gorodenkoff

Silence Therapeutics (NASDAQ:SLN) is an undercovered RNAi therapeutic company which has been struggling to enroll in one of its phase 1 trials in myelodysplastic syndrome, but recently announced some data from another trial in thalassemia of the same molecule. Lead drug candidate is SLN360 targeting cardiovascular disease. The stock is up nearly 50% from its lows in June, although it is yet to recover the ground it lost in February.

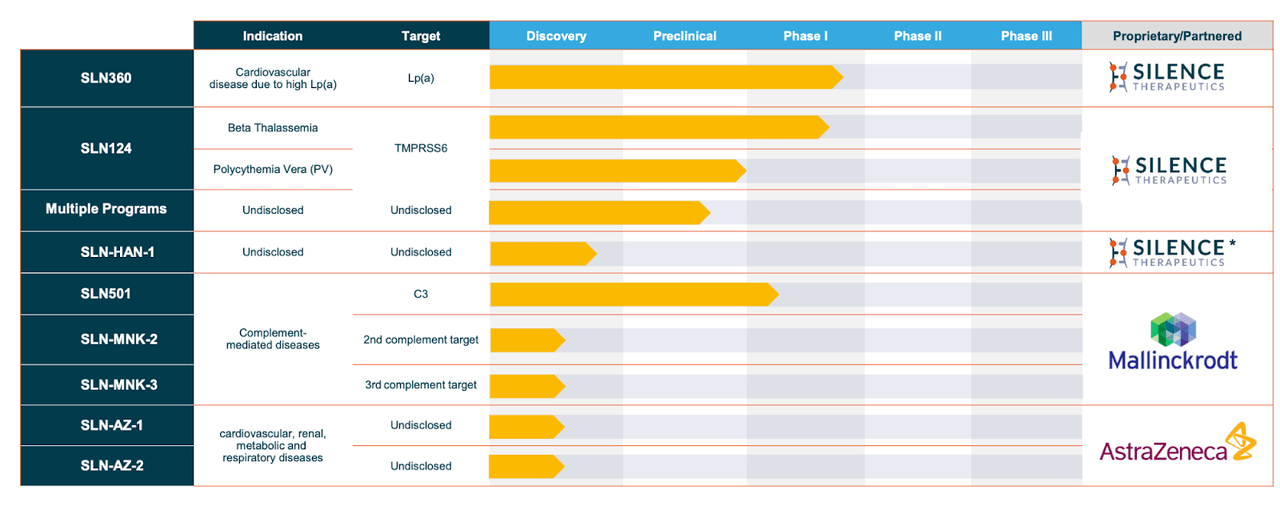

As its name implies, Silence Therapeutics works with small interfering RNAs (siRNA) to silence messenger RNAs (mRNAs) from producing specific proteins that could be pathogens. The company says it has two decades of R&D behind its platform. Its lead program, SLN360, is targeting cardiovascular diseases and has posted positive phase 1 data in healthy volunteers with high Lipoprotein(a). Its second asset, SLN124, is targeting hematological disorders and has produced proof of concept data in healthy volunteers and safety data in thalassemia patients. The pipeline is here:

Pipeline (Company website)

The company presents some easy-to-understand pros and cons of various genetic treatment modalities. These are gene silencing, gene therapy and gene editing. Gene silencing is what SLN does. Gene silencing stops a disease-causing gene from producing a pathogenic protein by silencing the mRNA necessary to produce that protein. Gene therapy produces a functional copy of a dysfunctional gene. Gene editing corrects a disease-causing gene by editing it, either by adding or deleting something. These are the three mechanisms of action of each module. Each module’s target is to stop a bad gene from producing a bad protein. One does that by silencing the process, one by adding a fresh and good gene, and the last one by modifying the gene.

Each method has its pros and cons. The benefit of gene silencing is that it can be made very precise. It does not produce permanent changes, and its effects can be stopped by simply stopping treatment. These treatments are, also, just a few outpatient injections every year.

Gene therapy and gene editing are different. While they can theoretically cure a disease with just a single dose, gene therapy does not change the expression of the already-existing mutant gene, and gene editing may produce off-target, unwanted edits. Both are also non-reversible and require major medical treatments.

