Funtap

Author’s note: This article was released to CEF/ETF Income Laboratory members on September 26th.

The Vanguard Total World Bond ETF (NASDAQ:BNDW) is a diversified global bond index ETF.

BNDW is a relatively lackluster fund, with few significant benefits. BNDW only yields 3.1%, significantly below current inflation rates, and moderately below its (riskier) peers. BNDW does focus on relatively high-quality, safe, bonds with strong credit ratings, but these have been of little benefit during the current inflationary environment. On the other hand, BNDW has above-average duration and interest rate risk, which has led to relatively large losses YTD, and which could lead to further losses if inflation remains elevated and rates continue to rise. BNDW’s international / global holdings make it a slightly riskier investment than purely U.S. bond funds, while not providing meaningful diversification. Although these are all minor issues, all things considered, the fund provides even fewer, smaller benefits. As such, I would not be investing in the fund at the present time.

BNDW Basics

- Investment Manager: Invesco

- Underlying Index: Bloomberg Global Aggregate Float Adjusted Composite Index

- Dividend Yield: 3.11%

- Management Fee: 0.06%

- Total Returns CAGR (Inception): -0.36%

BNDW Overview

BNDW is a diversified global bond index ETF. It tracks the Bloomberg Global Aggregate Float Adjusted Composite Index, an index of these same securities. It is a relatively simple index, investing in all fixed-rate, investment-grade bonds meeting a very basic set of liquidity, size, currency, and other assorted criteria. Bonds issued in emerging market currencies are not included in the index. Dollar-denominated bonds issued by emerging markets technically are, although these are a relatively small proportion of fund assets. Foreign-currency bonds are included too, but foreign currency risk is hedged through the use of derivatives.

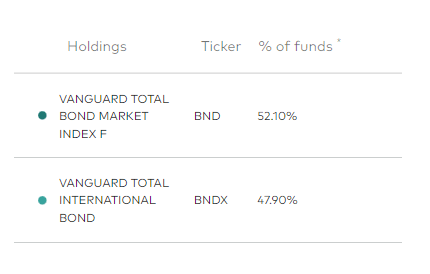

BNDW’s underlying index can be split in two: a U.S. aggregate, tracked by the Vanguard Total Bond Market ETF (BND), and an international aggregate, tracked by the Vanguard Total International Bond ETF (BNDX). BNDW could track its index by investing in the underlying holdings of the same, or in these two funds: both are equivalent choices. BNDW chose to invest in these two funds, almost certainly for simplicity’s sake. Allocations are as follows.

BNDW Corporate Website – Cropped By Author

Fund of funds like BNDW are sometimes very expensive, but that is most definitely not the case for BNDW itself. The fund has an expense ratio of only 0.06%, and said ratio includes any and all fees, including those of its underlying holdings / funds.

BNDW’s underlying holdings are incredibly well-diversified, high-quality funds, which provide several benefits for investors. Let’s have a look at these.

BNDW – Benefits and Positives

Diversified Holdings

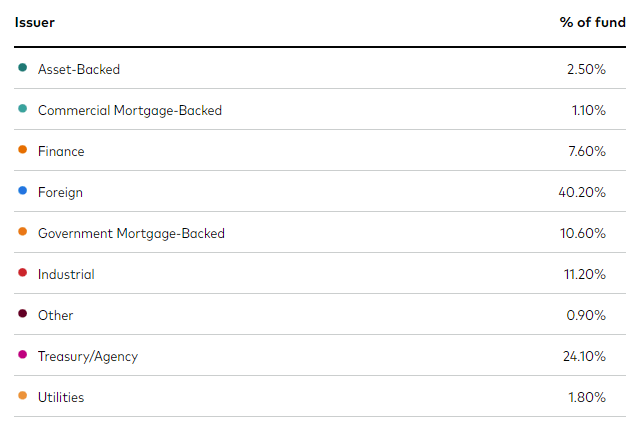

BNDW provides investors with exposure to over 16,000 individual bonds, of all relevant types / from all types of issuers. These include sovereign bonds, corporate bonds, mortgage-backed securities and others. Sovereign bonds, especially treasuries, are overweight, as these issuers encompass a significant portion of investment-grade bond markets.

