EUR/USD Rate Talking Points

EUR/USD trades to a fresh weekly low (1.1885) as the European Central Bank (ECB) steps up the pace of the pandemic emergency purchase programme (PPEP), and the Federal Reserve interest rate decision on March 17 may keep the exchange rate under pressure if Chairman Jerome Powell and Co.

EUR/USD Rate Eyes 200-Day SMA Again as ECB Boosts Pace of PPEP

EUR/USD may stage another attempt to test the 200-Day SMA (1.1834) after showing a limited reaction to the European Central bank (ECB) interest rate decision as the exchange rate carves a fresh series of lower highs and lows.

EUR/USD appears to be under pressure as the latest figures coming out of the ECB show the central bank’s balance sheet increasing by EUR 18.7 billion in the week ending March 12 after expanding EUR 18.2 billion the week prior, and it seems as though the Governing Council is in no rush alter the course for monetary policy as

It remains to be seen if the Federal Open Market Committee (FOMC) rate decision will influence the exchange rate as the central bank updates the Summary of Economic Projections (SEP), and the committee may adjust the forward guidance for monetary policy as Congress passes the $1.9 trillion coronavirus recovery package.

As a result, an upward revision in the interest rate dot plot may keep EUR/USD under pressure as Fed officials signal a greater willingness scale back its emergency measures, but more of the same from the FOMC may generate a bearish reaction in the US Dollar as Chairman Jerome Powell warns that “it’s not at all likely that we’d reach maximum employment this year.”

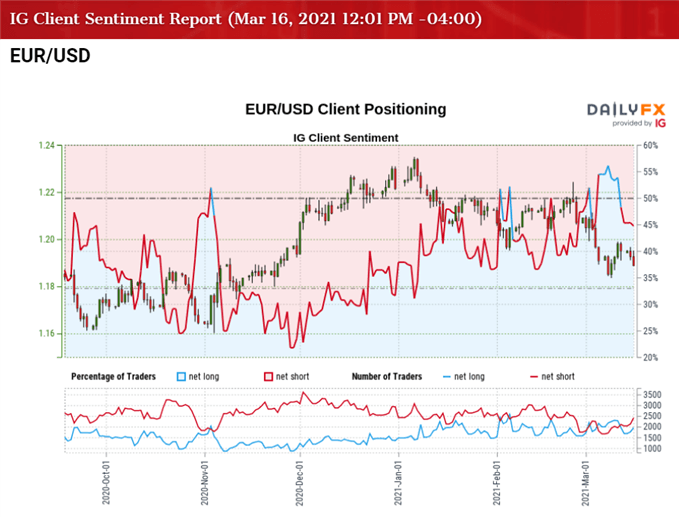

In turn, key market themes may continue to influence EUR/USD as the US Dollar still reflects an inverse relationship with investor confidence, with the crowding behavior seen in 2020 resurfacing as traders flip net-short the pair in March.

The IG Client Sentiment report shows 45.55% of traders are currently net-long EUR/USD, with the ratio of traders short to long standing at 1.20 to 1.

The number of traders net-long is 2.37% higher than yesterday and 14.57% lower from last week, while the number of traders net-short is 1.74% lower than yesterday and 22.04% higher from last week. The decline in net-long position comes as EUR/USD trades to a fresh weekly low (1.1885), while the jump in net-short interest as generated a flip in retail sentiment as 53.21% of traders were net-long the pair last week.

With that said, the decline from the January high (1.2350) may turn out to be a correction in the broader trend rather than a change in EUR/USD behavior as the crowding behavior from 2020 resurfaces, but the exchange rate may stage another attempt to test the 200-Day SMA (1.1834) as the exchange rate carves a fresh series of lower highs and lows.

Recommended by David Song

Learn More About the IG Client Sentiment Report

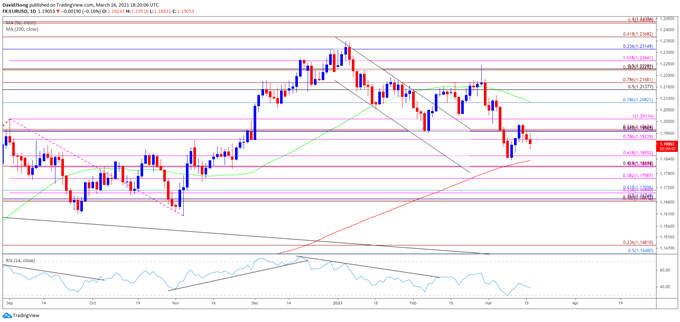

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the EUR/USDcorrection from the September high (1.2011) proved to be an exhaustion in the bullish price action rather than a change in trend following the string of failed attempts to close below the 1.1600 (61.8% expansion) to 1.1640 (23.6% expansion) region, with the Relative Strength Index (RSI) reflecting a similar dynamic as the oscillator broke out of the downward trend to recover from its lowest readings since March.

- However, EUR/USD appears to have reversed course following the failed attempt to test the April 2018 high (1.2414), with the exchange rate extending the decline from the January high (1.2350) as it struggled to push back above the 50-Day SMA (1.2084).

- The 50-Day SMA (1.2084) appears to be developing a negative slope as EUR/USD trades to a fresh yearlylow (1.1836) in March, and the exchange rate may stage another attempt to test the 200-Day SMA (1.1834) as the exchange rate carves a fresh series of lower highs and lows.

- Lack of momentum to hold above 1.1920 (78.6% expansion) brings the 1.1860 (61.8% expansion) area on the radar, with the next region of interest coming in around 1.1760 (38.2% expansion).

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment