlier. Operating cash flow for the company did decline, falling from $37.5 million to negative $23 million. But if we adjust for changes in working capital, it would have inched up from $25.5 million to $28.2 million. Meanwhile, EBITDA for the company also improved, rising from $29.8 million last year to $36.3 million this year.

This strong performance is likely to continue for the entirety of the 2022 fiscal year. In fact, management recently raised guidance for the year. They now think that revenue should come in at between $1.275 billion and $1.325 billion. At the midpoint, this would translate to a year-over-year revenue increase of 26.3%. Management also provided detailed guidance when it came to other profitability metrics. Adjusted net income, for instance, should be between $98.6 million and $103.8 million. At the midpoint, this would translate to a year-over-year improvement of 130.5%. Meanwhile, EBITDA should be around $189.8 million based on my calculations. By comparison, this metric in 2021 totaled just $149.9 million. No guidance was given when it came to operating cash flow. But if we assume that it will increase at the same rate that EBITDA should, then the metric, adjusted for Some other items, should be around $126.3 million.

In addition to generating strong performance, the company has also announced some rather interesting developments. Most significant was its announcement, on May 5th of this year, that The Chernin Group led a consortium that also included former Disney (DIS) CEO Robert Iger, Rich Paul (founder of Klutch Sports Group and Head of Sports at United Talent Agency), and even online auction giant eBay (EBAY), in acquiring 25% of Funko’s outstanding stock. This move did not transfer any cash to Funko but, instead, purchase the stock from ACON Investments in a deal worth $263 million. That represented a per-share price of $21.

In total, this translated to a premium over the closing price of the stock the day before the deal was announced of 25.6%. As part of the arrangement, the company also announced that it entered into an agreement with eBay whereby the online auction site would become the preferred secondary marketplace for Funko’s products. In addition to that, the two firms also partnered on creating exclusive product releases. The company also is expected to receive some guidance from Rich Paul based on his experiences in the sports and music sectors so that the enterprise can further expand its opportunities. Later, on June 13th of this year, management announced that the company had also agreed to acquire Mondo, a pop culture brand that focuses on creating vinyl records, posters, soundtracks, toys, apparel, books, games, and other collectible products. Unfortunately, terms for this deal were not disclosed, but management did say that the acquisition would not have a significant impact on financial results this year.

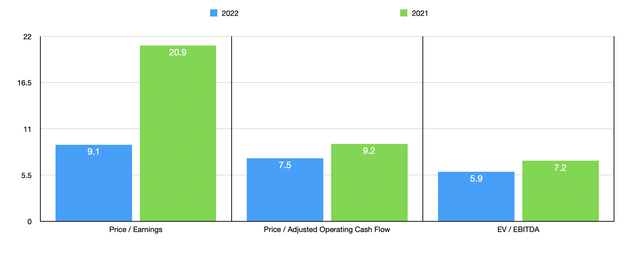

In addition to growing rapidly and striking the aforementioned developments, the company is also trading at a very low price. If we use data from 2021, the company is trading at a price-to-earnings multiple of 24.1. But that’s the only way in which shares are expensive. Using my 2022 estimates, for instance, this multiple plummets to 10.5. The 2021 data gives a price to adjusted operating cash flow multiple of 10.6. This drops to 8.4 if the 2022 estimates are accurate. And when it comes to the EV to EBITDA approach, shares are even cheaper. The stock is trading at a multiple of 8.5. But this drops to 6.7 if management’s own guidance for 2022 ends up being correct. To put this in perspective, I decided to compare the company with three other similar firms. On a price-to-earnings basis, these companies ranged from a low of 7.7 to a high of 30. Using the EV to EBITDA approach, the range was from 4.6 to 10.4. In both cases, only one of the three companies is cheaper than our prospect. Finally, using the price to operating cash flow approach, the range was from 19.5 to 96.8. In this case, Funko was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Funko | 20.9 | 9.2 | 7.2 |

| Mattel (MAT) | 7.7 | 21.1 | 10.4 |

| Hasbro (HAS) | 30.0 | 19.5 | 8.7 |

| JAKKS Pacific (JAKK) | 16.7 | 96.8 | 4.6 |

Takeaway

Rarely can you find a high-quality company that is growing at a rapid pace and that is trading at a price that many should consider incredibly attractive. Add on top of this the recent vote of confidence by the incoming investors and the acquisition management just announced, and I cannot help but to be incredibly bullish on the company. Even though shares of the firm have risen nicely while the market has declined, I fully suspect the stock will continue climbing for the foreseeable future. Shares look, to me, to be drastically undervalued, ultimately leading me to retain my ‘strong buy’ rating on the enterprise.

Be the first to comment