Dilok Klaisataporn

Today’s central argument is that Vanguard Value ETF (NYSEARCA:VTV) is a low-volatility vehicle instead of a value fund. The ETF exhibits clear signs that it is low-volatility driven. However, value metrics are astray.

We do not have an opinion about whether the ETF is a buy, sell, or hold. Instead, we aim to enhance market transparency by formulating a constructive, unbiased thesis.

Value In Today’s Climate

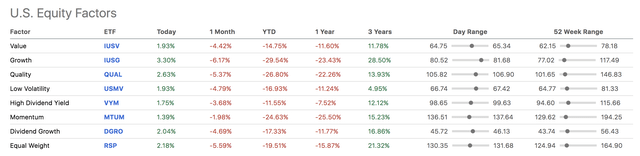

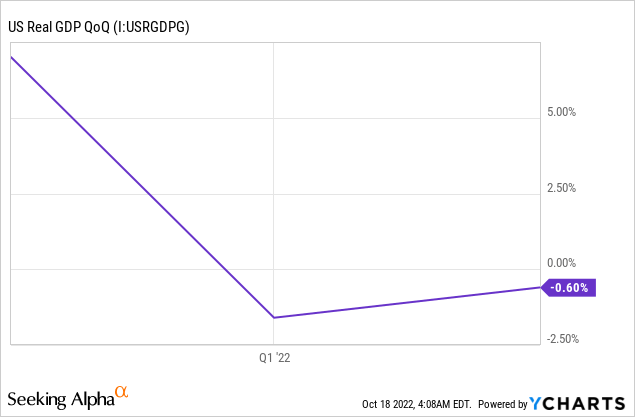

Value investing has beaten most other investment styles during the past year. However, contrary to mainstream opinion, it is not the ideal time to be invested in value. Sure, value stocks tend to outperform in inflationary environments. Yet, it depends on what kind of inflationary environment.

As a rule of thumb, value stocks outperform the broader market in early-stage bull markets when embedded economic growth and early-stage inflation rates start to proliferate. Thus, objectively, you would not be investing in value right now as we have recently entered a receding GDP growth trajectory.

Seeking Alpha

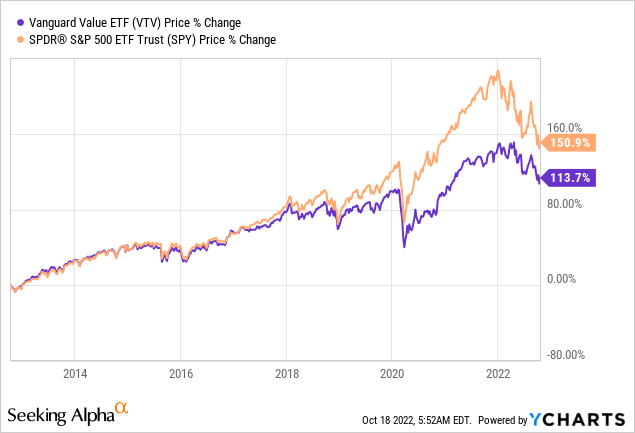

We have spent much of the past year loading up on low-volatility stocks, and the strategy has worked out quite well for us. We screened this ETF as we wanted to garner an understanding of value stocks’ relative performance. However, upon analyzing the ETF, we realized that it could be a low-volatility ETF, not a value ETF (explained in the next section).

Why We Believe VTV Isn’t A Value ETF

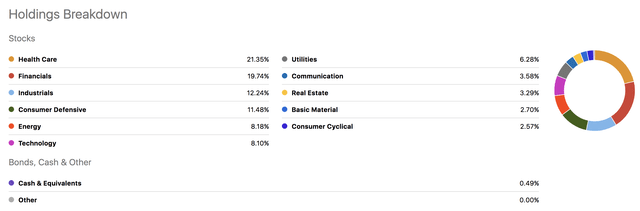

The first feature of Vanguard’s Value ETF that grabbed our attention is the ETF’s conviction. The fund is heavily invested in the healthcare sector and consumer defensive stocks. Therefore, it is likely that this ETF’s countercyclical exposure contributes toward a low volatility strategy.

