ilbusca/E+ via Getty Images

Introduction

In April of this year, I discussed Limestone Bancorp (NASDAQ:LMST), a small Kentucky-based bank which was completely flying under the radar (for instance, my article was the first article on this name in over 10 years). Understandably, as the market capitalization was less than $200M at the time, I was charmed by the bank’s valuation, multiples and strong tangible book value growth.

It looks like the Limestone Bancorp story has come to an end. Peoples Bancorp (NASDAQ:PEBO) has made an all-share offer to acquire all outstanding shares of Limestone.

What’s on the table?

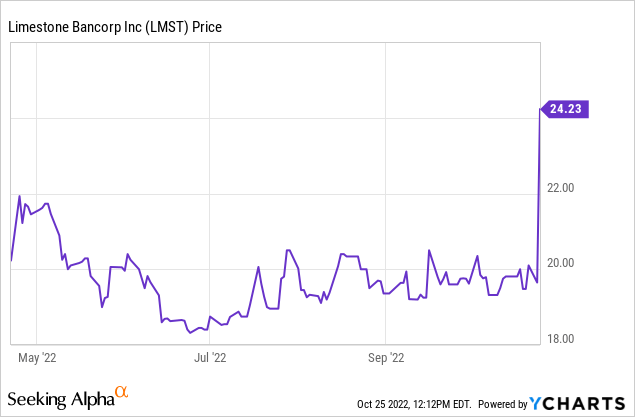

The proposal is very straightforward. Peoples Bancorp is offering 0.9 new shares of PEBO per share of LMST. No additional cash payments will be due. Based on Peoples’ closing price of $30.28 last Friday, the deal is valuing Limestone at approximately $27.25 per share. However, since the announcement has hit the wires, the Peoples Bancorp share price has been spiraling down and is currently trading at $28.36. This means the implied value per share of Limestone is 0.9 * $28.36 = $25.52. Limestone is currently trading at around $24/share, which means there’s an additional upside potential of approximately 6% (of course, assuming the share price of Peoples Bancorp will not decrease further).

Peoples is quite optimistic about this deal as it expects to generate an internal rate of return of in excess of 20% on the acquisition. That’s phenomenal as this means PEBO is eyeing in excess of $40M in annual return on this acquisition. An increasing interest rate environment will obviously help, but it clearly shows Peoples Bancorp’s confidence in how accretive the acquisition will be.

An additional bonus for income-oriented investors is Peoples Bancorp’s dividend policy. The bank is currently paying a quarterly dividend of $0.38 per share resulting in a dividend yield of approximately 5.35% at the current share price. That’s obviously much better than the sub-1% dividend yield Limestone was offering but Limestone shareholders who were interested in book value growth may not be too thrilled and may abandon ship as it’s a 90-degree turn (not a 180-degree turn) as Peoples Bancorp’s payout ratio is still very moderate at less than 50%.

Limestone did well in Q3, but this was mainly due to the reversal of provisions

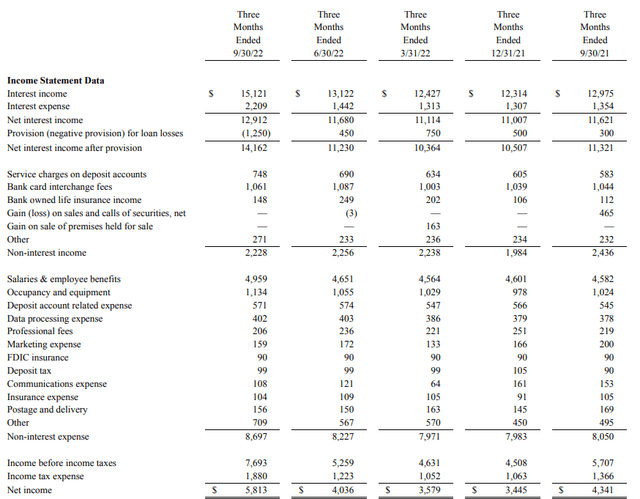

During the third quarter of this year, Limestone saw its interest income increase to $15.1M and although the interest expenses increased by approximately 50%, the net interest income still increased by more than 10% to $12.9M.

Limestone Bancorp Investor Relations

As you can see above, the total net non-interest expenses were approximately $6.45M, resulting in a pre-tax and pre loan loss provision income of $6.45M as well. Limestone was actually able to reverse some of its historical loan loss provisions and this further boosted the pre-tax income by $1.25M to $7.7M resulting in a net income of $5.8M which translates into an EPS of $0.76 per share. That’s great, but again, keep in mind that about a sixth of the pre-tax income was generated by the reversal of loan loss provisions, so the underlying result would have been lower, at an estimated $0.63 per share.

That’s still not bad as Limestone had recorded loan loss provisions to the tune of $1.2M in the first half of the year, and the EPS in the first three quarters of the year was $1.76 (and this includes just $50,000 in loan loss provision reversals). Additionally, it’s clear the net interest income is accelerating as the NII in Q3 was approximately 16% higher than in the first quarter of this year. So things were looking up for Limestone, although we surely should not “annualize” the Q3 results due to the impact of the reversal of the loan loss provisions.

Investment thesis

In the past six odd months since I discussed Limestone Bancorp, the share price of Limestone is currently up by about 11.2% (with a total return of just under 11.80% if you include dividends) while the S&P 500 is down by approximately 13%. So in theory, I should be happy with the relative performance as this clearly is a win, outperforming the S&P by almost 30% in six months, and I understand the buyout offer creates an interesting exit point.

Unfortunately for me, I only have a small position. A “placeholder” position to keep an eye on the stock, which usually helps me to keep closer tabs on names. So in my case, I will likely just sell the stock and keep the cash in my portfolio. That being said, the acquisition by Peoples Bancorp will likely add value for the Limestone shareholders as well, although I don’t know the acquirer well enough to fully support the merger.

That being said, if the PEBO share price stabilizes at the current level of $28.36 as of the time of writing this article, there still is upside potential in Limestone’s share price as the stock is trading at a discount of approximately 6% of the fair value of the offer. This could also pave the way for arbitrage as market participants could short PEBO and go long LMST and wait for the gap to close.

I haven’t decided yet if I will hold out until the merger effectively closes or if I will just liquidate my small position. I’m leaning toward monetizing my position.

Be the first to comment