400tmax

By Valuentum Analysts

Making the rounds on social media is a new artificial intelligence (AI) tool called ChatGPT. The Internet is literally abuzz on the potential prospects of this chatbot phenomenon, and after trying it out for ourselves, we think it has the long-term potential to be the real deal. ChatGPT can write poems as if it were a talking cat, deliver essays on topics based on unique parameters, draw up complicated legal documents with specific terms, simulate debates between late and current Presidents alike – all in a matter of seconds – and the list goes on and on.

So what is ChatGPT?

The Guardian has done a lot of background work on the topic. ChatGPT was created by an independent research body called the OpenAI Foundation, which Tesla’s (TSLA) CEO Elon Musk co-founded (Musk no longer is on the board, however). GPT stands for “Generative Pre-Trained Transformer.” The chatbot is pretty unique in that it, from our perspective, can truly understand the ins and outs of human language, picking up subtle nuances in requests, as if you’re really talking to a person or asking your very, very intelligent friend a question.

Frankly, we were impressed when we tried it out, and we’re not the only ones. Though there are skeptics out there on this current AI iteration and perhaps some may have already found some bugs (it only has data going up to late last year), others are calling it “scary-good, crazy-fun,” and Mashable noted that “OpenAI is a huge step toward a usable answer engine.” Whether or not the current iteration of this AI-driven chatbot is ready for the real world, however, is not necessarily the question when it comes to investors.

The reality is that ChatGPT showed us something, and we think it has shown a lot of people, that even with its flaws, AI, in the long run, is going to change a lot of industries, and perhaps no other feature may be more comparable to AI-driven chatbots than Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) search engine, Google. Meta Platforms (META) experienced a major disruption when TikTok emerged, and ChatGPT or something similar to it, if or when it establishes a revenue model, may be a huge disruptor to Google. Though it’s not something that is going to happen overnight, of course, we think long-term investors of Alphabet should take note.

We’re not going to overreact, however. It has taken nearly two decades for Alphabet to establish its search dominance, and one tool in its early innings may be something to keep one’s eyes on, but not panic over. We also can’t be completely sure what’s included in Alphabet’s ‘Other Bets’ segment, and it’s possible Alphabet may have something even better in that area, whether it is in AI or other.

With that said, ChatGPT is really, really interesting, and something to keep one’s eye on, particularly if you are an Alphabet shareholder. In this note, let’s cover why we still like Alphabet, despite impending long-term but not immediate threats from AI-driven chatbots and walk through how we derive our fair value estimate for Alphabet’s shares.

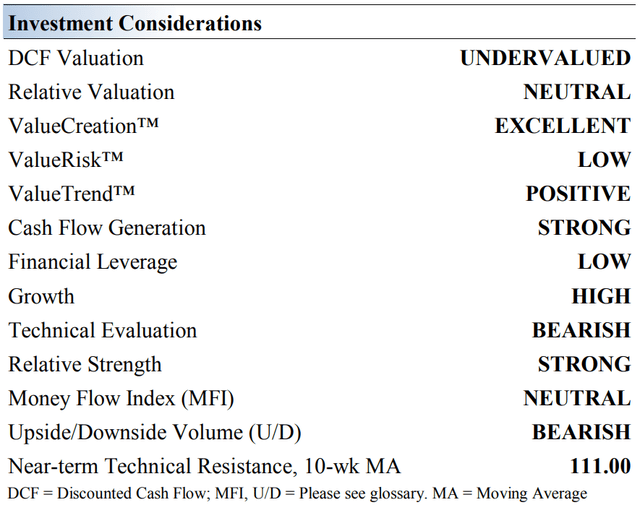

Investment Considerations (Image Source: Valuentum)

Alphabet is a tech giant focused on a number of things: Android, ads, YouTube, Chrome, and research. We think the company will have some megahits in the years ahead. It reports operating losses in its ‘Other Bets’ category frequently, suggesting core levels of profitability are higher than reported.

The company offers investors a compelling combination of attractive valuation, growth potential, cash flow generation, and competitive profile. Very few firms are more attractive on a fundamental basis, in our view, and its impressive free cash flow conversion rates (consistently above 100%) speak to this.

Alphabet is pleased with the momentum in its mobile division, particularly within strong mobile advertising revenue. The mobile Internet space will be key for the firm. YouTube and programmatic advertising offer upside potential, too, but we’re watching spending levels, which have spiked due in part to higher traffic acquisition costs.

Alphabet’s outlook in search remains robust, and we continue to be in awe of the strength in this division, but as noted above, AI-driven chatbots could really change the game for the company. However, we’ll have to see the revenue model behind any AI-driven chatbot that may try to challenge Google in search. Having great technology is only part of the equation.