BNDW BNDW

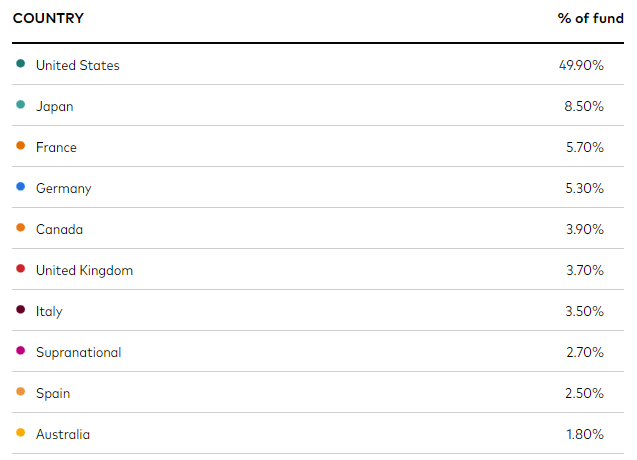

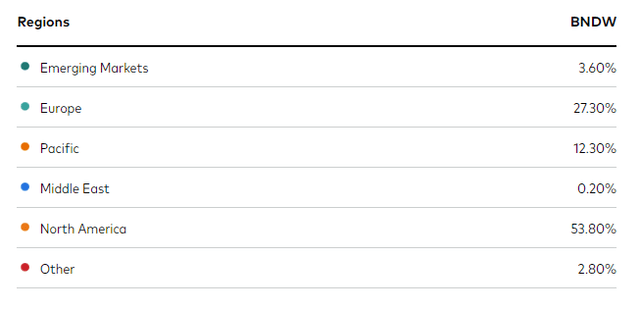

BNDW invests in bonds from dozens of countries. As with most bond funds, the fund is overweight U.S. securities, due to the large size of the country’s economy and debt market. BNDW does technically invest in emerging markets, but only relatively small, token amounts.

BNDW

BNDW is an incredibly well-diversified fund, providing investors with more than sufficient exposure to global bonds. Diversification reduces portfolio risk and volatility, and all but precludes the possibility of significant losses or underperformance due to losses or defaults in any one specific bond or issuer, benefitting investors.

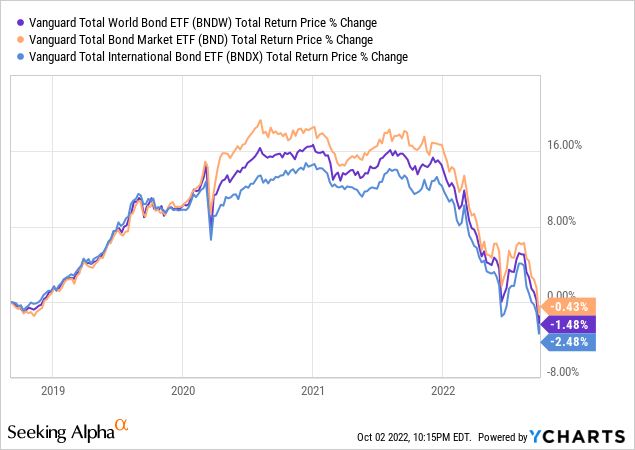

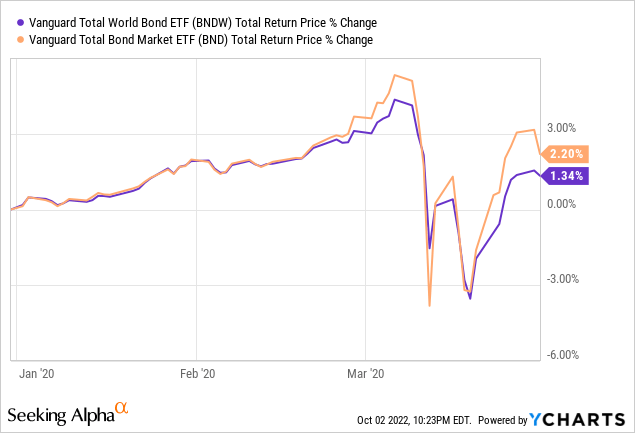

As an aside, BNDW’s international investments do not meaningfully increase fund / portfolio diversification. This is because investment-grade U.S. and international bonds are broadly similar securities, and behave in similar ways. BNDW’s performance is almost always identical to the performance of BND and BNDX, although a small, long-lasting gap did open during early 2020, during the onset of the coronavirus pandemic.

In any case, considering the above, I do not believe that BNDW’s international holdings provide meaningfully excess diversification to investors. Focusing on U.S. bonds / BND would have been fine as well.

