Justin Sullivan

Introduction

Berkshire Hathaway (BRK.A) (BRK.B) has been on a spending spree recently, acquiring shares in several companies, some of which I also find interesting. I’ve already written a piece about Citibank (C), where Berkshire has been buying stock in recent quarters. However, this one will be about HP Inc. (NYSE:HPQ). The 11th largest position in the Berkshire Hathaway Portfolio, and also a recent one. In this article, I will review HP Inc.’s fundamentals and outline why I also believe it is a good stock to consider.

HP Inc. is a multinational information technology company that develops printers, personal computers and related supplies. The company announced in 2014, that it would split into two separate companies. The company in this article is the one that retained the PC and printer segments, with the PC segment accounting for ~70% of revenue.

Fundamentals

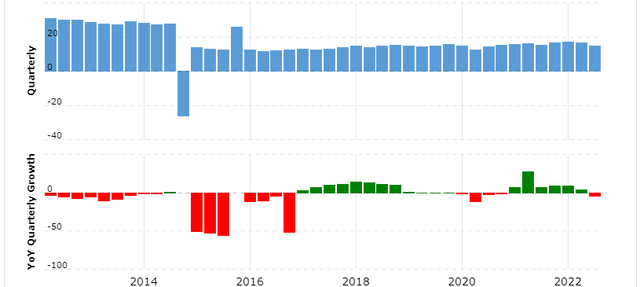

The revenue from HP Inc. has for many years been stable and consistent, but also just slowly growing. This is somewhat to be expected given the size of the company and the fact that the company is not building new equity. Revenue has, however, been slightly increasing after the split in 2015 due to growth in both segments, with the PC segment leading the way.

Analysts expect revenue to fall slightly next year.

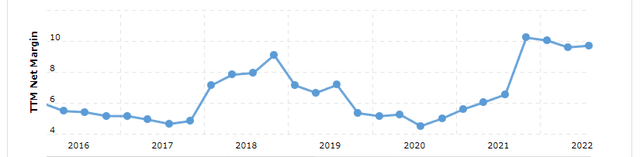

The net profit margin has also been stable. The company has not experienced periods of unprofitability and is unlikely to experience it anytime soon in my opinion.

Although the profit margin is on the low end, it is well within the industry standards.

It is clear to see, that HP Inc benefited from the sudden demand during covid. As demand now has fallen, I doubt how sustainable the current profit margin is.

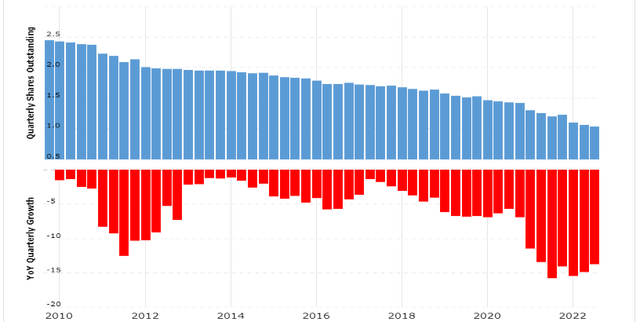

With the steady flow of profits, most of it has been spent on share buybacks. This was true before the split, and has only accelerated in recent years. As seen in the image below, a large portion of their outstanding shares have been bought back. What has not been used for share buybacks went to pay the dividend.

The dividend currently yields ~3.7%. The payout ratio is at a comfortable 25%, which has been the norm since the split.

Capital Allocation

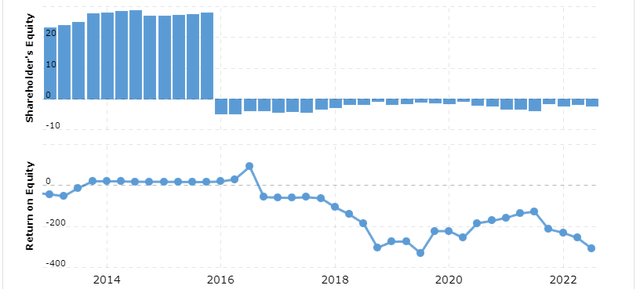

As briefly mentioned above, the company does not really reinvest earnings back into capital-producing assets. Equity has been kept at an almost constant value. I think it would therefore be unreasonable to assume that the company would show much net income growth going forward.

