jetcityimage/iStock Editorial via Getty Images

AutoZone (NYSE:AZO) is one of the world’s leading companies in the automotive aftermarket. It provides a comprehensive range of new and remanufactured automotive hard parts, maintenance items, accessories, and non-automotive products. Its flagship ALLDATA brand has helped the company establish a solid online retail foundation.

FY ’22 seems to be strong, with increasing adjusted ROIC and store count, but a closer look at AZO’s decreasing margin and ROA on top of its unattractive valuation makes this stock risky as of this writing.

Company Overview

Positive aspects of AZO include its great performance in achieving its expansion objectives, as seen by its growing store count and top line. In FY ’22, the company ended with 6,943 stores, up from 6,767 in FY ’21 and 6,549 in FY ’20. It attributed its growing total revenue of $16,252.20 million, up 11.09% from $14,629.60 million reported in FY ’21. However, we can witness a declining year-over-year growth performance from 15.81% recorded in the previous fiscal year.

AZO finished FY ’22 with an 8.4% YoY increase in same-store sales, down from 13.6% the previous fiscal year. On top of this, its estimated total revenue of $17.01 billion or 4.66% YoY increase in FY ’23, compared to its 8.34% 5-year CAGR, suggests an early warning sign of the company’s challenging operating environment.

Risks presented by the Biden administration’s support for the EV transition remain significant; however, considering the current economic environment, we may face a long road to a viable EV transition. This can keep AZO’s operational environment steady and allow the company adequate time to adjust to this development. With its deep industry knowledge, I believe AZO can successfully navigate this transition, especially in light of its recent partnership to expand into electric vehicle (EV) chargers and adapters.

As of this writing, AZO’s store growth is undoubtedly an excellent strategy to enhance its top line; but its growing fixed rent expenditure and expanding interest obligation will put more significant pressure on the company’s bottom line.

Growing Fixed Expenses

Growing fixed expenses due to the combination of rent and interest obligations may jeopardize AZO’s net margin, especially given the probability of a recession. The company ended FY ’22 with a growing rent expense of $373.28 million, up 8.1% from its $345.38 million recorded in FY ’21. Additionally, it accumulated a growing total debt amounting to $6,122.1 million, up from $5,269.8 million recorded in FY ’21. This translated to its increasing interest expense of $64 million this Q4 ’22, up 10.1% from the same quarter last year.

Pressured Margin

AZO continues to generate a higher operating income of $3,270.70 million, which is better than its $2,987.50 million recorded in FY ’21. Looking at its trailing operating margin of 20.12%, it posted declining figures compared to its 20.42% recorded in FY ’21 and below its average of 20.58% based on the prior five trailing quarters. This snowballed to its slowing cash flow from operation amounting to $3,211.1 million, down from $3,518.5 million recorded last fiscal year.

Strong at its Adjusted ROIC

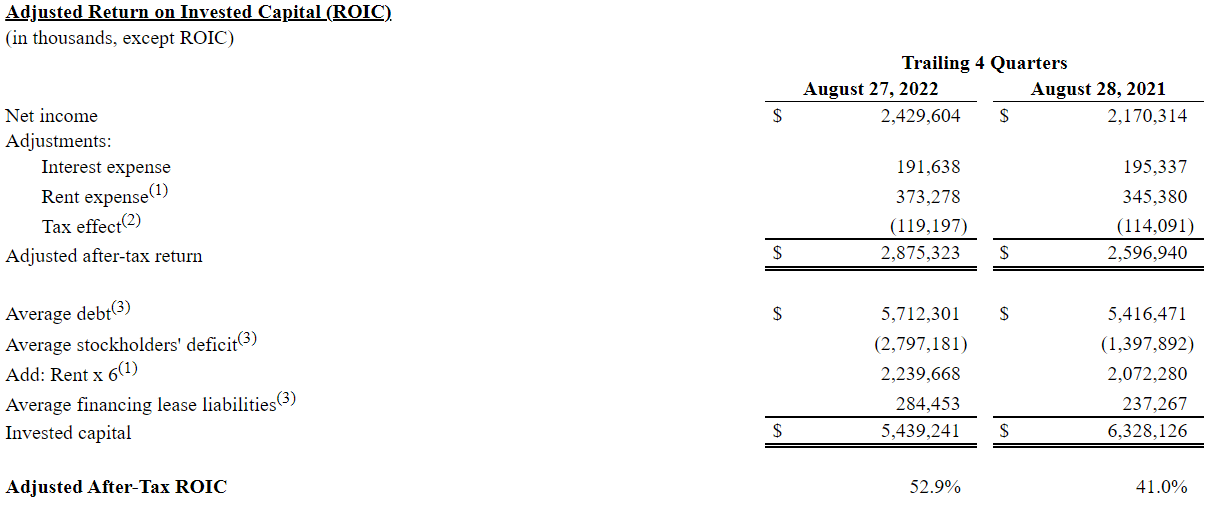

AZO: Growing Adjusted ROIC (Source: Company Filing)

The management provides adjusted ROIC to measure its strong profitability. As shown in the image above, the management added back total interest and rent expenses to arrive at an outstanding 52.9% adjusted ROIC, up from 41.0% recorded last fiscal year.

In addition, despite the continuous price appreciation, AZO has continued to offer substantial share repurchase catalysts and has just authorized an additional $2.5 billion share buyback on top of its $2.0 billion share buyback in March ’22. This implies strong confidence in AZO’s long-term opportunities. In fact, despite the hurdles of EV transition, the global automotive aftermarket market is predicted to reach $1,286,250 million by 2028, up from $1,021,990 million in 2021, at a 3.3% CAGR.

Additionally, there is solid growth in its e-commerce operation, as shown in its other revenue, which includes ALLDATA. The company’s Other revenue totaled $289.03 million, up 16.6% from $247.87 million recorded last fiscal year.

This serves as one of AZO’s interesting catalysts, with the possibility of recurring income from its automotive diagnostic, repair, and shop management solutions.

Fairly Valued

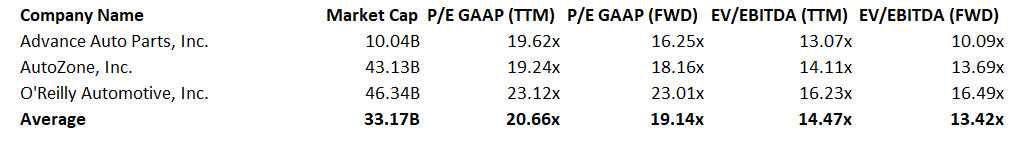

AZO: Relative Valuation (Source: Data from SeekingAlpha)

Advance Auto Parts, Inc. (NYSE:AAP), O’Reilly Automotive, Inc. (NASDAQ:ORLY).

AZO’s trailing P/E multiple of 19.24x trades at a premium compared to its 5-year average of 17.04x. While looking at its trailing EV/EBITDA of 14.11x compared to its 5-year average of 11.85x, it says that AZO is historically overvalued.

While looking at AZO’s forward P/E multiple and forward EV/EBITDA, it tells us a mixed signal. Its forward P/E multiple of 18.16x reveals a favorable discount compared to its peer group’s average of 19.14x. However, its forward EV/EBITDA multiple of 13.69x shows a premium valuation compared to its peer group’s average of 13.42x.

At an implied P/E of 20.6x, estimated $158.98 earnings per share in FY ’25, and a discount rate of 10%, we can arrive at a price target of $2,468 or roughly 9% upside potential, as of this writing. This leaves no decent margin of safety, which makes this stock unattractive at today’s price.

Strong Bulls Momentum

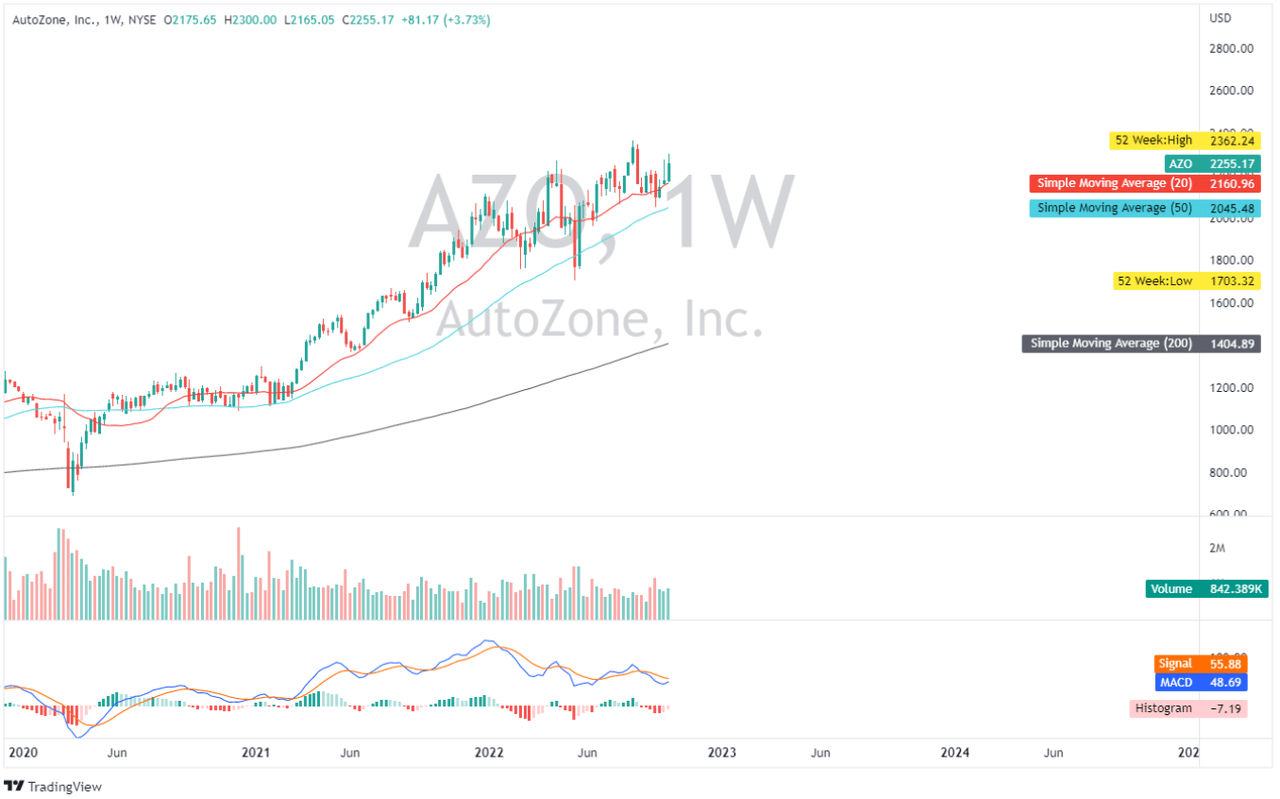

AZO: Weekly Chart (Source: TradingView.com)

Despite the overall market’s bearish sentiment, AZO’s price continues to rise, as illustrated in the chart above. Looking at its simple moving averages, the 20-day SMA remains above both the 50-day and 200-day SMAs, indicating strong bullish momentum. However, given its pressured margin and unappealing margin of safety, I believe starting a long position now is risky.

Conclusive Thoughts

In addition to the previously indicated pressured margins, utilizing ROA and GAAP figures to assess AZO’s profitability reveals weakness. Its trailing ROA of 16.31% declined from its 16.79% recorded in Q3 ’22 and down from its 17.1% recorded in Q2 ’22.

As of this writing, AZO is trading at a prolonged bullish move, has some profitability concerns, and has no appealing margin of safety, making this stock risky.

Thank you for reading and good luck!

Be the first to comment