Editor’s note: Seeking Alpha is proud to welcome Lubo Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Povozniuk

Altra Industrial Motion Corp. (NASDAQ:AIMC) intends to improve its EBITDA margins thanks to strategic pricing initiatives and manufacturing techniques. Besides, if management continues to acquire other targets, revenue growth would likely remain elevated. Yes, there are some risks due to covenants and recession outside the United States. Still, the share price appears, in my view, cheap enough to justify a position in the stock.

Company Background

Altra produces and markets electromechanical power transmission motion control products. The company manufactures gear drives, precision motors, inductors, and many other devices in which reliability and precision are very important.

Company’s Website

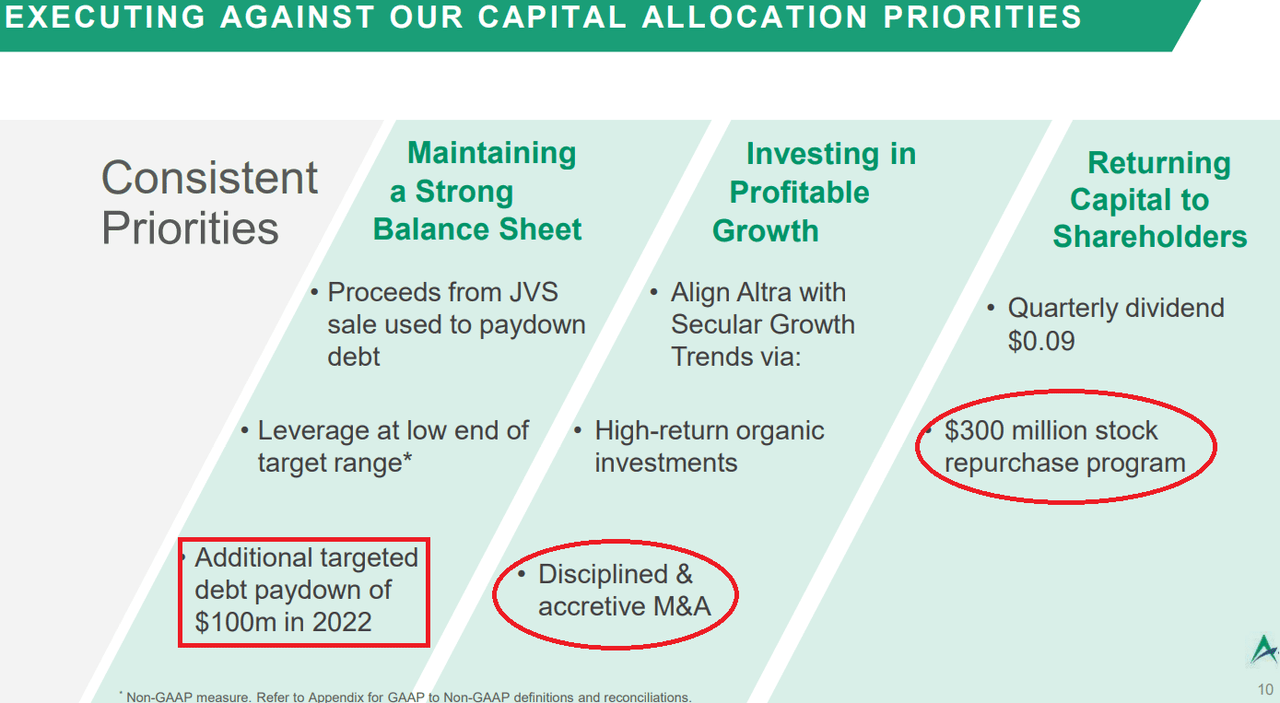

I researched Altra Industrial due to a $300 million stock repurchase program and a lot of M&A activity. Management noted these initiatives in a recent slide.