As can be seen in the picture below, equity has not been built in recent years.

Since not much of the earnings go toward building equity, I think it’s safe to assume they’ve probably been mostly spent on either dividend payments and/or share buybacks. In this case it has been a mixture of both.

Given that the returns from both dividends and share buybacks depend on the market valuation of the company, investors should cherish these low valuations.

I believe management is doing the best they can with their limited possibilities of how they can use excess cash. They recognize that the company is already large in a saturated industry and that growth via reinvestment is limited. Making meaningful acquisitions with the size of the company is also challenging, so share buybacks are one of the few tools left.

Given that returns from dividends and share buybacks are likely directly correlated, and that investors avoid the tax with share buybacks, I think management is prudent by buying back shares.

Valuation

The shares in HP Inc. have (since the split) traded at low multiples. The average p/e has been 9.22, which is well below the standard multiple of 15. I think this is partly due to the amount of net debt that HP Inc. is carrying. A high debt should justify a lower multiple, as it increases the cost of the investment.

I also believe the lower multiple is given because of the company’s capital allocation. Since investment returns in this case are likely highly correlated with share buybacks and dividends, a low multiple must be provided for the investment to remain competitive.

Were the company to trade at a standard 15 multiple, dividends and share buybacks would yield a total of only 6.66%. Not very competitive compared to the average S&P return of 11.8%. On the contrary, trading at a p/e of 9.22, which is the average of HP Inc., the total return now stands at 10.8%.

A return to its average p/e of 9.22, which I believe is an appropriate multiple, would indicate that it is undervalued by ~30%.

Stock Chart

Quick disclaimer. A technical analysis in itself is not a good enough reason to buy a stock but combined with the company’s fundamentals, it can greatly narrow your price target range when you buy.

I have included many years of data in the image below to show the power of the moving averages. Notice how the stock tends to stay above the moving averages, but occasionally dips below the 50 moving average. This is very common for consistently growing businesses.

The 200-month moving average is typically only touched during market crashes or if the company’s fundamentals deteriorate rapidly. This was true during the market crash of 1990 and 2002, when the market crashed. What was different during the stock price crash of 2012, was that it was not the market that crashed, but instead the fundamentals of the company that declined.

With annual growth once again being the norm, the moving averages can once again greatly narrow the buying range. Based on the stock chart alone, a price close to the 50- moving average seems exciting. This would currently be at today’s price.

Final thoughts

This is clearly not a growth stock. Investors shouldn’t expect a quick profit from this stock, but should instead expect at least low double-digit annual gains going forward.

Management hardly reinvests any earnings back into the company. Equity has remained the same since the split, so it may be optimistic to expect a lot of growth in net income going forward.

The low multiple may make the company seem extremely cheap at first glance, but as we have discovered, it is probably necessary for the investment to remain competitive. However, I believe that despite the weak forecast for next year’s earnings, the investment will yield good returns. Trading at a p/e of ~6.6 is far below its average p/e. Given that the company mostly spends its earnings on the dividend and share buybacks, both of which benefit from low valuations, investors should see good returns going forward.

I believe the company will continue to pay dividends and buy back shares, which in total is currently yielding ~15%. Should the stock be rewarded with a higher multiple in the future, which I think is likely to happen, then a return to its fair multiple of ~9.22 would result in capital gains of ~30%.

The company is sitting at a moving average of 50, which is a strong support area supported by a historically low multiple with large share buybacks. I therefore give the stock a “bullish” rating.

Be the first to comment