Let’s observe a few of the ETF’s key holdings to affirm our central argument. Note that Beta refers to a stock’s sensitivity relative to the broader market, and the price-to-book ratio compares a stock’s market capitalization to its tangible book value. Thus, the prior is a measure of volatility, while the latter reflects a stock’s potential value gap.

| Stock | Price-Book | Beta | % Held |

| UnitedHealth (UNH) | 6.34 | 0.75 | 2.96% |

| Berkshire Hathaway | 1.33 | 0.90 | 2.95% |

| Johnson & Johnson | 5.74 | 0.56 | 2.58% |

| Procter & Gamble | 6.66 | 0.39 | 2.45% |

| Eli Lily & Co | 37.02 | 0.33 | 1.57% |

| Chevron | 2.06 | 1.13 | 1.54% |

| JPMorgan | 1.33 | 1.07 | 2.03% |

| Coca-Cola (KO) | 10.47 | 0.57 | 1.46% |

Source: Seeking Alpha; Yahoo Finance

We understand that the ETF contains more constituents than listed in our table, and we also appreciate that related metrics stretch beyond the price-to-book and beta coefficient. However, based on a parsimonious observation, it is clear that many of the ETF’s top constituents trade well above their intrinsic book values while also trading at low beta coefficients. Thus, based on its top holdings, we classify this ETF as a low-volatility ETF, not a value ETF.

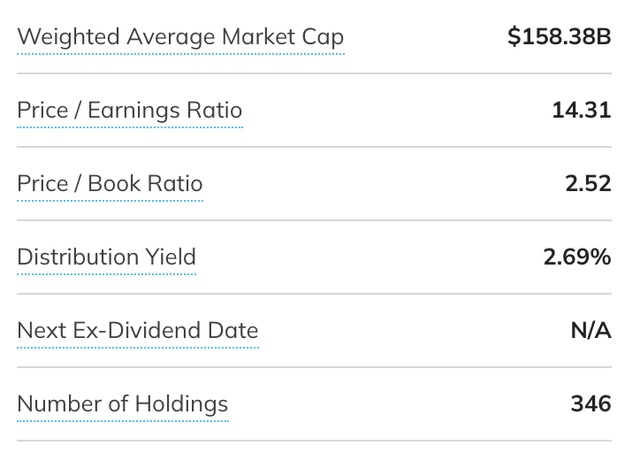

Furthermore, by observing the ETF’s holistic price multiples, it is clear that its price-to-book ratio is above the generally accepted value threshold (1.00). In addition, we believe the ETF’s price-to-earnings ratio does not exactly provide a strong value signal either.

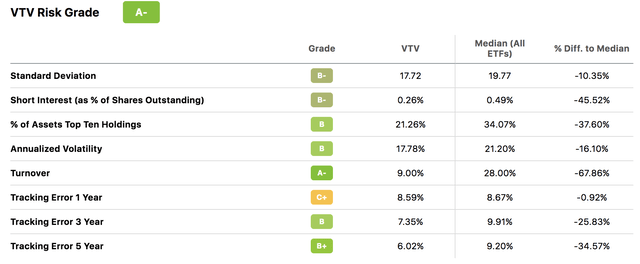

Lastly, Seeking Alpha’s risk grades add substance to our low volatility claim. For example, Vanguard’s Value ETF exhibits a lower standard deviation than the median (relative to other ETFs) according to both continuous and annualized rates. This does not mean we are correct; however, it provides a reasonable basis for our claim.

What Could’ve Caused This Disalignment?

We suspect that liquidity might be a determining factor. Although Vanguard’s Value ETF is an open-ended fund with a vast pool of capital, its thesis states that it only/mainly invests in large-cap U.S. stocks. Thus, the fund’s thesis could get cornered whenever the broader equity market is overvalued.

Based on the above, liquidity might get trapped, and the fund will not be able to circle out of overvalued assets. Again, we are not bearish on the ETF; we are just explaining why this is likely not a value ETF but rather a low-volatility ETF.

Concluding Thoughts

As mentioned in the introduction, this article is not a buy, hold, or sell argument. Instead, our analysis uncovered various indicators that suggest Vanguard’s Value ETF is a low-volatility play and not a value ETF. Our theory behind it all is that the ETF’s mandate is restrictive; therefore, it is not always able to invest in undervalued stocks.

Relative valuation metrics, beta analysis, and the ETF’s standard deviation indicate that this ETF is not geared toward value but rather low volatility.

Be the first to comment