Q1 2022 Earnings Slides

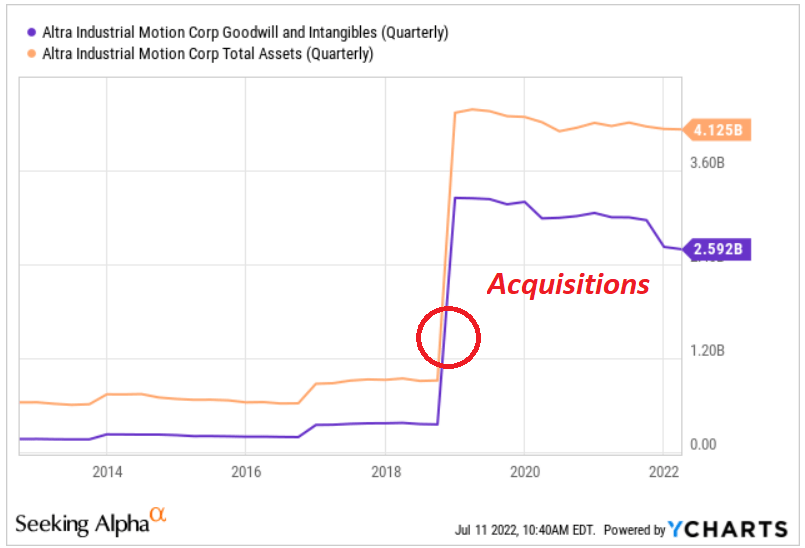

With respect to the company’s mergers and acquisitions, let’s note that the number of targets in recent years appears impressive. As a result, the number of assets increased from less than $1.2 billion to around $4.12 billion. Besides, the amount of intangibles and goodwill accumulated also increased significantly. In my view, if management continues to be that ambitious, and the assets keep increasing, the demand for the stock may increase too.

Ycharts

Recently, Altra Industrial Motion demonstrated that it is ready to reshape by divesting parts that don’t represent the core of the business. As stated in the 10-K excerpt below, the company sold the Jacobs Vehicle Systems business segment in order to focus on highly engineered products. In my view, if management sells other segments, and reinvests in more growing and profitable targets, shareholders will likely profit.

On February 8, 2022, we entered into an agreement with Cummins Inc., a leader in the heavy-duty trucking industry, to divest all of our issued and outstanding equity interest in our entities which collectively constitute the Jacobs Vehicle Systems business segment. This divesture aligns with our strategy to focus on highly engineered products in the motion control and power transmission markets. A copy of the Purchase Agreement is filed as an exhibit herewith.

Source: 10-k

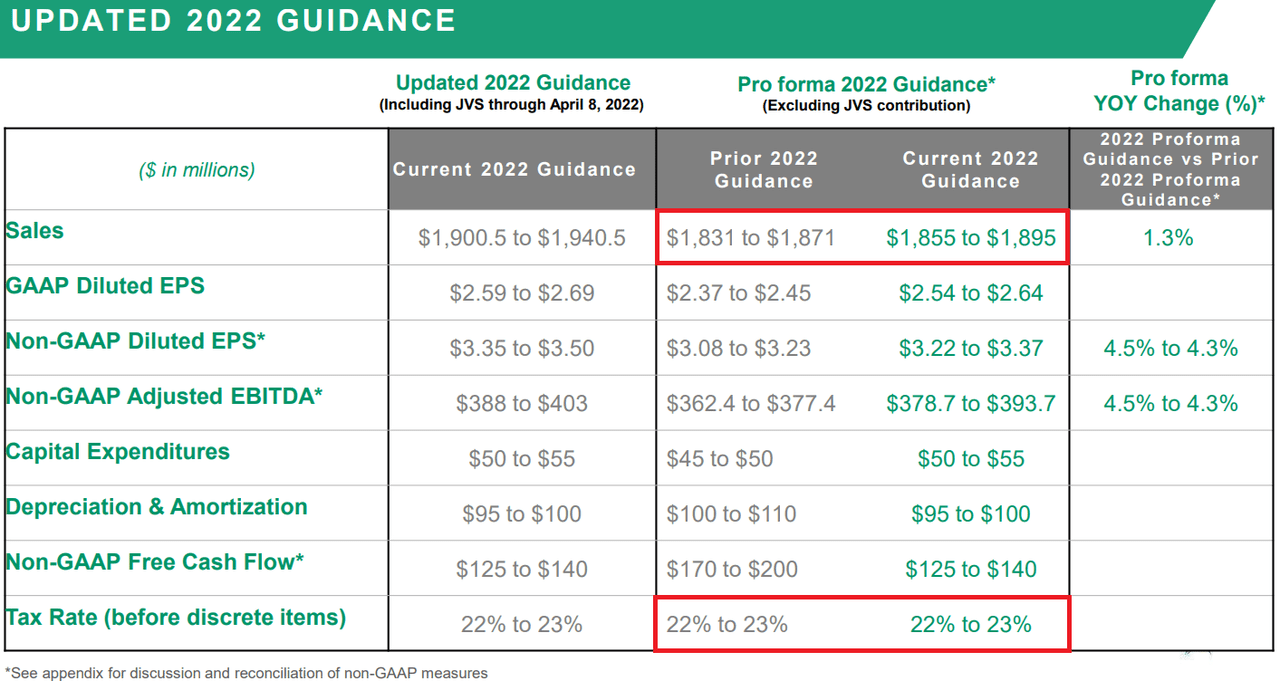

In my view, recent transactions and corporate reorganizations are helping the company in offering better financial figures. Recently, management decided to increase the sales guidance and the expected adjusted EBITDA for the year 2022.

