U.Ozel.Images

The well-known French automaker Renault SA (OTCPK:RNSDF, OTCPK:RNLSY) disappointed analysts’ expectations of €11.81 billion in revenues versus the reported €9.80 billion. Contrary to what one might think, the market did not react badly to this news, as the company confirmed the outlook for the entire FY2022; however, there are important aspects to clarify.

Highlights Q3 2022

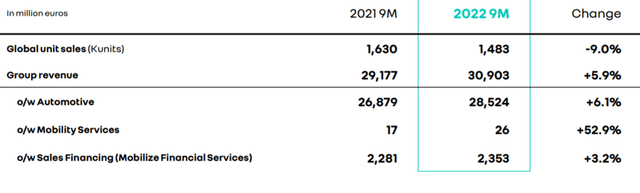

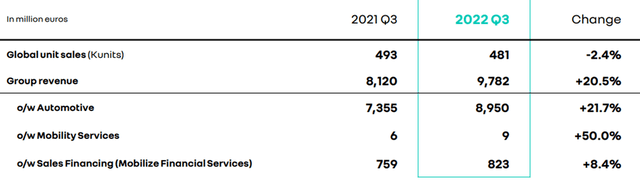

Consider that for the first nine months of 2022, there was a rather significant 9% reduction in terms of thousands of units sold. However, even though Renault sold fewer cars, the group’s total revenues still increased by 5.9%, thanks to the increase in price per unit sold. With double-digit inflation in Europe, this rise was inevitable to cover part of the increase in production costs. In addition, the ECB’s increase in interest rates makes it more onerous to buy a car through financing, discouraging its purchase by consumers. These issues are becoming more serious as the months go by.

Contrary to what one might think, however, the latest quarterly had better results than the first 9M. This surprised me, as I would have expected increasing difficulties for the company, which was not the case. Revenues for Q3 2022 were €9.78 billion, 20.5% higher than Q3 2021, plus there was only a 2.40% drop in units sold. In light of these rather positive figures, it makes me wonder if the analysts overshot the estimates, which is why the market did not take it badly when they were not reached.

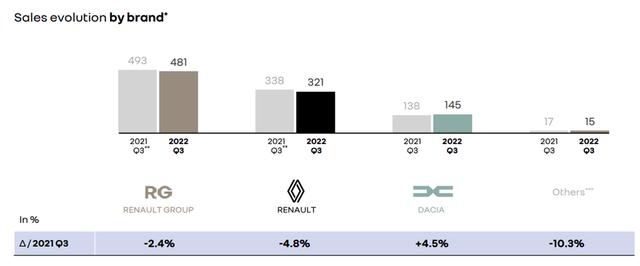

Going into more detail, it was the Renault brand that decreased total units sold, as Dacia even had a 4.50% increase.

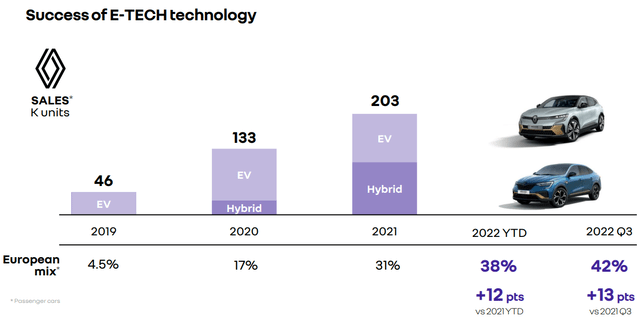

As for EV/Hybrid car sales, however, the trend is growing year after year. Renault is also focusing on the green transition and taking advantage of this fast-growing market.

So far, it seems to be a very positive quarterly, but it is time to talk about what I consider to be the main problems.

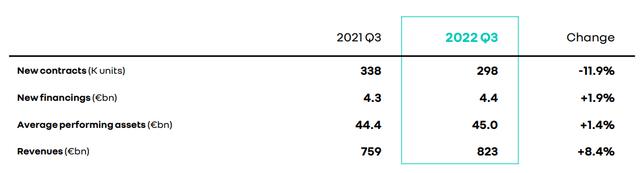

Delving deeper into the composition of revenues from financing, we can see that new contracts have fallen dramatically. Rising interest rates are beginning to discourage new consumers from buying a new car, and there is no reason to think that the trend will be reversed in the coming months. European inflation has taken on even more worrisome traits than U.S. inflation being driven by energy prices, and the ECB is largely overdue to combat it. A sharp rate hike in the coming months is mandatory and obtaining financing will become increasingly complex. In addition, the labor market in Europe is not as robust as that in the United States, which is why in the event of a recession, the unemployment rate could skyrocket. The automotive sector is one of the most cyclical, so investing in it at this stage is very risky because it would mean betting on an economic recovery, which is quite unlikely.

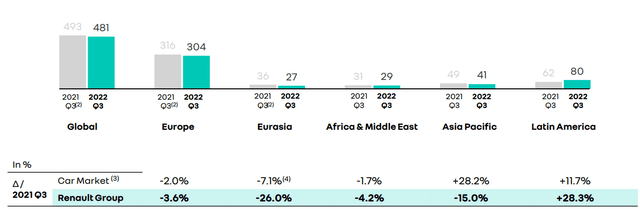

With the exception of Latin America, in all other geographic areas, Renault has seen units sold shrink more than the car market. In particular, this divergence was most noticeable in Asia Pacific, a sign that Renault is probably not exploiting this market sufficiently.

Finally, to conclude, the company’s FY 2022 outlook remains unchanged:

- Group operating margin >5%

- Automotive operating free cash flow >€1.50 billion

Final Thoughts

Renault’s Q3 2022 despite not beating analysts’ estimates showed some positive signs such as revenue growth compared to Q3 2021 of 20.50%, an increase in electric/hybrid units sold, and an increase in cars sold under the Dacia brand. As of now, there are no strong negative aspects, however, I would never buy this company as I am concerned about how Europe may react to the inflationary environment and a creaking labor market. 63 percent of the cars produced by the Renault group were sold in Europe, so in the event of a severe recession, it is inevitable that this company will suffer.

Given the current macroeconomic environment, I think it is almost absurd to believe that Europe will emerge unscathed in the coming months/years. It is unreasonable to expect the ECB to stop raising interest rates in the short-to-medium term, and this only makes access to credit more difficult, as well as slowing the consumer propensity of households to make expensive purchases. In fact, new loan contracts are already starting to decline, and I expect this downward trend to continue.

Be the first to comment