Juanmonino/iStock Unreleased via Getty Images

United Parcel Service, Inc. (NYSE:UPS) enjoys a solid positioning. Along with FedEx (FDX), UPS continues to exude dominance while increasing its operating capacity. However, market risks may have a disruptive impact on its performance. Also, the stock price does not seem to reflect the actual value of the company. The bearish pattern is still prominent even after the recent rebound. The target stock price using the P/E multiple is below the current stock price. Hence, investors must watch out for headwinds that may once again reduce returns.

Company Performance

As macroeconomic headwinds persist, the transportation and logistics sectors face more challenges. Despite this, United Parcel Service, Inc. demonstrates resilience by reaching its 2022 targets. It continues to deliver quality service to customers.

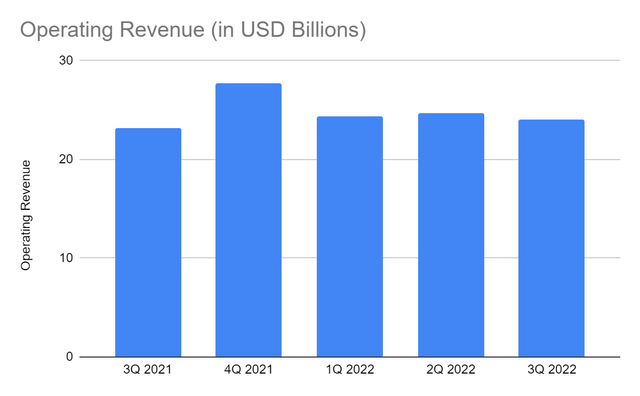

The most recent operating revenue amounted to $24.2 billion, a 4% year-over-year growth. UPS’s ability to control business dynamics allowed it to sustain its operating capacity. Domestic package remained its primary growth driver, particularly the ground segment. We can attribute it to higher purchasing power and business reopenings. The rise in ecommerce and digital transformation were other primary driving forces. It has a larger operating capacity and presence to dominate the market today. Indeed, it capitalizes on growth through prudent acquisitions. It shows that amidst skyrocketing prices, it can sustain its performance.

UPS’s International package also improved, particularly in the export segment. But the increase remained meager at 1.7%. Even so, it is still understandable due to restrictions and the ForEx impact. Meanwhile, its chain solutions segment decreased by 7%. We can attribute it to supply chain disruptions, rising fuel costs, and port congestion. Overall, the revenues of UPS appear stable.

Operating Revenue (MarketWatch)

Meanwhile, UPS’s revenue growth in recent years has been increasing. From 2.7%, it rose to 15% in 2021 and averaged 10%. However, the nine-month YoY growth as of 3Q 2022 was only 5.4%. It may still be hard to conclude UPS’s growth since the market remains volatile. It may still rebound with seasonality in 4Q, but my estimation is lower than the company’s. There may be more market headwinds, but the expansion appears unstoppable. Its recent acquisition of Bomi Group may help it sustain growth. Efforts may materialize once the economy becomes more stable. With that, we must be careful in assessing it. We must ensure UPS’s growth is driven by its actual performance and not its acquisition. It may face a problem with overcapacity if the recession takes place.

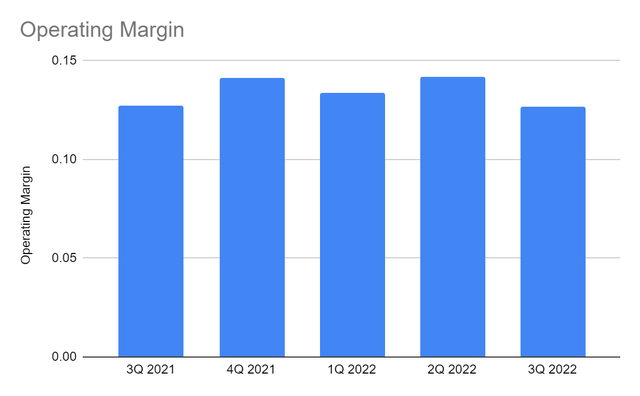

On the other hand, costs were stable, showing sustained productivity despite higher prices. But operating expenses were high for the production level. It could be attributed to higher compensation and other expenses. It was most visible in fuel expenses, with a 57% year-over-year growth. As a small package carrier, fuel is vital to its core operations. The primary driving forces were the higher energy prices, slow border reopenings, particularly in Asia Pacific, and European geopolitical tension. Despite this, a higher operating capacity captured more demand, partially offsetting higher expenses. The operating margin remained almost the same as 3Q 2021 at 12.7%. Although it was lower than in earlier quarters this year, UPS sustained its viability. It also showed a solid capacity to balance growth, viability, and stability.

Operating Margin (MarketWatch)

Market Risks, Opportunities, And Core Competencies

Opportunities remain evident. Border reopenings and port congestion improvement may help. The rise in e-commerce and digital transformation are potential growth avenues. But its potential advantages may not materialize quickly as energy commodities remain expensive. It becomes more costly as routes and energy prices are still affected by restrictions and the European war.

We have seen the impact of rising prices, port congestion, and pandemic restrictions. UPS is not an exemption. Port congestion has been a challenge for UPS. For instance, port congestion in Los Angeles and Long Beach hampered the volume flow into UPS’s network. It peaked again in 3Q 2022, with over 100 vessels waiting. Although it was a different culprit, it led to the same challenge. Likewise, the impact of port congestion in China is still evident. Despite the initial easing, backlogs remain above pre-pandemic levels. It also affects US shipments. In addition, China and Hong Borders remain closed after its recent hard lockdown. It is another problem since UPS has over 50 locations in Mainland China and several in Hong Kong.