Q1 2022 Earnings Slides

Analysts Estimates Are Also Optimistic

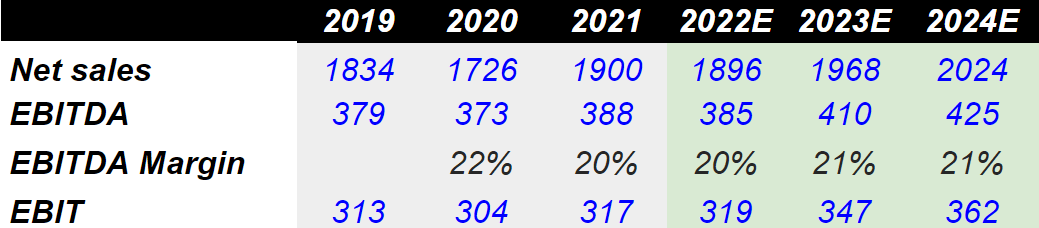

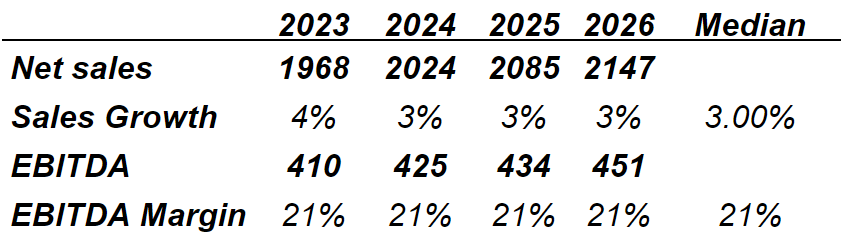

Taking into account that investment analysts delivered a beneficial outlook, I believe that including some of their figures is necessary. Estimates delivered by analysts include median sales growth of 3% and 2024 sales close to $2024 million. Expectations for 2022, 2023, and 2024 also include an EBITDA margin of 20% to 21% and operating income of 18%.

Marketscreener.com

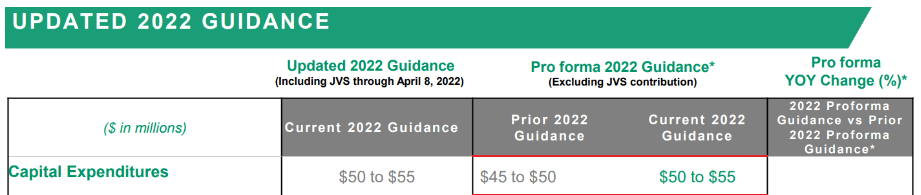

Market estimates are beneficial with respect to Altra’s FCF/Sales figures. The ratio stands between 8.7% and 11.53% with capital expenditures of approximately $51-$53 million.

