dusanpetkovic/iStock via Getty Images

Business Description

WestRock Company (NYSE:WRK) is one of the top companies in the corrugated packaging industry. WRK employs over 50,000 team members, including material scientists, packaging designers, mechanical engineers, and manufacturing experts across the globe. WRK is headquartered in Sandy Springs, Georgia. WRK has over 320 manufacturing facilities, design centers, research labs, and sales offices around the world which it uses to design, manufacture, and sell various products, including containerboard, corrugated containers, displays, folding cartons, kraft paper, paperboard, and pulp. The company’s purpose is to “Innovate boldly. Package sustainably. At WestRock, we are using imagination and expertise to turn big challenges into real solutions.” WRK has a wide variety of customers across dozens of industries, including packaged food, distribution + paper, beverage, retail + E-commerce, Industrial, Healthcare, Home, Beauty + Personal Care, etc. WRK’s customers use WRK’s many products to contain, protect, ship, store, promote and display their products.

WRK’s roots can be traced back to 1846 when Ellis, Chafin & Co. founded the Mead Corporation. After several mergers and name changes throughout the 20th and early 21st century, the WRK we know today was founded as a product of a merger between MeadWestvaco and RockTenn in 2015. The mergers haven’t stopped since, with WRK acquiring SP Fiber Holdings, Inc in 2015, Cenveo Packaging in 2016, Star Pizza Box and Multi Packaging Solutions International in 2017, and Plymouth Packaging and Kapstone in 2018. Today, WRK has a market cap of $9.2 billion and did over $21 billion in sales over the last 12 months.

In October 2021, WRK reorganized its business into four reportable segments: Corrugate Packaging, Consumer Packaging, Global Paper, and Distribution. The Corrugate Packaging segment’s main products include containerboard, corrugated sheets, and corrugated packaging sold to consumer and industrial product manufacturers, and this segment produced sales of $9.3 billion last year. The Consumer Packaging Segment sells consumer packaging products, including folding cartons, interior partitions, inserts, and labels. Last year the Consumer Packaging Segment did $4.9 billion in sales. The Global Paper segment generates revenues by selling containerboard and paperboard sold to external customers. The Global Paper segment produced $5.9 billion in sales last year. Finally, the distribution segment is WRK’s smallest segment and generates revenue through the distribution of specialty packaging products, including stretch film, void fill, and carton sealing tape. The Distribution segment reported $1.4 billion in sales last year.

Track Record

Famous Value Investor Peter Lynch once said, “Stick with a steady and consistent performer.” Peter Lynch is far more intelligent than me, so I will take his advice as we evaluate WRK as a potential investment. To ensure WRK is a “steady and consistent performer,” we need to look at how WRK has performed in the past. Of course, past performance doesn’t predict future success. Still, it gives investors insight into the company’s capabilities and how management has navigated different market environments.

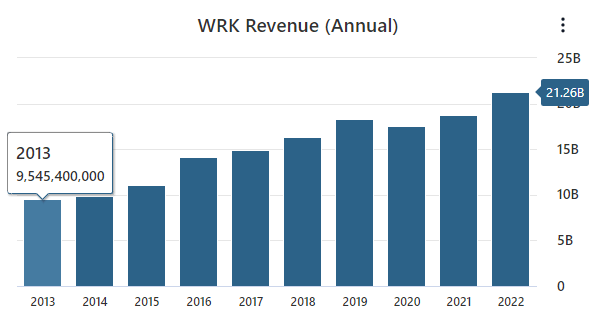

WRK has done an excellent job growing its revenue over the years. In 2013, WRK reported total revenue of $9.5 billion, and last year WRK recorded a total revenue of $21.2 billion which is a 123% revenue increase over the past ten years. This is an excellent level of sales growth, but it’s equally impressive how consistently WRK has grown its revenues. There was only one year out of the previous ten years that WRK did not increase its sales which happened to be 2020, the year the Covid-19 pandemic struck. Despite the decrease in revenue in 2020, WRK rebounded nicely in 2021, reporting higher revenue than before the pandemic in 2019.

WRK data by Stock Analysis

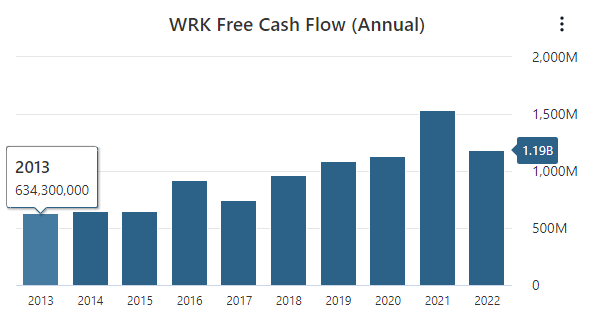

Indeed, the top-line growth looks suitable for WRK. Free cash flow growth has also been pretty good. However, WRK has yet to grow free cash flows as consistently as WRK has grown its revenue. There have been two years out of the previous decade where WRK has not managed to increase its free cash flow and one of those years happens to be this past year in 2022, free cash flow decreased by 22.4%. Although WRK grew its free cash flows by 87% over the last decade, I typically look for companies that have managed to at least double their free cash flow over the previous ten years.

