Zhuqin Chen/E+ via Getty Images

Investment thesis

As the pandemic risks are fading away, SL Green Realty Corp. (NYSE:SLG) can be a good choice even in this high inflation environment. For income-seeking investors looking for monthly dividend payments, SLG could be an ideal choice with a 4.62% dividend yield and the potential for an additional one-time dividend payment at the end of the year. SLG is fairly valued and I would rather see a price closer to $70 to buy in but the fundamentals are stable and SLG’s dividend is secure and well covered. Despite the not-so-shiny 2021 annual results, the occupancy rate is very impressive and new developments could fuel the company’s growth in the future.

Business Model

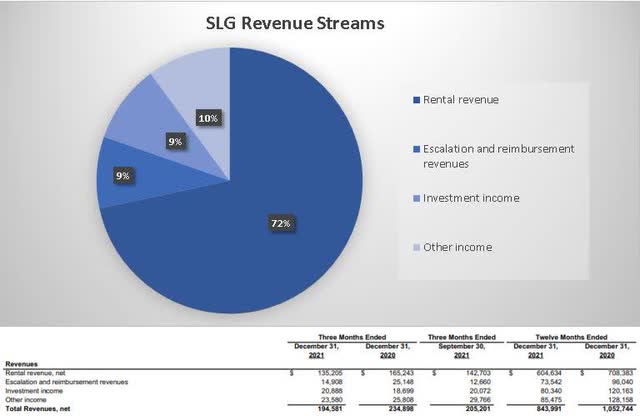

SL Green Realty is Manhattan’s largest office landlord. SLG is a fully integrated REIT, that is focused primarily on acquiring, managing, and maximizing the value of Manhattan commercial properties. The company owns approximately 5% of the total office real estate in Manhattan and has another 1.3% as secured debt and preferred equity investments. As of December 31, 2021, SL Green held interests in 73 buildings totaling 34.9 million square feet. Since SLG is a REIT it recognizes the lion’s share (almost three-quarters of its revenue) from rental income. 35% of their tenants are (not surprisingly) coming from the financial services sector as you would expect in Manhattan. Their top 10 tenants include Nike, Bloomberg, ViacomCBS, Credit Suisse Securities USA, etc.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Financials & Earnings

Q4 and 2021 annual results

The company was hit hard by the pandemic although they were the first ones who returned from WFH to lead by example in 2021. SLG’s management realized in the last years that only providing office, residential or retail spaces will not be enough for tenants so the company develops its new projects with integrated amenities into the workplace or living space. Funds from operations were $1.52 per share in Q4 2021 fell short of the estimate of $1.56 per share. The total FFO was approximately 14.5% lower in 2021 compared to 2020 full-year results due to the ongoing pandemic. Rental revenues declined by 14.69%, investment income by 33.14%, and other income by 33.3%.

Rental revenues decrease was primarily due to the disposed of properties ($45.5 million) and properties moved into redevelopment ($39.7 million). The investment income decrease was a result of a decrease in the weighted average balance and a weighted average yield of the company’s debt and preferred equity investment portfolio which shrunk by 21.43% while the average yield went down from 7.7% to 7.1%. Other income decreased mainly due to lower lease termination income which would have been great if the other income segments grew.

Future plans

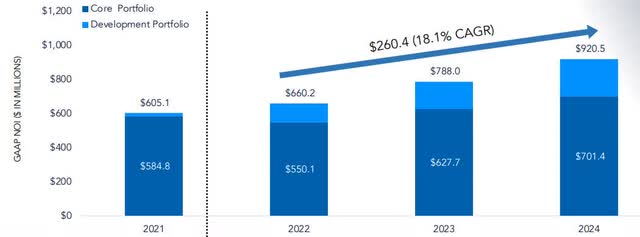

The company has an above the average occupancy rate of 93% and the management intends to shrink the 7% vacant places. “This market – Manhattan market has a vacancy rate of 16% to 18% depending on what source you use and our portfolio is only 7% vacant and shrinking.” Marc Holliday, CEO. The company had a total of $605.1 million in net operating income in 2021 and the management intends to grow it by 18% CAGR until the end of 2024.

2022 CITI GLOBAL PROPERTY CEO CONFERENCE

Valuation

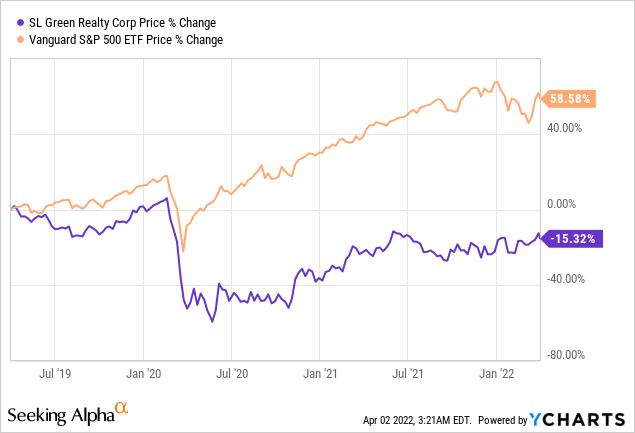

SLG is fairly valued. The company lost approximately 55-57% of its value during the first shock of the pandemic and since then the stock price could more or less recover. However, it is still 18% below its pre-pandemic height. At the moment it is trading at approximately 8.4x its forward FFO which is better than the sector average. In addition, there is a relatively high short interest in the stock with 8.67%. SLG’s price to tangible book value remained relatively stable in the last 9 months ranging between 1.16 to 0.96. At the moment it is trading at 1.12x its TBV.