Balance Sheet

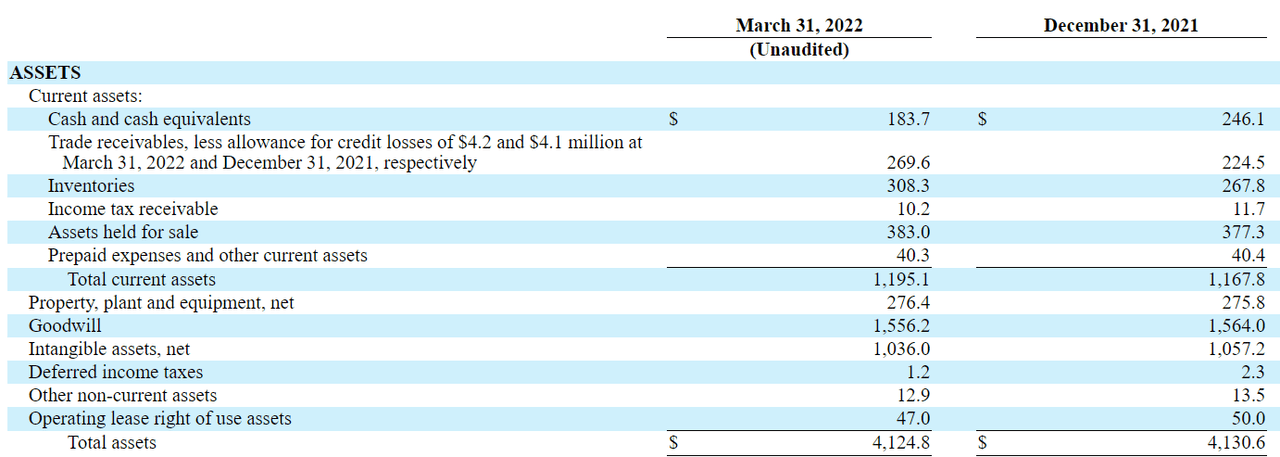

As of March 31, 2022, Altra Industrial Motion reported cash of $183 million, $4.1 billion in assets, and an asset/liability ratio of 1x-2x. In my view, the company’s financial situation appears pretty much under control.

10-Q

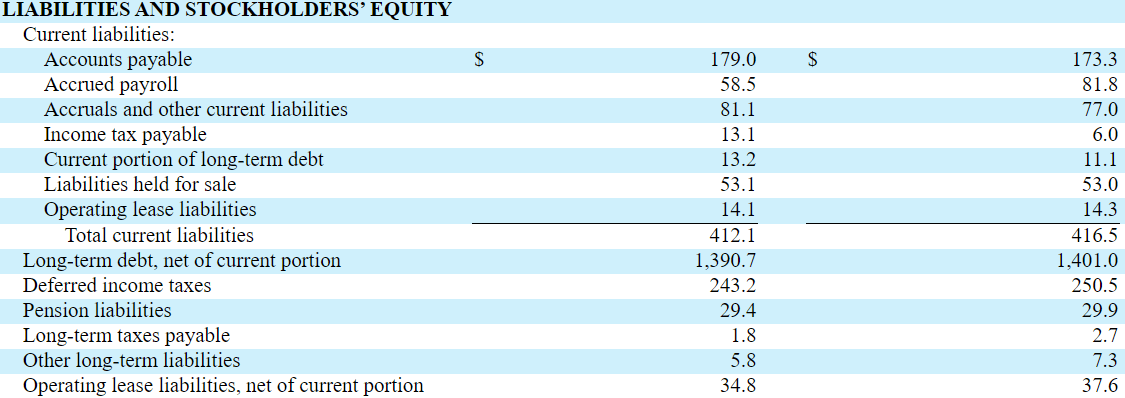

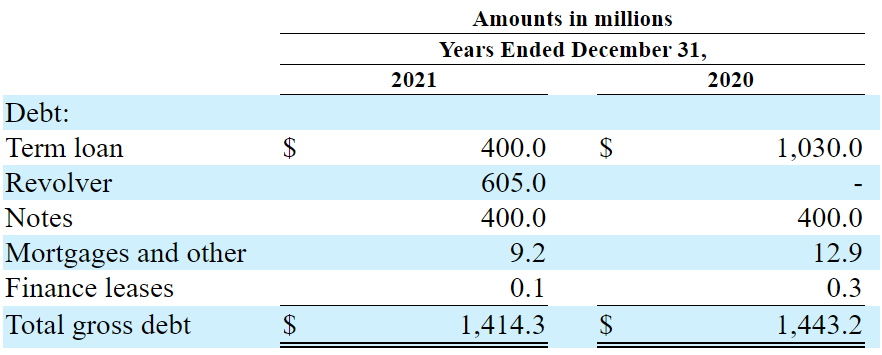

The company’s long-term debt is equal to $1.39 billion, which does not seem small. With that, let’s note that Altra Industrial reduced its net debt from 3.8x in 2019 to 2.3x in 2022. In my view, if Altra continues to reduce its leverage, the financial risk may diminish, which could lead to an increase in the demand for the stock.

10-Q

Q1 2022 Earnings Slides

Competitive Scene

The power transmission motion control market is quite fragmented. Technavio reports that there are a number of competitors of different sizes Cangro Industries Inc., C-Flex Bearing Co. Inc., Custom Machine and Tool Co. Inc., E and E Special Products LLC, Electromate Inc., Forbes Engineering Sales Inc., MinebeaMitsumi Inc. (OTCPK:MNBEY), Poklar Power Motion Inc., and Servo2Go.com Ltd. Altra is a global player with a broad product offering, which contributes to a market share advantage over Altra’s peers.

