JHVEPhoto/iStock Editorial via Getty Images

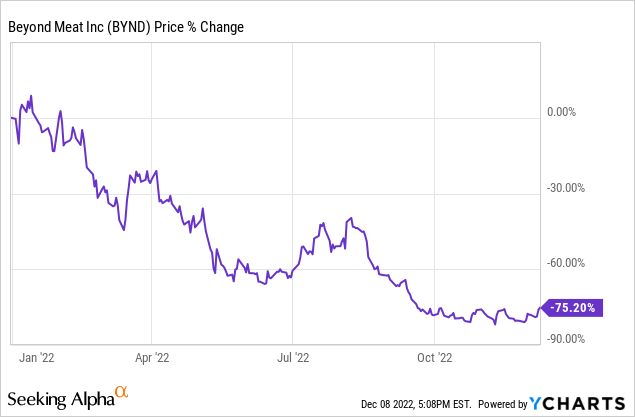

Beyond Meat (NASDAQ:BYND) faces intense competition from both established food companies and startups, which has limited and continuously will limit its growth potential. Many of these competitors have deep pockets and strong relationships with suppliers and distributors, which give them an advantage in the market. Additionally, the plant-based meat industry needs to be more specialized and highly specialized, making it difficult for Beyond Meat to achieve the economies of scale necessary to be profitable. Lastly, the company’s reliance on a limited number of raw materials, such as pea protein, also makes it vulnerable to supply chain disruptions and price fluctuations, which has been the case for the last nine months. Beyond Meat’s growth has plateaued in an otherwise growing alternative-protein market. As of today, there is no reasonable scenario in which the company will turn a profit. While the company has been able to reduce its burn, this reduction came at the expense of ~50% of its revenue. With the current cash burn, Beyond Meat has four to six quarters left before running out of money. Hence my recommendation for Beyond Meat stock is “Sell.”

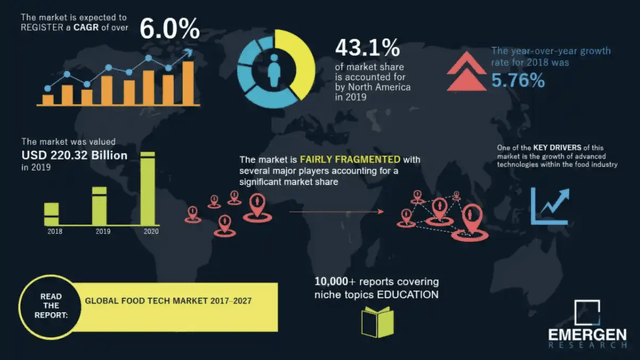

FoodTech Market:

FoodTech companies are struggling for several reasons. One primary reason is the intense competition in the market. With more and more companies entering the space, it has become increasingly difficult for FoodTech firms to differentiate themselves and gain a significant market share. Additionally, the high cost of food production and distribution and the complex and heavily regulated nature of the food industry has made it difficult for these companies to profit. Finally, consumer trust and adoption have also been challenges for FoodTech companies, as many people are hesitant to try new and innovative food products. Consumer trust has been lost over various supplement ingredients used in alternative protein foods.

FoodTech Market (Emergen Research)

Operating Margins in the Food Industry

The food industry, including the plant-based meat industry, is known for its low margins and difficulty achieving economies of scale. This means that it can be challenging for food companies to profit, especially as they face the high costs of food production and distribution. Beyond Meat, like many other food companies, must navigate these challenges to succeed in the market. Over the last two years, their performance has given little confidence that Beyond Meat possesses any competitive advantage in these areas. While the company has made efforts to expand its distribution network and develop new products, it will likely continue to face challenges as it strives to improve its margins in a highly competitive and challenging industry.

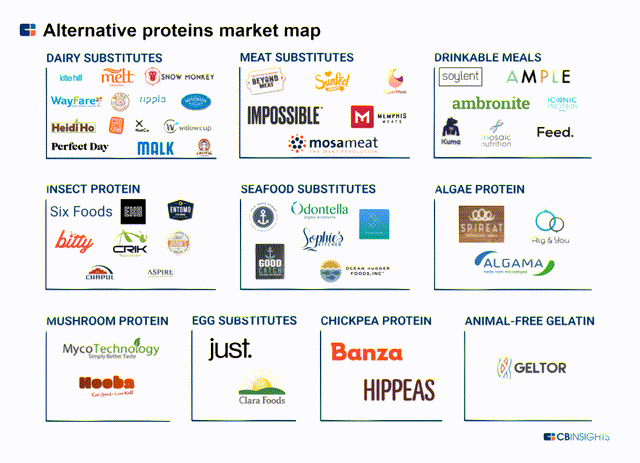

Competition

Beyond Meat faces competition from a number of companies, both established food companies, and startups. Some of its main competitors include Impossible Foods (IMPF), which makes plant-based meat products using soy and potato protein, and Field Roast, which offers a range of plant-based meat products made from grains and vegetables. Beyond Meat also competes with companies that produce traditional meat products, such as Tyson Foods (TSN) and Perdue Farms. Additionally, it faces competition from other plant-based protein companies that produce tofu, tempeh, and legume-based meat alternatives. Overall, the plant-based meat industry is highly competitive and crowded, making it challenging for companies like Beyond Meat to differentiate themselves and gain market share.

Competition (CBInsights)

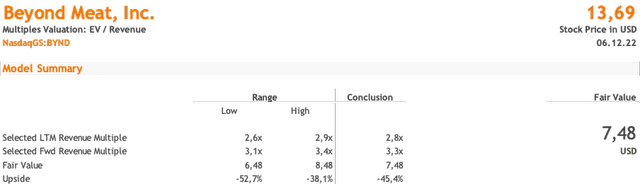

Financials & valuation

As of Q3 2022, Beyond Meat had $390 million in cash & cash equivalents. Considering an operating cash burn of $90 million in Q3 alone, the company has roughly five quarters left before it runs out of money. While Beyond Meat has taken measures to reduce burn, this has brought down revenue significantly. While the steps may help keep Beyond Meat floating, how much of the company will be left to generate money? The only case I currently see in which shareholders may see a tolerable return is in case of an acquisition of the brand. While shareholders have been cheerful in the past couple of days, with Beyond Meat stock rising, over the long-term I see more pain to go with the stock reaching a fair value of around $7.50. As for revenue, I went with the midpoint of the full-year guidance issued by management in their Q3 earnings call of approximately $414 million. The revenue multiples below represent an average of the FoodTech space and the traditional food industry and should thus present an accurate metric to evaluate future growth

Beyond Meat Valuation (Personal Source)

Conclusion

Beyond Meat faces several challenges in the market, including intense competition, difficulty in achieving economies of scale, and vulnerability to supply chain disruptions. Additionally, the company’s recent reduction in cash burn came at the expense of a significant portion of its revenue, which may make it difficult for the company to continue operating. Based on these factors, I do not believe that Beyond Meat will realistically come back, and therefore I rate the stock as “Sell.”

Be the first to comment