The company’s platform is called GOLD, short for GalNAc Oligonucleotide Discovery Platform. A GalNAc is a ligand that works as a delivery mechanism of siRNAs to the liver cells. GalNAc has a carbohydrate moiety that “binds to the highly liver-expressed asialoglycoprotein receptor 1 (ASGPR1) with high affinity (Kd = 2.5 nM).” Through the ASGPR-GalNAc homeostasis pathway, a therapeutic siRNA is able to enter the liver cells and the RISC (RNA induced silencing complex) area. The company has developed proprietary linker molecules that can produce the siRNA-GalNAc conjugates with reduced off-target effects and other beneficial properties.

Silence Therapeutics has partnerships with three companies – AstraZeneca (AZN), Mallinckrodt (MNK), and China’s Hansoh Pharma. Total deal value is $7.5bn. AZN paid $60mn upfront payment, $20mn equity investment and up to $4bn in milestone payments for a number of early-stage programs. Mallinckrodt paid $20mn upfront and $5mn equity plus up to $2bn in milestones and tiered royalties for 3 targets. Hansoh paid upfront cash payment of $16 million and will pay up to $1.3 billion in potential milestones plus royalties for rights to 2 targets in the China region.

In the phase 1 trial of SLN360, there was a 98% reduction in Lp(a) observed after a single dose, and the treatment effect lasted for 5 months. The treatment was well-tolerated. Data was presented in April in a late breaker session at the ACC and published in JAMA.

Lead author Steven E. Nissen, M.D., Chief Academic Officer of the Heart, Vascular and Thoracic Institute at Cleveland Clinic, said:

We thought it would work, but we were surprised by the magnitude and the duration of the effect. Lipoprotein(a) is the last frontier in lipids…

High Lp(a) is a genetic risk factor of cardiovascular disease which cannot be modified by lifestyle changes, unlike high cholesterol levels, and there are few medications to treat it. The reason for that is companies have not targeted Lp(a) because to see treatment benefit, it may be required to eliminate Lp(a) entirely. Now, the cholesterol market is huge, numbering tens of billion dollars, and so is, likely, the high Lp(a) market. In terms of competition, Novartis (NVS) has an antisense molecule pelacarsen (TQJ230) targeting Lp(a) reduction in a phase 3 trial. Eli Lilly (LLY) also has a phase 1 trial for an Lp(a) lowering RNAi drug. The NVS molecule has shown it can reduce Lp(a) by 80%. While SLN’s number is far greater, there are two issues – one, there is no clear indication that lowering Lp(a) has CV benefits; two, there is no clear indication that lowering Lp(a) more than 70% had additional CV benefits; three, NVS will read out in 2025 while SLN will have to run a very large trial for a number of years before it can commercialize; and four, CV drugs are not easy to sell (from Endpts).

In the phase 1 trial, there was a single dose arm and a multiple dose arm – this was a SAD/MAD trial. The single dose evaluated SLN360 30 mg, 100 mg, 300 mg, and 600 mg in high Lp(a) patients. The MAD arm is enrolling patients and will evaluate SLN360 in ASCVD (atherosclerotic cardiovascular disease) stable High Lp(a) patients with 30 mg, 100 mg, ≥ 300 mg, ≥ 600 mg doses. Data from this arm will be the next data catalyst for the company. Silence plans to begin a phase 2 trial of SLN360 in patients with ASCVD in the second half of this year.

In the phase 1 trial for SLN124, treatment effects consistent with TMPRSS6 gene knockdown was observed, with a 4-fold average hepcidin increase after a single dose. The drug was well-tolerated.

Financials

SLN has a market cap of $350mn and a cash balance of $113mn. Research and development expenditure for the three months ended September 30, 2022, was £8.8 million and general and administrative expenses were £5.8 million. At that rate, they have cash for about 7 quarters. Of course, they are in early stages, so cash expenses will increase significantly.

Bottom line

SLN is an interesting company with early-stage product candidates but no negative news yet. I discussed its competitive hurdles despite the superior data. I think we will need to watch this closely for some more time, and if there’s some easing out of the competition, that could make it more attractive.

Be the first to comment