In my view, the company’s Altra Business System is one of the best competitive advantages. It allows the company to offer continuous improvement in lean manufacturing and outstanding tools. Management talked about the system in the last annual report:

ABS incorporates a management philosophy with integrated practices that focus on employing best-in-class tools, knowledge and expertise to drive continuous improvement in lean manufacturing, leadership and growth objectives, further enhancing our ability to achieve our aggressive strategic objectives.

Source: 10-k

Collaborations With Customers, Lean Manufacturing Could Push The Stock Up To $55-$56

I am optimistic about Altra’s ability to develop new products. In particular, Altra will likely develop new revenue opportunities thanks to collaborations with customers that were already announced in the annual report (see 10-K excerpt below). More products will likely lead to more revenue growth.

We focus on developing new products across our business in direct response to customer requirements. Our extensive application-engineering know-how drives both new and repeat revenue opportunities, supported by a substantiated history of innovation, with over 800 patents granted and pending worldwide.

In addition, we also plan to expand our customer collaboration initiatives by continuing to move up the technology spectrum, providing more advanced product, software and service solutions.

I also believe that Altra Industrial will be able to improve its EBITDA margin figures thanks to lean manufacturing techniques and strategic pricing initiatives. Let’s note that the company’s operating plan (as per 10-k) included several other initiatives that would please investors:

We believe we can continue to improve profitability through cost control, overhead rationalization, global process optimization, expanded implementation of lean manufacturing techniques and strategic pricing initiatives. Our operating plan, executed through our manufacturing centers of excellence and supported by ABS, provides additional opportunities to consolidate purchasing processes and reduce costs by sharing best practices across geographies and business lines.

Source: 10-k

Valuation

I assumed sales growth of 3% from 2024 to 2026 and an EBITDA margin of 2023-2026. Also, with an operating margin around 17%-18%, I obtained 2026 EBIT of $387 million and 2026 EBITDA of $451 million.

Lubo Capital

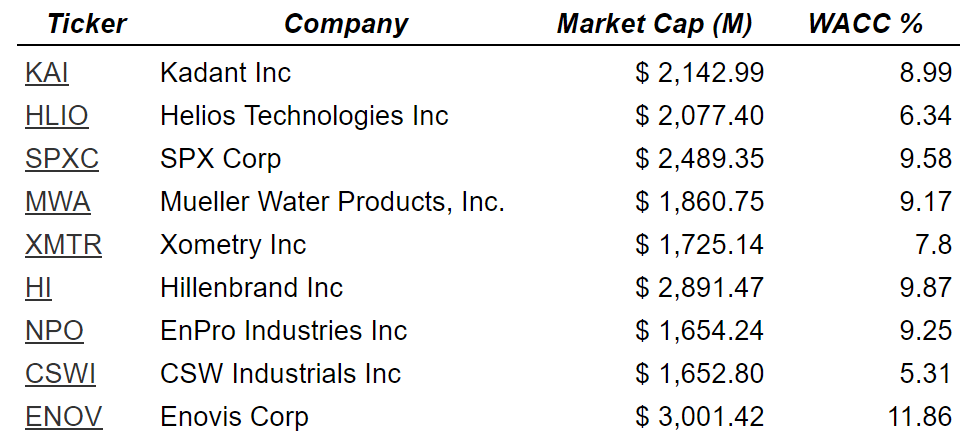

If we use a CAPM model including a discount of 9%, I believe that we would be conservative. Keep in mind that other peers report a weighted average cost of capital close to 11%-7%.