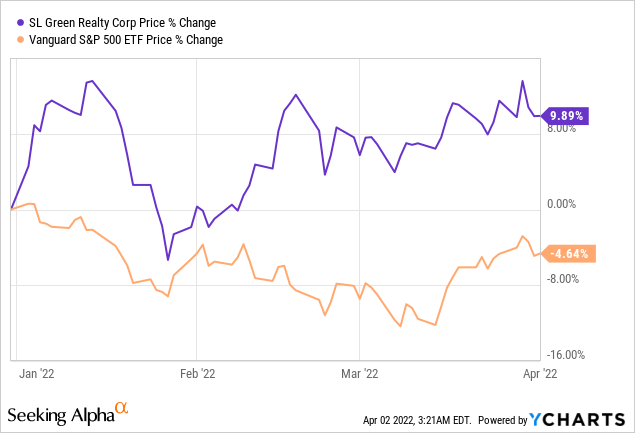

It is interesting to compare its price return to the market because it can lead to interesting facts. If we compare the S&P500 price return to SLG we can see that the pandemic hit the company hard while the overall market not only recovered but hit new record highs. This is the same situation as in the 2008 financial crisis when SLG was hit hard and took many years to recover (if we only take into consideration the actual 2008 crisis) while the S&P 500 could recover relatively fast. However, looking at only this year when the overall market was hit by interest rate hikes, the Ukrainian war, etc. SLG remained strong and had a positive return compared to the S&P 500.

Company-specific Risks

A significant majority of SLG’s property holdings are comprised of commercial office properties located in midtown Manhattan. Their property holdings also include some retail properties. As a result of the concentration of the company’s holdings, its business is dependent on the condition of the New York metropolitan area economy in general and the market for office space in midtown Manhattan in particular. Five of their properties accounted for 39% of the portfolio’s annualized cash rent. In addition, unfortunately, this makes the company vulnerable to terrorist activities. In the aftermath of a terrorist attack, tenants in the New York metropolitan area may choose to relocate their business to less populated, lower-profile areas of the United States that those tenants believe are not as likely to be targets of future terrorist activity.

The upward swing in construction cost is a major risk factor for SLG’s new developments. Supply chain disruptions due to the war in Ukraine could affect the cost of raw materials and sourcing difficulties can occur. In my opinion, this rise in raw material costs will not affect SLG operations significantly because the company recognizes the majority of its revenue from rental income.

The vast majority of the company’s investment loans are floating rate loans which means the rising interest rates are advantageous for them. However, under their 2021 credit facility and certain property-level mortgage debt bear interest at a variable rate. In addition, SLG could increase the amount of its outstanding variable rate debt in the future, in part by borrowing additional amounts under their 2021 credit facility but the interest on those loans will be higher than before.

My take on SLG’s dividend

Current dividend

SLG has been paying a consecutive dividend for 24 years but the company has no consecutive dividend growth history. The management intended to grow the dividend when the real estate and office market was stable but they had to cut the dividend in 2008. Since the beginning of 2020, the company pays a monthly dividend. The management announced a slightly increased monthly dividend from $0.3033 per share to $0.3108 per share from December 2021. SLG is currently yielding at 4.62% which is slightly higher than the sector average.

Future sustainability

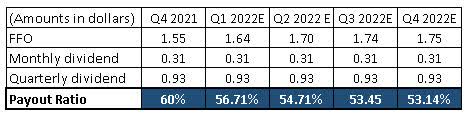

Earnings estimates are realistic in my opinion for the next quarters as companies already returned to the office and the old leases need to be renewed. The FFO growth can be further supported by residential and retail units and investment income. The payout ratio is sustainable and secure in the long term even if the management decides to raise the current dividend. Analysts expect a smaller dividend increase in 2022 than in the previous year. The last increase was 2.47% and analyst estimates are 0.33% but I think this is a very conservative estimate. I would rather suggest a 1-2% increase because of rent increases due to inflation.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final Thoughts

There is no doubt in my mind that SLG is a good company with great dividend coverage and a stable future outlook. Comparing SLG to the overall market I think it is a safer choice at the moment because of recession fears due to the inverted yield curve, war insecurity, and supply chain disruptions. For income investors SLG can be a safe and good choice in the long term, however, I would like to see a better valuation to have some shorter-term capital gain as well. I would consider a buy position at around $70 because the $81 is a bit expensive for me taking into consideration all the valuation and fundamental factors.

Be the first to comment