Alphabet’s massive net cash position gives the company a substantial cushion to fall back on as it invests in high-return opportunities and new concepts such as smart home features, Glass, Fiber, or other innovative ideas. We’re pretty sure Alphabet is aware of the long-term threats and opportunities associated with AI-driven chatbots, and we’re not jumping to conclusions one way or another, but we’re not ignoring it either.

The technology could seriously challenge Google search in the long run, at least from our perspective and preliminary experience trying out ChatGPT. As our right now, however, we think such uncertainty is best captured by viewing shares of Alphabet in the context of a fair value range – something that we think makes sense for all companies, but perhaps may not be more relevant than in this situation.

Alphabet’s Cash Flow Valuation Analysis

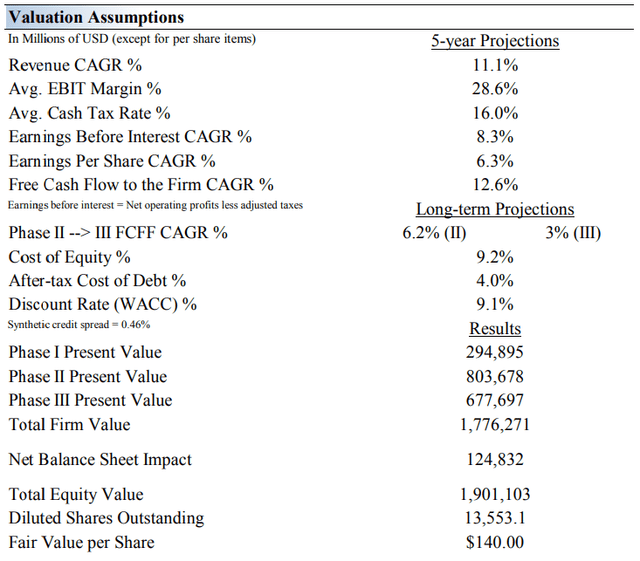

Valuation Assumptions (Image Source: Valuentum)

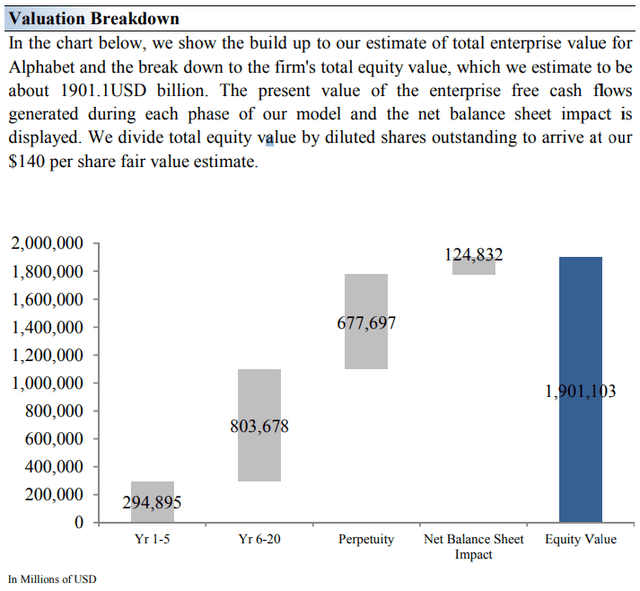

Shares of Alphabet are trading at ~$100 at the time of this writing. On the basis of our cash flow derived fair value estimate, we think Alphabet is worth $140 per share with a fair value range of $112-$168. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our valuation model reflects a compound annual revenue growth rate of 11.1% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 23.5%.

Our model reflects a 5-year projected average operating margin of 28.6%, which is above Alphabet’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 6.2% for the next 15 years and 3% in perpetuity. For Alphabet, we use a 9.1% weighted average cost of capital to discount future free cash flows.

Though ChatGPT is something that we’re watching very closely and believe AI-driven chatbots can challenge Google in search, right now, we’re capturing such a dynamic in the concept of our fair value estimate range and not making any changes to our fair value estimate at this time, as the technology remains in its early innings, despite being extremely impressive out of the gates.

Valuation Breakdown (Image Source: Valuentum)

Alphabet’s Latest Financials and Quarterly Update

During the first half of 2022, Alphabet generated $44.5 billion in net operating cash flow (up 8% year‐over‐year) and spent $16.6 billion on its capital expenditures (up 45% year‐over‐year), allowing for $27.9 billion in free cash flow. Its capital expenditures are on the rise as Alphabet is scaling up the data center operations of its Google Cloud unit while building new corporate offices to handle its growing workforce. Alphabet remains a free cash flow cow and it utilized its free cash flows to buy back $28.5 billion of its stock through its repurchase program during the first half of this year.