GuruFocus.com

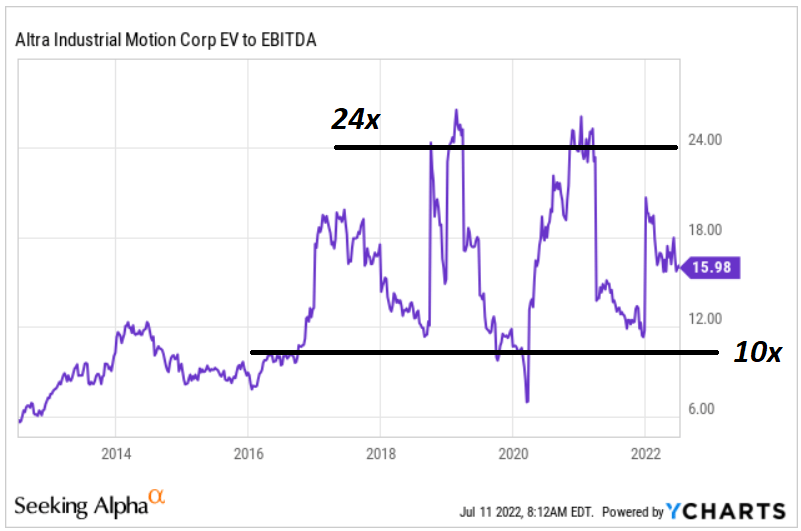

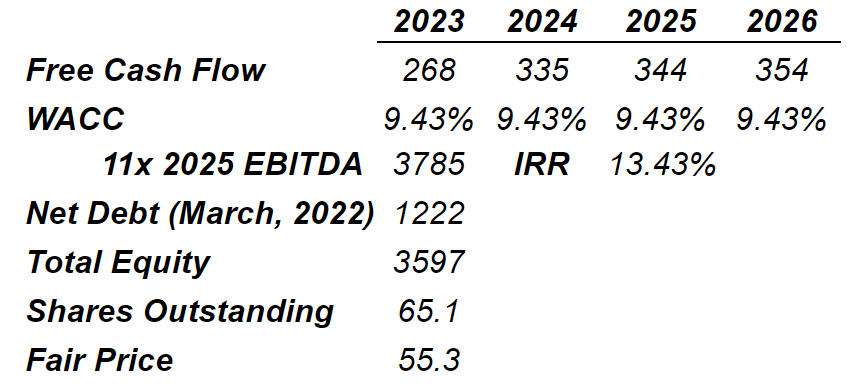

If we sum the FCF from 2023 to 2026, and use a discount of 9.43% and an exit multiple of 11x, the implied equity would be $3.59 billion. Note that Altra Industrial Motion traded between 10x and 24x, so 11x EBITDA appears conservative.

Ycharts And Lubo Capital

With a terminal value of $4.96 billion in 2026 and net debt of $1.222 billion, I obtained an implied equity of $3.6 billion and an implied fair price of $55-$56. Considering the current stock price, the company appears cheap in my view.

Lubo Capital

Risks

Highly Cyclical Markets

With many analysts out there claiming that a recession is quite likely, most investors may not want to invest in cyclical markets. In this regard, let’s note that Altra has exposure to the truck, metals, mining, and energy markets. If these markets suffer from a recession in the United States, Altra Industrial may see a decline in its revenue growth. As a result, I believe that the price mark would decline significantly. The 10-k highlights the following.

Expected cyclical activity or sales may not occur or may be delayed and may result in significant quarter-to-quarter variability in our performance.

Lack Of Innovation

Altra will be fully successful if and only if the company’s investments in capital expenditures meet customers’ changing demands. Management expects to invest around $45 million to $50 million in 2022, which is not a small amount of money. Hence, I hope that the investments are properly done.

Q1 2022 Earnings Slides

Management explained very recently (as stated in the 10-k excerpt here) that without adequate technological developments, their business model will likely fail. If equity researchers notice the failure, in my view, the stock price could decline.

Furthermore, our own technological developments may not be able to produce a sustainable competitive advantage.

Detrimental Economic Growth Outside The United States

Altra Industrial Motion makes close to 51% of its total revenue outside the United States. It means that investors in the United States will be affected by the economy of Russia, China, Czech Republic, Denmark, France, or Brazil. In my view, certain investors may not appreciate that risks coming from economies outside the United States may damage their portfolio. In sum, if you only want to invest in the United States, Altra Industrial may not be for you.

Covenants May Limit The Number Of Acquisitions, Which Would Lower Future Sales Growth

Altra Industrial Motion signed several debt agreements that contain negative covenants and restrictions, which may limit what management can do. The 10-k cites the following:

The Credit Agreement contains usual and customary representations and warranties, usual and customary affirmative and negative covenants and restrictions.

In the worst case scenario, the company may not acquire more targets as debt holders may not like the deals proposed. With new acquisitions, sales growth could decline, which may lower the company’s fair valuation.

10-k

Conclusion

Altra intends to increase its profitability margins through lean manufacturing techniques and strategic pricing initiatives. Management wants to acquire more targets, which will likely improve the company’s EBITDA margins, and may push the stock price up. There are a number of risks that may limit the number of acquisitions or lower profitability. However, in my view, the upside potential seems sufficient to justify a position in the company.

Be the first to comment