Laurence Dutton

Investment Thesis

American Software, Inc. (NASDAQ:AMSWA) is an application software provider headquartered in Atlanta, United States. In this thesis, I will analyze the company’s performance in Q2 FY23 and its future growth prospects. I will also analyze its valuation at current price levels. I believe the company is currently overvalued, and with no significant revenue growth prospects and contracting profit margins, I assign a sell rating for AMSWA.

Company Overview

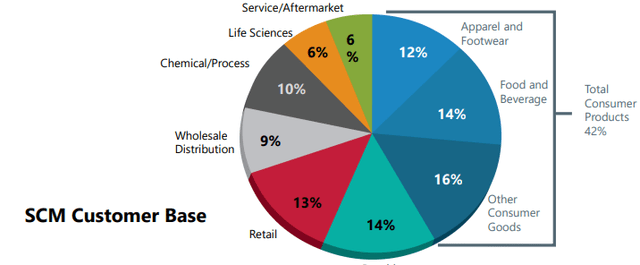

AMSWA is primarily involved in providing supply chain management and enterprise software solutions to companies from multiple industries. The majority of the company’s clients are from the retail segment, dealing in fast-moving consumer goods. Along with supply chain management solutions, they also provide IT consulting and enterprise resource planning solutions. The company also provides maintenance services to complement its solutions software business. They are planning on venturing into the cloud hosting business, given the increasing global cloud business market.

Q2 FY23 Results

AMSWA recently posted second-quarter results, beating the market estimates by 29% but missing the revenue estimates by 5%. The second quarter results failed to impress me. The company experienced a contracted profit margin, and the revenues didn’t witness any growth. Apart from a 19% growth in the revenues from the subscription fees segment, the company saw a decline in revenue from the other three segments. I think the company has hit a stagnation point, and I don’t see scope for significant growth in its revenue or profits in the near future.

AMSWA posted total revenue of $31.5 million, up 1% compared to $31.2 in the same quarter last year. As per my analysis, weak demand for professional services and maintenance resulted in the revenue growth being flat. If we look at the segment-wise distribution, we realize that the subscription fees segment proved to be an outperformer posting $12.3 million in revenues, up 19% compared to $10.3 million in the same quarter last year. As per my analysis, higher subscription charges coupled with an increased client base resulted in this increase. The revenue from the professional services segment fell 11% to $9.5 million compared to $10.8 million in the same quarter last year.

I believe the company experienced weak demand for professional services, which resulted in this decline. The professional services revenue saw a decline even q-o-q as well, from $10.1 million in Q1 FY23 to $9.5 million. This reflects that the revenues from this segment are consistently declining, and it is a matter of concern for the management. The revenue from the maintenance segment was reported at $8.8 million, down 5% compared to $9.3 million in the corresponding quarter last year. According to the company, a shift in customer demand toward cloud revenues resulted in this decline.

The company’s gross margins remained flat at 59% y-o-y. They reported net earnings of $2.1 million, down 37% compared to $3.3 million in the same quarter last year. As per my analysis, this decline was primarily due to an increased interest expense. The company reported a net profit margin of 6.7% compared to 10.6% in the same quarter last year. The dilute EPS stood at $0.06 compared to $0.10 in the corresponding quarter last year. I believe the company will experience contracted profit margins throughout FY23, given declining revenues and consistent inflationary headwinds. The company declared a quarterly dividend of $0.11, reflecting an annualized dividend yield of 3.15% at current price levels.

Overall, the results failed to impress on multiple parameters. Degrading profit margins and flat revenue growth are the main cause of concern for the company. They have estimated FY23 revenues to be in the range of $125.5-$127.5 million, representing no growth compared to FY22 revenues of $127.5 million. This reflects that the company is stagnating in terms of revenue growth, and with the inflationary headwinds, I think the company will perform poorly even in the upcoming quarters.

Key Risk Factor

Highly competitive industry: AMSWA operates in a highly competitive industry, and the competition is only expected to become severe in the future. A highly competitive market brings along multiple challenges. Firstly, it will have to consistently innovate to maintain the client base, and it requires a high expenditure on research and development. Secondly, high competition could put high pressure on the company’s profit margins. To acquire and maintain a sustainable client base, it might have to rely on price discounts, which could impact its profit margins. I believe investors should consider this risk before investing in the company.

Quant Rating and Valuation

Seeking Alpha

AMSWA is ranked 30th out of the 211 companies in the application software industry, which reflects that there are better investment opportunities in the industry. When it comes to valuation, it has a C- grade, which clearly represents that it is overvalued at current price levels. It has a B grade in both growth and profitability, but I think it doesn’t clearly reflect the company’s current financial performance, and the grades could degrade in the coming months.

AMSWA is trading at a share price of $13.95, down 47.5% YTD. It has a market cap of $470 million. The company is overvalued on multiple valuation metrics. It is trading at a forward GAAP P/E multiple of 54x compared to the industry standard of 23.5x. This clearly reflects that the company is highly overvalued compared to its peers in the industry. The company is trading at a price/book multiple of 3.5x compared to the industry standard of 2.8x. I believe there is no significant upside potential in the stock price in the near future, and I would recommend investors not to make any buying positions in AMSWA.

Conclusion

AMSWA posted a weak second-quarter result with contracted profit margins. The FY23 guidance by the company reflects there is no significant scope for revenue growth even in the coming quarters. It is highly overvalued, trading at a forward P/E multiple of 54x. AMSWA is operating in a highly competitive industry, and there is no significant barrier to entry that could cause serious trouble for the company in the future. After considering all these aspects, I assign a sell rating for American Software, Inc.

Be the first to comment