At the end of June 2022, Alphabet had $125.0 billion in cash, cash equivalents, and current marketable securities on hand versus $14.7 billion in long‐term debt with no short‐term debt on the books. Its $110.3 billion net cash position at the end of June 2022 is further enhanced by the $30.7 billion in non‐marketable securities Alphabet had on the books at the end of this period, which includes cash‐like assets and strategic investments that are not cash‐like. Alphabet’s fortress‐like balance sheet can be utilized to support its future share repurchase activities.

Inflationary pressures, a tight jobs market, and substantial headcount growth in recent years are driving up Alphabet’s operating expenses in a big way. During the first half of 2022, Alphabet’s GAAP revenue rose by 17% year‐over‐year to reach $137.7 billion as its digital advertising business remains resilient while its Google Cloud business is experiencing robust demand growth. Revenue at Google Cloud was up 39% year‐over‐year during the first half of 2022, reaching $12.1 billion.

However, Alphabet’s total costs and operating expenses grew by 21% year‐over‐year during the first half of 2022, reaching $98.1 billion. While Alphabet’s GAAP operating income rose by a nice 10% year‐over‐year during the first half of 2022 to hit $39.5 billion, its operating margins are facing sizable headwinds at a time when recessionary clouds are building across the globe. Alphabet has responded by committing to slowing down the pace of its hiring activities and implementing other changes.

Alphabet completed its acquisition of cybersecurity firm Mandiant in September 2022 through an all‐cash deal worth ~$5.4 billion when including Mandiant’s net cash position. Mandiant will join Alphabet’s Google Cloud unit as cloud computing services represent one of Alphabet’s major long‐term growth drivers. This acquisition and future acquisition activities will grow the size of Alphabet’s payrolls, and it’s possible that the firm will place a greater emphasis on rationalizing the size of its workforce post‐acquisition activities in the near future.

In late September 2022, Alphabet’s CEO Sundar Pichai held an all‐hands meeting where he communicated to the company’s workforce that cost containment measures would be a priority going forward. That includes limiting discretionary spending measures where possible, such as holiday parties. We appreciate that Alphabet is adapting to the changing macroeconomic landscape.

Our Margin of Safety for Alphabet’s Fair Value Estimate

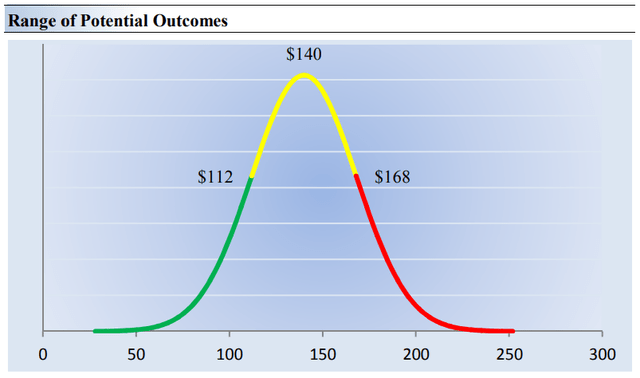

Range of Potential Outcomes (Image Source: Valuentum)

ChatGPT’s entrance on the stage has emphasized the importance of thinking in terms of fair value ranges for stocks, as we continue to contemplate how AI-driven chatbot technology will challenge Google in search in the long run. Right now, we’re not changing our valuation for Alphabet’s shares, but rather pointing more intensely to thinking in terms of the fair value estimate range as it relates to the company’s valuation.

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Alphabet’s fair value at about $140 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Alphabet. We think the firm is attractive below $112 per share (the green line) but quite expensive above $168 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion. Alphabet’s shares still look cheap, even after considering long-term threats.

Concluding Thoughts

Over the long haul, Alphabet’s dominant position in the digital advertising industry along with the momentum seen at its Google Cloud unit in recent quarters and the long‐term upside its self‐driving Waymo unit could provide underpin its bright growth runway. However, ChatGPT is not something that should be ignored when it comes to Google search, as the technology seems to be a serious contender.

Further, Alphabet’s near‐term outlook is facing substantial headwinds as recessionary clouds are building across the globe, and Alphabet’s recent commitment to cost containment efforts should go a long way in preserving its profitability levels. On the basis of our fair value estimate range, shares of Alphabet still look cheap, and we continue to reiterate the importance of a fair value estimate range in our work in light of recent technological threats.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment