ewg3D/iStock via Getty Images

Camping World Holdings, Inc. (NYSE:CWH) continues to be a top holding in my investment portfolio. The bull case though is the diversified business model, growth execution, and shareholder friendliness, i.e. a sustainably high dividend yield combined with share buybacks. The main challenges are a fiercely competitive industry and a generally weak macro economy. As a shareholder, I tend to focus on things that can go wrong with investments and that helps guide my decisions.

My current outlook, also encompassing previous articles, is that inflation has squeezed margins and that slowly demand for RV and other services remain an overhang. I expect top and bottom line numbers to get worse before they get better. Too many indicators point to the fact that consumers are being squeezed by inflation and people simply cannot allocate much of their budget for discretionary spending.

More specifically, RV shipments have been declining at wholesale and retail levels, and declines are expected to continue well throughout 2023. Baird Equity Research provided more detail by stating that all RV categories declined by 41% year-over-year in August.

I’m of the mindset that eventually inflation trends will calm down in late 2023 or early 2024. Once the economy moves out of this lull period, consumer sentiment and spending should improve. But we’ll have to wait for time to run its course.

The Pain of Leverage

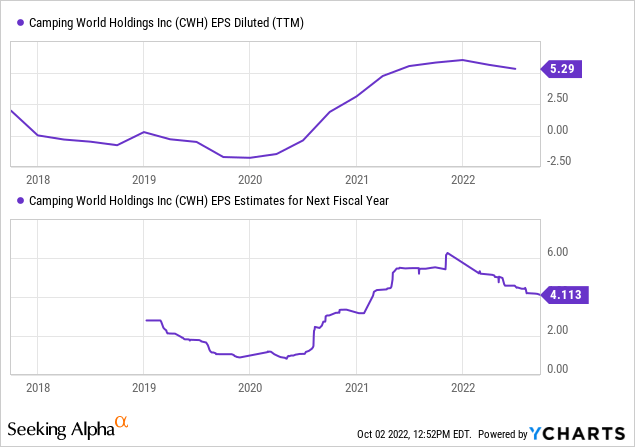

Camping World initially surged on a strong Q2 report, which disclosed record quarterly revenue and a solid earnings beat against estimates. There were a few concerns though. Despite that revenue was up 6.8%, margins eroded a touch. Going forward, the top line will probably come more into focus as wholesale and retail shipments have declined, which will cause operating deleveraging. I think overall operating performance will deteriorate for at least the next year or two before turning better in the subsequent 3 to 5 years, consistent with secular trends for RV demand and services.

In the Q2 call, Marcus Lemonis stated that interest rates do have a moderate impact on the cost of its product, but they remain affordable relative to alternative channels:

“in case it will be asked interest rate rises have a moderate effect on our business, but because we finance anywhere between 180 and 240 months and our average financing is around $40,000, average sale price is around $40,000, the numbers move, but they don’t take people out of the lifestyle, especially when you’re comparing it to airline travel, hotel travel, theme parks, professional sports eating out at night, doing a lot of other things.”

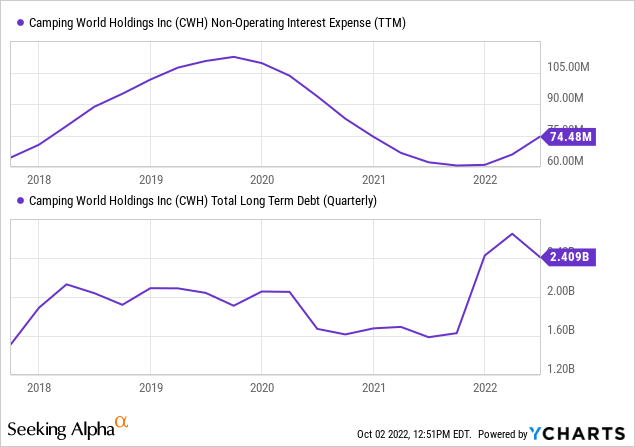

That’s fair. And I think CWH will maintain reasonable profitability, but outside of operations, rising interest rates impact future financing and investment plans. So the near-term risk I’m focused on is the interest expense line. There’s floor plan debt, term loans, and a sliver of capital leases, all of which have variable rates.

In FY21, total net interest expense reached a low point of only $61 million annually against a debt stack of around $2.4 billion. Funding new acquisitions and inventory purchases for an effective 2.5% (even less considering the interest tax shield) was an excellent way to finance the business.

As the Federal Reserve has raised interest rates and banks have increased rates embedded in their contracts in 2022, borrowing costs have risen for most companies. The pain now comes for companies that have borrowed too much.

In the Q2 report, CWH’s floor plant debt interest expense more than doubled and other debt also increased by a decent clip. That’s an aggregated increase from $15 million last year to $24 million in Q2 2022; or net swing from $60 million to $100 million annualized. So that will translate to the highest net interest expenses going back to 2019.

More importantly, this interest expense growth effectively makes shareholders lose about $1+ EPS annualized going forward, which is pretty significant for a company that earns between $4-5/per share.

We should also consider that the Fed raised another 75bps on September 22, an impact that will roll in after the Q2 report, and potential incremental rate hikes will push interest expenses to new highs. For now, the Fed remains hawkish, so, until that changes, CWH has this interest expense headwind.

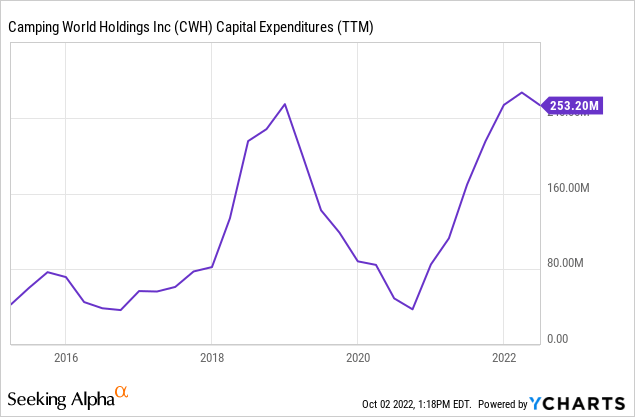

Beyond the P&L, I think it will be difficult for CWH to utilize incremental debt growth in a rising interest rate environment. I have no doubt that any new deals will make good strategic sense, but incremental debt issuance is now inherently riskier than it was last year. If management does continue with this strategy, the deals should be accretive in the short term and have a healthy ROIC against their new cost of capital.

Unfortunately, many companies that have relied on debt for the last 10 years are suddenly losing their luster in 2022 because the debt-financing game is over. We’re seeing companies see their equity multiples re-rate significantly lower, not simply due to higher discounted cash flow rates but the inherently higher costs associated with leveraged capital structures.

Given Marcus Lemonis has tremendous insider ownership, I think management will think carefully about how to finance the business going forward. Will see if management decelerates their acquisition spree and/or finances internally. One indicator to watch will be capex, and whether that moderates over the next year or two; ideally it should.

Bottom Line

While revenue and operating margins are key performance indicators, I think investors are increasingly focused on how interest expenses are impacting equity valuations. Debt funding was an excellent strategy leading up to 2022, but now investors should pay close attention to CWH’s interest expense and its impact on the bottom line. Clearly, higher rates will continue to have a measurable negative impact on earnings. The question is whether that will tweak management’s ongoing capital allocation decisions to benefit shareholders. How do you think CWH will perform? Let me know in the comments section below. As always, thank you for reading.

Be the first to comment