Pascal Le Segretain/Getty Images Entertainment

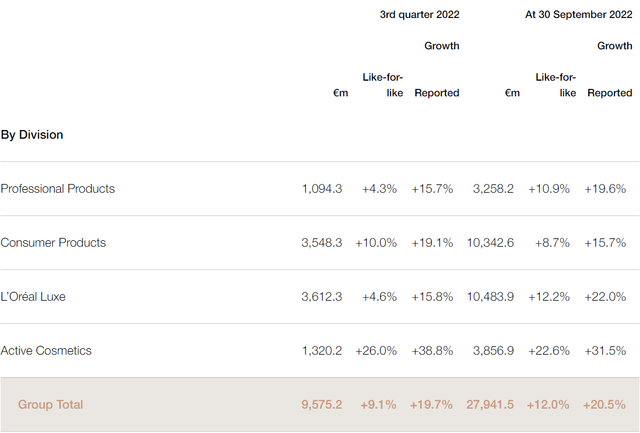

For the sixth consecutive quarterly, L’Oréal (OTCPK:LRLCF) beat analysts’ estimates by reporting revenues of €9.58 billion versus the expected €9.15 billion. Q3 2022 was very solid overall and showed no relevant signs of weakness related to the current macroeconomic environment. According to CEO, Nicolas Hieronimus, the global beauty market remained dynamic and consumer appetite for beauty products is intact. All this has further strengthened L’Oréal’s position as the world’s No. 1 beauty company.

Highlights of Q3 2022

Every division of L’Oréal achieved double-digit growth this Q3; however, a large part of it came from a positive impact of the exchange rate. In fact, as L’Oréal is a European company, it benefited from a weakened euro against major international currencies in foreign sales. This mainly impacted sales to the U.S., where the dollar had not been so strong against the euro in 20 years. Professional Products and L’Oréal Luxe were greatly affected by this, as their growth would have been below 5% if we had considered a constant exchange rate.

There will now be an in-depth look at how individual divisions performed in 2022 excluding Q4. I will premise that I will evaluate only organic growth, excluding the impact of the exchange rate being an exogenous factor.

Professional Products Division

This division is responsible for 11.60% of total revenues. As of September 30, growth over 9M 2021 was 10.90%, driven mainly by sales in India, mainland China, Brazil, and Germany. The hair care market takes a key role in this division, where L’Oréal performed well thanks to Kérastase, Serie Expert, Shades EQ, and Inoa.

Consumer Products Division

This division is responsible for 37% of total revenues and is the second largest. As of September 30, growth over 9M 2021 was 8.70%, lower than all other divisions. Most of the growth achieved was derived from growing demand in India, Latin America, and emerging markets; Europe and North America showed less growth as the market for beauty products in these two geographic areas was already saturated. Driving the growth of this division were once again the major brands; Superstay Vinyl Ink lipstick and Bare With Me concealer serum for the makeup segment, Elvive Hyaluron Plump and Garnier for the hair care segment.

L’Oréal Luxe Division

This division is responsible for 37.50% of total revenues and is the most important. As of Sept. 30, growth over 9M 2021 was 12.20%, a more than positive result considering that Q3 2022 was adversely affected by continued lockdowns in China and the difficulty of sourcing key products such as perfume bottles. Revenues nevertheless grew in every geographic area, and paradoxically the most important result was achieved in China. Lockdowns significantly weakened the beauty market, but L’Oréal achieved a remarkable sell-out performance, widening the gap with its competitors even further. Performing best in this division were the blockbusters Libre by Yves Saint Laurent, La Vie est Belle by Lancôme, Paradoxe by Prada, and Armani Code. In the burgeoning fragrance market, L’Oréal has a significant competitive advantage thanks to its brands, which have been appreciated worldwide for decades.

Moving from the fragrance segment to skincare, Lancôme Rénergie Triple Serum represents the main innovation, Helena Rubinstein and Lancôme Absolue have bolstered the positive trend of the entire division. Finally, in North Asia Takami experienced strong growth.

Active Cosmetics Division

This division is responsible for 13.80% of total revenues and is the one that has grown the most; in fact, as of September 30, growth over 9M 2021 was 22.60%. The products sold in this division are often the result of partnerships with healthcare providers, and in some cases their sale is possible only by prescription. In 2022, the growth of this division was higher than the average for the dermocosmetics market thanks mainly to the La Roche-Posay and Vichy brands. Finally, in October this division acquired Skinbetter Science, a brand involved in the sale of skin care products and presenting a cutting-edge dermatological research segment.

