Andrew Burton

Elevator Pitch

I assign a Buy investment rating to Alcoa Corporation’s (NYSE:AA) shares. A negative earnings surprise for Q2 2022 is less probable in my view, considering that the market’s expectations are low. More significantly, AA is valued by the market at an appealing mid-single digit forward P/E, and this is very attractive in view of favorable supply-demand dynamics for the aluminum market in the long term.

When Does Alcoa Report Earnings?

Alcoa will report its earnings for the second quarter of this year on July 20, 2022 after the market closes, according to the company’s press release dated July 28, 2022.

Prior to providing a preview of AA’s Q2 2022 earnings, I review Alcoa’s recent financials and share price performance in the next quarter.

AA Stock Key Metrics

At first glance, there appears to be a huge disconnect between AA’s Q1 2022 earnings beat and its post-results release share price performance.

Alcoa announced the company’s first-quarter earnings on April 20, 2022 after trading hours. AA’s non-GAAP adjusted EPS grew by +22% QoQ and +287% YoY to $3.06 in Q1 2022; Alcoa’s first-quarter bottom line exceeded the Wall Street analysts’ consensus EPS estimate of $2.75 by +11%.

But AA’s share price fell by -17% from $86.93 as of April 20, 2022 to $72.20 as of April 21, 2022 following the company’s earnings beat. Alcoa’s shares subsequently dropped by another -40% to close at $43.06 as of July 15, 2022. In other words, Alcoa’s stock price has roughly halved since it reported its Q1 2022 results in late-April.

I think there are a number of reasons why AA’s shares have performed poorly in recent months even though the company achieved better-than-expected earnings.

One reason is that the market fears that high aluminum prices, which were a key driver of AA’s Q1 2022 EPS growth, won’t be sustained. Investors’ concerns on this front have been validated, with a recent July 12, 2022 Seeking Alpha News article noting that “benchmark aluminum (LMAHDS03:COM) on the London Metal Exchange” dropped to “$2,352/ton, the lowest price since May 2021.”

Another reason is that investors are worried about the negative effects of inflation on Alcoa’s future profitability. Alcoa mentioned at the company’s Q1 2022 investor call that it sees a $30 million QoQ increase in expenses for its aluminum segment in Q2 2022 as a result of higher-than-expected “raw materials prices and energy” costs.

Separately, Alcoa’s share repurchases for Q1 2022 also disappointed the market. AA spent $75 million on share buybacks in the first quarter of this year, which was equivalent to about 0.9% of its current market capitalization. At its first-quarter earnings briefing, Alcoa acknowledged that “we’re being conservative on the buybacks in the first quarter as we saw the working capital build.” Notably, AA also didn’t commit to accelerating the pace of share repurchases in subsequent quarters, noting at the recent quarterly earnings call that “future capital returns are expected to be based on a variety of factors.”

In the next section, I preview AA’s upcoming Q2 2022 earnings release.

What To Expect From Earnings

The sell-side analysts expect Alcoa’s YoY bottom line growth to moderate from +287% in Q1 2022 to +76% in Q2 2022. This translates into an expected -14% QoQ contraction in normalized EPS for AA in the second quarter.

In the past three months, the consensus Wall Street analysts’ Q2 2022 EPS projection for Alcoa has been reduced by a significant -24% to $2.63. Notably, seven of the 12 analysts covering AA’s shares have also cut their respective earnings forecasts for the company over the same period.

Separately, Alcoa noted at Deutsche Bank’s (DB) 13th Annual Global Basic Materials Conference on June 9, 2022 that its shipments for Q2 2022 should be “still better than what we had in the first quarter.” AA also emphasized at the DB conference in June that while “overall EBITDA is lower in the second quarter than in the first”, Q2 2022 is “still a very, very strong quarter.”

In a nutshell, I am of the view that AA’s Q2 2022 earnings should be in line with market expectations. Investors’ expectations are already low as evidenced by the substantial cuts to consensus earnings forecasts. On the flip side, the company’s management comments at the early-June 2022 DB conference suggest that Alcoa’s Q2 financial performance should be decent.

What Is Alcoa’s Long-Term Forecast?

Alcoa’s long-term growth outlook is dependent on the demand and supply for aluminum. Credit ratings agency Fitch refers to Alcoa as “among the world’s largest and lowest cost bauxite and alumina producers.”

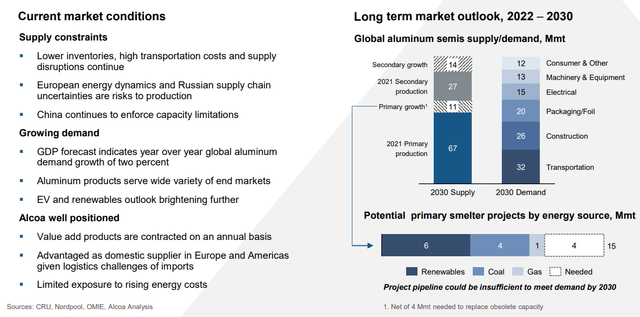

AA described the aluminum market as one with the characteristics of “growing demand, lagging supply in short and long run” in the company’s June 2022 investor presentation. As per the chart below, Alcoa thinks that there will be a supply-demand imbalance for the aluminum market in eight years’ time considering the “pipeline” of “primary smelter projects.”

Demand-Supply Dynamics And Outlook For Aluminum In The Long Run

Alcoa’s June 2022 Investor Presentation

Dutch bank ING also sees supply exceeding demand in the aluminum market in the long run. According to a November 2, 2021 research commentary published by ING, future aluminum supply will be constrained by “the long-term decarbonization goal”, while the growth in aluminum demand in the years ahead will be driven by “vehicle light-weighting and renewable energy” needs.

In summary, the favorable supply-demand dynamics are a good reason to be bullish on aluminum and Alcoa, taking into account the future demand and supply forecasts and expectations referred to in this section of the article.

Is Alcoa Stock Fairly Valued?

I view Alcoa stock as undervalued rather than fairly valued.

AA trades at an undemanding 5.6 times forward P/E based on an EPS of $7.63 (average of sell-side consensus normalized earnings for Alcoa in the FY 2022-2026 period) and its last stock price of $43.06 as of July 15, 2022.

As a comparison, Alcoa used to trade at forward P/E multiples in the high single-digit to mid-teens range in the three years prior to COVID-19, as per S&P Capital IQ’s historical valuation data.

Is AA Stock A Buy, Sell, or Hold?

AA stock is a Buy. Alcoa is a good play on the favorable prospects of the aluminum market in the long term. The stock’s -50% price correction in the last three months since its Q1 2022 earnings announcement offers a buying opportunity for investors.

Be the first to comment