WRK data by Stock Analysis

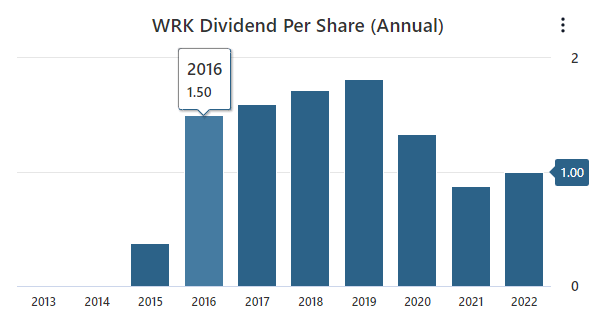

WRK has done a decent job in growing its free cash flow and an even better job of increasing its revenue, but one area where WRK has lagged is returning capital to shareholders. WRK has repurchased just 2.6% of shares outstanding since 2015. WRK does pay its shareholders a dividend, but the dividend growth has yet to be there. The dividend in 2022 is smaller than it was in 2016. On a brighter note, WRK did have a total shareholder return, or dividend yield + buyback yield, of 8% last year, which is nice to see.

WRK data by Stock Analysis

One final concern is that WRK appears to be only somewhat profitable. Since 2015, WRK has averaged an ROE of just 5.41%. Compared to industry rival Packaging Corporation of America (PKG), which averaged an ROE of 25.76% over the same period, this level of disparity is a major red flag because it indicates that WRK is not competing effectively within its industry.

Growth Drivers

WRK’s management team has a plan to increase EBITDA to over $4 billion, EBITDA margins to over 19%, return on invested capital to over 10%, and my favorite is increasing free cash flow per share to over $5.50 by 2025. The pathway to this goal began in 2021 when EBITDA margins were 16%. WRK plans to increase EBITDA margins by 100-150 BPS by optimizing its product portfolio and growing sales of complete solutions. WRK sees another 50-100 basis points of growth by developing innovative fiber-based solutions to help customers use fewer plastics. WRK also plans to invest in digital and automation tools to increase asset utilization and optimize its supply chain network, which management believes will add 200-300 BPS of EBITDA margin. Finally, management says they will rely on a decision-making process based on maximizing return on invested capital.

This approach is music to investors’ ears, but whether or not WRK can execute this strategy remains to be seen. In 2022, WRK’s EBITDA only slightly increased to $3 billion from $2.9 billion the year prior, and EBITDA margins decreased from 15.50% in 2021 to 14.20% in 2022. Therefore, management is not on pace to reach their lofty 2025 goals and they face some serious head winds moving forward.

Risks

At the end of the day, there’s nothing that special about a corrugated case. It’s just a box used to ship and store products. Therefore, most of WRK’s products are commodities, making keeping costs low critical to WRK’s success. Price increases in raw materials, energy, and transportation have been headwinds to WRK’s business in 2022. We are currently in a high inflationary environment, and the price of virgin and recycled fiber, the essential raw materials to WRK’s company, has not been spared. Virgin fiber accounts for 65% of fiber used by WRK to produce corrugate and paper board, while recycled fiber makes up the other 35%. Both virgin fiber and recycled fiber costs have increased significantly in 2022.

WRK primarily uses natural gas and electricity in its paper-making process, and the price of both has increased considerably in 2022. Increased freight costs and shipping delays have also hurt WRK. Most of these headwinds are a product of the current macroeconomic environment, and there is little that WRK can do to combat this. Still, if the cost of raw materials, energy, and transportation continues to rise, then WRK will continue to get hurt.

Valuation

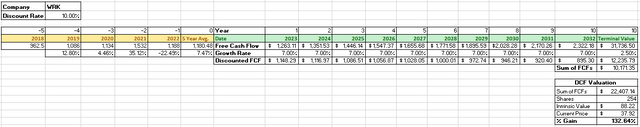

We will run a discounted cash flow analysis to find WRK’s intrinsic value. We’ll begin the DCF by taking the average of WRK’s free cash flows over the past five years, which is $1.1 billion. Then, based on the long-term growth rate we’ve seen from WRK over the past decade, we’ll use a 7% growth rate over the next decade. If you’re wondering, this growth rate would assume that WRK hits its 2025 free cash flow target of $5.50 per share. We’ll use a 2.5% growth rate from there to determine the terminal value. Finally, we’ll use a discount rate of 10%. The sum of the free cash flows is $22.4 billion. Dividing this figure by the 254 million shares outstanding, we end up with an intrinsic value of $88.22. Therefore, based on this DCF calculation, investors stand to gain 132% from the current share price.

Author’s work

An over 100% return sounds great, but it may be too good to be true. Therefore, we should verify this intrinsic value using another valuation method, a comparative analysis. The 5-year average P/E ratio for WRK is 11.16, which compares favorably to the current P/E of 10.17. If we take WRK’s next year’s consensus earnings per share estimate of $3.86 and multiply it by WRK’s 5-year average P/E ratio, we end up with an intrinsic value of $43.07 per share, which represents a 13.6% return.

Summary

There’s plenty to like about WRK’s business. The world we live in is constantly changing. However, I’m confident that in 25 years, companies will still ship and store products in corrugated containers, so I’m not worried about potential disruptors to WRK’s industry. WRK has a sophisticated network of manufacturing facilities, design centers, research labs, and sales offices worldwide. Therefore its capabilities cannot be easily replicated, so I am confident that WRK will continue being a strong player in this industry for years to come. WRK’s valuation appeals to me, especially if management can execute 2025 margin and free cash flow goals. However, I am concerned by the lack of capital returned to shareholders in recent years and that WRK’s competitor, PKG, has averaged an ROE almost 5x higher than WRK since 2015. These two red flags are enough for me to pass on WRK as an investment. If you disagree, please let me know in the comment section below. Thank you for reading!

Be the first to comment