High-Quality Holdings

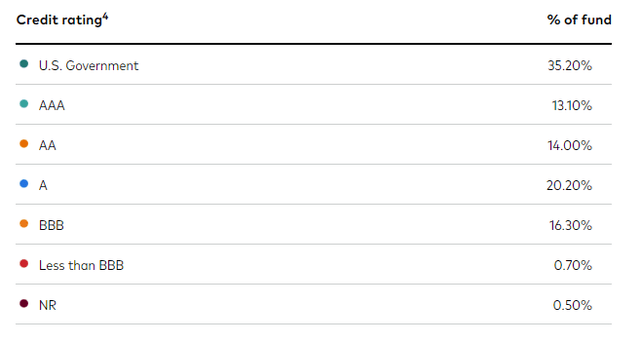

BNDW exclusively invests in investment-grade bonds, with over 2/3rds of the fund’s portfolio consisting of bonds rated AA-AAA.

These are strong credit ratings, with very low default rates, and issued countries or corporations with strong balance sheets and fundamentals.

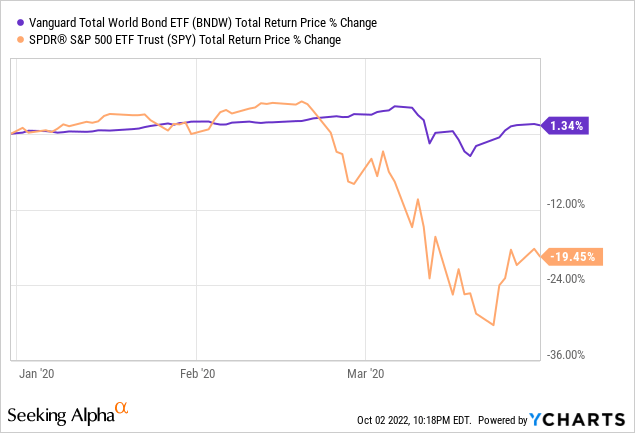

BNDW’s high-quality holdings protect investors from the possibility of losses from defaults, real or perceived. Expect the fund to perform reasonably well during recessions and periods of economic stress, as was the case during 1Q2020, the onset of the coronavirus pandemic.

BNDW’s high-quality holdings have very little credit risk, a benefit for the fund and its shareholders. The fund does face other important risks. Let’s have a look at these.

BNDW- Risks and Drawbacks

Interest Rate Risk

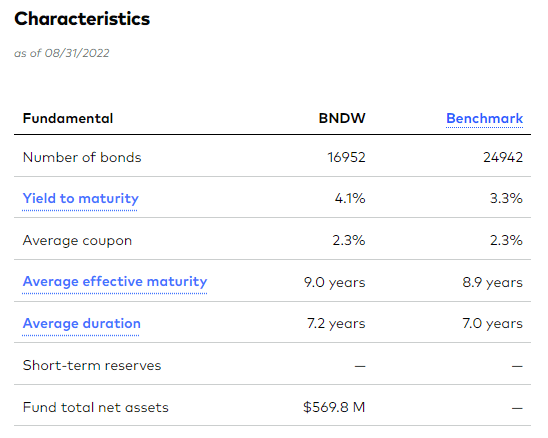

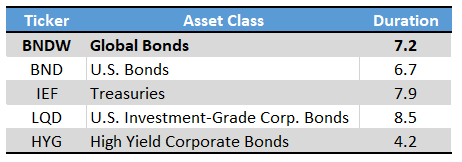

BNDW exclusively invests in investment-grade bonds, issued by high-quality counterparties with strong credit ratings. Credit-worthy institutions tend to issue long-term bonds, to minimize interest rate risk, rollover risk, and, in prior years, to lock-in low interest rates. Due to this, BNDW sports a duration of 7.2 years, a relatively high figure, indicative of high interest rate risk. On a more positive note, the fund’s duration is about average for a broad-based bond fund.

Fund Filings – Chart by author

BNDW’s somewhat high duration is a negative for the fund for two reasons.