Is it worth buying L’Oréal now?

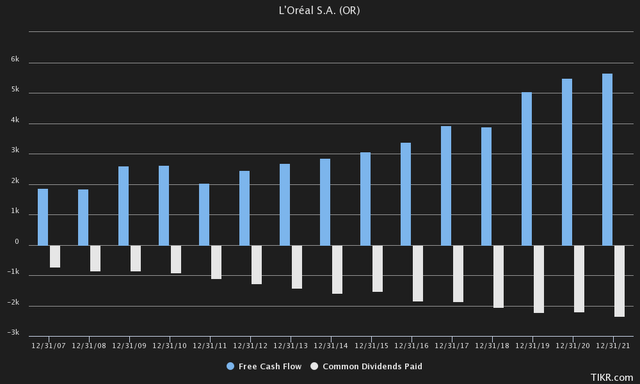

Overall, the Q3 results showed once again that L’Oréal is one of the most reliable consumer staples, as its products show steady growth even during difficult economic times. Whether it is a simple Garnier shampoo or an expensive Yves Saint Laurent perfume, people can hardly give up these products in their daily lives. After all, this Q3 is nothing but a continuation of a growing trend that has been going on for years.

Since 2007, the long-term trend of free cash flow has been increasing, and it has always managed to amply cover the dividend issue (current dividend yield 1.55%). Soundness is L’Oréal’s strength, yet when one wants to buy such companies the main problem is always the same: they are expensive.

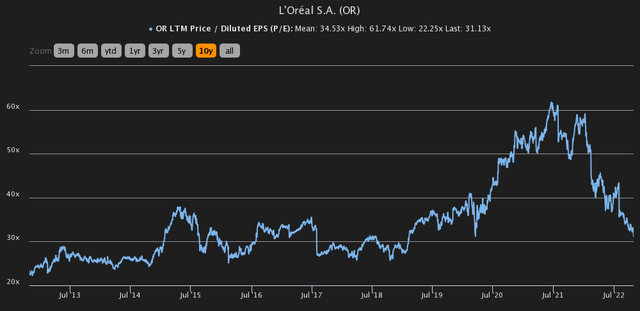

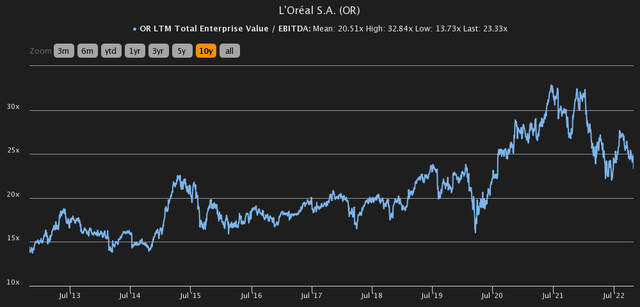

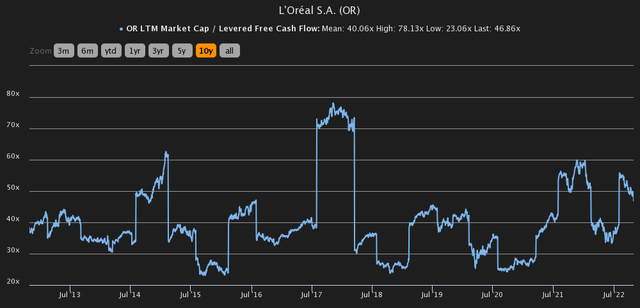

Their price multiples are often higher than market multiples and are not justified by expected future growth. Personally, when it comes to valuing such dominant companies as L’Oréal, I prefer to compare price multiples with their historical values rather than with those of competitors, otherwise one risks running into misleading results.

LTM P/E is 31.13x, while the historical average for the past 10 years is 34.53x.

LTM EV/EBITDA is 23.33x while the historical average for the past 10 years is 20.51x.

LTM Market Cap/ Levered Free Cash Flow is 46.86x while the historical average for the past 10 years is 40.06x.

Price multiples are still too high and far from the lows achieved over the past 10 years, which is why my rating is a hold. At €310 per share L’Oréal is neither given away nor overvalued, but traded at a reasonable price. Thinking of starting to build a position might be a good idea, but I personally prefer to wait for €250, aware that I may never buy it at this price. The dividend yield is still too low and capital gain expectations are not that high being a consumer staples. Better to wait for a further drop.

Be the first to comment