Aside from these, overcapacity may become a problem during the recession. It must also watch out for the potential entry of smaller businesses and cheaper alternatives. Indeed, UPS sees a market mix and needs to be more prudent to stabilize revenues and margins. Unfortunately, industry headwinds appear to outweigh potential opportunities. Hence, UPS has to ensure its capacity to sustain expansion amidst the rising prices.

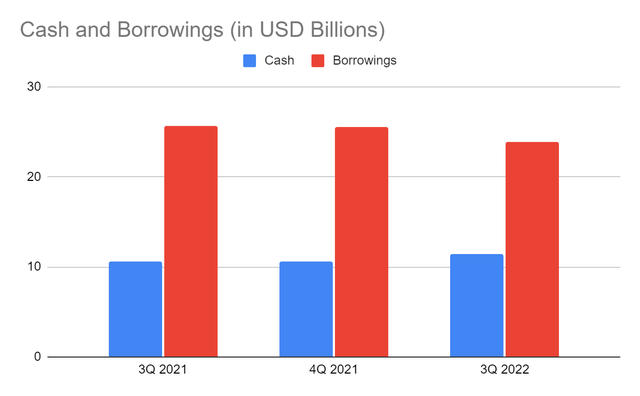

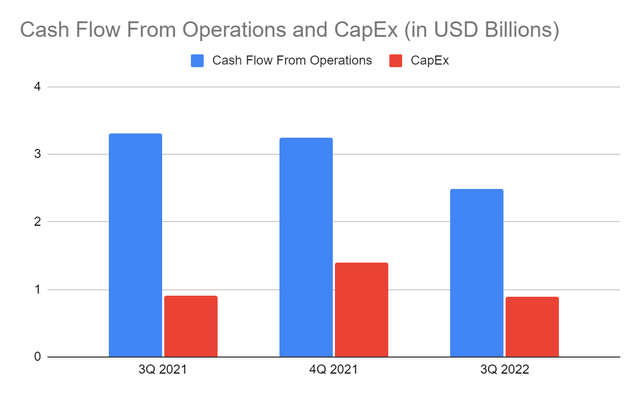

Despite this, the impressive Balance Sheet makes UPS a durable company. Cash is in an uptrend, proving that a larger operating size generates more returns. Also, it comprises 16% of the total assets, which is an ideal percentage in the industry. Borrowings are stable and lower than in the comparative quarter. The Net Debt/EBITDA Ratio is only 0.74x. It is a very low ratio, given that UPS is capital-intensive. The company is very liquid, so it can expand without raising financial leverage. Likewise, cash inflows are stable and have a positive value. Only the company appears to have a lower capacity to turn revenues into cash this quarter. It is in adherence to its lower margins. Nevertheless, its stable cash inflows can be an assurance.

Cash And Cash Equivalents And Borrowings (MarketWatch)

Cash Flow From Operations And CapEx (MarketWatch)

Stock Price Assessment

The stock price uptrend of United Parcel Service, Inc. adheres to fundamentals. It has slightly increased as it improves and expands, although it has yet to bounce back. At $179-180, it is still 15% lower than the starting price. It is a good bargain, as shown by its earnings multiple of 14x. Its Price/Cash Flow is in agreement, showing reasonable pricing. However, the target price drops to $176 to $178 if we multiply the current P/E multiple by forecasted earnings.

Meanwhile, its dividends continue to increase, with a dividend yield of 3.2%. It is even higher than the S&P 500 average of 1.82%. Payouts are also well-covered, with a dividend payout ratio of 48%. But the stock price upside has been unexciting. If we compare the stock price change to retained earnings change, gains seem insufficient. The stock price growth rate in 2016-2020 was only 83% of the growth rate in retained earnings. For every increment in retained earnings, the price only changed by $0.83 then.

In the last two years, returns have risen in line with its expansion. We have seen a massive chunk of the stock price increase. However, I still find it insufficient relative to company returns. The stock price has risen by 71%, but earnings were already more than twice the value. Indeed, there has been a massive growth disparity. Both are increasing, but their difference is wider today. Retained earnings are already eight times larger than the value.

Investors must be more careful now that market headwinds appear to outweigh opportunities. UPS is a capital-intensive company and relies on fuel and the easing of restrictions. These factors may impact its ability to achieve its potential. In turn, shareholder value may decrease again. In addition, PTBV is not impressive. We understand that being capital-intensive may lead to a higher ratio. Yet, it is very high at 9.2x and more than five times the value of FDX at only 1.8x. It shows that the stock price may not be reflecting the company’s intrinsic value. To assess the stock price better, we can use the DCF Model.

FCFF $3,208,000,000

Cash $11,379,000,000

Outstanding Borrowings $3,148,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding $864,800,000

Stock Price $174

Derived Value $102.83

The derived value adheres to my supposition of overvaluation. It also tells about the stock price inconsistency with the intrinsic value of the company. Yet, it somehow explains why the stock price increase cannot compare to income. That is, for a long time, it has been overvaluation. There may be a 41% decrease in the next 12-18 months. Dividend investors may cling to it. But, we appreciate it more since it may become a perfect opportunity for selling and generating massive gains.

Bottom line

United Parcel Service, Inc. remains stable despite the hampered growth. It has sound fundamentals, allowing it to navigate a stormy landscape. It has adequate cash levels to suffice its expansion, borrowings, and dividends. However, its actual returns do not match its expanding business. Also, recessionary headwinds may have a substantial impact on its performance.

Meanwhile, the stock price pattern adheres to its fundamentals but appears very high relative to its actual value. While I am optimistic about UPS’s improvement once the economy stabilizes, the price does not match returns. If you value dividends, it may be a hold. But after weighing risks, opportunities, and shareholder value, United Parcel Service, Inc. is a sell.

Be the first to comment