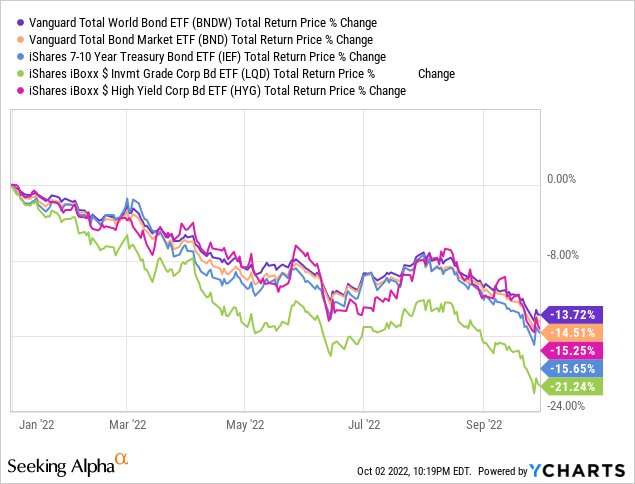

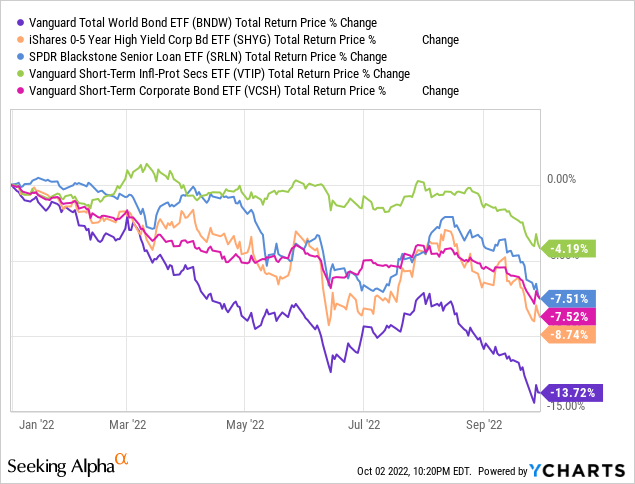

First, is the fact that interest rates are rising across the board, as the Federal Reserve hikes rates to combat elevated inflation. Higher interest rates have led to high losses for BNDW and its shareholders, although these have been slightly lower than average.

Inflation remains elevated, which could lead to further interest rate hikes, resulting in even more capital losses in the coming months.

Second, is the fact that there are several bond funds out there focusing on short-term or variable rate bonds, with lower duration and interest rate risk. These funds have performed comparatively well YTD and would outperform relative to BNDW if rates continue to increase. BNDW compares unfavorably to these funds under current market conditions, a negative for the fund and its shareholders.

International Risk

BNDW’s international bonds are slightly riskier than comparable bonds issued by U.S. counterparties, due to the strength and resilience of the U.S. economy. Expect slight underperformance relative to comparable U.S. bond funds during downturns and recessions, as was the case during 1Q2020.

BNDW’s European holding, accounting for 27.3% of its portfolio, look particularly risky right now, due to the energy crisis engulfing Europe.

Low Dividend Yield

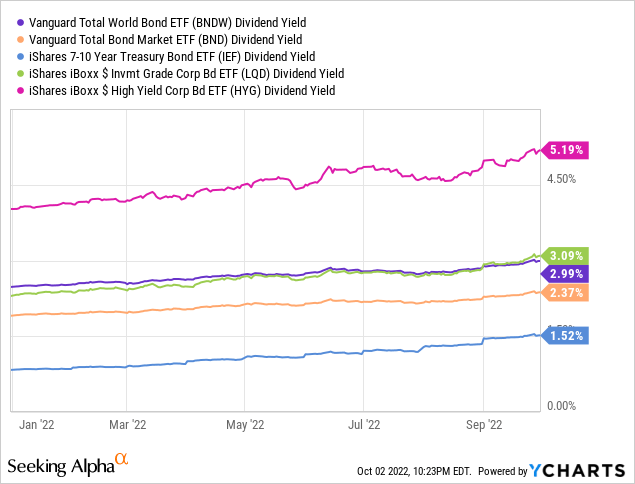

BNDW currently yields 3.1%, a relatively slow amount, although about average for a bond fund.

As BNDW’s dividend yield is not materially lower than average, it might not be accurate to describe it as a negative, but it is most definitely an absence of a positive. Lots of funds sport strong yields, including those focused on high yield corporate bonds, BDCs, mREITs, and other niche asset classes, but BNDW does not. Income investors might prefer higher yielding alternatives to BNDW, in my opinion at least.

Conclusion

BNDW is a diversified global bond index ETF. BNDW is a relatively lackluster fund, with few significant benefits, but several minor risks and negatives. As such, I would not be investing in the fund at the present time.

Be the first to comment